In today’s interconnected world, financial transactions, whether between individuals, businesses, or even family members, often necessitate clear and legally sound documentation. The seemingly simple act of lending or borrowing money carries inherent risks and potential for misunderstanding if the terms are not explicitly defined. This is precisely where a robust personal loan repayment agreement template becomes an indispensable tool, serving as the bedrock of transparent and amicable financial arrangements.

Such a template offers a structured framework for outlining the precise conditions under which money is lent and subsequently repaid. It’s not merely a formality; it’s a vital instrument for safeguarding the interests of both the lender and the borrower, providing a clear roadmap for all obligations and expectations. Professionals in legal documentation, small business owners, financial advisors, and even individuals navigating significant private loans will find immense value in a well-crafted, adaptable template that minimizes ambiguity and fosters trust.

The Imperative of Documented Agreements in Modern Transactions

Gone are the days when a handshake and mutual trust were sufficient for significant financial commitments. The complexities of modern life, coupled with the potential for disputes, demand a higher level of precision and legal enforceability in all monetary exchanges. A written agreement transcends verbal promises, offering a tangible record that can be referenced, reviewed, and, if necessary, upheld in a court of law.

For businesses, clear documentation mitigates risk, ensures regulatory compliance, and maintains professional integrity. For individuals, especially in inter-family or friend loans, a formal agreement can prevent strained relationships and provide a clear framework for repayment without awkwardness or resentment. This document stands as undeniable proof of intent and terms, protecting both parties should unforeseen circumstances or disagreements arise regarding the personal loan repayment agreement.

Unlocking Clarity: Advantages of a Standardized Framework

Utilizing a well-designed template for a personal loan repayment agreement offers a multitude of benefits, streamlining the creation process while enhancing legal protections. First and foremost, it saves considerable time and resources that would otherwise be spent drafting a contract from scratch. Professionals can quickly populate pre-defined fields, ensuring consistency across various agreements they manage.

Beyond efficiency, a template guarantees a level of comprehensiveness that might be overlooked in a custom draft. It typically includes clauses and considerations proven necessary through countless legal precedents, thereby minimizing omissions that could expose parties to risk. This standardization provides peace of mind, knowing that critical legal protections and clear terms, such as interest rates, repayment schedules, and default conditions, are consistently addressed. It fosters professionalism, reduces potential conflicts, and provides a clear audit trail for all financial interactions.

Tailoring Your Agreement for Diverse Contexts

While a personal loan repayment agreement template provides a solid foundation, its true power lies in its adaptability. This flexibility allows for customization across a broad spectrum of industries and scenarios, from individual-to-individual lending to more complex inter-company arrangements. For instance, a small business loan from a private investor would require specific clauses related to business assets as collateral, whereas a loan between family members might emphasize flexible repayment terms over strict enforcement.

The template can be modified to account for varying interest rate structures, grace periods, or the inclusion of co-signers, depending on the specific risk profile and relationship between the parties. Industries with unique regulatory requirements, such as real estate or specific financial services, can integrate industry-specific clauses to ensure full legal compliance. This modular approach ensures that while the core protective elements remain, the document can be precisely tailored to meet the unique demands and nuances of each individual lending situation.

