The allure of transforming a neglected property into a gleaming, profitable home is a powerful magnet for aspiring entrepreneurs and seasoned investors alike. Television shows paint a picture of dramatic reveals and instant riches, but the reality behind a successful house flip is far less glamorous and far more reliant on meticulous planning. The dream of turning a profit can quickly evaporate without a firm grasp on finances, making a comprehensive House Flip Budget Template not just a suggestion; it’s the very backbone of a successful venture. It’s the essential tool that separates hopeful ambitions from tangible returns, guiding every decision from acquisition to sale.

Whether you’re eyeing your very first project or managing multiple properties, mastering your House Flip Budget Template will empower you to make smarter decisions, anticipate challenges, and ultimately, safeguard your investment. This isn’t just about tracking expenses; it’s about creating a living financial blueprint that reflects the dynamic nature of real estate rehabilitation. A well-constructed budget serves as your North Star, ensuring that every dollar spent aligns with your profit goals and keeps your project on a sustainable trajectory.

Why a Robust Budget is Your Flipping Foundation

Embarking on a house flip without a detailed budget is akin to sailing without a map. While exciting in theory, it dramatically increases the risk of getting lost at sea, financially speaking. A robust flipping budget isn’t merely a spreadsheet; it’s a strategic document that outlines every potential cost, from the initial purchase to the final sale, and critically, projects your potential profit margin. It forces a realistic assessment of the project’s financial viability before any hammers swing.

This financial framework helps in managing expectations, both your own and those of any partners or lenders. It provides a clear picture of cash flow, allowing you to anticipate when funds will be needed and for what purpose. Without this clarity, unexpected costs can quickly derail a project, leading to delays, increased holding costs, and a significant reduction in anticipated profits. A thorough renovation project budget acts as your primary risk management tool, identifying potential pitfalls early and enabling proactive solutions rather than reactive damage control.

Key Elements of a Comprehensive Flipping Budget

Building an effective financial plan for property ventures requires a detailed breakdown of all possible expenses. Missing even minor categories can lead to significant budget overruns. Your budget should be exhaustive, covering every phase of the project from the moment you consider a property until the closing papers are signed on its sale. Here are the core components that must be included in your property investment financial plan:

- **Acquisition Costs:** These are the initial expenses to secure the property. This includes the actual **purchase price**, all associated **closing fees** (attorney fees, title insurance, recording fees), and potentially **realtor commissions** if you’re using a buyer’s agent.

