Embarking on a new project, whether it’s launching a startup, renovating your home, or organizing a community event, is often exciting and full of promise. However, the enthusiasm can quickly fade if the financial realities aren’t managed meticulously from the outset. Many aspiring project managers and entrepreneurs find themselves overwhelmed by the prospect of complex spreadsheets and intricate financial forecasting, leading to abandoned budgets or, worse, significant cost overruns. This is where the right tool can make all the difference, transforming a daunting task into a manageable and even empowering process.

Understanding and controlling your project’s finances doesn’t have to be a Herculean effort. In fact, with the right approach and a straightforward resource, anyone can master the art of financial foresight. This article will guide you through the invaluable benefits and practical applications of an easy simple project budget template, demonstrating how it can be your most reliable companion in achieving project success without financial stress. It’s designed to bring clarity and control to your financial planning, no matter the scale or complexity of your endeavor.

Why a Straightforward Budget Plan is Essential for Every Project

Effective financial management is the bedrock of any successful project. Without a clear financial roadmap, even the most brilliant ideas can falter due to unforeseen expenses or misallocated resources. A straightforward budget plan acts as your project’s financial compass, guiding every decision and helping you stay on course. It eliminates guesswork and replaces it with informed choices, leading to better outcomes and reduced stress.

The primary benefit of adopting such a plan is gaining absolute clarity over your financial commitments. You’ll understand exactly where your money is going, how much you have left, and what adjustments might be necessary. This level of transparency not only empowers you but also instills confidence in stakeholders, clients, or even family members involved in the project. It transforms potential financial pitfalls into manageable challenges.

