In today’s fast-paced world, managing personal finances can often feel like an uphill battle. Between rising living costs, unexpected expenses, and the desire to save for future goals, it’s easy to feel overwhelmed and disconnected from where your money actually goes each month. Yet, gaining clarity on your financial situation is not only achievable but essential for peace of mind and long-term security.

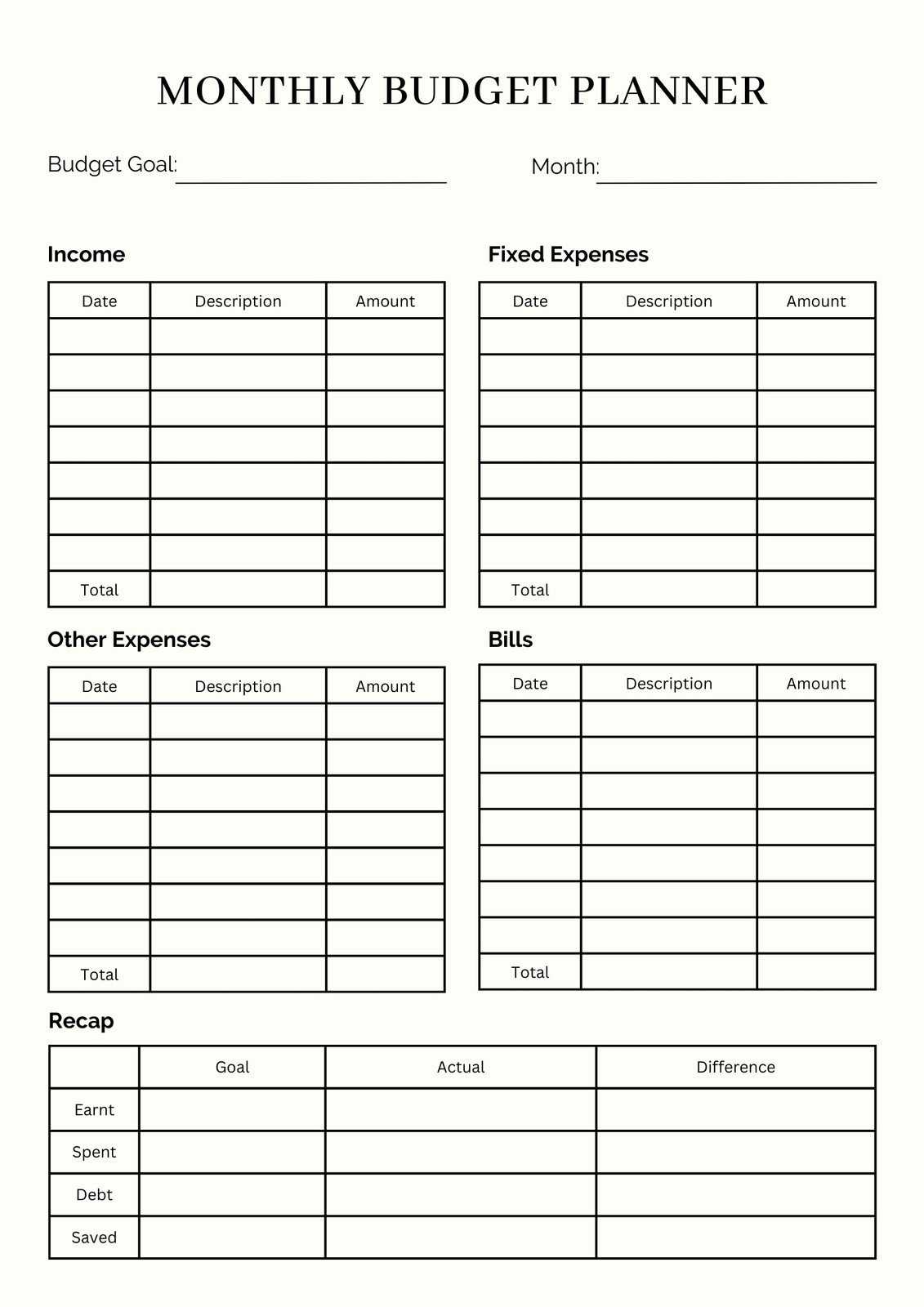

This is where a structured, yet simple, financial tool can transform your approach to money. An Easy Monthly Budget Template serves as your personal financial compass, guiding your spending and saving habits towards your desired destination. It’s designed not to restrict you, but to empower you with knowledge and control, making the path to financial stability clearer for anyone seeking to master their income and expenses.

Why a Simple Budget is Your Financial North Star

Budgeting often carries a negative connotation, conjuring images of deprivation and strict limitations. However, at its core, a budget is simply a plan for your money, a roadmap that shows you where your income comes from and where it’s allocated. When you embrace a user-friendly budgeting tool, you transform a daunting task into an enlightening process. It allows you to see the big picture and make intentional decisions, rather than letting money simply slip through your fingers.

The benefits of adopting a straightforward monthly budgeting tool are profound. It provides a clear snapshot of your financial health, helping you identify areas where you might be overspending and opportunities where you can save more. This clarity is crucial for setting realistic financial goals, whether that’s paying off debt, building an emergency fund, or saving for a down payment on a home. A consistent financial plan reduces stress, builds confidence, and fosters a sense of control over your economic future.

Deconstructing Your Monthly Financial Blueprint

Understanding the fundamental components of any financial plan is the first step toward effective money management. A comprehensive yet easy-to-use budget planner breaks down your finances into two primary categories: income and expenses. By meticulously, but not obsessively, tracking these elements, you gain invaluable insight into your financial flow.

