Navigating the financial landscape of an independent educational institution can be a complex endeavor, requiring foresight, precision, and an unwavering commitment to both fiscal health and academic excellence. Unlike public schools, private schools operate without direct government funding for core operations, relying instead on a delicate balance of tuition revenue, philanthropic support, and often, auxiliary programs. This unique financial model necessitates a highly structured and adaptable approach to financial planning, making a robust budget framework not just helpful, but absolutely essential for long-term sustainability and mission fulfillment.

Imagine a clear roadmap that guides every financial decision, from allocating funds for new academic initiatives to planning for essential facility upgrades or investing in staff development. This is precisely the role a well-crafted budget tool plays. It transforms abstract financial data into actionable insights, empowering administrators, board members, and finance committees to make informed choices that directly impact the school’s present and future. It’s about proactive management, not just reactive accounting, ensuring that every dollar spent aligns with the institution’s strategic goals and educational promises.

Why a Dedicated Financial Framework is Indispensable

The distinct operational environment of a private academy demands a specialized approach to financial management. Generic business budgeting tools often fall short because they don’t account for the nuances of educational institutions, such as multi-year enrollment projections, variable tuition models, the cyclical nature of fundraising, or the deferred maintenance common in older campuses. A financial framework designed specifically for independent schools provides the structure needed to navigate these complexities with clarity and confidence.

Such a framework offers numerous benefits, from enhanced transparency for all stakeholders to improved accountability across departments. It facilitates strategic planning by linking financial resources directly to institutional goals, ensuring that every allocation serves a purpose. Furthermore, a detailed budget enables better forecasting, allowing schools to anticipate challenges, seize opportunities, and maintain financial stability even amidst economic fluctuations. It’s the bedrock upon which sound financial governance is built, fostering trust and ensuring the school can continue to deliver on its educational mission for generations to come.

Core Components of an Independent School Financial Plan

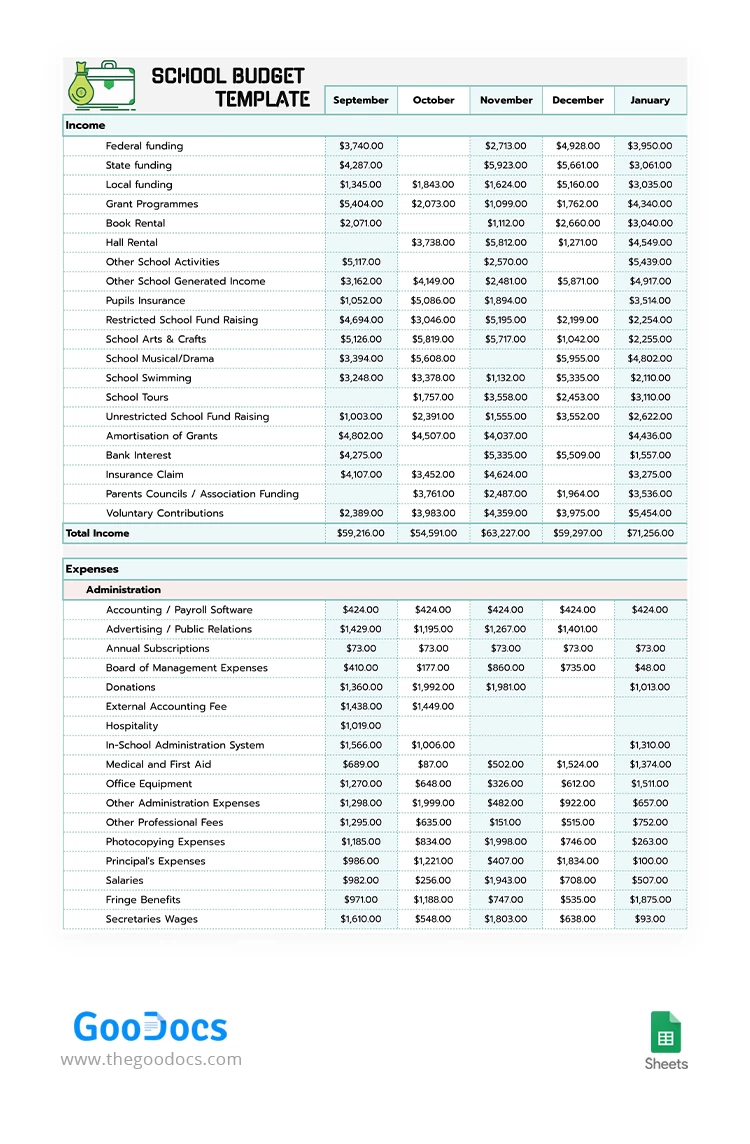

A comprehensive financial plan for an educational institution must meticulously detail both anticipated revenues and projected expenditures. Understanding these two sides of the ledger is fundamental to creating a balanced and sustainable budget. While the specifics will vary by institution, certain core components are universal.