Core Components of an Effective Project Cost Estimation Form

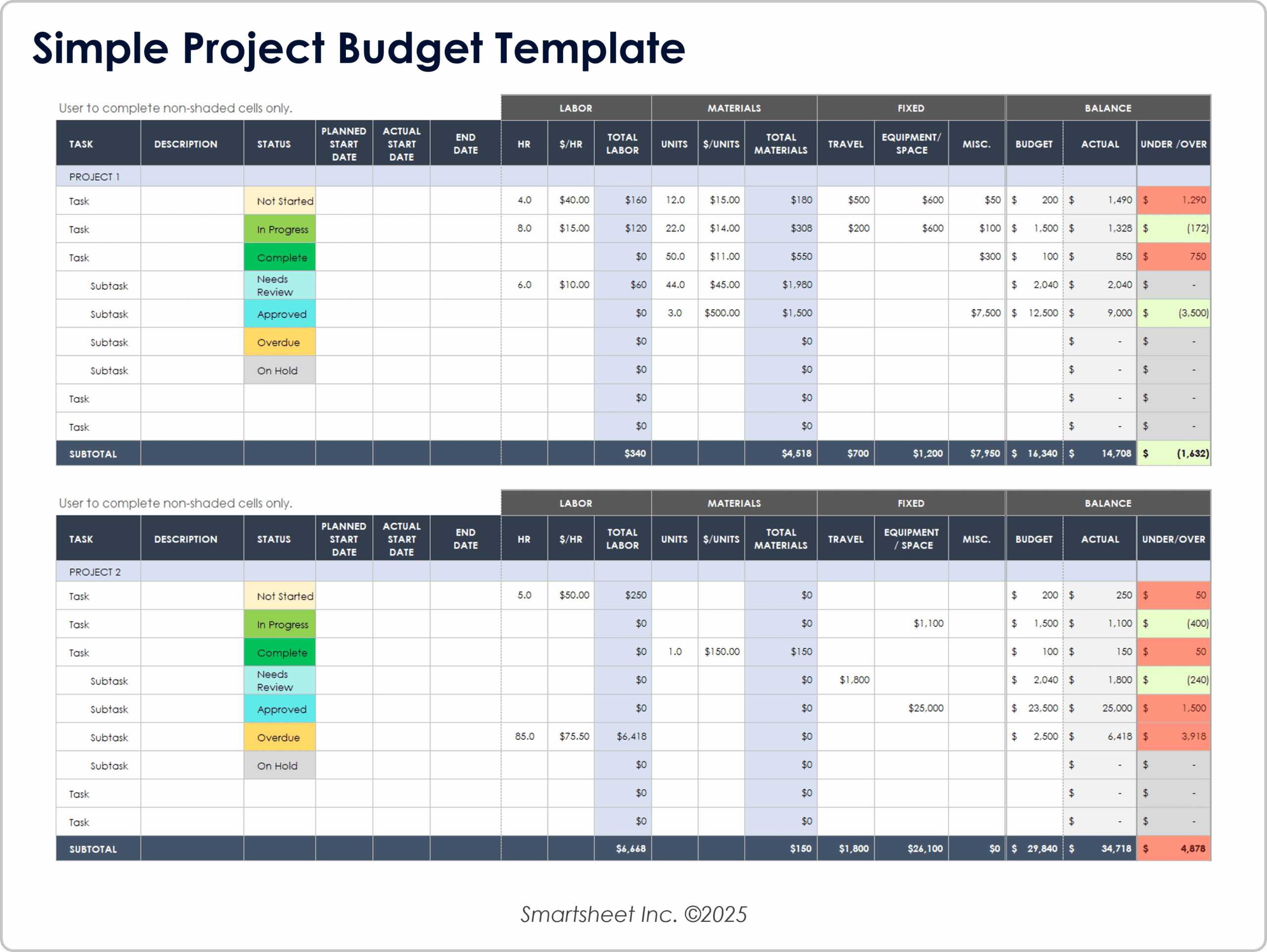

While the term “template” might suggest rigidity, an effective project cost estimation form is actually a flexible framework designed to capture all essential financial details. It breaks down the larger financial picture into digestible segments, making it easier to track and manage. The beauty of a well-designed budget tool lies in its ability to adapt to various project types while maintaining core functionality.

Understanding these core components is key to maximizing the utility of any budget planner. They serve as the building blocks for comprehensive financial oversight, ensuring no critical element is overlooked. By consistently categorizing and recording these aspects, you create a reliable financial narrative for your project.

Breaking Down Costs: Categories and Examples

A crucial aspect of any accessible budget guide is its ability to categorize expenses logically. This allows for easier tracking, comparison, and analysis. Here are some common categories you’ll typically find, along with examples:

- Personnel Costs: This includes salaries, wages, contractor fees, and benefits for anyone directly working on the project. Think of consultants, developers, designers, or skilled laborers.

- Materials and Supplies: Any physical items consumed or incorporated into the project. Examples include raw materials, software licenses, office supplies, or construction materials.

- Equipment: Costs associated with purchasing or renting necessary tools, machinery, or technology that isn’t consumed but is vital for the project’s execution. This might be specialized software, hardware, or heavy machinery.

- Travel and Accommodation: Expenses related to project-specific travel, such as flights, hotel stays, per diems, and transportation for team members or client meetings.

- Marketing and Communication: Funds allocated for promotion, advertising, public relations, website hosting, or communication tools used to reach your audience or stakeholders.

- Contingency Fund: A critical buffer set aside for unexpected costs or risks that may arise. This is typically a percentage of the total budget and serves as a financial safety net.

- Administrative Overhead: Indirect costs that support the project but aren’t directly tied to a specific task. This could include rent, utilities, insurance, or general administrative staff time.

How to Leverage Your Basic Budget Spreadsheet for Success

Having a basic budget spreadsheet is one thing; actively leveraging it to drive project success is another. This isn’t just about listing numbers; it’s about using those numbers to make informed decisions, anticipate challenges, and maintain financial discipline throughout your project’s lifecycle. Think of it as an active management tool, not just a static record.

The true power of a simplified budgeting framework emerges when it becomes an integral part of your project management routine. Regular review and adjustment are paramount, ensuring that your financial plan remains relevant and accurate as the project evolves. This proactive approach helps in mitigating risks before they escalate.

Step-by-Step Guide to Using a Simplified Budgeting Framework

Implementing a simple project budget effectively involves a series of practical steps. These actions transform the template from a mere document into a dynamic financial planning and control system.

- **Define Your Project Scope Clearly:** Before you can budget, you must know what your project entails. Outline objectives, deliverables, timelines, and resources needed. A well-defined scope prevents scope creep, which is a major budget killer.

- **Estimate All Potential Costs:** Go through each category identified earlier and estimate the cost for every item. Be as detailed as possible. For recurring expenses, multiply the cost by the number of occurrences. Consult with experts or past projects for accurate figures.

- **Allocate Funds and Set Baselines:** Once you have your estimates, allocate specific funds to each category. This becomes your initial budget baseline. Ensure your total allocated funds match your available resources. This baseline serves as a reference point for future comparisons.

- **Track Actual Expenses Diligently:** This is perhaps the most critical step. As expenses occur, record them immediately in your project expense sheet. Compare actual costs against your budgeted amounts. This ongoing tracking is what gives you real-time financial insight.