Your income represents all the money you bring in each month, from your primary job to any side gigs or investments. Expenses, on the other hand, are where your money goes. These can be further categorized to provide a clearer picture of your spending habits. Here’s a typical breakdown you’d find in a robust personal financial plan:

- **Fixed Expenses**: Costs that generally stay the same each month, such as your rent or mortgage, loan payments (car, student), and insurance premiums. These are often easier to account for.

- **Variable Expenses**: Costs that fluctuate from month to month, like groceries, utilities, transportation (gas, public transit), and entertainment. These require more diligent tracking.

- **Discretionary Spending**: Money spent on non-essential items or activities that enhance your lifestyle but could be cut back if needed. This includes dining out, shopping for new clothes, hobbies, and vacations.

- **Savings & Debt Repayment**: Allocated funds for your financial goals, such as an emergency fund, retirement contributions, or extra payments towards high-interest debt. Prioritizing these is key to long-term success.

By segmenting your outgoings, you can quickly identify where adjustments can be made without feeling deprived. It’s about making conscious choices that align with your financial objectives.

Getting Started: How to Use Your Budget Template

Embarking on your budgeting journey with an Easy Monthly Budget Template is simpler than you might imagine. The beauty of a well-designed template lies in its intuitive structure, guiding you through the process without requiring advanced accounting skills. The initial setup requires a bit of focused effort, but once established, maintenance becomes a quick and routine task.

First, gather all your financial documents. This includes pay stubs, bank statements, credit card statements, and any bills from the past month or two. This information will provide the data you need to accurately populate your budget planner. Begin by listing all your sources of income, ensuring you account for your net income (what you actually take home after taxes and deductions). Next, move on to your expenses. Go through your bank and credit card statements line by line, categorizing each transaction into the appropriate expense category. Be honest with yourself about your spending; this data is for your eyes only and serves as the foundation for better financial habits.

Once your template is populated, you’ll have a clear overview of your "income minus expenses." The goal is for your income to exceed your expenses, leaving you with a surplus that can be directed towards savings or debt repayment. If you find your expenses are greater than your income, don’t despair. This is precisely the insight a good expense tracker provides, allowing you to pinpoint where cuts can be made or where you might need to find ways to increase your income. Regularly reviewing and adjusting your monthly spending plan is vital; think of it as a living document that evolves with your life.

Tailoring Your Budget for Personal Success

One size rarely fits all, and budgeting is no exception. While an Easy Monthly Budget Template provides an excellent starting point, its true power lies in its adaptability to your unique financial situation and goals. Customizing your budget planner ensures it remains a relevant and effective tool, rather than a rigid set of rules that you’re likely to abandon.

Consider your personal financial goals. Are you saving for a down payment, planning a big vacation, or aggressively paying down credit card debt? Adjust your savings and debt repayment categories to reflect these priorities, perhaps even creating specific sub-categories. You might also want to explore different budgeting methodologies that resonate with your personal style. For example, the 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Alternatively, zero-based budgeting involves assigning every dollar of income a purpose, ensuring no money is left unaccounted for. Experimenting with these approaches within your template can help you find what truly works for you, transforming a generic tool into your personalized financial roadmap.

Beyond the Numbers: Cultivating Healthy Financial Habits

A budget is more than just a spreadsheet; it’s a powerful tool for cultivating discipline and building healthy financial habits. Successfully managing your money isn’t a one-time event but an ongoing process that requires commitment and regular attention. The consistent use of an Easy Monthly Budget Template will naturally lead to a more mindful approach to your finances.

Regularly schedule time, perhaps once a week or bi-weekly, to review your spending and reconcile it with your budget. This practice helps you stay on track, catch potential overspending early, and make necessary adjustments before they become major issues. It also encourages a proactive mindset, allowing you to anticipate future expenses and plan for them accordingly. Beyond the practical application, budgeting fosters a deeper understanding of your financial behavior, empowering you to make smarter choices that align with your values and long-term aspirations. It’s about building a sustainable financial management system that serves you well into the future.

Frequently Asked Questions

How long does it take to set up an Easy Monthly Budget Template?

Initial setup typically takes 1-2 hours. This involves gathering your financial documents and accurately inputting your income and expense data. Once the groundwork is laid, monthly maintenance usually only requires 15-30 minutes.

What if my income is irregular?

If your income fluctuates, consider using an average of your past 3-6 months’ earnings to set a conservative budget. Prioritize covering your fixed expenses, then allocate funds for variable expenses, and finally for savings. You can also implement a “buffer” savings account for leaner months.

Should I include every tiny expense in my budget?

Yes, ideally. Small, seemingly insignificant expenses like daily coffee or subscription services can add up quickly. Tracking these “small leaks” provides the most accurate picture of your spending and highlights areas where minor adjustments can yield significant savings.

How often should I review my budget?

A weekly review is ideal for staying on top of your spending and making timely adjustments. A more comprehensive monthly review, perhaps at the end of each month, allows you to evaluate your progress towards goals and plan for the upcoming month.

Can I use this budget planner to help with debt repayment?

Absolutely. By clearly identifying your income and expenses, you can free up funds to make extra payments on debt. Dedicate a specific category in your template for debt repayment and watch your progress accelerate towards becoming debt-free.

Embracing a systematic approach to your finances doesn’t have to be complicated. With an effective budget planner, you gain the clarity and control needed to navigate your financial landscape with confidence. It’s not about restriction, but rather about intentionality – directing your hard-earned money towards what truly matters to you.

Start today by giving yourself the gift of financial awareness. The simple act of tracking your income and expenses can unlock a world of possibilities, from eliminating debt to building substantial savings. Your journey to financial freedom begins with a single, empowered step, guided by a clear and understandable financial roadmap.