- **Revenue Streams:** This is where the school generates its income.

- **Tuition and Fees:** Often the largest component, including gross tuition, net tuition (after financial aid/scholarships), and various student fees (activity, technology, enrollment).

- **Fundraising and Contributions:** Annual giving, capital campaign pledges, endowment draws, and other philanthropic support.

- **Auxiliary Programs:** Income from summer camps, after-school programs, facility rentals, bookstore sales, or food services.

- **Investment Income:** Returns from endowment funds or other investment portfolios.

- **Grants:** Specific project-based grants from foundations or government entities.

- **Operational Expenditures:** These are the costs associated with running the school day-to-day.

- **Salaries and Benefits:** Typically the largest expense, covering faculty, administration, and support staff. This includes wages, health insurance, retirement contributions, and professional development.

- **Facilities and Maintenance:** Rent or mortgage payments, utilities, repairs, maintenance, groundskeeping, and security.

- **Academic Programs:** Curriculum materials, library resources, technology infrastructure, laboratory supplies, and special program funding.

- **Administrative and General:** Office supplies, insurance, legal and audit fees, accreditation costs, and professional services.

- **Marketing and Admissions:** Costs associated with student recruitment, advertising, and outreach efforts.

- **Debt Service:** Principal and interest payments on loans for capital projects.

- **Capital Expenditures:** Funds allocated for significant long-term investments like new buildings, major renovations, or large equipment purchases, distinct from operating expenses.

Navigating Revenue Generation for Private Academies

Effective revenue generation is the lifeblood of any independent school. Unlike businesses that sell products, schools offer an invaluable service—education—and their funding models reflect this unique position. Tuition, while primary, is rarely the sole source of income and requires careful management, particularly regarding financial aid. Crafting a sustainable tuition model involves balancing accessibility with the need to cover operational costs, often utilizing an enrollment management system that projects student numbers years into the future.

Beyond tuition, successful independent schools cultivate robust fundraising programs. An annual fund ensures ongoing support for immediate needs, while capital campaigns address long-term infrastructure and endowment growth. Engaging alumni, current parents, and the wider community through strategic development efforts is critical. Additionally, auxiliary programs like summer camps, after-school activities, or facility rentals can provide significant supplemental income, diversifying the school’s financial base and reducing over-reliance on tuition alone. These multiple streams, when strategically managed within an organized financial blueprint, contribute to overall financial resilience.

Strategic Allocation of Operational Expenses

Once revenues are understood, the focus shifts to judiciously allocating funds to support the school’s mission without compromising its financial health. Operational expenses typically consume the largest portion of a school’s budget, with personnel costs almost always at the top. This includes not just salaries for teachers and administrators but also the ever-increasing cost of benefits, professional development, and retirement contributions. Attracting and retaining top talent is paramount, and a competitive compensation package is a significant line item in any educational institution budget framework.

Beyond personnel, facilities maintenance and upgrades represent another substantial ongoing expense. Safe, well-maintained, and modern learning environments are crucial for student success and competitive advantage. This includes everything from routine cleaning and utility bills to major repairs, landscaping, and security systems. Academic programs themselves require continuous investment in curriculum development, technology, library resources, and specialized equipment. Furthermore, administrative overhead, marketing and admissions efforts, and compliance costs all demand careful budgeting to ensure efficient operation and continued growth. Every expenditure should be evaluated for its alignment with educational goals and its contribution to the school’s overall mission.

The Strategic Advantage of Proactive Fiscal Management

Adopting a detailed financial planning tool for an educational institution offers far more than just tracking income and expenses; it provides a powerful strategic advantage. With a clear fiscal roadmap, independent schools can shift from a reactive stance to a proactive one, anticipating financial challenges and opportunities well in advance. This foresight enables leadership to make informed, data-driven decisions that strengthen the institution’s long-term viability.

