Navigating life as a single mother is a testament to strength, resilience, and unwavering love. From managing daily routines to nurturing a curious toddler, every day presents a unique set of joys and challenges. Among these, mastering personal finance often feels like scaling a mountain while juggling a million other things. The financial landscape for single parents, particularly those with young children, is distinctly demanding, making a clear, actionable budget not just helpful, but absolutely essential for peace of mind and long-term stability.

This isn’t just about tracking pennies; it’s about empowerment, creating a secure foundation for your family, and reclaiming control over your financial destiny. A well-structured financial blueprint offers clarity amidst the chaos, illuminating where your money goes and where it can work harder for you. It transforms the daunting task of money management into an achievable system, tailored precisely to the unique dynamic of a single mom household with a little one in tow.

The Unique Financial Landscape for Single Mothers

Single mothers often shoulder the full financial responsibility of their households, a weight that can feel immense. Unlike dual-income families, there’s no second income to fall back on during emergencies or to help absorb rising costs. This solo financial journey comes with specific pressures, including the high cost of childcare, limited time for extra work, and the sole burden of managing all household expenses and future planning. Without a dedicated financial plan for single mothers, it’s easy for expenses to outpace income, leading to stress and uncertainty.

Childcare alone can consume a significant portion of a single parent’s income, often ranking as one of the largest monthly expenditures. Coupled with the everyday needs of a growing toddler—diapers, formula, clothing, and educational toys—and the inevitable unexpected expenses, the budget can quickly feel stretched thin. This reality underscores the critical need for a proactive and strategic approach to money management, ensuring that every dollar is accounted for and working towards your family’s security.

Why a Dedicated Budget Template is Your Superpower

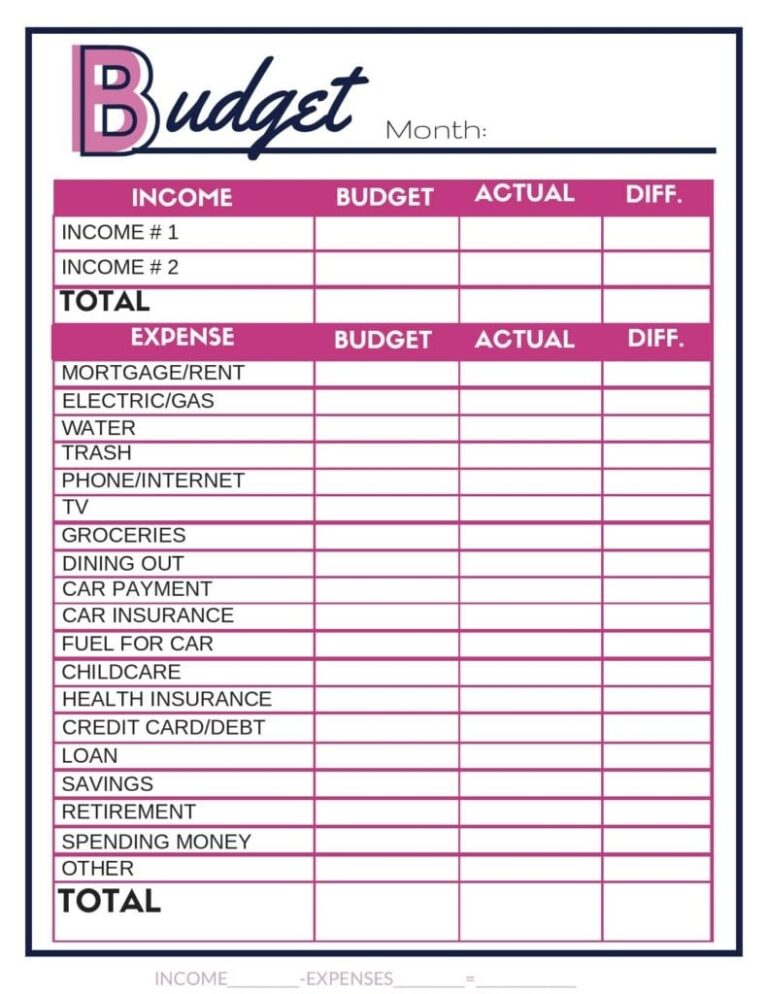

A budget isn’t a restrictive chain; it’s a powerful tool for freedom. For single mothers, a specialized budgeting tool for parents with young children acts as a roadmap, guiding you through the financial journey with confidence. It helps you see the complete picture of your income and expenses, identify areas where you can save, and allocate funds towards important goals like an emergency fund or your child’s future education.

