Embarking on any project, regardless of its scale or complexity, is an exciting venture. Yet, beneath the innovative ideas and ambitious goals lies a critical foundation that often determines success or failure: meticulous financial planning. Without a clear understanding of the costs involved and a robust plan to manage them, even the most brilliant initiatives can falter, leading to missed deadlines, scope creep, and ultimately, wasted resources.

This is where a well-structured approach to financial foresight becomes indispensable. Whether you’re a seasoned project manager overseeing a multi-million dollar development, a small business owner launching a new product, or an individual planning a home renovation, having a systematic way to project expenses and allocate funds is paramount. It transforms abstract ideas into tangible plans, allowing for informed decision-making and proactive risk management, setting the stage for a smooth execution and a successful outcome.

Why Accurate Project Financial Planning Matters

The financial health of a project is directly tied to its overall success. Accurate financial planning isn’t just about predicting expenses; it’s about creating a realistic roadmap that guides every decision, from resource allocation to risk mitigation. It provides the clarity needed to secure funding, justify investments, and communicate expectations to stakeholders effectively.

Moreover, an initial project cost estimation and subsequent budgeting effort serve as a benchmark. They offer a point of comparison against actual expenditures, allowing project teams to identify deviations early. This early detection capability is crucial for implementing corrective actions before minor issues snowball into significant financial crises, safeguarding the project’s viability and financial integrity.

The Anatomy of a Robust Cost Estimate

A comprehensive cost estimate is the bedrock of any sound financial plan. It involves breaking down the project into manageable components and assigning a monetary value to each. This process requires a detailed understanding of the project scope, resources, and potential risks.

Developing an effective project cost estimation typically involves several key stages. It starts with defining the work required, identifying the resources needed, and then calculating the associated costs. It’s an iterative process that refines as more information becomes available, ensuring the estimate remains relevant and accurate throughout the project lifecycle.

Key elements that contribute to a thorough cost assessment include:

- **Labor Costs:** Wages, salaries, benefits for all personnel involved.

- **Material Costs:** Raw materials, components, supplies required for the project.

- **Equipment Costs:** Purchase, rental, or lease expenses for machinery and tools.

- **Software & Technology:** Licenses, subscriptions, development tools, and infrastructure.

- **Subcontractor/Consultant Fees:** Costs for external services or specialized expertise.

- **Travel & Accommodation:** Expenses for business trips, site visits, or team relocation.

- **Marketing & Sales:** Promotional activities, advertising, and distribution costs.

- **Administrative Overheads:** Indirect costs like office space, utilities, and support staff.

- **Contingency Reserve:** A buffer for unforeseen expenses or scope changes.

- **Risk Management Costs:** Expenses related to mitigating identified project risks.

Building Your Project Budget: More Than Just Numbers

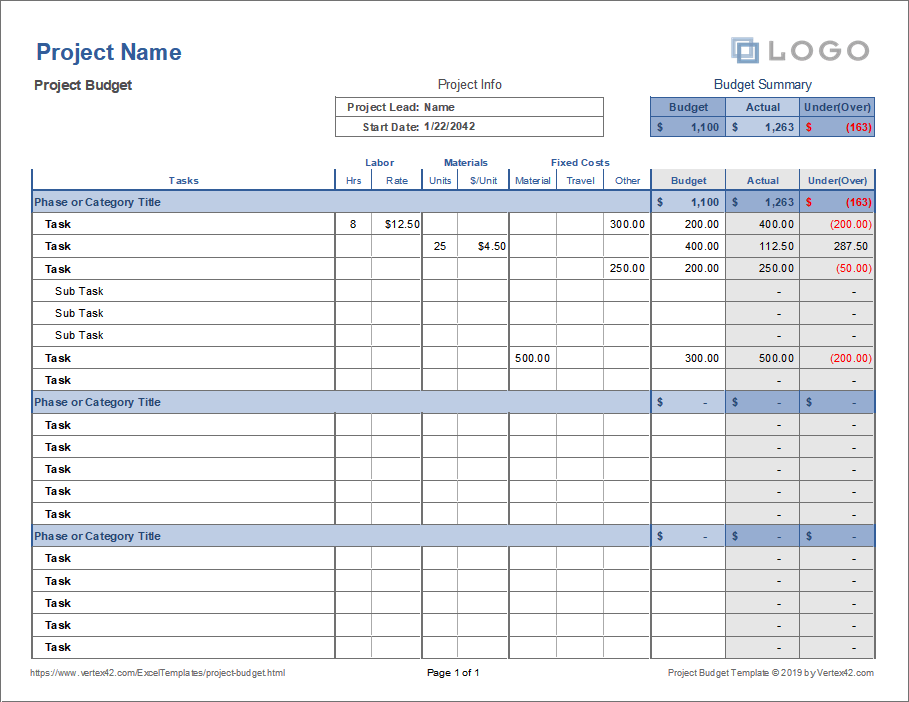

While a cost estimate predicts what a project *will* cost, a budget dictates what a project *can* cost and how those funds will be allocated. It transforms the estimation into an actionable spending plan, assigning specific amounts to different categories and phases of the project. A detailed project budget is not merely a static document; it’s a living tool that requires continuous monitoring and adjustment.

The process of budget planning for projects involves prioritizing expenses, making trade-offs, and ensuring that resource allocation aligns with strategic objectives. It also sets financial boundaries, helping to prevent overspending and ensuring that funds are utilized efficiently to achieve the desired outcomes. This fiscal blueprint empowers project managers to maintain control over expenditures and report on financial performance accurately.

