Organizing a church event, whether it’s a community outreach program, a youth retreat, a special worship service, or a fundraising gala, is a deeply rewarding endeavor. These gatherings foster fellowship, enrich spiritual lives, and serve the broader community. However, the spiritual and communal benefits often overshadow a crucial, practical element: financial planning. Without a clear financial roadmap, even the most well-intentioned event can encounter unforeseen challenges, leading to stress, overspending, or under-delivery.

This is where a dedicated financial plan becomes not just helpful, but essential. Imagine having a comprehensive tool that allows your team to foresee expenses, allocate resources wisely, and maintain fiscal transparency throughout the planning process. Such a framework ensures that every dollar spent aligns with your event’s mission, maximizing impact while minimizing waste. It transforms a potentially daunting task into an organized, manageable project, empowering your ministry to focus on what truly matters: serving God and your congregation.

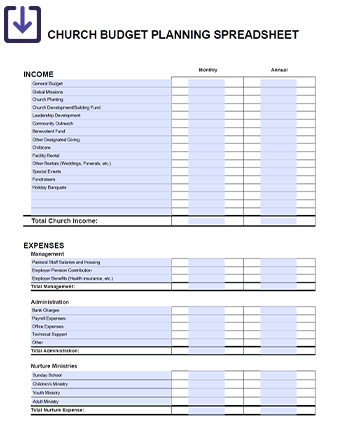

Why a Dedicated Budget Is Essential for Church Events

The notion that a church event should somehow be exempt from rigorous financial planning often stems from a place of faith and generosity. While faith certainly plays a role, good stewardship demands diligence in managing the resources God has entrusted to us. A proper event spending plan provides a clear picture of where resources are coming from and where they are going, ensuring accountability to both donors and the congregation. It helps prevent those awkward moments of realizing funds are insufficient for a critical element or, conversely, overspending on non-essentials.

Having a robust financial outline for church events fosters better communication within your planning committee and with church leadership. It sets realistic expectations for what can be achieved with available funds, prompting creative solutions for cost savings or targeted fundraising efforts. Moreover, it serves as a historical record, offering invaluable insights for future events, helping your church continuously improve its planning efficiency and financial prudence. It’s more than just numbers; it’s a strategic tool for successful ministry.

The Anatomy of an Effective Event Spending Plan

An effective financial plan for church events isn’t just a list of costs; it’s a dynamic document that accounts for both income and expenditure, allowing for adjustments as planning progresses. It moves beyond simple line items to include detailed descriptions, assigned responsibilities, and projected vs. actual costs. This level of detail ensures that every aspect of the event, from the grand vision to the smallest detail, is considered from a financial perspective. It provides a holistic view, enabling proactive decision-making rather than reactive problem-solving.

This comprehensive approach also encourages the identification of potential revenue streams beyond typical tithes and offerings. It prompts questions like: Can we host a small fundraiser specifically for this event? Are there grants available for community-focused programs? Can we partner with local businesses for sponsorships? By mapping out both sides of the ledger, your ministry can create a truly sustainable and impactful event, avoiding the common pitfall of assuming all expenses will be covered without a clear strategy.

Key Elements to Include in Your Event Budget

Creating a detailed financial framework for church events requires careful consideration of various categories. While every event is unique, certain core elements are consistently present. This structured approach helps ensure no critical expense is overlooked and provides a clear breakdown for analysis and reporting. This kind of planning tool for church gatherings ensures all bases are covered.

- Income Sources:

- **Registrations/Ticket Sales:** Revenue generated directly from attendees.

- **Donations/Offerings:** Specific contributions for the event.

- **Sponsorships:** Funds from businesses or individuals in exchange for visibility.

- **Fundraising Activities:** Income from bake sales, auctions, etc., held for the event.

- **Church Budget Allocation:** Funds pre-approved from the general church budget.

- **Grants:** External funding for specific program types.

- Venue & Setup:

- **Rental Fees:** Cost for off-site venues or specific rooms/equipment on-site.

- **Decorations:** Banners, flowers, lighting, table settings.

- **Furniture Rental:** Tables, chairs, stage elements.

- **Setup/Teardown Labor:** If external help is needed.

- Food & Beverages:

- **Catering Services:** Professional food preparation and service.

- **Groceries:** For events where volunteers prepare food.

- **Drinks:** Water, juice, coffee, tea.

- **Serving Supplies:** Plates, cups, napkins, cutlery.

- Program & Speakers:

- **Speaker Fees/Honorariums:** Compensation for guest speakers, musicians, or performers.

- **Travel & Accommodation:** For out-of-town guests.

- **Program Materials:** Handouts, worship guides, activity supplies.

- **Licenses/Permits:** For music, specific activities, or public gatherings.

- Marketing & Promotion:

- **Printing Costs:** Flyers, posters, banners.

- **Digital Advertising:** Social media ads, website promotions.

- **Photography/Videography:** Professional services for capturing the event.

- **Website/Registration Platform Fees:** Costs associated with online presence.

