The journey to “I do” is often envisioned as a beautiful tapestry woven with dreams, joy, and shared futures. Yet, beneath the surface of venue tours and cake tastings, lies a critical, often overlooked, foundation: financial planning. Without a clear roadmap for your wedding expenses, the excitement can quickly turn into stress, and the vision can become clouded by unexpected costs. This is where a robust and comprehensive approach to managing your finances becomes not just helpful, but absolutely essential.

For couples embarking on this wonderful adventure, understanding where your money is going is the first step towards a stress-free celebration. A well-structured financial plan provides clarity, helps you prioritize, and ensures that your big day reflects your style without compromising your future financial goals. It empowers you to make informed decisions, negotiate with confidence, and enjoy the planning process without constant worry about your bank balance.

The Indispensable Role of a Wedding Budget

Many couples approach wedding planning with a general idea of what they want to spend, but a vague number rarely translates into effective financial control. A dedicated wedding budget planning tool isn’t just about limiting spending; it’s about allocating resources strategically. It allows you to align your financial realities with your wedding aspirations, ensuring that every dollar contributes meaningfully to your celebration. This proactive approach prevents overspending and helps maintain harmony between partners, as financial disagreements are a common source of stress during this period.

Having a clear outline of your marital finance blueprint from the outset offers immense peace of mind. It helps you identify areas where you might be able to save, and conversely, where it makes sense to invest a little more for a greater impact. Think of it as your financial co-pilot, guiding you through the myriad decisions, from selecting vendors to finalizing decor, all while keeping your financial objectives firmly in sight. It transforms the daunting task of managing wedding expenses into an organized and manageable process.

What Makes a Wedding Budget Truly “Detailed”?

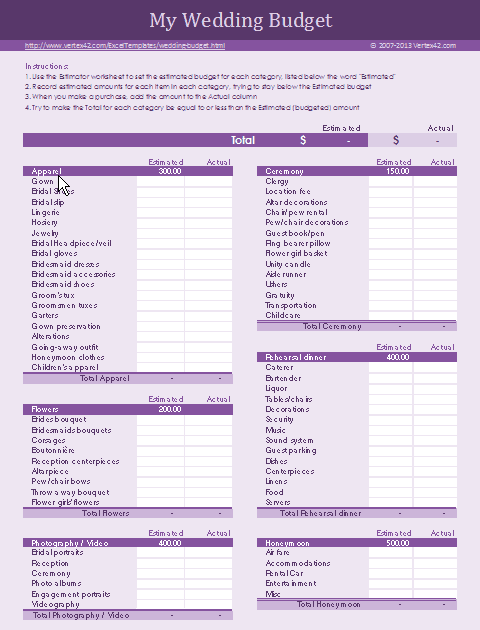

A truly effective wedding spending plan goes far beyond just listing major categories like “venue” and “catering.” It delves into the granular details, anticipating every possible cost, no matter how small, to prevent last-minute surprises. This level of thoroughness is what distinguishes a mere list from a powerful financial management tool. It accounts for the main attractions as well as the numerous incidentals that collectively can add up significantly, offering a realistic view of your total investment.

The goal of a detailed financial template for weddings is to provide a comprehensive overview, ensuring that every anticipated expense has a home. It’s about empowering you to make informed decisions, seeing not just the cost of the main service, but also potential taxes, gratuities, delivery fees, and setup charges that often accompany them. This foresight is crucial for maintaining control and confidence throughout your planning journey.

Key Categories for Your Comprehensive Wedding Financial Plan

Building your financial roadmap for your big day requires breaking down the celebration into its core components. Each element, from the grandest to the most minute, contributes to the overall experience and carries its own cost. Organizing these into clear categories helps immensely in tracking and managing funds effectively.

- **Venue & Catering:** This is often the largest single expense. Consider not just the base price, but also potential costs for **service charges**, **gratuities**, **corkage fees**, and **rental items** like linens or special chairs if not included.

- **Attire & Accessories:** Beyond the wedding dress and suit, budget for alterations, shoes, jewelry, hair accessories, and **getting-ready outfits**.

- **Photography & Videography:** Professional coverage is invaluable. Factor in **extra hours**, **second shooters**, **engagement sessions**, and **albums** or prints.

- **Music & Entertainment:** Whether a DJ, live band, or string quartet, remember potential costs for **setup fees**, **lighting packages**, and **additional equipment**.

- **Floral & Decor:** This includes bouquets, boutonnieres, centerpieces, ceremony decor, and reception enhancements. Account for **delivery** and **setup/teardown fees**.

- **Stationery & Paper Goods:** Invitations, save-the-dates, RSVPs, thank you cards, escort cards, menus, and programs. Don’t forget **postage** and **calligraphy** if desired.

- **Hair & Makeup:** Budget for **trials**, **on-site services**, and services for bridesmaids or mothers.

- **Officiant:** Their fee, if applicable, and any required **travel expenses**.

- **Wedding Rings:** The cost of both engagement and wedding bands, plus potential **engraving** or sizing.

- **Transportation:** Limo services, shuttles for guests, or special getaway cars.

