In the vibrant landscape of faith-based organizations across the United States, effective stewardship is more than just good practice—it’s a sacred responsibility. Every dollar received and spent represents an opportunity to further the ministry’s mission, impact lives, and serve the community. However, managing finances without a clear, organized plan can quickly lead to inefficiencies, missed opportunities, and even a loss of trust among congregants and donors.

This is where a dedicated financial framework becomes indispensable. For any church or ministry, having a robust system for tracking income and expenses is not merely about balancing the books; it’s about intentionality, transparency, and strategic foresight. A well-crafted budget serves as a roadmap, guiding your organization’s financial decisions and ensuring that resources are aligned with your core values and objectives.

Why a Dedicated Financial Framework is Essential for Faith-Based Organizations

Operating a church or ministry involves a unique blend of spiritual purpose and practical administration. While the mission is divinely inspired, its execution often relies on earthly resources. A sound financial framework ensures these resources are managed with integrity and wisdom. It promotes transparency, allowing congregants and stakeholders to see how their contributions are being utilized to fulfill the church’s mission.

Beyond transparency, a robust financial plan fosters accountability among leadership and staff. It clearly delineates spending limits and allocation priorities, preventing ad-hoc decisions that could deviate from the ministry’s vision. Furthermore, it empowers leaders to make informed decisions, anticipating future needs, identifying potential challenges, and planning for sustainable growth. Without such a framework, ministries risk operating reactively, which can hinder their long-term effectiveness and impact.

The Core Benefits of Utilizing a Church Ministry Budget Template

Adopting a specialized financial planning tool offers a multitude of advantages for any faith-based organization. Primarily, it provides clarity and structure to what can often feel like a complex and overwhelming task. Instead of reinventing the wheel each year, a comprehensive resource for church financial planning offers a pre-defined format that captures all essential financial data.

This structured approach significantly enhances financial control, allowing ministries to monitor cash flow, track spending against projections, and identify variances early. It also serves as a critical communication tool, simplifying the presentation of financial information to boards, committees, and the congregation, thereby building confidence and trust. Ultimately, leveraging such a tool frees up valuable time and energy that can be redirected toward the ministry’s core mission, rather than getting bogged down in administrative financial management.

Key Elements Your Ministry’s Financial Blueprint Should Include

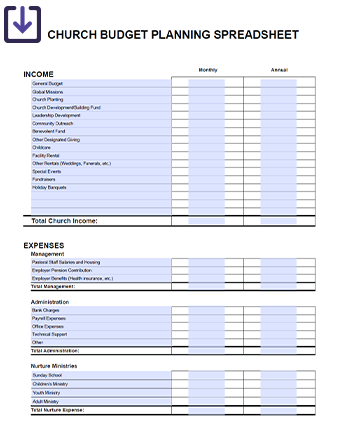

A truly effective Budget Template For Church Ministry isn’t just about columns and rows; it’s a living document that reflects the unique financial realities and aspirations of your faith community. To be comprehensive and useful, your ministry financial blueprint should encompass several critical categories. A detailed outline ensures that no vital aspect of your church’s financial life is overlooked.

Consider the following core components when developing or customizing your budget:

- **Income Sources:** Detail all expected revenue, including tithes and offerings, special donations, fundraising events, facility rentals, and grants. Categorize these to track diversified income streams.

- **Personnel Expenses:** This typically forms a significant portion of a church budget. Include salaries, wages, benefits (health insurance, retirement contributions), payroll taxes, and professional development for all staff, from pastoral to administrative.

- **Program and Ministry Expenses:** Allocate funds for specific ministries such as youth programs, children’s ministry, outreach initiatives, worship arts, missions, and small group activities. Each program should have a clear budget line.

- **Occupancy Costs:** Cover expenses related to your physical facilities, including mortgage or rent payments, utilities (electricity, gas, water, internet), insurance, property taxes, and maintenance and repairs.

- **Administrative and Office Expenses:** Budget for supplies, technology (software, hardware, website hosting), postage, printing, professional fees (accounting, legal), and communication tools.

- **Contingency Fund:** Always include a reserve for unexpected expenses or emergencies. This buffer is crucial for financial resilience.

- **Debt Service:** If your church carries any debt, ensure clear provisions for principal and interest payments.

- **Capital Expenditures:** Plan for larger, infrequent purchases or projects such as building renovations, new equipment, or vehicle acquisitions. These are often distinct from regular operational expenses.