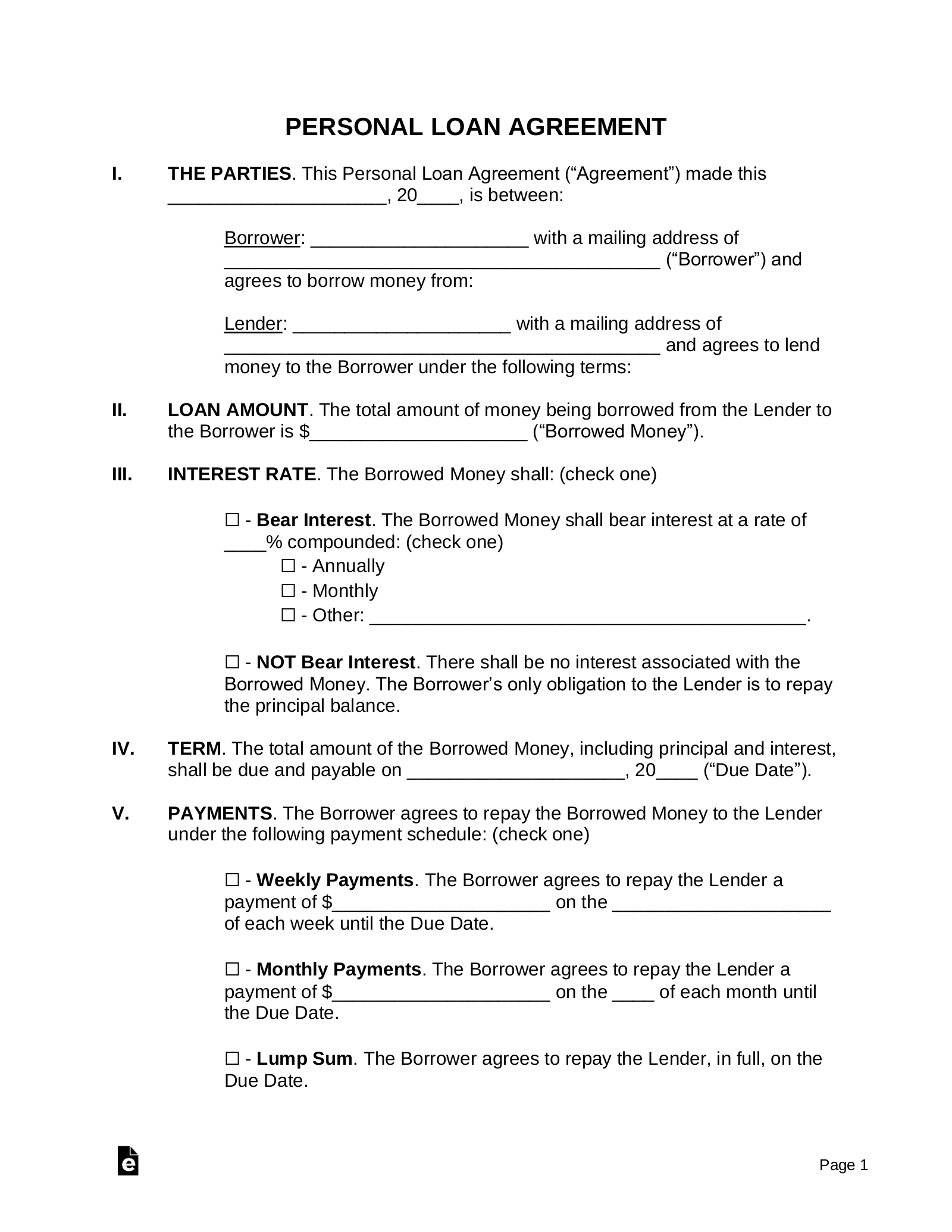

Anatomy of a Robust Repayment Contract: Essential Elements

A comprehensive personal loan repayment agreement must meticulously detail all aspects of the loan to prevent ambiguity. Each section plays a crucial role in defining obligations, expectations, and recourse.

- Identification of Parties: Clearly state the full legal names, addresses, and contact information for both the Lender and the Borrower. If applicable, include co-signers or guarantors.

- Loan Amount: Specify the exact principal sum being loaned in both numerical and written form to avoid any discrepancy.

- Interest Rate: Detail the annual interest rate, explaining whether it is fixed or variable, and how it will be calculated (e.g., simple interest, compound interest). Ensure compliance with usury laws.

- Repayment Schedule: Outline the specific dates and amounts of each payment. This includes the frequency (e.g., monthly, quarterly), the start date, and the final due date for full repayment. Amortization schedules can be very helpful here.

- Payment Method: Clearly define how payments will be made (e.g., bank transfer, check, direct deposit) and to whom.

- Default Terms: Crucial for protecting the lender, this section defines what constitutes a default (e.g., missed payments, bankruptcy) and the immediate consequences, such as acceleration of the loan’s due date or the right to pursue collateral.

- Late Fees and Penalties: Specify any charges incurred for late payments, detailing the amount or percentage, and when they will be applied.

- Prepayment Penalties: If the lender wishes to discourage early repayment (to secure interest income), this clause will outline any fees associated with paying off the loan ahead of schedule.

- Collateral (if applicable): Describe any assets pledged by the borrower to secure the loan, detailing the type of asset and the process for its repossession or liquidation in case of default.

- Governing Law: State the jurisdiction (state and county) whose laws will govern the agreement, which is vital for legal enforceability.

- Dispute Resolution: Outline the preferred method for resolving disputes, such as mediation or arbitration, before resorting to litigation.

- Representations and Warranties: Statements from both parties affirming their legal capacity to enter the agreement and the accuracy of information provided.

- Entire Agreement Clause: States that the written document constitutes the complete and final agreement, superseding all prior oral or written understandings.

- Severability Clause: Ensures that if one part of the agreement is found to be unenforceable, the remaining parts remain valid.

- Signatures: Dated signatures of all parties involved, preferably witnessed or notarized for added legal weight.

Enhancing User Experience: Design and Presentation Best Practices

The effectiveness of any legal document is not solely dependent on its content but also on its usability and readability. For a personal loan repayment agreement template, thoughtful design ensures that both parties can easily understand their obligations and rights. Start with a clear, concise title and use headings and subheadings to logically segment the content. This allows readers to quickly navigate to specific sections.

Employ consistent formatting throughout the document, including font types, sizes, and paragraph spacing, to create a professional and organized appearance. Utilize bullet points or numbered lists for complex clauses or step-by-step instructions, enhancing comprehension. For digital use, ensure the template is easily editable in common word processing software and accessible across various devices. For print, include sufficient margins for binding or filing. Finally, integrate clear spaces for signatures, dates, and any required notarizations, making the execution process straightforward and legally compliant.

The strategic deployment of a well-crafted personal loan repayment agreement template stands as a testament to professional due diligence and proactive risk management. It transforms complex financial undertakings into clear, manageable processes, offering a secure foundation for all parties involved. This powerful tool not only saves invaluable time and resources but also instills confidence and fosters transparency in every lending scenario.

Ultimately, by embracing a standardized, yet customizable, solution, businesses and individuals alike can navigate the nuances of financial obligations with greater ease and assurance. It’s an investment in clarity, a safeguard against potential disputes, and an indispensable component for any financially responsible transaction.