Key Benefits of Utilizing a Standardized Template

The beauty of a structured Project Cost Estimate And Budget Template lies in its ability to streamline a complex process, offering consistency and clarity. Instead of starting from scratch each time, a well-designed template provides a ready-made framework that can be adapted to various project types.

Using a standardized budget planning tool brings numerous advantages to any organization or individual managing projects. It simplifies the initial setup, reduces the chances of overlooking critical cost categories, and facilitates better communication among team members and stakeholders. Such a template becomes an invaluable asset for efficient project management.

Here are some of the core benefits:

- **Consistency and Standardization:** Ensures all projects follow the same financial planning procedures, making comparisons and reporting easier.

- **Time Savings:** Reduces the effort and time spent creating financial documents from scratch, allowing more focus on analysis.

- **Improved Accuracy:** Guides users to consider all relevant cost categories, minimizing the risk of errors or omissions in cost estimates.

- **Enhanced Transparency:** Provides a clear, detailed breakdown of all projected expenses, fostering trust among stakeholders.

- **Better Decision-Making:** Offers a solid financial foundation for making informed choices about resource allocation and project direction.

- **Easier Tracking and Control:** Facilitates ongoing monitoring of actual versus budgeted expenses, enabling proactive adjustments.

- **Risk Mitigation:** Helps identify potential financial risks early by incorporating contingency planning and risk-related costs.

- **Resource Optimization:** Guides efficient allocation of funds and resources to maximize project value.

Customizing Your Template for Success

While a Project Cost Estimate And Budget Template offers a strong foundation, its true power lies in its adaptability. No two projects are identical, and a generic template needs to be tailored to the specific nuances of your initiative. Customization ensures that the budget template for projects accurately reflects your unique scope, industry, and organizational requirements.

Start by reviewing the template’s existing categories and adjusting them to match your project’s needs. Add new line items that are specific to your work, and remove those that are irrelevant. Consider the level of detail required; some projects might need granular expense tracking, while others might benefit from broader categories. Incorporating project-specific milestones or phases into the financial roadmap can also provide a clearer picture of spending over time.

Don’t hesitate to integrate custom formulas for automated calculations, or link to external data sources if your project relies on dynamic pricing or exchange rates. The goal is to make the template a living, breathing document that evolves with your project, providing the most accurate and useful financial data possible. A truly effective project financial model is one that feels tailor-made for your specific context.

Practical Tips for Effective Budget Management

Creating a detailed project budget is an excellent start, but effective financial management extends throughout the project lifecycle. It involves continuous monitoring, proactive adjustments, and clear communication to keep the project on track and within its financial constraints. Successful cost management requires diligence and a willingness to adapt.

Regularly compare your actual expenditures against your budget. This variance analysis is crucial for identifying areas where costs are exceeding expectations or where savings are being made. Don’t shy away from revising your spending plan if circumstances change; a rigid budget that doesn’t adapt to reality is less useful than a flexible one.

Communicate financial updates to your team and stakeholders transparently. Everyone involved should understand the project’s financial status and their role in managing expenses. Encouraging a culture of cost-consciousness across the team can significantly contribute to staying within the allocated funds and achieving financial targets.

Frequently Asked Questions

What is the difference between a cost estimate and a budget?

A cost estimate is an approximation of the costs required to complete a project, based on available information and assumptions at a specific point in time. A budget, on the other hand, is a detailed, approved financial plan that allocates specific funds to different project activities and serves as a control mechanism for spending.

How often should I review my project budget?

Project budgets should be reviewed regularly, ideally at least once a month, or more frequently for projects with volatile costs or tight financial constraints. Regular reviews allow for timely identification of variances and necessary adjustments to the financial roadmap.

What should I do if my project costs are exceeding the budget?

If costs are exceeding the budget, first identify the root cause of the overruns. Then, explore options such as re-evaluating scope, seeking cost-saving alternatives, re-negotiating contracts, or requesting additional funding. Early detection through continuous expense tracking is key to addressing these issues effectively.

Can a single template work for all types of projects?

While a basic Project Cost Estimate And Budget Template can provide a starting point for various projects, it will almost always require customization. Different project types (e.g., software development, construction, marketing campaigns) have unique cost categories and structures, necessitating adjustments to the template for optimal relevance and accuracy.

Why is a contingency reserve important in project budgeting?

A contingency reserve is a crucial component of a project budget because it accounts for unforeseen expenses, risks, or changes in scope that were not anticipated during the initial planning phase. It acts as a financial buffer, preventing minor unexpected events from derailing the entire project’s financial health.

Mastering project finances is not just about crunching numbers; it’s about strategic foresight and proactive management. By leveraging a comprehensive project cost estimation process and an adaptable budget planning tool, you equip yourself with the insights needed to navigate the complexities of project execution with confidence. This robust financial framework ensures that your initiatives are not only well-planned but also financially sustainable, bringing your vision to fruition without unexpected fiscal surprises.

Embrace the power of a well-crafted Project Cost Estimate And Budget Template to transform your project management approach. It’s more than just a document; it’s your compass for financial stability, your guide for resource optimization, and your ultimate tool for delivering successful projects on time and within financial parameters. Start building your detailed project budget today and pave the way for a more predictable and prosperous project journey.