In the intricate world of finance and business, where capital flows are the lifeblood of growth and innovation, loan agreements stand as foundational pillars. Whether you’re a startup securing essential seed funding, an established corporation financing a major expansion, or an individual lending to a business venture, the clarity and enforceability of your lending terms are paramount. A well-crafted long term loan agreement template serves as an indispensable tool, offering a standardized yet flexible framework to formalize these crucial financial relationships.

This comprehensive guide delves into the nuances of developing, utilizing, and customizing such a template, providing a robust resource for anyone navigating the complexities of long-term financing arrangements. It’s designed for business owners, legal professionals, financial advisors, and individuals who recognize the inherent value in meticulous documentation. By providing a clear, legally sound foundation, a robust template mitigates risk, fosters trust, and ensures all parties are aligned on their obligations and expectations from the outset.

The Imperative of Written Agreements in Modern Business

In today’s fast-paced business environment, relying on handshake deals or vague verbal understandings is a recipe for potential disaster. The stakes involved in long-term financial commitments demand absolute precision and legal enforceability. A written agreement transcends the limitations of memory and subjective interpretation, providing an undeniable record of the agreed-upon terms and conditions.

This clarity becomes especially critical when dealing with substantial sums, extended repayment periods, or complex interest structures. Disagreements can arise from misinterpretations, unforeseen circumstances, or a simple lapse in recall. A professionally drafted loan document acts as the definitive reference point, reducing the likelihood of disputes and offering a clear pathway for resolution should they occur. It underscores professionalism and demonstrates a commitment to transparency for all involved parties.

Unpacking the Protections and Advantages of a Standardized Document

Utilizing a comprehensive agreement template offers a multitude of benefits that extend far beyond mere documentation. Primarily, it provides robust legal protection for both the lender and the borrower. For the lender, it clearly defines the repayment schedule, interest rates, default provisions, and remedies, safeguarding their investment. For the borrower, it sets out clear expectations regarding payment obligations, avoiding ambiguities that could lead to unforeseen penalties or demands.

Moreover, a well-structured document streamlines the negotiation process. By presenting a pre-defined framework, it ensures that all critical aspects of the loan are considered and addressed, preventing omissions that could become problematic later. It also saves significant time and legal costs, as parties can adapt an existing, vetted structure rather than building a custom agreement from scratch every time. This efficiency is invaluable in the dynamic landscape of financial transactions, allowing for quicker and more confident deal closures.

Tailoring Your Agreement: Customization for Diverse Needs

While a long term loan agreement template provides a strong foundation, its true power lies in its adaptability. No two loan scenarios are exactly alike, and the template must be flexible enough to accommodate various industries, loan types, and specific requirements. For instance, a loan to a real estate developer might include provisions for collateral in the form of property deeds and specific covenants related to project completion. Conversely, a business loan for working capital might focus more on financial reporting requirements and performance metrics.

The template should be designed with placeholders and customizable sections for elements such as collateral, guarantees, specific repayment triggers, and conditions precedent or subsequent. It allows for the inclusion of industry-specific jargon or regulatory compliance clauses, ensuring the agreement remains relevant and legally sound for its intended purpose. Whether it’s a secured loan, an unsecured line of credit, or a shareholder loan, the core framework can be adapted to reflect the unique risk profiles and operational realities of the transaction.

Essential Components of a Robust Loan Contract

Every effective loan agreement, regardless of its specific context, must contain certain core elements to be legally binding and comprehensive. These sections ensure that all critical aspects of the financial relationship are explicitly addressed, leaving no room for ambiguity.