- Technical & Production:

- **Sound System Rental:** Microphones, speakers, mixers.

- **Audio-Visual Equipment:** Projectors, screens, laptops.

- **Technical Support:** Sound engineers, AV technicians.

- **Lighting Equipment:** Special effects or stage lighting.

- Contingency Fund:

- **Unexpected Expenses:** A crucial line item, typically 10-15% of the total budget, for unforeseen costs or emergencies.

Maximizing Your Resources: Tips for Budget Optimization

Effective resource management for church initiatives goes beyond just listing expenses; it involves strategically optimizing every dollar. One powerful strategy is to leverage the talents and generosity within your own congregation. Volunteers can dramatically reduce labor costs for setup, food preparation, or technical support. Tap into professional skills within your church – graphic designers for promotional materials, photographers for event coverage, or musicians for worship. This not only saves money but also builds community and encourages participation.

Another key tip is to seek in-kind donations or discounts. Many local businesses are eager to support community organizations, especially churches. Don’t hesitate to ask for discounted rates on food, printing, or venue rentals. Consider partnerships with other local ministries or non-profits to share resources or even co-host events, splitting costs. Always get multiple quotes for significant expenses to ensure you’re getting the best value. Finally, meticulous tracking of actual expenses against projected figures throughout the planning process allows for real-time adjustments, preventing overspending before it becomes a problem.

Common Pitfalls to Avoid

Even with the best intentions, several common financial missteps can derail a church event. One major pitfall is failing to include a **contingency fund**. Unexpected costs are almost guaranteed, whether it’s a last-minute equipment rental, a sudden need for more supplies, or an emergency repair. Without this buffer, the event team can face significant stress or be forced to cut essential elements. Another error is underestimating the cost of “small” items. Things like office supplies, name tags, small decorations, or even transportation costs can quickly add up if not accounted for individually.

A lack of transparency and communication is also problematic. When different teams or individuals are spending money without a central record or clear approval process, it’s easy to lose track and overspend. Ensure there’s a designated budget manager and a clear system for expense submission and approval. Lastly, neglecting post-event financial review is a missed opportunity. Without analyzing what was spent and why, your ministry misses valuable lessons for improving future event cost estimation and overall financial planning for outreach and other programs.

Streamlining Your Process: Benefits of a Structured Approach

Implementing a comprehensive event financial plan transforms the way your church organizes its gatherings. It brings a level of professionalism and foresight that not only ensures financial stability but also elevates the quality of the events themselves. With a clear expenditure tracker for church programs, you gain peace of mind knowing that every financial decision is informed and deliberate. This structured approach means less scrambling, fewer surprises, and more confidence for your planning team.

Beyond the immediate financial benefits, a well-defined fiscal planning for worship services or community programs builds trust within your congregation. It demonstrates responsible stewardship of their generous contributions, encouraging continued support for future ministry initiatives. It also serves as an excellent training tool for new volunteers or staff, providing a clear blueprint for financial management. Ultimately, it frees up your team to focus on the spiritual and relational aspects of the event, knowing the practical details are firmly in place, helping to manifest God’s vision for your church’s activities.

Frequently Asked Questions

What is the primary purpose of an event financial plan for a church?

The primary purpose is to ensure responsible stewardship of financial resources, prevent overspending, facilitate informed decision-making, and provide transparency to the congregation and leadership regarding event costs and funding.

How often should we review our event spending plan during the planning process?

It’s advisable to review your event financial plan regularly, typically weekly or bi-weekly, during the active planning phase. A final review should occur immediately after the event to reconcile actuals against projections.

What if we don’t have a specific budget allocation from the church for our event?

If there’s no initial allocation, your financial roadmap for congregational activities should prioritize identifying and planning for external revenue streams like donations, sponsorships, registration fees, or specific fundraising activities. The plan will then serve as a proposal to secure the necessary funds.

Is it necessary to track small expenses like paper clips or pens?

While individual small items might seem insignificant, their cumulative cost can be substantial. It’s crucial to track them, either individually for larger events or by grouping them into categories like “office supplies” or “miscellaneous” for smaller gatherings. A good event cost estimator helps account for these.

What percentage should our contingency fund be?

A good rule of thumb for a contingency fund is 10-15% of your total projected expenses. This buffer accounts for unforeseen circumstances, price increases, or last-minute needs, providing flexibility without derailing the overall financial framework for church events.

Implementing a detailed financial plan for your church events is a testament to wise stewardship and effective leadership. It’s an investment in the success and sustainability of your ministry’s endeavors, ensuring that every outreach, fellowship, and worship gathering is not only spiritually impactful but also financially sound. By embracing this structured approach, your church can move forward with confidence, clarity, and peace of mind.

Empower your team with the tools to plan effectively, allocate resources thoughtfully, and execute events that truly reflect your church’s mission and values. Begin today to transform your event planning process, making it more efficient, transparent, and ultimately, more fruitful for God’s glory.