In the vibrant, fast-paced world of beauty and wellness, passion often drives the initial spark of opening a salon. From the intoxicating aroma of fresh cuts and color to the soothing hum of a busy spa, the artistic and relational aspects are undoubtedly fulfilling. However, behind every perfectly styled client and every successful service lies a crucial, often overlooked, foundation: sound financial management. Without a clear financial roadmap, even the most talented stylists or estheticians can find their dream business struggling to stay afloat.

Many salon owners pour their hearts and souls into their craft, sometimes neglecting the spreadsheets and numbers that dictate their establishment’s health. This is where a dedicated financial framework becomes indispensable. It transforms abstract hopes into concrete plans, turning guesswork into calculated decisions. Understanding your salon’s financial pulse isn’t just about avoiding disaster; it’s about identifying opportunities for growth, maximizing profitability, and ensuring the longevity of your cherished business.

The Imperative of Financial Clarity for Beauty Businesses

Operating a salon without a budget is akin to navigating a new city without a map. You might get to some destinations, but you’ll inevitably take wrong turns, waste time, and miss out on the most efficient routes. In the beauty industry, this translates to unpredictable cash flow, surprise expenses, and a constant feeling of uncertainty about your financial standing. It’s a common pitfall for many entrepreneurs who are experts in their services but less experienced in detailed financial oversight.

Moving from a passion-led venture to a sustainably profitable enterprise requires a fundamental shift in perspective. It means recognizing that every product sold, every service rendered, and every penny spent contributes to the bigger financial picture. A robust financial plan doesn’t stifle creativity; it empowers it by providing the stability and resources needed to innovate and expand. It ensures that your salon isn’t just surviving, but thriving, even amidst market fluctuations and economic shifts.

Unpacking the Benefits of a Dedicated Salon Financial Plan

Implementing a structured approach to your salon’s finances offers a multitude of advantages that directly impact your bottom line and overall business health. It’s more than just tracking money; it’s about strategic growth and peace of mind.

Firstly, it enables **better decision-making**. When you have a clear overview of your income and expenditures, you can make informed choices about everything from staffing levels to product inventory. Should you invest in new equipment? Can you afford a marketing campaign? These questions become much easier to answer with data at your fingertips.

Secondly, a precise financial strategy helps in **identifying profit leaks**. Hidden costs, underperforming services, or inefficient spending can silently erode your profits. By categorizing and scrutinizing every expense, you can pinpoint areas where money is being unnecessarily spent and take corrective action. This vigilance ensures that your hard-earned revenue isn’t just flowing out the back door.

Thirdly, it allows for **setting realistic goals**. Whether it’s increasing service revenue by 10% or reducing product waste by 5%, measurable objectives are crucial for growth. A comprehensive financial strategy provides the baseline data against which you can set, track, and achieve these targets, fostering accountability and continuous improvement.

Finally, a strong financial framework leads to **improved cash flow management**. Understanding when money comes in and when it goes out is vital for covering operational costs and avoiding financial shortfalls. Proactive cash flow management prevents those stressful moments when you’re scrambling to pay bills, allowing you to operate with greater confidence and stability.

