Running a successful landscaping business is about more than just green thumbs and sharp shears; it demands a keen eye on the financial foliage. Many business owners pour their passion into creating beautiful outdoor spaces, but without a clear financial roadmap, even the most thriving enterprises can face unexpected droughts. Understanding where your money comes from, where it goes, and how to optimize both is not just good practice—it’s essential for long-term growth and stability.

This is where a meticulously crafted financial plan becomes your most powerful tool. It transforms guesswork into strategy, allowing you to anticipate challenges, seize opportunities, and ultimately, cultivate a more profitable and resilient operation. Whether you’re a seasoned veteran looking to optimize your existing structure or a budding entrepreneur laying the groundwork, embracing a structured approach to your finances can dramatically alter your business trajectory, turning potential pitfalls into stepping stones for success.

The Unseen Foundation of Profitability: Why Every Landscaper Needs a Solid Financial Plan

Many landscaping professionals might view financial planning as a daunting, numbers-heavy task best left to accountants. However, neglecting a robust landscaping financial plan is akin to planting a garden without preparing the soil – you might see initial growth, but it won’t last. A well-constructed budget for a landscaping company provides more than just an overview of expenses; it offers critical insights into your operational health and future potential.

Without a clear financial blueprint, businesses often fall victim to cash flow crises, inaccurate pricing, and missed opportunities for investment or expansion. It’s difficult to make informed decisions about purchasing new equipment, hiring additional staff, or even adjusting service prices without a concrete understanding of your revenue and expenditure. A solid financial plan empowers you to set realistic goals, measure performance against them, and quickly pivot when market conditions or operational realities change. It builds a foundation of transparency and accountability, ensuring every dollar works as hard as you do.

Key Elements of a Robust Landscape Operation Budget

Crafting an effective operating budget for landscaping firms requires a comprehensive look at all financial aspects, from the ground up. This isn’t just a list of what you spent last month; it’s a forward-looking document that projects your financial future based on past performance and anticipated activities. A well-detailed budget will include several critical categories to ensure no stone is left unturned in your financial planning.

Here are the essential components you should consider when developing your landscaping business budget:

- Revenue Streams: Detail all sources of income, including installation projects, recurring maintenance contracts, seasonal services (e.g., snow removal, holiday lighting), and any ancillary sales.

- Fixed Costs: These are expenses that generally don’t change regardless of your service volume. Examples include office rent, administrative salaries, insurance premiums, vehicle lease payments, and loan repayments.

- Variable Costs: These fluctuate directly with your service volume. This category includes fuel for vehicles and equipment, plant materials, fertilizers, mulch, hourly labor for specific projects, equipment rental, and repair costs.

- Operational Expenses: Costs associated with running the day-to-day business that aren’t directly tied to service delivery. This can cover marketing and advertising, software subscriptions, office supplies, utilities, and professional development.

- Capital Expenditures: Significant investments in assets that benefit the business for more than one year. Think new trucks, heavy machinery, large equipment upgrades, or office renovations.

- Debt Service: Payments on any business loans or lines of credit, including both principal and interest.

- Contingency Fund: An often-overlooked but crucial component, this allocates funds for unexpected expenses, equipment breakdowns, or unforeseen economic downturns. Aim for at least 10-15% of your total expenses.

Building Your Custom Landscape Company Financial Blueprint: A Step-by-Step Guide

Developing a detailed financial template for a landscape business doesn’t have to be overwhelming. By breaking it down into manageable steps, you can create a clear and actionable financial model that reflects your unique operations and goals. This systematic approach ensures accuracy and provides a solid base for future decision-making.

First, gather your historical data. Look back at your financial records for the past one to three years. This includes profit and loss statements, balance sheets, and cash flow reports. Understanding past performance is the bedrock for accurate future projections. Identify seasonal trends in both revenue and expenses, as these are significant for a landscaping business.

Next, forecast your revenue. Based on historical data, upcoming contracts, and market trends, project your anticipated income for the next 12 months, usually broken down by month or quarter. Be realistic but also factor in any planned growth initiatives or new service offerings. This is where understanding your sales pipeline becomes crucial.