- **Review and Adjust Regularly:** Your project’s financial landscape can change. Schedule regular budget reviews (weekly or bi-weekly) to assess variances. If actual costs deviate significantly, investigate why and make necessary adjustments to future spending or the budget itself.

- **Communicate Financial Status:** Keep all relevant stakeholders informed about the project’s financial health. Transparency builds trust and helps in collective decision-making, especially when adjustments are needed.

Beyond the Numbers: The Broader Impact of Financial Planning for Projects

While the immediate goal of using an effective financial planning tool is to control costs, its impact extends far beyond mere numerical accuracy. Implementing a robust financial planning for projects strategy fosters a culture of accountability and precision within your team. When everyone understands the financial constraints and objectives, they are more likely to make cost-conscious decisions.

Moreover, a well-managed budget enhances stakeholder confidence. Whether it’s investors, clients, or internal management, a clear and well-maintained financial overview demonstrates professionalism and competence. This can lead to increased trust, better collaboration, and even future opportunities. It portrays an organization or individual that is in control and capable of delivering on promises.

Customizing Your Project Budgeting Tool: Making It Work for You

No two projects are exactly alike, and neither should their budgets be. The strength of an easy project budget template lies in its adaptability. While it provides a solid foundation, successful implementation often involves tailoring it to your specific needs. This customization ensures that the tool is not just a generic form but a precise reflection of your project’s unique financial landscape.

Consider the nature of your project. A marketing campaign will have different expense categories than a construction project or a software development initiative. Don’t hesitate to add, remove, or rename categories to align with your specific operations. For instance, a freelancer might need sections for client invoicing and payment terms, which a corporate project might not.

Common Pitfalls to Avoid When Managing Project Finances

Even with the best quick project budget template, certain pitfalls can derail your financial planning. Being aware of these common mistakes can help you navigate around them, ensuring your project remains on a solid financial footing. Proactive avoidance of these issues is as important as diligent tracking.

One frequent error is over-optimism in estimates. It’s easy to underestimate costs, especially for unforeseen challenges or delays. Always build in a buffer, which is where your contingency fund becomes invaluable. Another pitfall is failing to track small expenses. Individually, they might seem insignificant, but collectively, these "microsplurges" can quickly erode your budget. Finally, ignoring budget variances is a major problem. If actual costs consistently exceed estimates without intervention, your budget effectively becomes meaningless.

Frequently Asked Questions

What is a simple project budget template?

A simple project budget template is a pre-designed spreadsheet or document that provides a structured framework for estimating, allocating, and tracking the financial resources required for a project. It typically includes categorized sections for various expenses, income, and a summary to give a clear overview of the project’s financial health. It aims to simplify the complex task of financial planning for projects.

Who can benefit from using this type of budget planner?

Virtually anyone managing a project, regardless of size, can benefit. This includes small business owners, freelancers, team leaders, non-profit organizations, event planners, and even individuals undertaking personal projects like home renovations or travel planning. Its accessible budget guide nature makes it suitable for those who need efficient financial planning without extensive accounting knowledge.

How often should I review my project’s expense sheet?

The frequency of review depends on the project’s duration and complexity. For short, fast-paced projects, a weekly review might be appropriate. For longer, more stable projects, bi-weekly or monthly reviews can suffice. The key is consistency and ensuring that reviews happen often enough to catch deviations early and allow for timely adjustments.

Can I use this for personal projects?

Absolutely. Many individuals successfully adapt a project cost estimation form for personal endeavors such as planning a wedding, saving for a major purchase, managing a home improvement project, or even organizing a large family vacation. The principles of estimating, tracking, and managing expenses remain the same, providing valuable financial control.

What if my actual costs differ significantly from my budget?

Significant deviations mean it’s time for a thorough review. First, identify the exact areas where variances occurred. Then, determine the reasons behind these differences (e.g., inaccurate initial estimates, scope changes, unforeseen expenses). Based on your findings, you’ll need to adjust future spending, reallocate funds, or potentially seek additional funding. It’s a learning opportunity to refine your future financial planning for projects.

Taking control of your project’s finances doesn’t have to be an intimidating ordeal. With the right tools and a disciplined approach, you can navigate the financial landscape of any project with confidence and clarity. The power of a well-utilized easy simple project budget template lies in its ability to demystify budgeting, turning it into an accessible and invaluable asset for achieving your goals.

By embracing this straightforward financial management tool, you’re not just tracking money; you’re actively shaping the success of your ventures. It provides the visibility and control necessary to make informed decisions, avoid costly surprises, and ultimately bring your projects to a successful and financially sound conclusion. Start leveraging the power of smart financial planning today, and watch your projects flourish.