Beyond practical benefits, a clear financial system significantly reduces stress. Knowing exactly where you stand financially can alleviate late-night worries and allow you to focus more on enjoying precious moments with your toddler. It empowers you to make informed decisions, set realistic financial goals, and build a resilient financial future, transforming what might feel like a daily struggle into a strategic and empowering process.

Core Elements of an Effective Budget Template For Single Mom And Toddler

Creating a robust **Budget Template For Single Mom And Toddler** requires a comprehensive look at all income sources and expenditures. It needs to be detailed enough to capture specific needs, yet flexible enough to adapt to life’s inevitable changes. Here are the essential components:

-

Income Tracking

Start by listing all money flowing into your household. Be thorough and accurate.

- Primary Income: Your regular salary or wages.

- Child Support: Any support payments received for your toddler.

- Government Assistance: TANF, SNAP, WIC, housing assistance, or other benefits.

- Freelance/Side Hustle Income: Any extra earnings from part-time work or gigs.

- Other Income: Tax refunds, gifts, or sporadic income sources.

-

Fixed Expenses

These are costs that typically remain the same each month and are non-negotiable.

- Housing: Rent or mortgage payments.

- Utilities: Electricity, gas, water, internet, and phone bills.

- Childcare: A significant expense, including daycare, preschool, or babysitting costs.

- Transportation: Car payments, insurance, and public transport passes.

- Debt Payments: Student loan payments, credit card minimums, personal loan payments.

- Insurance: Health, life, or renter’s insurance premiums.

-

Variable Expenses

These costs fluctuate month-to-month but are still essential.

- Groceries: Food for your household, including baby food and snacks.

- Toddler Needs: Diapers, wipes, formula (if applicable), clothing, and toys.

- Household Supplies: Cleaning products, toiletries, laundry detergent.

- Transportation (Gas): Fuel costs for your car.

- Personal Care: Haircuts, hygiene products, occasional treats for yourself.

- Medical Co-pays: Doctor visits for you or your child.

-

Discretionary Spending

These are non-essential expenses that can often be adjusted or cut.

- Entertainment: Movies, dining out, subscriptions (streaming services).

- Shopping: Non-essential clothing, gifts, impulse buys.

- Hobbies: Any costs associated with personal interests.

-

Savings & Debt Repayment

Crucial categories for building financial security and reducing future burdens.

- Emergency Fund: Aim for 3-6 months of living expenses.

- Future Goals: College savings for your toddler, down payment for a home, retirement.

- Aggressive Debt Repayment: Beyond minimum payments to reduce debt faster.

Setting Up Your Single Mom Budget: A Step-by-Step Guide

Implementing a money management system for moms doesn’t have to be complicated. Here’s a straightforward approach to getting started:

1. Calculate Your Net Income: Gather all your pay stubs, child support statements, and any other income sources from the past month. Add them up to get your total after-tax income.

2. List All Your Expenses: Go through your bank statements, credit card bills, and receipts for the last 1-2 months. Categorize every expense into fixed, variable, and discretionary. Don’t forget those small, recurring charges.

3. Identify Areas for Adjustment: Compare your total income to your total expenses. If expenses exceed income, it’s time to make cuts, starting with discretionary spending. Look for ways to reduce variable costs, like meal planning for groceries or finding cheaper childcare alternatives.

4. Allocate Funds for Savings: Even if it’s a small amount, make saving a priority. Treat your savings contribution as a “fixed expense” that gets paid first. This helps build your emergency fund and secures your future goals.