Key Components of an Effective Salon Budgeting Tool

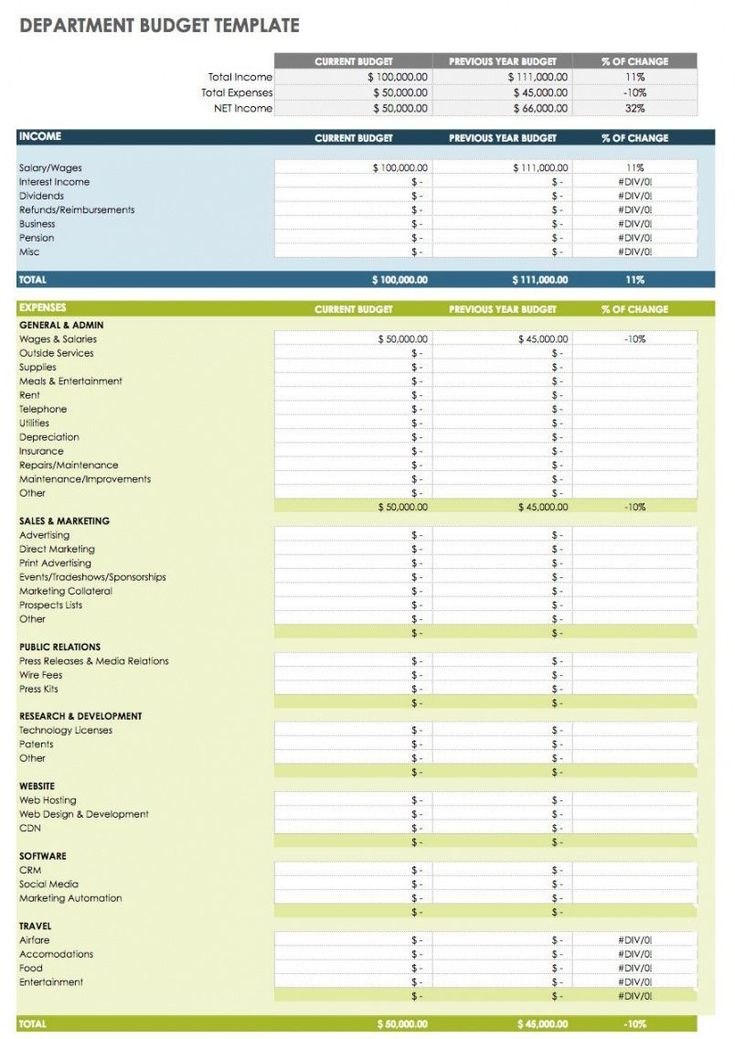

A truly effective salon budgeting tool must be comprehensive, capturing all facets of your business’s financial activity. It breaks down the complex flow of money into manageable, understandable categories, giving you a clear picture of where you stand.

At its core, a robust financial plan for beauty businesses starts with **revenue streams**. This includes income from all services (haircuts, coloring, treatments, manicures, pedicures, facials, etc.), product sales (shampoos, conditioners, styling products, skincare), and other miscellaneous income like gift card redemptions or rental income from chairs. Accurately projecting these inflows is critical for setting realistic financial goals.

Next are the **expenses**, which typically fall into several categories. **Fixed costs** are those that remain relatively constant regardless of your service volume. These include rent or mortgage payments, base salaries for administrative staff, insurance premiums, software subscriptions for booking or POS systems, and certain licenses. Understanding these non-negotiable costs is fundamental.

**Variable costs**, on the other hand, fluctuate with your business activity. This category encompasses commissions paid to stylists or technicians, the cost of retail products sold, professional supplies (color, foils, towels, disposables), utilities (electricity, water, gas, especially if they vary by usage), marketing and advertising expenses, and repair and maintenance costs. Tracking these helps you understand the true cost of each service.

Finally, there are **one-time or capital expenses**. These are typically larger investments like new equipment (salon chairs, dryers, specialized treatment machines), significant renovations, or initial setup costs. While not recurring monthly, planning for these ensures you have the capital available when needed. An integrated beauty salon financial blueprint also includes sections for **profit and loss (P&L) tracking**, allowing you to continuously compare actual performance against your budget projections.

Getting Started: How to Implement Your Beauty Salon Financial Blueprint

Adopting a structured approach to your salon’s finances might seem daunting, but breaking it down into manageable steps makes the process straightforward and incredibly rewarding. The goal is to build a practical, living document that guides your financial decisions.

The initial step involves **gathering historical data**. Look back at your past 6-12 months of financial records—bank statements, sales reports, and expense receipts. This provides a realistic baseline for your income and spending patterns. Don’t skip this; it’s the foundation of accurate projections.

Once you have your data, **categorize every expense**. Group similar items together, creating clear buckets for fixed costs, variable costs, and capital expenditures. This organized view will immediately highlight where your money is going and which areas are consuming the most resources.

Next, **project your revenues**. Based on historical sales, current client base, and any planned marketing efforts or service expansions, estimate your expected income for the upcoming period (e.g., quarter or year). Be realistic, factoring in seasonality if applicable to your business.

With projections in hand, **set clear financial targets**. This could involve a target profit margin, a specific revenue increase, or a reduction in certain variable costs. These targets provide direction and motivation for your financial efforts. Finally, and crucially, **monitor and adjust regularly**. A financial plan is not a static document. It requires ongoing review, comparing actual performance to your budget, and making necessary adjustments. Market conditions, client preferences, and operational costs can change, so your plan must evolve with them.

Customizing Your Financial Planning for Beauty Businesses

One of the most important aspects of effective financial management is recognizing that there’s no one-size-fits-all solution. A single-chair barbershop will have vastly different financial needs and complexities compared to a multi-location full-service spa. Therefore, the key to success lies in customizing your approach to managing salon finances.