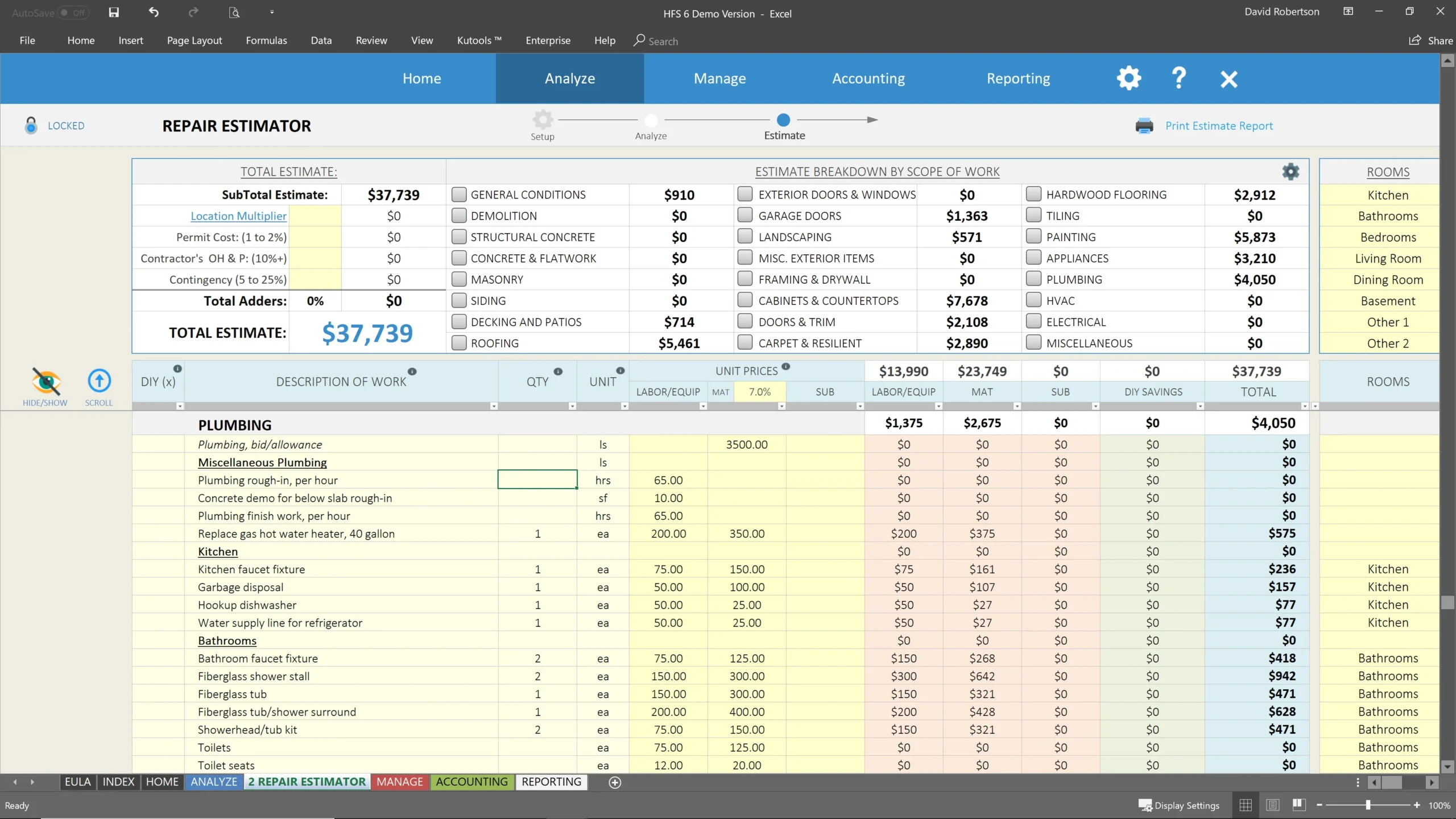

- **Renovation Expenses:** Often the largest and most variable category. This encompasses all costs related to improving the property. Break this down further into **materials** (lumber, drywall, flooring, fixtures), **labor** (contractors, plumbers, electricians), **permits** and inspections, and professional **design services** if utilized.

- **Holding Costs:** These are the ongoing expenses incurred while you own the property and before it sells. Crucial items include monthly **loan interest payments**, **property taxes**, **homeowner’s insurance**, and **utilities** (water, gas, electricity) that continue to accrue during the renovation period.

- **Contingency Fund:** This is arguably the most critical element and often underestimated. A contingency fund is a dedicated portion of your budget (typically 10-20% of renovation costs) set aside for **unexpected repairs**, unforeseen structural issues, or **project delays**. Ignoring this can lead to catastrophic financial surprises.

- **Selling Costs:** Once the property is renovated and ready, there are expenses associated with getting it off the market. This includes **realtor commissions** for the selling agent, **staging costs** to enhance appeal, and additional **closing costs** typically paid by the seller.

- **Marketing & Legal:** Consider costs for professional **photography** to showcase the renovated home, online listings, and any **attorney fees** for contract reviews or other legal matters beyond closing.

Leveraging Your Budget for Success

A house renovation cost tracker is not a static document you create once and then forget. Its true power lies in its active use throughout the entire flipping process. To truly leverage your budget, you must treat it as a dynamic tool that informs every decision. Begin by inputting detailed estimates for each line item, gathered through thorough research and contractor quotes. This initial phase requires diligent due diligence, visiting the property multiple times, and consulting with professionals.

As the project progresses, continuously track actual expenses against your budgeted amounts. This real-time monitoring allows you to identify overages or savings as they occur, providing an immediate opportunity to adjust other spending categories or re-evaluate your scope of work. Regular reviews, perhaps weekly or bi-weekly, are essential. These check-ins are not just about tracking spending, but about making informed decisions. For instance, if you find a material cost is significantly higher than anticipated, you might explore alternative suppliers or adjust your design choices to stay within the overall project expense blueprint. This proactive approach to cost management tool implementation is what keeps projects on track and preserves profit margins.

Common Pitfalls and How to Avoid Them

Even with a well-intentioned budget, numerous pitfalls can sabotage a house flip. One of the most common errors is **underestimating renovation costs**. Many flippers, especially beginners, fail to account for the full spectrum of materials, labor, and the inevitable “discovery” of hidden issues once walls are opened up. To avoid this, get multiple bids from contractors, ensure their quotes are comprehensive, and always factor in a robust contingency.

