The exhilaration of tossing that cap into the air, the sense of accomplishment as you grasp your diploma – these moments are priceless milestones. But as the confetti settles and the celebratory dinners wind down, a new reality often sets in: the world of adult finances. Gone are the days of ramen-fueled study sessions and student discounts being your primary financial strategy. You’re entering the workforce, possibly with your first "real" paycheck, and suddenly, managing money moves from an abstract concept to an immediate, crucial skill. This transition can feel daunting, but it doesn’t have to be a source of stress.

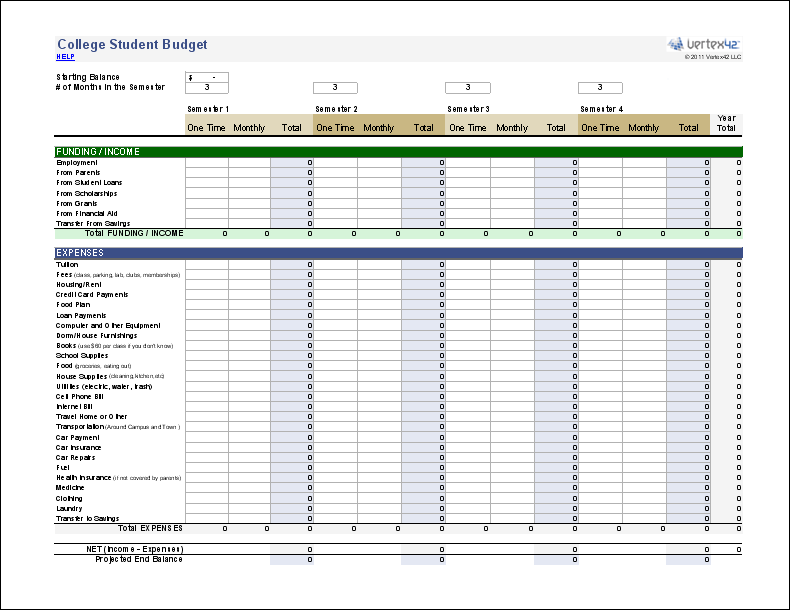

Embarking on this new chapter requires a robust plan, a clear map for your financial journey. That’s precisely where a structured financial tool like a Budget Template For College Graduate becomes indispensable. It’s more than just a spreadsheet; it’s your first step towards financial independence, empowering you to navigate income, expenses, and savings with confidence. This personalized financial blueprint helps you avoid common pitfalls, set achievable goals, and lay a solid foundation for your future wealth.

The Financial Crossroads: Why Graduates Need a Budget

Graduation marks a significant shift not just in your career path, but in your entire financial ecosystem. You might be moving to a new city, starting a job with a steady income, and facing a host of new financial responsibilities that weren’t part of your student life. Rent payments, student loan obligations, car insurance, health benefits, and even simply managing your grocery bill can quickly become overwhelming without a system in place. A comprehensive financial planning sheet for new degree holders helps you see exactly where your money is coming from and, more importantly, where it’s going.

Without a clear post-college spending plan, it’s easy to fall into a cycle of reactive spending. You might find yourself consistently running out of money before your next paycheck, accumulating credit card debt, or feeling stressed about unexpected expenses. Proactive money management, facilitated by a well-designed financial framework for young adults, transforms these potential anxieties into opportunities for growth. It allows you to make informed decisions, prioritize your spending, and consciously allocate funds towards both immediate needs and long-term aspirations. It’s about taking control, rather than letting your finances control you.

Understanding Your New Financial Landscape

Your financial landscape post-graduation is a mix of exciting new income streams and often unavoidable expenses. Getting a firm grasp on these elements is the first step in creating an effective graduate financial blueprint. Your income will likely be your first stable salary, but remember to distinguish between your gross pay (before deductions) and your net pay (what actually hits your bank account). Taxes, health insurance premiums, and retirement contributions will typically reduce your gross income significantly, so budgeting based on your net income is crucial.

On the expense side, you’ll encounter a blend of fixed and variable costs. Fixed expenses are generally consistent month-to-month and are often non-negotiable, such as rent, student loan minimum payments, car loan payments, and insurance premiums. Variable expenses, however, fluctuate. This category includes groceries, dining out, entertainment, transportation (gas, public transit), and utilities. Identifying these categories and tracking how much you spend in each is vital for creating a realistic and manageable budget template for college graduate. Understanding these nuances will allow you to prioritize, cut back where necessary, and direct your hard-earned money towards your financial goals.

Key Components of an Effective Graduate Budget

A robust financial planning sheet for new degree holders isn’t just about listing numbers; it’s about providing a clear, actionable overview of your financial life. Here are the essential elements that any comprehensive post-college spending plan should include:

- **Income Sources**: Clearly itemize all sources of income, including your primary salary, any freelance work, or other side hustles. List the **net amount** you receive after taxes and deductions.

- **Fixed Expenses**: Dedicate a section to your non-negotiable, regular monthly payments. This includes **rent/mortgage**, student loan minimums, car payments, insurance premiums (health, auto, renter’s), and subscription services.

- **Variable Expenses**: This category covers costs that change from month to month. Break it down into sub-categories like **groceries**, dining out, transportation (gas, public transit fares), utilities (electricity, internet), and personal care items.

