In the intricate dance of modern life, managing personal finances can often feel like navigating a complex labyrinth. From daily expenses to long-term savings goals, the ebb and flow of money can be both a source of stress and immense opportunity. Yet, for many, the path to financial clarity remains shrouded in mystery, leading to missed opportunities, unexpected debts, and a general sense of unease about the future.

Imagine having a clear roadmap for your money—a tool that not only tracks where every dollar goes but also empowers you to make conscious decisions aligned with your financial aspirations. This isn’t just wishful thinking; it’s the tangible benefit of embracing a well-structured personal household budget template. Far from being a restrictive chore, a robust budgeting framework is your ally, transforming abstract financial goals into actionable steps and providing the peace of mind that comes with true financial control.

Why a Budget is Your Financial North Star

At its core, a budget is simply a plan for your money. It’s a forward-looking strategy that allocates your income to various spending categories and savings goals, ensuring you have enough to cover your needs, fund your wants, and build a secure future. Without such a plan, money tends to dissipate, often leaving individuals wondering where their paycheck went by the end of the month.

Implementing a personal household budget template isn’t just about cutting costs; it’s about intentional living. It helps you identify financial leaks, understand your spending habits, and prioritize what truly matters. Whether you’re saving for a down payment on a home, planning a dream vacation, or simply aiming to reduce credit card debt, a clear financial blueprint provides the guidance needed to stay on track. It removes the guesswork and replaces it with informed decisions, turning financial uncertainty into confident action.

For families, a comprehensive household financial plan fosters open communication about money, aligning everyone towards common goals. It can prevent arguments about spending and encourage a collaborative approach to financial management. For individuals, it offers a sense of independence and the power to shape their financial destiny without external pressures dictating their choices.

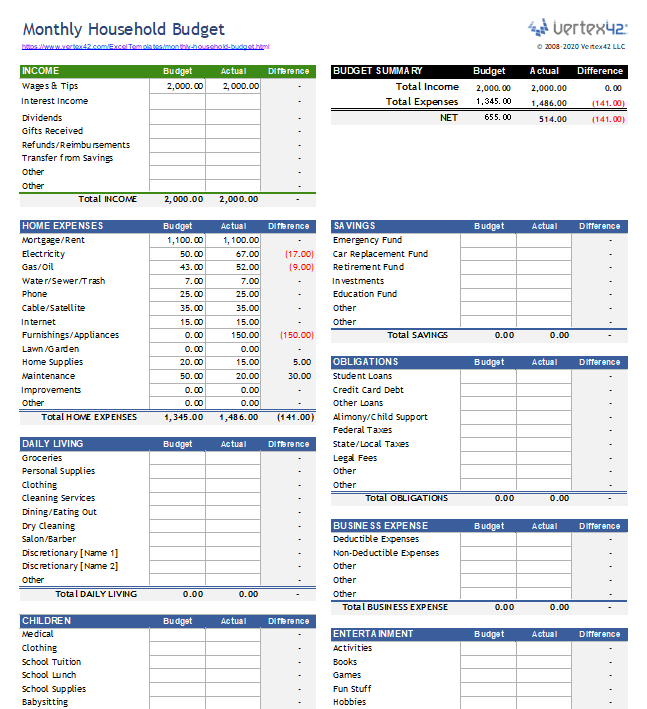

Deconstructing the Essential Elements of a Household Budget

While the specific format may vary, a truly effective budget template will always contain several key components. Understanding these building blocks is crucial for anyone looking to create an accurate and useful financial planning guide for their household.

- Income Sources: This is where you list all money flowing into your household. Include salaries, freelance income, rental income, benefits, and any other regular earnings. Be sure to account for net income (after taxes and deductions) for the most accurate picture.

- Fixed Expenses: These are costs that typically stay the same each month and are often contractual. Examples include your rent or mortgage payment, car loan payments, insurance premiums, and subscription services. These are usually non-negotiable in the short term.

- Variable Expenses: These are costs that fluctuate month-to-month and offer the most flexibility for adjustments. Groceries, utilities (which can vary with usage), dining out, entertainment, and transportation costs fall into this category. This is often where conscious spending decisions can have the biggest impact.

- Savings Goals: Crucially, a good budgeting framework incorporates dedicated allocations for savings. This could include an emergency fund, retirement contributions, college savings, a down payment for a house, or even a specific vacation fund. Treat savings as a fixed expense; “pay yourself first.”

- Debt Repayment: Beyond minimum payments, allocating extra funds to high-interest debts (like credit cards) can significantly accelerate your path to financial freedom. This section highlights how much extra you can commit to reduce your principal balances.

- Discretionary Spending: This category covers “wants” rather than “needs.” It includes things like hobbies, personal care, shopping, and non-essential entertainment. While important for quality of life, this is often the first place to trim if you need to free up funds.

By meticulously tracking these elements, you create a holistic view of your financial landscape. This detailed income and expense sheet is more than just numbers; it’s a narrative of your financial priorities and a powerful tool for informed decision-making.

Choosing and Customizing Your Ideal Budgeting Tool

The beauty of modern financial management lies in the array of tools available. There isn’t a single “best” personal household budget template; the ideal one is the one you will consistently use. Your choice depends on your comfort level with technology, your desire for detail, and your personal learning style.

Many individuals start with a simple spreadsheet, like Google Sheets or Microsoft Excel. These offer unparalleled flexibility to create custom categories, formulas, and visual graphs that resonate with your specific needs. Online templates are readily available and can serve as an excellent starting point, requiring only minor tweaks to fit your unique financial situation.

