In a world buzzing with complex financial tools, intricate investment strategies, and overwhelming budgeting apps, it’s easy to feel lost before you even begin managing your money. Many people yearn for financial control but are deterred by the sheer volume of information and the perception that personal finance must be complicated. The truth is, sometimes the most effective path to clarity and control is the simplest one.

That’s where the idea of a "bare bones" approach comes in. It’s about stripping away the noise and focusing on the absolute essentials—your income and your foundational expenses. This method isn’t just for financial novices; it’s a powerful reset button for anyone feeling overwhelmed, those starting anew, or even seasoned budgeters who need to reconnect with the core mechanics of their cash flow. It empowers you to build a sturdy financial foundation without getting bogged down in minutiae.

Why a “Bare Bones” Approach?

The term “Bare Bones Budget Template” might sound restrictive, but its true power lies in its liberating simplicity. The primary goal is to cut through the complexity that often paralyzes people when they attempt to manage their finances. Traditional budgeting methods can involve dozens of categories, intricate calculations, and an expectation of perfect forecasting, which can quickly lead to burnout and abandonment. A minimalist money plan bypasses this by focusing solely on what’s absolutely necessary to track.

This streamlined budget offers several key advantages. It reduces decision fatigue by limiting the number of choices you have to make about where your money goes. It provides immediate clarity on your financial health, highlighting whether you are spending more than you earn on essential items. Furthermore, it builds confidence. Successfully managing even a simplified spending plan creates momentum, making it easier to tackle more detailed financial planning down the line. It’s about establishing fundamental habits before layering on sophisticated strategies.

Who Needs a Simplified Spending Plan?

While a comprehensive financial framework is beneficial, a lean financial plan is particularly transformative for certain individuals and situations. It’s an ideal starting point for anyone who has never budgeted before or who has tried and failed with more elaborate systems. The simplicity makes it less intimidating, encouraging consistent engagement rather than sporadic attempts.

Consider the young professional just starting their career, navigating their first independent financial responsibilities. Or perhaps someone emerging from a period of financial instability, seeking to regain control and rebuild their financial footing. It’s also incredibly useful for individuals experiencing a significant life change, such as a new job, a move, or a shift in family structure, where finances need to be quickly re-evaluated. Essentially, if you’re looking for a quick, effective way to get a handle on your basic income and outflow without feeling overwhelmed, a core financial tracking tool is precisely what you need. It provides a foundational spending strategy that prioritizes essentials and establishes a clear financial baseline.

The Core Elements of Your Essential Budget

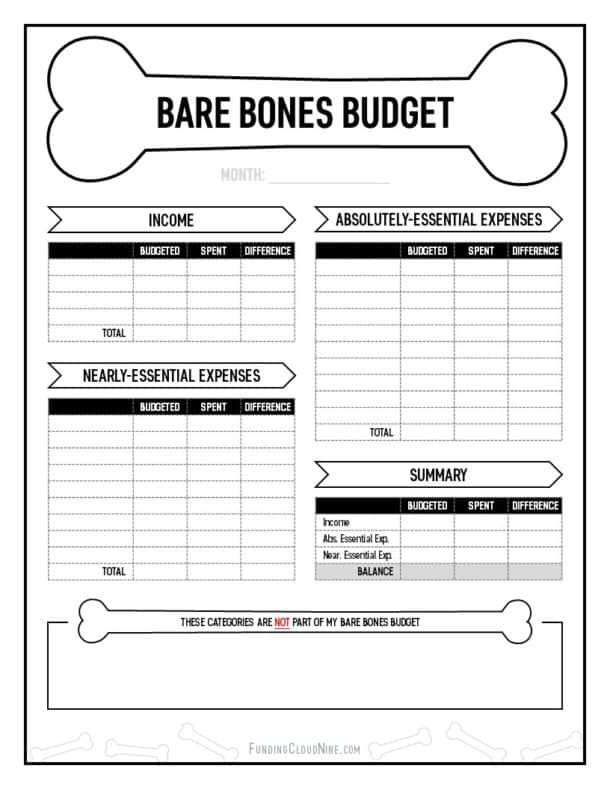

Creating your own Bare Bones Budget Template involves identifying just a handful of critical financial components. The beauty here is in its limited scope; you’re not trying to categorize every latte or every impulse purchase. Instead, you’re focusing on the big rocks: what money comes in, and what absolutely *must* go out to keep your life running. This forms your basic budget outline.

Here are the essential categories that make up a functional, no-frills budget:

- Income: All money you receive after taxes and deductions. This typically includes your net pay, but also any other regular income sources like side gigs, benefits, or passive income.

- Fixed Essential Expenses: These are recurring costs that are generally the same amount each month and are non-negotiable for living. Think of these as your foundational bills.

- Housing: Rent or mortgage payment.

- Utilities: Electricity, gas, water, internet (basic service).

- Debt Payments: Minimum payments on credit cards, student loans, car loans.

- Insurance: Health, auto, renter’s/homeowner’s.

- Transportation: Car payment, public transit pass (if fixed).

- Variable Essential Expenses: These are costs that fluctuate but are necessary for daily life. While they vary, they are not optional.

- Groceries: Food and household necessities.

- Transportation: Gas for your car, occasional ride-sharing (if not covered by a fixed pass).

- Personal Care: Essential toiletries, basic hygiene.

- Medical: Prescription co-pays, necessary doctor visits not covered by insurance.

Notice what’s missing: discretionary spending categories like entertainment, dining out, or shopping for non-essentials. The initial goal is to ensure your income covers your true needs. Once that foundation is solid, you can thoughtfully allocate funds for wants.