Another frequent mistake is neglecting holding costs. These ongoing expenses, while seemingly small individually, accumulate rapidly over extended project timelines. Delays, whether due to permits, labor issues, or unforeseen repairs, directly translate to higher holding costs and diminished profits. Diligent project management and realistic timelines are your best defense here. Furthermore, emotional spending or scope creep can quietly inflate expenses. Sticking to your original rehab budget and resisting the urge for extravagant upgrades not initially planned is crucial. Every additional feature, no matter how appealing, must pass a cost-benefit analysis against your ultimate profit goals.

Customizing Your Budget for Any Project

The beauty of an effective financial plan for property ventures is its adaptability. No two house flips are identical, and your budget should reflect the unique characteristics of each project. A cosmetic refresh of a condo will have a vastly different cost structure than a full gut renovation of a single-family home. When you approach a new property, adjust your cost estimation tool by considering its specific needs, location, and market conditions. For example, properties in high-cost-of-living areas will naturally have higher labor and material costs.

Consider the property type: a multi-family unit might require separate budgeting for each unit, while a commercial space conversion introduces entirely new categories like zoning changes and specialized build-outs. The extent of renovation is another key differentiator. A light refresh might allocate more to aesthetic upgrades, whereas a major overhaul will emphasize structural, plumbing, and electrical work. Always scale your budget to the project’s complexity and anticipated scope. This flexibility ensures your investment financial blueprint remains relevant and accurate, regardless of the property’s size or the ambition of your renovation.

Putting Your Budget into Action

The most meticulously crafted budget for a house flip is useless if it simply sits in a folder. The true value comes from its active implementation and continuous management. Begin by gathering all your estimates before purchase – contractor quotes, material lists, and projected timelines. This upfront work allows you to set realistic expectations and negotiate effectively. Once you own the property, immediately set up your tracking system, whether it’s a spreadsheet, specialized software, or a notebook.

Every single expense, no matter how small, must be recorded and categorized against your budget for real estate rehabs. This rigorous tracking is non-negotiable. It allows you to see where your money is going, identify potential leaks, and make informed adjustments. Regular budget reviews, ideally weekly, are paramount. During these sessions, compare actual spending to budgeted amounts. If you’re over in one area, look for opportunities to save in another. This iterative process of planning, executing, reviewing, and adjusting is the hallmark of successful flipping. Your renovation spending plan is a living document, evolving with the project, guiding your decisions, and ultimately paving the way for a profitable outcome.

Frequently Asked Questions

How often should I review my flipping budget?

Ideally, you should review your budget weekly. This allows you to catch overages or identify potential issues early, giving you time to make adjustments before costs spiral out of control. Daily tracking of expenses is also recommended to ensure nothing is missed.

What’s a typical contingency percentage for a rehab budget?

A standard contingency fund typically ranges from 10% to 20% of your estimated renovation costs. For older homes, projects with significant structural work, or properties where you anticipate hidden problems, a higher percentage (e.g., 20% or even 25%) is often prudent.

Can I use this for multiple projects?

Yes, the core framework of a house flip budget template is highly adaptable. While each project will require its own dedicated budget with specific line items and numbers, the underlying categories and principles remain consistent. You can create a master template and then copy and customize it for each new venture.

How does market volatility affect my renovation project budget?

Market volatility can impact your budget in several ways, primarily affecting material costs and the final sale price. Fluctuations in supply chains can increase material prices, while shifts in the housing market can influence how quickly your property sells and at what price. Regularly monitor market trends and build in buffers for these uncertainties.

Is a digital or paper budget better?

A digital budget, typically a spreadsheet (like Excel or Google Sheets) or specialized budgeting software, is generally superior. It allows for easier calculations, real-time updates, integration of formulas, and better organization of receipts and invoices. While a paper budget can work for very small projects, it lacks the flexibility and analytical power of digital tools.

The journey of a house flip, from a neglected shell to a shining jewel, is immensely rewarding, but its success hinges on disciplined financial management. By embracing a robust budget for a house flip, you transform uncertainty into clarity, guesswork into strategy, and risk into calculated opportunity. It’s not just about managing money; it’s about managing expectations, mitigating risks, and maximizing your return on investment.

So, as you envision your next project, remember that the most beautiful transformations begin not with a sledgehammer, but with a meticulously planned investment financial blueprint. Start building your comprehensive cost estimation tool today, empower your decisions, and lay the foundation for a truly profitable house flipping career. Your financial success is just a well-organized budget away.