Embarking on a college journey is an exhilarating experience, a blend of academic challenges, new friendships, and newfound independence. For many students, this independence extends to managing their own finances for the very first time. The transition from relying on parental support for daily expenses to handling tuition, rent, groceries, and social outings can be daunting, often leading to stress and, potentially, debt if not managed thoughtfully. This is where the power of proactive financial planning truly shines, providing a roadmap for navigating the complexities of student life without constant money worries.

Understanding where your money comes from and, more importantly, where it goes, is the bedrock of financial stability during your college years and beyond. Without a clear picture, it’s easy to overspend, miss bill payments, or feel perpetually short on cash. Fortunately, modern tools have made this crucial task more accessible and less intimidating than ever before. An online approach to financial organization offers a dynamic and flexible solution, perfectly suited for the busy and often unpredictable schedule of a university student.

Why Every College Student Needs a Budget

College life, while rich in experiences, is also rich in expenses. From textbooks and lab fees to late-night pizza runs and spring break trips, costs can accumulate rapidly. Without a clear financial plan, it’s easy for expenses to outpace income, leading to unnecessary financial strain. A well-structured budget serves as your financial compass, guiding your spending and helping you stay on course toward your financial goals.

Beyond preventing overspending, a budget empowers students to make informed decisions about their money. It fosters financial literacy, teaching valuable lessons about saving, prioritizing, and understanding the true cost of purchases. Developing these skills early on sets a strong foundation for future financial success, long after graduation. It transforms abstract financial concepts into practical daily habits.

The Power of an Online Monthly College Budget Planner

Gone are the days of scribbling numbers on paper or wrestling with complex spreadsheets that feel more like a homework assignment than a helpful tool. An online monthly college budget planner offers unparalleled convenience and functionality. It allows students to track income and expenses in real-time, from anywhere, using a device they already carry—a smartphone, tablet, or laptop. This accessibility means you can update your budget while waiting for class, during a study break, or even on the bus.

The dynamic nature of a digital budget tool also means it’s easily adaptable. College life is rarely static; your income might fluctuate from a part-time job, or your expenses could change from one semester to the next. An online budget template for students makes it simple to adjust categories, add new sources of income, or reallocate funds as your circumstances evolve. This flexibility ensures your financial plan remains relevant and effective throughout your academic journey.

Key Components of an Effective College Budget Template

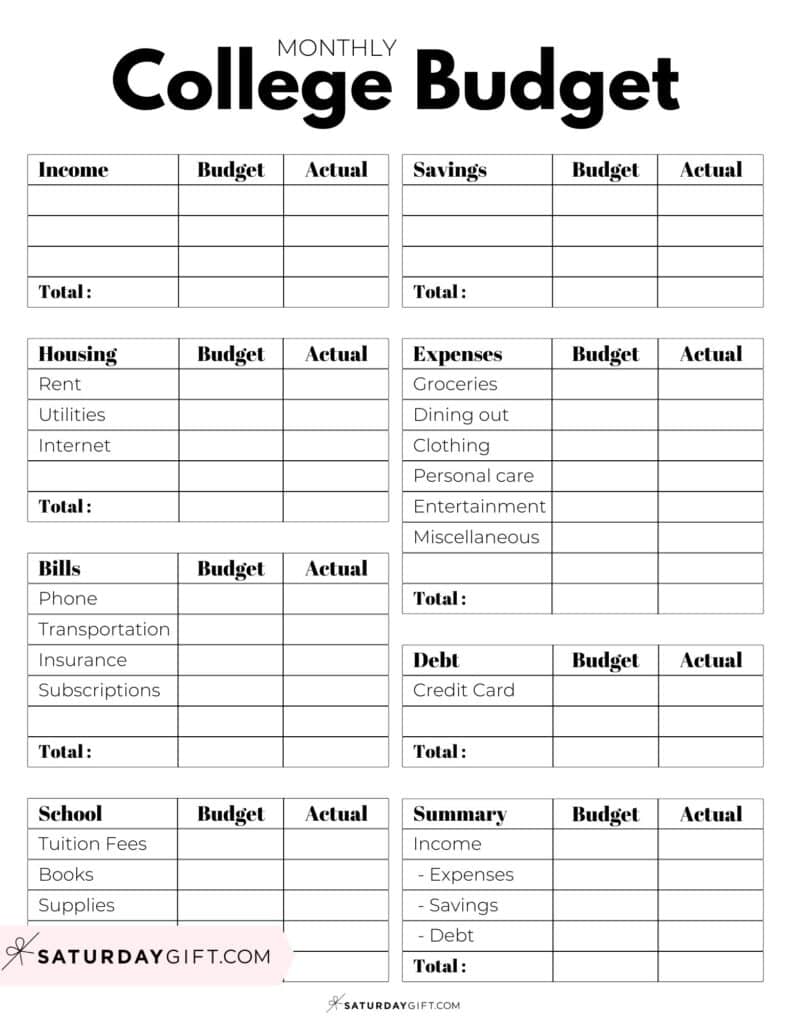

A robust student financial planning template should capture all essential aspects of your financial life. While individual needs may vary, several core categories are universally crucial for college students. Ensuring these elements are well-defined in your digital college budget tool provides a comprehensive overview of your financial health.