Then, itemize all your expenses, distinguishing between fixed and variable costs. Go through every outgoing payment your business makes. For fixed costs, these numbers should be relatively straightforward. For variable costs, estimate based on your forecasted revenue and historical averages (e.g., X% of revenue typically goes to materials). Using a Landscape Business Budget Template can significantly streamline this process by providing predefined categories and calculation fields, ensuring you don’t miss any critical line items.

After that, account for capital investments. If you plan to purchase new vehicles, major equipment, or undertake significant property improvements, these one-time or infrequent large expenditures need to be budgeted separately. These often require significant upfront capital and impact your cash flow differently than recurring operational expenses.

Finally, allocate funds for contingencies and review regularly. As mentioned, a contingency fund is vital for unexpected events. Once your initial budget is drafted, review it critically. Is it realistic? Are there areas for cost reduction? A financial planning for landscaping is a living document, so commit to reviewing it monthly or quarterly, comparing actual results against your projections, and making necessary adjustments. This iterative process allows your budget to evolve with your business.

Leveraging Your Financial Plan for Growth and Stability

A well-developed financial model for a landscape business is far more than just a tracking document; it’s a powerful strategic tool. By consistently monitoring your budget, you unlock insights that drive smarter decisions, foster sustainable growth, and enhance your overall stability. It provides the clarity needed to navigate the competitive landscape industry with confidence.

One key benefit is improved strategic decision-making. When you have a clear picture of your profitability analysis for landscape companies, you can make informed choices about pricing your services, investing in new equipment, or expanding into new markets. You can identify which services are most profitable and allocate resources accordingly, optimizing your service offerings and ensuring maximum returns. Furthermore, a detailed budget aids in proactive cash flow management for landscaping, helping you anticipate periods of low cash and plan accordingly, perhaps by securing a line of credit or adjusting payment terms with clients. This foresight prevents financial distress and ensures your operations run smoothly year-round.

Beyond the Numbers: Practical Tips for Effective Budget Management

Creating a comprehensive budget is an excellent first step, but its true value is realized through consistent application and smart management. The ongoing process of managing your money effectively transforms your financial plan from a static document into a dynamic tool that propels your landscaping business forward. It requires discipline, flexibility, and a commitment to understanding your financial pulse.

Implementing a well-structured Landscape Business Budget Template is just the beginning. Here are some practical tips to ensure your budgeting efforts translate into tangible business benefits:

- Track Actuals vs. Budget: Regularly compare your actual revenues and expenses against your budgeted figures. This “actual vs. budget” analysis helps identify discrepancies early, allowing you to understand where you’re overspending or under-earning.

- Don’t Fear Adjustments: Your business environment is constantly changing. Be prepared to revise your budget quarterly or even monthly if significant changes occur in your market, costs, or service offerings. Flexibility is key to an effective budgeting tool for landscape companies.

- Involve Your Team (Where Appropriate): While not everyone needs to see the full financial picture, involving project managers or team leaders in understanding their departmental budgets can foster a sense of ownership and encourage cost-conscious behavior.

- Set Realistic Goals: Avoid overly optimistic revenue projections or unrealistic cost-cutting measures. An achievable budget is one you can stick to, providing a more reliable foundation for decision-making.

- Automate Where Possible: Utilize accounting software or specialized landscaping business management platforms that can track expenses, manage invoices, and generate financial reports automatically. This reduces manual errors and saves valuable time for money management for landscapers.

- Focus on Key Performance Indicators (KPIs): Beyond just revenue and expenses, monitor specific KPIs relevant to your business, such as average project margin, labor cost as a percentage of revenue, or equipment utilization rates. These metrics provide deeper insights into operational efficiency.

Frequently Asked Questions

How often should I update my landscaping company budget?

Ideally, your budget should be reviewed monthly, comparing actual performance against your projections. However, a significant update or revision, adjusting for market changes or new business strategies, should be done annually at a minimum, and quarterly if your business experiences rapid growth or significant fluctuations.

What’s the biggest mistake landscapers make with their budgets?

The most common mistake is creating a budget and then forgetting about it. A budget is a living document that requires continuous monitoring and adjustment. Another significant error is failing to account for seasonality and unexpected contingencies, which are crucial for a business like landscaping.