Setting Up Your Basic Financial Framework

Embarking on your journey with a fundamental spending guide is simpler than you might imagine. You don’t need expensive software or a finance degree; just a willingness to look at your money honestly. The goal is to create a streamlined budget that provides immediate insight without overwhelming you.

Start by gathering your financial statements from the last one to three months. This includes bank statements, credit card statements, pay stubs, and any loan statements. Your initial task is to identify your total income and then meticulously list out all your fixed and variable essential expenses as defined above. For variable expenses, use an average from the past few months to get a realistic estimate. Don’t worry about being perfectly precise at this stage; approximations are perfectly acceptable for your entry-level budgeting tool.

Once you have these figures, subtract your total essential expenses from your total income. The resulting number is your True Surplus (if positive) or True Deficit (if negative). This is the absolute core of your personal finance foundation. If you have a surplus, great! That’s money you can begin to allocate strategically. If you have a deficit, this basic budget outline immediately highlights that you’re spending more than you earn on necessities, signaling an urgent need for adjustment. You can track this using a simple spreadsheet, a dedicated budgeting app, or even just pen and paper. The method matters less than the act of consistent tracking.

Making Your Minimalist Money Plan Work

The power of any budget, especially a simple budget blueprint, lies not just in its creation, but in its consistent application. A “bare bones” approach is designed for sustainability, but there are still key strategies to ensure its success and to prevent it from becoming just another abandoned financial plan.

First and foremost, consistency is paramount. Make it a habit to check in with your financial tracking tool regularly—daily, weekly, or bi-weekly. This isn’t about rigid adherence to every single line item, but about staying aware of your overall financial flow. Second, be realistic with your estimates. It’s better to slightly overestimate variable essential expenses, like groceries, than to underestimate and constantly feel like you’re failing. Third, review and adjust your basic budget outline periodically. Life changes, and so do your expenses. A simple check-in every month or quarter allows you to adapt your plan to new realities. Fourth, automate where you can. Set up automatic payments for your fixed essential expenses to avoid late fees and ensure they’re covered. Finally, find your “why.” Understanding the deeper reason behind your money management efforts—whether it’s to reduce stress, save for an emergency, or pay off debt—will provide the motivation needed to stick with your foundational spending strategy even when challenges arise.

Beyond the Basics: When to Expand Your Budget

The goal of using a Bare Bones Budget Template is to provide immediate clarity and control, not to permanently limit your financial planning. Once you consistently demonstrate that your income comfortably covers your essential expenses, and you have a clear picture of your True Surplus, you can begin to thoughtfully expand your financial framework.

This transition isn’t about making your budget complicated again, but about strategically adding layers that align with your evolving financial goals. You might introduce new categories like "Savings Goals" (e.g., emergency fund, down payment), "Debt Acceleration" (paying more than the minimum), or "Discretionary Spending" (e.g., entertainment, dining out, hobbies). The crucial difference is that these new categories are added from a position of control and awareness, not out of guesswork or financial anxiety. Your initial streamlined budget serves as the launchpad, ensuring that your core financial needs are always met before you allocate funds to wants and long-term aspirations. It’s about building intelligently, layer by layer, on a solid foundation.

Frequently Asked Questions

How often should I review my essential spending plan?

For a basic financial management plan, reviewing it weekly is ideal, especially when you’re just starting. This allows you to catch any discrepancies early and make minor adjustments. Once you’re more comfortable and consistent, a bi-weekly or monthly review might suffice, focusing on your income and major outgoings.

What if my income is irregular?

Managing an essential spending plan with irregular income requires a slightly different approach. Focus on identifying your absolute minimum essential expenses. Then, when income arrives, prioritize covering those minimums for the upcoming period. Any surplus can then be allocated to a “buffer” fund to smooth out future lean periods, or distributed to variable essentials. Aim to build a small emergency cushion as quickly as possible.

Is a digital tool necessary for a simplified financial framework?

Absolutely not. While digital tools can be convenient, a pen-and-paper ledger, a basic spreadsheet program, or even a simple notebook can serve as an effective core financial tracking tool. The method of tracking is far less important than the act of consistently tracking your income and essential expenses. Choose what feels most accessible and least intimidating to you.

How do I handle unexpected expenses with a lean financial plan?

Unexpected expenses are an inevitable part of life. With a lean financial plan, the best strategy is to first establish an emergency fund, even if it’s small. If an unexpected cost arises before you have an emergency fund, look for areas within your variable essential spending where you can temporarily reduce costs. If that’s not enough, then consider the most responsible short-term borrowing options, always with a clear plan for repayment. The aim is to get back on track quickly.

Can this approach help me get out of debt?

Yes, absolutely. A simplified financial framework is a powerful tool for debt repayment. By clearly identifying your income and essential expenses, you reveal exactly how much “free” money (your True Surplus) you have each month. This surplus can then be intentionally directed towards aggressive debt repayment, beyond just making minimum payments. It gives you the clarity to attack your debt with purpose, rather than just hoping you have extra money at the end of the month.

Embracing the simplicity of a "bare bones" approach to your finances isn’t about deprivation; it’s about clarity, control, and building a foundation that truly lasts. By focusing only on your absolute essentials, you strip away the overwhelm, gain immediate insight into your financial health, and empower yourself to make informed decisions. This fundamental spending guide isn’t a permanent straitjacket; it’s a powerful launchpad for greater financial freedom and more sophisticated planning down the road.

Don’t let the complexity of traditional budgeting deter you from taking control of your money. Start small, stay consistent, and watch as this minimalist money plan transforms your relationship with your finances. It’s time to stop feeling intimidated and start building the clear, stable financial future you deserve. Take the first step today and discover the profound power of simplicity.