In the dynamic world of business, managing finances effectively is not just an advantage—it’s a necessity for survival and growth. While direct costs of production often receive intense scrutiny, the less glamorous world of indirect expenses, collectively known as overheads, can quietly erode profitability if not properly managed. This is where a robust system for tracking and projecting these costs becomes indispensable, offering a clear lens into your operational efficiency.

For businesses of all sizes, from nascent startups to established corporations, understanding and controlling non-production expenses can be the key differentiator between merely breaking even and achieving sustainable success. It’s about more than just cutting costs; it’s about strategic allocation, forecasting, and ensuring every dollar spent contributes meaningfully to your overarching business objectives. A well-designed overhead budget template serves as your compass, guiding financial decisions and illuminating the path to fiscal health.

Why an Overhead Budget is Crucial for Business Success

Many entrepreneurs and business leaders focus intensely on revenue generation and direct cost reduction, sometimes overlooking the consistent drain of operational costs. These indirect expenses, while not directly tied to producing a product or service, are absolutely essential for keeping the business running. They include everything from rent and utilities to administrative salaries and marketing efforts, forming the bedrock of your operational framework.

Without a structured approach to these expenditures, businesses risk unexpected cash flow shortages, inaccurate pricing, and an inability to forecast future financial health. A comprehensive budgeting framework allows for proactive financial management rather than reactive damage control. It provides the foresight needed to make informed decisions about scaling operations, investing in new ventures, or identifying areas for efficiency improvements.

Deconstructing the Overhead Budget: Key Components

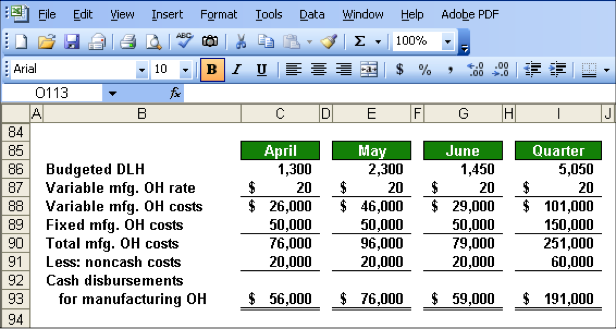

Understanding what goes into an overhead budget is the first step toward effective financial control. These costs are typically categorized as either fixed or variable, impacting how they are managed and forecast. A good budgeting tool will naturally accommodate both types, allowing for precise tracking and analysis.

Here are the essential elements typically found in a robust overhead budgeting framework:

- **Rent or Mortgage Payments**: A primary fixed cost for most businesses.

- **Utilities**: Includes electricity, water, gas, and internet services; can be semi-variable.

- **Administrative Salaries**: Wages for non-production staff (e.g., HR, accounting, reception).

- **Insurance**: Premiums for various policies like liability, property, and workers’ compensation.

- **Office Supplies**: Consumables like paper, pens, and printer ink.

- **Maintenance and Repairs**: Costs associated with keeping facilities and equipment in working order.

- **Marketing and Advertising**: Expenses related to promoting the business and its offerings.

- **Professional Services**: Fees for legal, accounting, or consulting expertise.

- **Software and Subscriptions**: Licenses for operational software, cloud services, etc.

- **Depreciation**: The systematic expensing of an asset’s cost over its useful life.

Each of these components needs to be meticulously tracked and projected to ensure a holistic view of your non-production expenditures.

The Core Benefits of Utilizing a Standardized Budget Framework

Adopting a structured approach to managing your indirect costs offers a multitude of benefits that extend far beyond simple cost-cutting. It empowers businesses with clearer financial visibility, improved decision-making capabilities, and enhanced strategic planning. A well-implemented overhead budget template transforms guesswork into data-driven insights.

One significant advantage is enhanced financial transparency. By detailing every non-production expense, businesses gain a granular understanding of where their money is going. This clarity is invaluable for stakeholders, investors, and internal management, fostering trust and accountability. Moreover, it significantly improves cost control and efficiency. Pinpointing areas of overspending or underutilization allows management to implement targeted interventions, optimizing resource allocation and boosting operational efficiency. This proactive management of non-production expenses directly contributes to healthier profit margins.

Furthermore, a detailed budgeting tool aids in strategic planning and forecasting. It provides a reliable foundation for setting future financial goals, evaluating potential investments, and making informed decisions about expansion or contraction. Businesses can model different scenarios, understanding the impact of various overhead adjustments on their bottom line. Finally, it streamlines the pricing strategy for products and services. By accurately accounting for all indirect costs, businesses can set prices that ensure profitability, avoiding the common mistake of underpricing due to an incomplete understanding of total operational expenses.

Crafting Your Own: Steps to Using a Budgeting Framework

While the idea of managing indirect expenses can seem daunting, utilizing a pre-designed overhead budget template simplifies the process significantly. It provides a structured starting point, reducing the initial effort and allowing you to focus on the numbers rather than the format. The goal is to make this tool a living document, reviewed and updated regularly.

- Gather Historical Data: Start by collecting all expense records from previous months or years. This data is crucial for creating realistic projections. Look for trends and patterns in your spending on utilities, rent, administrative salaries, and other recurring costs.