5. Choose Your Tracking Method: Whether it’s a spreadsheet, a budgeting app, or a simple notebook, pick a method you’ll consistently use. Consistency is key to the success of any budget.

6. Review Regularly: Life changes, and so should your budget. Schedule a monthly check-in to review your spending, adjust categories, and ensure your financial blueprint remains aligned with your goals and current situation.

Navigating Common Challenges and Finding Savings

Even with a solid financial blueprint for a single parent and toddler, challenges will arise. The key is adaptability and creativity in finding solutions. Childcare costs are often the biggest hurdle. Explore state subsidies, inquire about sliding scale fees at local daycares, or consider co-op childcare arrangements with other parents. Family support, if available, can also offer invaluable help.

When it comes to groceries, meal planning is your best friend. Plan meals around sales, buy in bulk for non-perishables, and cook larger batches to freeze for later. Look for community programs that offer food assistance or free meals for children. For unexpected expenses, that emergency fund you’re building will be your safety net. If you don’t have one yet, focus on saving even $5-$10 a week until you reach a small buffer. Every little bit adds up, creating a resilient financial framework for single parent households that can withstand life’s curveballs.

Customizing Your Financial Blueprint for Growth

A budget isn’t a static document; it’s a living tool that evolves with your life. As your toddler grows, their needs will change—diapers will be replaced by school supplies, and childcare costs might shift to after-school programs. Your income might also change, whether through a raise, a new job, or additional side hustles. Regularly customizing your budget is crucial to ensure it continues to serve your family’s best interests.

Think of your budget as a strategic partner in achieving your financial dreams. Set clear, measurable goals, both short-term (like paying off a small debt or saving for a specific item) and long-term (like a down payment on a home or college savings). This single mom’s financial planning guide should inspire action and adapt to your aspirations, allowing you to continually refine your strategy and build a future of increasing financial security and opportunity for both you and your child.

Frequently Asked Questions

How often should I review my single parent budget?

Ideally, you should review your budget at least once a month. This allows you to compare your actual spending to your budgeted amounts, identify any overspending, and make necessary adjustments for the upcoming month. A quarterly deeper dive can help you assess progress towards larger financial goals.

What’s the best way to track my expenses?

The “best” way is the one you’ll consistently use. Options include budgeting apps (like Mint, YNAB), online spreadsheets (Google Sheets, Excel), or a simple pen-and-paper ledger. Many people find linking their bank accounts to an app helpful for automatic categorization, reducing manual entry.

How much should I aim to save for emergencies?

The general recommendation is to save 3-6 months’ worth of essential living expenses in an easily accessible emergency fund. As a single mother, aiming for the higher end of this range, or even more, can provide greater peace of mind given the sole reliance on your income.

Can a single mom budget really help with debt?

Absolutely. A detailed budget helps you clearly see how much money you have available after covering essential expenses. This clarity allows you to intentionally allocate extra funds towards debt repayment, accelerating the process and saving you money on interest over time. You can prioritize high-interest debts using strategies like the debt snowball or avalanche method.

What if I fall off track with my financial plan?

Don’t get discouraged! Budgeting is a skill that takes practice, and everyone experiences setbacks. Instead of giving up, acknowledge what went wrong, learn from it, and gently guide yourself back on track. Adjust your budget if necessary to better reflect your reality, and remember that flexibility is a key component of a successful long-term financial strategy.

Embracing a tailored financial strategy is one of the most powerful steps you can take as a single mother. It’s not about deprivation; it’s about making conscious choices that align with your values and secure your family’s well-being. By actively managing your money, you’re building a legacy of financial literacy and stability for your child, demonstrating foresight and strength.

Having a robust and personalized Budget Template For Single Mom And Toddler isn’t just about managing money; it’s about investing in your future and creating the freedom to navigate life’s adventures with confidence. Start today, take that first step, and watch as clarity replaces confusion, and financial empowerment becomes a cornerstone of your family’s incredible journey.