Alternatively, numerous budgeting apps and software solutions offer automation features, linking directly to your bank accounts and credit cards to categorize transactions automatically. Tools like Mint, YNAB (You Need A Budget), or Personal Capital provide robust platforms for expense tracking, goal setting, and net worth analysis. While some may involve a subscription fee, the convenience and insights they offer can be invaluable for those who prefer a more streamlined, digital approach to their money management system.

Regardless of the medium, the key is customization. Take the generic framework and adapt it to reflect your real-world spending. If you spend more on pets than dining out, create a “Pet Care” category. If you have unique income streams, ensure they are accurately represented. The more personal and realistic your budget becomes, the more effective it will be in guiding your financial journey.

Practical Strategies for Budgeting Success

Having a budget template is only half the battle; consistently using it and making it work for you is the true challenge. Here are some actionable tips to transform your budgeting process from a chore into a powerful habit:

Set Realistic Expectations: Don’t aim for perfection from day one. Your first month or two might be about trial and error. Be patient with yourself and adjust categories as you learn more about your actual spending habits. A budget should adapt to your life, not the other way around.

Track Every Dollar: This is fundamental. Whether manually entering transactions, using a budgeting app, or regularly reviewing bank statements, knowing where your money goes is crucial. Even small, seemingly insignificant expenses can add up over time.

Automate Your Savings: Treat savings like a non-negotiable bill. Set up automatic transfers from your checking account to your savings accounts (emergency fund, retirement, specific goals) immediately after you get paid. This “pay yourself first” strategy ensures you build wealth consistently.

Review Regularly: Schedule weekly or bi-weekly check-ins with your budget. This allows you to catch overspending early, reallocate funds if necessary, and ensure you’re still aligned with your goals. Monthly reviews are essential for bigger picture adjustments.

Find Your Motivation: What is your “why” for budgeting? Is it buying a home, paying off debt, or gaining financial independence? Keep your goals visible and let them fuel your commitment to your personal spending plan. This motivation is critical for long-term adherence.

Be Flexible, Not Rigid: Life happens. Unexpected expenses arise, and priorities shift. A good budget is dynamic. If you overspend in one category, look for areas to cut back in others for that month. Don’t let a single setback derail your entire effort.

Celebrate Small Wins: Acknowledge your progress! Did you stick to your grocery budget for the month? Did you pay off a small debt? Celebrate these achievements. Positive reinforcement helps build momentum and keeps you motivated.

Beyond the Spreadsheet: The Long-Term Impact of Mindful Spending

While the immediate benefits of a diligent money management system are evident in improved cash flow and reduced financial stress, the true power of consistent budgeting unfolds over the long term. It’s not merely about knowing your numbers; it’s about cultivating a healthier relationship with money, fostering discipline, and ultimately building a robust financial future.

A well-maintained household budget tool becomes a historical record, revealing trends and patterns that can inform future decisions. You’ll gain invaluable insights into seasonal spending, the true cost of certain lifestyle choices, and the effectiveness of your savings strategies. This data empowers you to set more ambitious yet realistic goals, from investing for retirement to funding your children’s education.

Ultimately, a robust financial blueprint isn’t just about managing today’s income and expenses; it’s about shaping tomorrow’s possibilities. It provides the freedom to pursue your passions, weather economic storms, and leave a lasting legacy. It transforms financial planning from a daunting task into an empowering journey toward true financial well-being.

Frequently Asked Questions

What is the 50/30/20 rule for budgeting?

The 50/30/20 rule is a popular guideline for allocating your after-tax income: 50% for needs (housing, utilities, groceries, transportation), 30% for wants (dining out, entertainment, hobbies, shopping), and 20% for savings and debt repayment (emergency fund, retirement, high-interest debt). It’s a simple yet effective framework to start your budgeting journey.

How often should I review my budget?

Ideally, you should review your budget at least once a week to track recent spending and make small adjustments. A more comprehensive review should be conducted monthly to assess overall progress, compare actual spending to planned spending, and adjust categories for the upcoming month. Annually, it’s wise to perform a full financial check-up to account for salary changes, new goals, or significant life events.

What if I consistently overspend in a category?

If you consistently overspend in a particular category, it’s a sign that your initial allocation might be unrealistic or that you need to re-evaluate your spending habits in that area. First, try to adjust your budget by reallocating funds from less critical categories. If that’s not feasible, explore ways to reduce spending in that specific area or acknowledge that your lifestyle requires more in that category and adjust your overall budget accordingly.

Is it better to use an app or a spreadsheet for budgeting?

Both apps and spreadsheets have their advantages. Budgeting apps (like Mint, YNAB) offer automation, bank synchronization, and often robust reporting, making tracking convenient. Spreadsheets (Excel, Google Sheets) provide maximum customization and control, allowing you to design the exact income and expense sheet you need. The “better” choice depends on your preference for automation versus manual control, and which tool you’ll commit to using consistently.

How long does it take to see results from budgeting?

You can start seeing immediate results in terms of increased awareness of your spending within the first month. Tangible financial improvements, such as building an emergency fund, reducing debt, or increasing savings, typically become evident within three to six months of consistent budgeting. The most significant long-term benefits, like achieving major financial goals, will unfold over years of disciplined money management.

Embracing a systematic approach to your finances through a well-crafted personal household budget template is more than just a financial exercise; it’s an investment in your peace of mind and future prosperity. It transforms the daunting task of money management into an empowering journey, providing clarity, control, and confidence with every dollar you earn and spend.

Take the first step today. Download a template, open a spreadsheet, or explore a budgeting app. The power to transform your financial future is literally at your fingertips. By committing to this simple yet profound practice, you’re not just budgeting; you’re building the life you envision, one intentional financial decision at a time.