Proactive fiscal management ensures resources are optimally allocated to support strategic initiatives, whether it’s expanding academic programs, enhancing campus facilities, or investing in faculty development. It builds stakeholder confidence by demonstrating financial responsibility and transparency to parents, donors, and accreditation bodies. Moreover, a robust financial blueprint allows schools to better weather economic downturns, adapt to changing enrollment trends, and maintain tuition stability, all while upholding the high standards of education they promise. This strategic approach transforms the annual budgeting process into a dynamic tool for institutional advancement.

Customizing Your School’s Financial Blueprint

While the core elements of a budgeting for private academies framework remain consistent, the actual implementation must be highly customized to suit the unique characteristics of each institution. A small, nascent school will have different financial needs and complexities than a large, established boarding school with a significant endowment. Factors such as the school’s age, size, mission, student demographics, geographic location, and growth trajectory all influence how a budget tool should be structured and utilized.

Customization involves more than just plugging in numbers. It means tailoring categories to reflect specific programs, adjusting revenue projections based on historical enrollment and market trends, and building in flexibility for unforeseen circumstances. Historical financial data is invaluable here, providing benchmarks and insights into spending patterns and revenue stability. Modern financial planning for independent schools often incorporates scenario planning, allowing leadership to model different outcomes—such as changes in enrollment or fundraising success—and prepare contingency plans. Whether using sophisticated financial software or a well-designed spreadsheet, the goal is to create a dynamic and accurate reflection of the school’s unique financial reality.

Best Practices for Implementing a Robust Budgeting System

Implementing an effective budgeting system for an independent school goes beyond merely adopting a private school budget template; it involves a commitment to process, communication, and continuous improvement. A key best practice is to foster a collaborative environment where key stakeholders, including department heads, admissions, and development teams, are involved in the budget creation process. Their insights are invaluable for developing realistic projections and ensuring broad buy-in.

Regular review and adjustment are also critical. A budget should not be a static document but a living financial roadmap that is monitored monthly or quarterly. This allows for timely adjustments based on actual performance, economic shifts, or unexpected needs. Transparency in reporting to the board of trustees and other relevant committees builds trust and facilitates sound governance. Investing in professional development for finance staff to keep them abreast of best practices and relevant technologies can significantly enhance the accuracy and efficiency of the budgeting process. Ultimately, linking every budgetary decision directly to the school’s strategic plan ensures that financial resources consistently serve the educational mission.

Frequently Asked Questions

What is the primary benefit of using a structured financial planning tool?

The primary benefit is enhanced clarity and control over the school’s financial health, enabling proactive strategic decision-making rather than reactive problem-solving. It helps ensure resources align with the school’s mission and long-term sustainability goals.

How often should an independent school’s budget be reviewed?

While an annual budget is standard, it should be reviewed at least monthly or quarterly by the finance committee and leadership team. This allows for real-time adjustments, performance tracking, and identification of variances against projections.

What are common pitfalls to avoid in school budgeting?

Common pitfalls include underestimating expenses (especially personnel and facilities), overestimating revenue (particularly fundraising and enrollment), lacking transparency, not involving key stakeholders, and failing to link the budget to the school’s strategic plan.

Can a small private school effectively use a comprehensive budget framework?

Absolutely. A comprehensive budget framework is arguably even more critical for smaller schools with tighter margins. It helps optimize limited resources, ensure financial stability, and plan for sustainable growth more effectively than informal methods.

What role does the board of trustees play in budget approval?

The board of trustees holds ultimate fiduciary responsibility for the school. They review, question, and ultimately approve the annual budget presented by the administration. This oversight ensures financial prudence and alignment with the school’s mission and strategic vision.

A well-implemented financial blueprint for private education transcends mere accounting; it becomes a powerful tool for institutional leadership. It empowers schools to manage their resources wisely, make informed decisions, and secure their future, ensuring that the unique educational experience they offer can continue to thrive. By providing a clear, comprehensive overview of both income and expenditures, such a template fosters accountability, transparency, and strategic foresight, turning financial data into a catalyst for positive change.

Embracing a systematic approach to financial planning means investing in the very foundation of your school’s success. It safeguards its mission, supports its faculty, enriches its students, and strengthens its community. The journey of financial stewardship is ongoing, but with a robust independent school financial planning tool, schools are well-equipped to navigate the complexities, achieve their strategic objectives, and continue their vital work of shaping future generations.