Consider the **size and scope of your salon**. A smaller, independent stylist might have fewer fixed costs and a simpler revenue structure, while a larger establishment with multiple employees and diverse services will require more detailed tracking for payroll, commissions, and inventory. Your template should be flexible enough to scale up or down to match your business’s current state.

Think about your **specific service offerings**. Do you specialize in high-ticket treatments or offer a broad range of everyday services? The cost structure for a luxury facial will differ significantly from that of a quick trim. Ensure your expense tracking accurately reflects the unique inputs required for each service, allowing for precise profitability analysis for salons.

Finally, factor in your **growth plans and aspirations**. Are you aiming to expand to a new location, introduce new services, or invest in advanced technology? Your financial plan should be forward-looking, accommodating these future ventures and helping you allocate resources strategically to achieve them. The ability to adapt your financial planning for beauty businesses ensures it remains a relevant and powerful tool for your unique journey.

Tips for Maximizing Your Salon’s Financial Health

Beyond simply creating a financial plan, there are several practices that can significantly enhance its effectiveness and contribute to the long-term prosperity of your beauty business.

- **Regular Reviews:** Don’t just set it and forget it. Schedule monthly or quarterly meetings (even if it’s just with yourself) to review your expense tracker for beauty businesses, compare actuals to budget, and identify trends.

- **Contingency Planning:** Always allocate a portion of your budget to an emergency fund. Unexpected repairs, dips in client numbers, or health crises can happen, and having a financial cushion provides security.

- **Leverage Technology:** Utilize salon management software that includes budgeting and reporting features. This can automate much of the data collection, saving you time and reducing errors.

- **Involve Your Team:** Educate your staff (especially senior stylists or managers) on the importance of cost control for salons and revenue generation. They are on the front lines and can offer valuable insights or contribute to achieving financial goals.

- **Focus on ROI:** When considering new investments, whether it’s a marketing campaign or a new piece of equipment, always calculate the potential return on investment (ROI). Will it truly bring in more revenue or significantly reduce costs?

- **Minimize Waste:** From product usage to utility consumption, be mindful of waste. Even small efficiencies in daily operations can add up to significant savings over time.

Frequently Asked Questions

What is the primary purpose of a salon budgeting tool?

The primary purpose of a salon budgeting tool is to provide a clear, organized framework for tracking and managing your salon’s income and expenses. It helps you understand where your money comes from and where it goes, enabling informed financial decisions, goal setting, and improved profitability.

How often should I update my beauty salon financial blueprint?

While you should ideally monitor your financial performance against your plan weekly or monthly, a comprehensive review and update of your overall beauty salon financial blueprint should happen at least quarterly, and a major revision annually. This ensures it remains relevant to your business performance and market conditions.

Can a small, single-chair salon benefit from managing salon finances?

Absolutely. Even the smallest salons benefit immensely from managing salon finances. It helps single-chair stylists track their service revenue, product sales, commission expenses, and overhead, ensuring they are profitable and can plan for growth, equipment upgrades, or personal financial goals.

What’s the biggest mistake salon owners make with their budget?

One of the biggest mistakes is creating a budget and then failing to stick to it or review it regularly. A budget isn’t a one-time exercise; it’s an ongoing process that requires consistent monitoring, comparison against actuals, and adjustments to be effective.

Where can I find a reliable expense tracker for beauty businesses?

Many salon management software platforms offer integrated expense tracking features. Alternatively, widely available spreadsheet programs (like Excel or Google Sheets) can be customized, or you can use specialized accounting software like QuickBooks. Look for a solution that aligns with your salon’s size and complexity, and that integrates easily with your existing financial processes.

Embarking on the journey of detailed financial planning for your salon isn’t merely about crunching numbers; it’s about investing in the future of your business. It’s about transforming uncertainty into clarity, reactive decision-making into proactive strategy, and passion into sustainable profitability. By diligently using a tailored financial framework, you empower yourself to navigate the economic landscape with confidence and precision.

So, take the crucial step today to gain control over your salon’s financial destiny. Embrace the power of understanding your income and expenses, setting clear goals, and making data-driven choices. Your commitment to financial clarity will not only lead to a more stable and profitable business but also free you to focus more energy on the artistry and client relationships that brought you into the beauty industry in the first place.