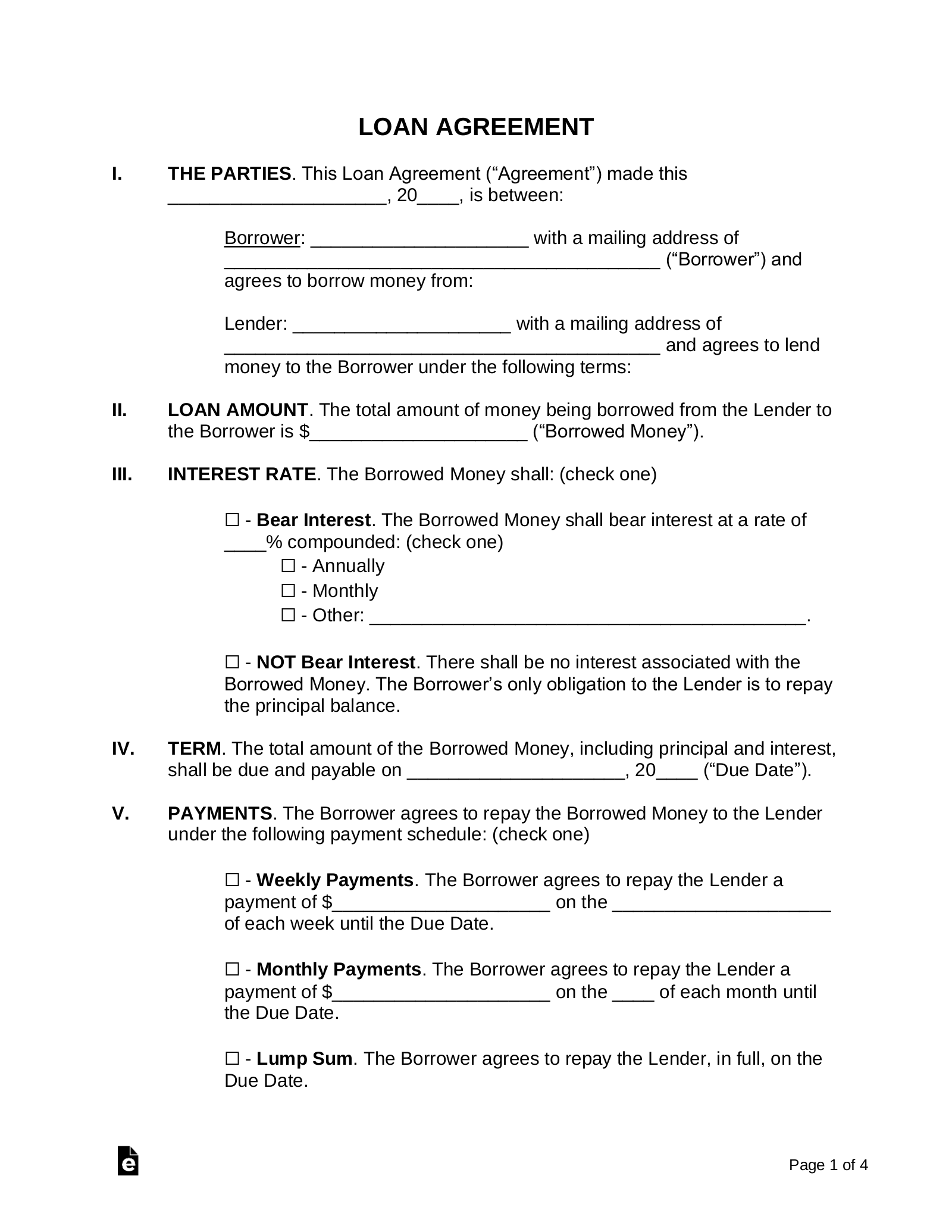

- Identification of Parties: Clearly state the full legal names and addresses of both the lender and the borrower. If applicable, identify any guarantors.

- Loan Amount and Purpose: Specify the exact principal sum being loaned and, if relevant, the intended use of the funds.

- Interest Rate: Detail the annual interest rate, whether it’s fixed or variable, and how it will be calculated and applied.

- Repayment Schedule: Outline the payment frequency (e.g., monthly, quarterly), the due date for each payment, and the total term of the loan. Include any provisions for early repayment or penalties for late payments.

- Default and Remedies: Define what constitutes an event of default (e.g., missed payments, bankruptcy) and the actions the lender can take to recover the funds, such as acceleration of the loan or enforcement of collateral.

- Collateral and Security: If the loan is secured, describe the collateral in detail, including its type and value, and outline the lender’s rights to it in case of default.

- Covenants: Include positive covenants (what the borrower must do, like maintain insurance) and negative covenants (what the borrower must not do, like incur additional debt without consent).

- Representations and Warranties: Statements of fact made by both parties about their legal capacity, financial standing, and the truthfulness of information provided.

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is particularly crucial for US-based transactions.

- Amendments and Waivers: Outline the process for making changes to the agreement and the conditions under which a party might waive certain rights.

- Confidentiality: If sensitive financial or business information is exchanged, include clauses protecting its confidentiality.

- Signatures: Spaces for the authorized representatives of all parties to sign and date the agreement, often witnessed or notarized for added legal weight.

Enhancing Usability: Formatting and Readability Best Practices

A comprehensive legal document, however sound, loses its effectiveness if it’s difficult to read or navigate. Practical considerations for formatting and readability are essential for both print and digital use. Employing clear, concise language free of unnecessary jargon is paramount. While legal precision is required, it should not come at the expense of comprehension for the average reader.

Use headings and subheadings (<h2>, <h3>) to break up the text into manageable sections, allowing users to quickly locate specific clauses. Short paragraphs (typically 2-4 sentences) improve flow and reduce cognitive load. Bullet points or numbered lists, as demonstrated for the essential components, are excellent for detailing specific provisions, conditions, or schedules. Ample white space around text blocks and between sections also enhances readability. For digital templates, ensure they are compatible with common word processing and PDF software, allowing for easy editing and secure sharing. Consider providing an editable digital format alongside a static PDF version for broad usability.

Ultimately, the goal is to create a document that is not only legally robust but also user-friendly, encouraging thorough review and understanding by all parties involved before signing. A well-formatted agreement minimizes confusion and increases confidence in the agreed terms, laying the groundwork for a successful and transparent long-term financial partnership.

The strategic application of a thoughtfully designed long term loan agreement template offers unparalleled advantages in today’s demanding financial landscape. It transcends a mere collection of legal clauses, evolving into a foundational tool for fostering trust, mitigating risk, and ensuring compliance across complex long-term financial arrangements. By providing a clear, comprehensive, and legally sound blueprint, it empowers both lenders and borrowers to approach their commitments with confidence and clarity.

Embracing such a professional, time-saving solution not only streamlines the often-arduous process of securing or extending credit but also fortifies the relationship between parties through transparent and explicit terms. It allows businesses and individuals to focus on their core objectives, secure in the knowledge that their financial agreements are built on a solid, defensible legal framework, preventing future disputes and promoting a stable financial future.