Can a small landscaping business truly benefit from a detailed budget?

Absolutely. Small businesses benefit immensely from detailed budgets, perhaps even more so than larger ones, as every dollar counts. A budget helps small landscaping operations identify profitable services, control cash flow, make informed decisions on equipment purchases, and plan for growth without overstretching resources.

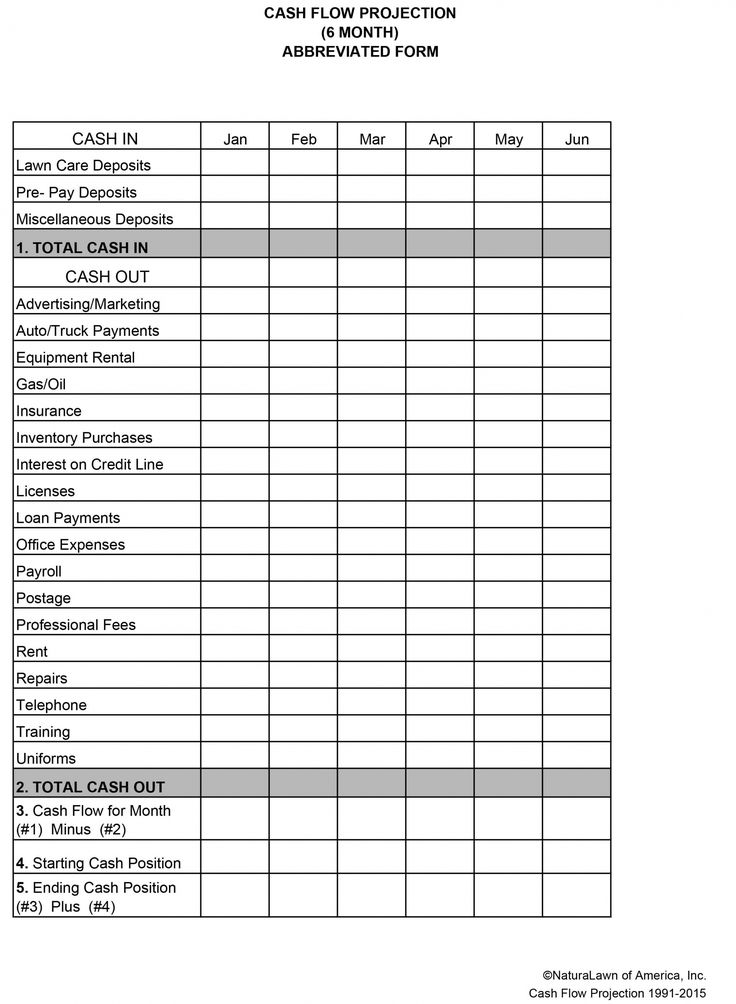

Is there a difference between a budget and a cash flow projection?

Yes, they are distinct but related. A budget outlines your planned income and expenses over a period, focusing on profitability. A cash flow projection, on the other hand, tracks the actual movement of cash in and out of your business, focusing on liquidity. You can be profitable on paper but still have cash flow issues, so both are vital.

How do I account for seasonal fluctuations in my budget?

Seasonal fluctuations are a hallmark of the landscaping industry. Your budget should reflect these variations by forecasting higher revenues and variable costs during peak seasons and lower figures during off-peak times. This often means building reserves during busy periods to carry the business through leaner months or planning for diverse off-season services (like snow removal) to stabilize income.

Embracing a structured financial approach through a robust budget isn’t just about managing money; it’s about empowering your landscaping business to thrive. It provides the clarity to make confident decisions, the foresight to navigate challenges, and the strategic vision to seize opportunities for expansion and success. No longer just an administrative chore, your budget becomes a dynamic partner in growth, guiding every decision from hiring to equipment investment.

Don’t let your passion for creating beautiful landscapes overshadow the crucial need for a solid financial foundation. Start building your financial roadmap today, and watch as your business cultivates not just greenery, but consistent profitability and enduring stability. The path to a more organized, efficient, and prosperous landscaping company begins with a clear financial vision.