Here are the critical components you should expect in a good online budgeting solution for university students:

- **Income Sources**: This includes money from scholarships, financial aid disbursements, student loans, parental contributions, part-time jobs, or freelance work. Accurately listing all income is the first step.

- **Fixed Expenses**: These are costs that remain relatively consistent each month. Examples include **rent and utilities**, internet bills, phone plans, loan payments, and subscription services like streaming platforms or gym memberships.

- **Variable Expenses**: These costs fluctuate month-to-month and are often where students have the most control. Common variable expenses include **groceries**, dining out, transportation (gas, public transit), entertainment, personal care items, and books/supplies beyond tuition.

- **Savings Goals**: Even on a student budget, setting aside money for specific goals is vital. This could be for an **emergency fund**, future education, a down payment after graduation, or a large purchase like a new laptop.

- **Debt Repayment**: If you have any credit card debt or other personal loans, dedicate a specific portion of your budget to **making timely payments** to avoid accumulating interest and damaging your credit score.

Setting Up Your Digital College Budget: A Step-by-Step Guide

Getting started with an online monthly budget guide might seem daunting, but it’s a straightforward process that pays dividends. The key is to be honest and thorough with your financial information.

First, gather all your financial statements. This includes bank statements, credit card bills, financial aid award letters, and pay stubs from any jobs. You need a clear picture of what money is coming in and what has been going out over the past month or two. Once you have your data, input all your income sources into your chosen online budget template. Be realistic about the consistency of these funds.

Next, list all your fixed expenses. These are usually easy to identify as they appear regularly. For variable expenses, estimate initially based on your past spending habits. Many online tools can link to your bank accounts, automatically categorizing transactions, which significantly simplifies this step. Review your spending regularly, ideally weekly, to ensure you’re staying within your allocated amounts. If you consistently overspend in one area, adjust your budget or find ways to cut back. Remember, your college spending plan is a living document, meant to be refined and improved over time.

Maximizing Your Budgeting Success: Tips and Best Practices

Creating an initial student budget worksheet is a fantastic start, but consistency and smart practices are what truly lead to financial success. Treat your budget not as a restrictive chore, but as an empowering tool.

One crucial tip is to track every dollar. Whether it’s a coffee or a textbook, knowing where your money goes is essential. Many online monthly college budget planner templates offer features like transaction importing or mobile apps for on-the-go logging. Regularly review your budget, perhaps once a week, to identify areas where you might be overspending or where you could save more. Another effective strategy is to "pay yourself first" by allocating a portion of your income to savings as soon as you receive it, before you start spending on other things. Don’t forget to build in a small buffer for unexpected expenses; college life is full of surprises, and having a small cushion can prevent minor issues from becoming major financial headaches. Finally, don’t be afraid to adjust your budget. Life happens, and your financial plan should reflect your current reality, not a rigid ideal.

Frequently Asked Questions

How often should I update my college budget?

While an initial setup is crucial, the real power of a college expense tracker comes from regular updates. Aim to review and adjust your budget at least once a week. This allows you to catch overspending early, make necessary reallocations, and keep your financial plan current with your actual spending habits and income changes.

What if my income or expenses change unexpectedly?

One of the significant advantages of an online monthly college budget planner is its flexibility. If your income increases or decreases, or if you face an unexpected expense (like a car repair or a medical bill), simply adjust your categories and allocations within the template. The goal is to adapt your financial template for college life to your current situation, not to stick rigidly to an outdated plan.

Is an online budget planner secure?

Reputable online budgeting tools and services prioritize user security with encryption, multi-factor authentication, and robust data protection measures. When choosing a platform, look for well-known services with strong privacy policies and positive user reviews. Always use strong, unique passwords and be mindful of phishing attempts.

Can I use this for more than just college expenses?

Absolutely. The foundational principles and structure of a digital finance management for students are highly transferable. Once you master using an online monthly budget planner for your college finances, you’ll find it an invaluable tool for managing your money throughout your adult life, whether for career, family, or retirement planning.

What’s the biggest mistake students make with budgeting?

The most common mistake is not tracking expenses consistently or being unrealistic about spending. Many students create a budget but then fail to log their daily transactions, making the budget ineffective. Another pitfall is setting overly restrictive budgets that are impossible to stick to, leading to frustration and abandonment. Be honest with yourself and track diligently.

Embracing the convenience and effectiveness of an online monthly college budget planner template is one of the smartest decisions you can make as a university student. It’s more than just tracking numbers; it’s about taking control of your financial narrative, reducing stress, and building a foundation for lifelong financial wellness. The discipline and insight gained from actively managing your money will serve you far beyond your graduation day, equipping you with essential skills for the complexities of the adult world.

Don’t let financial uncertainty overshadow the incredible opportunities college offers. By taking a proactive approach with a reliable online monthly college budget planner, you can navigate your academic journey with confidence and clarity, knowing you have a firm grasp on your financial future. Start today, and empower yourself with the knowledge and tools to thrive, both in and out of the classroom.