- Categorize Your Expenses: Organize your historical data into the predefined categories of your budgeting framework, such as rent, utilities, insurance, marketing, and professional services. Distinguish between fixed costs (which remain constant regardless of activity) and variable costs (which fluctuate with business activity).

- Project Future Costs: Based on historical data, upcoming contracts, and anticipated business growth, project your expenses for the next budget period (e.g., monthly, quarterly, annually). Be realistic and factor in any known changes, such as rent increases or new software subscriptions.

- Allocate Responsibilities: Assign specific team members or departments responsibility for monitoring and managing certain categories of overhead costs. This promotes accountability and ensures that all expenses are actively managed.

- Monitor and Adjust Regularly: A budget is not a static document. Regularly compare your actual spending against your budgeted amounts. Identify variances, understand their causes, and make necessary adjustments to your projections or spending habits. This continuous feedback loop is vital for maintaining financial discipline.

Customization and Best Practices for Effective Overhead Management

While a standardized budgeting template offers an excellent foundation, its true power lies in its adaptability to your unique business context. No two businesses are exactly alike, and your approach to managing indirect costs should reflect your specific operational realities and strategic goals. Tailoring your framework ensures it remains a relevant and powerful tool for financial control.

Consider adding custom categories that are specific to your industry or business model. For instance, a tech company might need detailed line items for specific software licenses or cloud infrastructure costs, while a retail business might focus more on store maintenance and visual merchandising expenses. The key is to make the framework work for you, not the other way around.

Beyond customization, adhering to best practices can significantly enhance the effectiveness of your overhead budgeting efforts. Always maintain a buffer for unexpected expenses; this financial cushion can prevent minor issues from becoming major crises. Regularly review your contracts and vendor agreements to ensure you’re getting the best possible rates for services like insurance, utilities, and internet. Furthermore, cultivate a culture of cost consciousness within your organization, encouraging all employees to be mindful of company resources. Finally, leverage technology; modern accounting software and financial planning tools can automate data collection, improve accuracy, and provide real-time insights into your spending patterns.

Common Pitfalls and How to Avoid Them

Even with the best intentions and a solid budgeting framework, businesses can fall into common traps when managing their overheads. Being aware of these pitfalls can help you steer clear of them and maintain more effective financial control. Ignoring them, however, can lead to inaccurate forecasts, unexpected cash flow issues, and missed growth opportunities.

One prevalent mistake is underestimating variable overheads. While fixed costs are relatively straightforward, variable overheads can fluctuate significantly with changes in business activity. Failing to account for these swings can lead to budgeting shortfalls when activity levels increase. Another pitfall is infrequent budget reviews. A budget that’s created once a year and then forgotten quickly becomes irrelevant. Regular, ideally monthly or quarterly, reviews are essential to compare actual spending against projections and make necessary adjustments.

A third common error is lack of departmental accountability. If no one person or department is explicitly responsible for managing specific overhead categories, costs can easily spiral out of control. Clear ownership fosters a sense of responsibility and encourages proactive cost management. Lastly, ignoring small, recurring expenses can accumulate into a significant problem. Individually, a small software subscription or a minor office supply order might seem insignificant, but collectively, these can add up to a substantial amount that impacts your overall profitability if not tracked and managed. Consistent diligence across all expense types is crucial for comprehensive overhead control.

Frequently Asked Questions

What is the primary purpose of an overhead budget template?

The primary purpose is to provide a structured method for planning, tracking, and controlling a business’s indirect costs or non-production expenses. It helps businesses understand where their operational funds are being spent and ensures these expenditures align with financial goals.

How often should a business review and update its overhead budget?

While the initial budget might be set annually, it’s highly recommended to review and update your overhead budget at least monthly or quarterly. This allows for timely identification of variances between actual and budgeted expenses, enabling proactive adjustments.

Are marketing expenses considered overhead?

Yes, marketing and advertising expenses are generally considered overhead costs. They are indirect costs that are necessary to support sales and business operations but are not directly tied to the production of a specific product or service.

What’s the difference between fixed and variable overheads?

Fixed overheads are costs that remain constant regardless of the level of business activity, such as rent or insurance premiums. Variable overheads, on the other hand, fluctuate in proportion to business activity, like some utility costs or certain office supplies.

Can a small business benefit from using a detailed overhead budgeting framework?

Absolutely. Small businesses often operate with tighter margins and less financial leeway, making effective management of all expenses, including overheads, even more critical. A detailed budgeting tool helps them maintain financial stability and supports sustainable growth.

In essence, mastering your indirect costs through a well-implemented budgeting system is not just about financial hygiene; it’s about strategic empowerment. It transforms nebulous operational expenditures into actionable insights, paving the way for more informed decision-making and robust financial health. By consistently applying the principles of planning, tracking, and adjusting, businesses can turn what often feels like a burden into a powerful lever for growth and profitability.

Embracing a systematic approach to overhead management ensures that every dollar contributes to your bottom line, not just disappears into the operational ether. It equips you with the clarity and control needed to navigate economic shifts, capitalize on opportunities, and build a more resilient and prosperous future for your organization. Start leveraging the power of a dedicated financial planning tool today to gain unparalleled clarity over your non-production expenditures.