- **Favors & Welcome Bags:** Small tokens of appreciation for guests.

- **Miscellaneous/Buffer:** Crucially, allocate 5-10% of your total budget as a **contingency fund** for unexpected expenses or forgotten items.

Beyond the Big Tickets: Accounting for Hidden Costs

While the major categories are easy to identify, it’s the smaller, often overlooked expenses that can collectively derail a poorly planned financial guide for engaged couples. These “hidden costs” are a notorious source of budget creep. For instance, did you consider the cost of obtaining your marriage license, or the potential for overtime charges from your photographer if the celebration runs longer than planned? These seemingly minor details add up quickly.

Other commonly forgotten expenditures include postage for invitations, alterations that can sometimes be as much as the gown itself, vendor meals, tips and gratuities for various service providers, and even beauty treatments like manicures or spray tans leading up to the big day. The true value of a master wedding budget lies in its ability to prompt you to think through every possible scenario, making sure no stone is left unturned. This foresight is what helps maintain financial equilibrium and prevents those unwelcome surprises.

Customizing Your Financial Blueprint for Marital Bliss

No two weddings are exactly alike, and neither should their financial plans be. A generic budget worksheet for weddings is a starting point, but true effectiveness comes from tailoring it to your unique vision, priorities, and circumstances. Begin by discussing what aspects of your wedding are most important to you as a couple. Is an open bar non-negotiable? Do you dream of lavish floral arrangements? Or is an intimate, destination elopement more your style? Your priorities should dictate where the bulk of your resources are allocated.

Once you’ve identified your "must-haves," you can then look at areas where you’re willing to compromise or reduce spending. This personalized approach to your expense tracking for weddings ensures that your money is spent on what truly matters to you, rather than on adhering to traditional expectations. Remember, this is your celebration, and your financial plan should reflect your personal values and dreams for the day, not just industry averages.

Tips for Successful Budget Management

Effective management of your wedding finances requires discipline, communication, and a proactive mindset. Simply creating a comprehensive wedding financial plan isn’t enough; you must actively maintain and review it throughout the planning process. Start by setting a realistic total amount you are comfortable spending, considering any contributions from family members. This anchor number will guide all subsequent decisions.

Regularly check in with your partner to review expenses and progress. Be transparent about spending and any concerns that arise. Use a digital spreadsheet or a dedicated app for your wedding cost tracker so it’s easily accessible and can be updated in real-time. Don’t be afraid to renegotiate with vendors if initial quotes exceed your allocated amounts, or explore alternative options. Always get everything in writing to avoid misunderstandings, and ensure you understand payment schedules and cancellation policies.

Maximizing the Value of Your Wedding Spending Plan

A well-executed financial roadmap does more than just control costs; it actively enhances your wedding experience. By having a clear understanding of your spending, you gain the confidence to make choices that truly reflect your style and preferences, rather than being swayed by pressure or assumptions. This allows you to invest in elements that will create lasting memories, whether that’s a top-tier photographer, an unforgettable band, or a dream honeymoon.

Think of your thorough financial template for weddings as a tool for intentional spending. It helps you differentiate between needs and wants, allowing you to splurge strategically where it matters most to you, while finding savings in less critical areas. This balance ensures that your wedding is not only beautiful and memorable but also financially responsible, setting a positive tone for your future together as a married couple.

Frequently Asked Questions

How much should we allocate for unexpected costs?

It’s highly recommended to allocate a buffer of 5-10% of your total budget for miscellaneous or unforeseen expenses. This contingency fund can cover everything from sudden price increases to last-minute purchases, ensuring you’re prepared for anything.

When should we start creating our wedding financial plan?

Ideally, you should start working on your wedding financial plan as soon as you get engaged and before you book any major vendors. Establishing your budget early will inform all your subsequent planning decisions, from venue selection to guest list size.

What’s the best way to track expenses once they start piling up?

Utilize a digital spreadsheet (like Google Sheets or Excel) or a dedicated wedding planning app. These tools allow for easy categorization, real-time updates, and sharing between partners, making expense tracking for weddings much more efficient.

Can we adjust our budget after we’ve started planning?

Yes, your budget is a living document. It’s perfectly normal and often necessary to adjust your comprehensive wedding financial plan as you receive quotes, solidify your vision, or make new decisions. Just be sure to revisit your entire plan when making significant changes to ensure balance.

How do we handle family contributions to the wedding budget?

Have an open and honest conversation with contributing family members early on. Clearly define what they are contributing towards and whether there are any expectations tied to their contribution. Integrate these funds directly into your master wedding budget, designating them for specific categories if agreed upon.

Embarking on the journey of wedding planning doesn’t have to be a source of financial anxiety. With a meticulously crafted and carefully managed detailed budget for your big day, you gain not just control over your finances, but also peace of mind. It’s an investment in a smoother planning process, a more enjoyable celebration, and a solid foundation for your future together.

By embracing the power of proactive financial planning, you can transform the daunting task of managing wedding expenses into an empowering experience. This approach ensures that your wedding day is everything you’ve dreamed of, without starting your married life burdened by unexpected debt. Take the first step today towards a beautifully planned and financially sound celebration.