Steps to Effectively Implement Your Ministry’s Financial Plan

Creating a sound budget is only the first step; its true value lies in effective implementation and ongoing management. Transitioning from a theoretical document to a practical, guiding tool requires deliberate action. Start by involving key stakeholders in the budgeting process, fostering a sense of ownership and shared responsibility. This could include board members, ministry leaders, and finance committee members.

Once the initial financial outline for ministry has been drafted, schedule a formal review and approval process. This ensures that the budget aligns with the church’s strategic goals and is financially viable. After approval, communicate the approved budget clearly to all relevant parties. Regular monitoring is crucial; establish a system for tracking actual income and expenses against the budget on a monthly or quarterly basis. Address any significant variances promptly, understanding why they occurred and making necessary adjustments. Finally, view your church budget management process as an iterative one, reviewing and revising the plan annually to reflect changing needs and priorities.

Customizing Your Financial Framework for Unique Ministry Needs

No two churches or ministries are exactly alike. What works perfectly for a large, multi-staffed urban congregation might be overkill or insufficient for a small, volunteer-led rural church. Therefore, the flexibility to adapt a general budget framework to your specific context is paramount. Think of a budget template for church finances as a starting point, not a rigid mandate.

Consider your ministry’s size, programs, income stability, and growth trajectory. A smaller church might combine several expense categories, while a larger organization may need greater granularity. If your ministry has specific outreach programs, separate budget lines for each can provide better oversight. Furthermore, if you receive restricted donations for particular projects, your template should clearly differentiate these funds from general operating income. The goal is to create an organizational budget for churches that accurately reflects your unique operations and supports your mission effectively.

Best Practices for Ongoing Financial Stewardship

Effective financial stewardship extends beyond merely creating an annual budget; it encompasses a continuous commitment to responsible management and transparency. One fundamental practice is to maintain clear and accurate financial records. This involves diligent record-keeping of all income and expenses, ensuring that every transaction is documented and categorized correctly. Regular reconciliation of bank statements with internal records is also vital to catch errors and prevent discrepancies.

Another best practice is to establish and adhere to internal controls. These are policies and procedures designed to safeguard assets, ensure accuracy, and promote operational efficiency. Examples include requiring two signatures on checks over a certain amount, separating financial duties among different individuals (e.g., one person deposits funds, another reconciles accounts), and conducting periodic internal audits. Consistent application of these controls builds trust and protects the ministry’s financial integrity. Furthermore, regularly educating ministry leaders and congregants on the church’s financial health fosters a culture of shared responsibility and informed giving.

Frequently Asked Questions

How often should our church review its budget?

Most churches conduct a formal budget review at least monthly, often tied to a finance committee meeting. A comprehensive annual review and revision process is also essential to prepare for the upcoming fiscal year.

Is a budget template suitable for small churches?

Absolutely. While larger churches may require more detailed categories, a financial planning guide for ministries provides an invaluable framework for small churches to manage their limited resources efficiently, ensuring every dollar supports their mission.

What’s the biggest challenge churches face in budgeting?

One common challenge is accurately forecasting unpredictable income streams, such as tithes and offerings, which can fluctuate. Another is balancing immediate operational needs with long-term strategic investments and unforeseen expenses.

How does a budget template help with financial transparency?

By providing a clear, itemized breakdown of anticipated income and expenses, a ministry budgeting tool allows church leadership to present financial information in an understandable format, fostering trust and accountability among congregants and donors.

Can this template help us track restricted donations?

Yes, an effective financial framework for ministries should include provisions to clearly identify and track restricted funds separately from general operating funds. This ensures that donations designated for specific purposes are used appropriately and reported accurately.

In the journey of faith and service, strong financial stewardship is the bedrock upon which thriving ministries are built. A well-constructed and diligently managed budget is not merely a fiscal instrument; it is a powerful spiritual tool that reflects intentionality, responsibility, and unwavering commitment to your mission. It empowers leadership to allocate resources wisely, fosters transparency with your congregation, and ultimately amplifies your capacity to make a meaningful difference in the world.

Embracing a comprehensive approach to your church’s finances means moving from reactive spending to proactive planning. By utilizing a clear financial plan, your ministry can navigate challenges with confidence, seize opportunities for growth, and ensure that every contribution is maximized for the glory of God and the benefit of your community. Take the step today to refine your financial strategy and equip your ministry for sustained impact and enduring success.