- **Debt Management**: Beyond minimum payments, allocate funds towards **accelerated debt repayment** for high-interest debts like credit cards or student loans, if possible. This is crucial for long-term financial health.

- **Savings Goals**: Even with a modest income, prioritizing savings is non-negotiable. Include allocations for an **emergency fund** (aim for 3-6 months of living expenses), retirement contributions (401k, Roth IRA), and specific short-term goals like a down payment on a car or a future trip.

- **Discretionary Spending**: This is your “fun money” – funds allocated for entertainment, hobbies, shopping, and other non-essential activities. Setting a **realistic limit** here is key to avoiding overspending while still enjoying life.

- **Tracking and Review**: A budget is a living document. Include a section or process for **regularly tracking your actual spending** against your budgeted amounts and reviewing your financial progress each month.

Building Your Personalized Financial Blueprint

The beauty of a graduate financial blueprint is its adaptability. While a template provides a fantastic starting point, truly effective money management post-graduation comes from customizing it to your unique circumstances and financial goals. You can leverage various tools, from simple spreadsheets (like Excel or Google Sheets) to dedicated budgeting apps that connect directly to your bank accounts. The best tool is the one you’ll actually use consistently.

Here’s a step-by-step approach to building out your personal finance tracker for young professionals:

First, gather all your financial information. This includes recent pay stubs, bank statements, credit card statements, and loan documents. Understanding your current financial reality is the foundation.

Next, input your net monthly income from all sources into your chosen tool. Be realistic and only count guaranteed income.

Then, list all your fixed expenses, ensuring you include every regular payment. Many people find it helpful to look at bank statements from the past few months to ensure nothing is missed.

After that, estimate your variable expenses. This can be challenging at first. Track your spending for a month or two without judgment to get an accurate picture of where your money is currently going for groceries, dining, and other flexible categories.

Allocate funds towards your debt repayment and savings goals. Remember the “pay yourself first” principle – move money into savings accounts as soon as you get paid, before you have a chance to spend it.

Finally, review and adjust. Your initial budget won’t be perfect. Life happens, and your spending habits may change. Be prepared to revisit your plan monthly, making tweaks and adjustments as needed. This flexibility is crucial for long-term adherence to your managing money post-graduation strategy.

Practical Tips for Budgeting Success

Having a robust budget template for college graduate is only half the battle; successfully implementing and sticking to it is where the real work happens. Here are some actionable tips to help you succeed:

**Automate Your Savings**: Set up automatic transfers from your checking account to your savings and investment accounts on payday. This ensures you consistently contribute to your financial goals without having to remember.

**Track Every Dollar (Initially)**: For the first few months, meticulously track every single dollar you spend. This intensive tracking provides invaluable insights into your actual spending habits and can highlight areas where you might be unknowingly overspending. Many budgeting apps can simplify this process.

**Embrace the 50/30/20 Rule**: This popular budgeting guideline suggests allocating 50% of your after-tax income to needs (housing, utilities, groceries), 30% to wants (dining out, entertainment, hobbies), and 20% to savings and debt repayment. It offers a great framework for starting a budget after university.

**Find an Accountability Partner**: Share your financial goals with a trusted friend, family member, or partner. Having someone to check in with can provide motivation and help you stay on track, especially when facing temptations.

**Review Regularly, Adjust Often**: Your financial situation isn’t static. Review your post-college spending plan at least once a month. Did you overspend in one category? Did you have unexpected income? Adjust your allocations for the next month accordingly. Treat your budget as a living document.

**Be Patient and Forgiving**: There will be months where you don’t stick perfectly to your budget, and that’s okay. Don’t let one misstep derail your entire effort. Learn from it, adjust, and move forward. Consistency over perfection is the goal.

**Avoid Lifestyle Creep**: As your income increases, resist the urge to immediately upgrade your lifestyle proportionally. Instead, use extra funds to accelerate debt repayment, boost your emergency fund, or increase your investments. This is a crucial element of effective college grad money management.

**Leverage Employer Benefits**: If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s essentially free money and a fantastic way to kickstart your retirement savings.

Frequently Asked Questions

Is a budget really necessary if I don’t have much income yet?

Absolutely. Even with a modest income, a budget is crucial. It helps you prioritize your limited funds, ensure essential bills are paid, and avoid accumulating debt. It’s about making the most of what you have and setting good financial habits from the start.

How often should I update my budget?

You should review your budget at least once a month. This allows you to track your actual spending against your plan, identify any discrepancies, and make necessary adjustments for the upcoming month. A full re-evaluation, where you revisit your financial goals and major allocations, can be done quarterly or annually.

What if I struggle to stick to my budget?

It’s common to struggle initially. Don’t get discouraged. Re-evaluate your budget to ensure it’s realistic. Are your allocations too restrictive? Are you consistently overspending in one area? Adjust your categories, reduce “wants,” and consider automating savings first. Focus on progress, not perfection, and learn from your overages.

Should I use an app or a spreadsheet for my post-college spending plan?

The best tool for your post-college spending plan is the one you will use consistently. Spreadsheets offer maximum customization and are free, while budgeting apps often provide automated transaction tracking, categorization, and visual reports, though some may come with a subscription fee. Try both to see which aligns better with your preferences and tech comfort.

How do I factor in student loan payments effectively?

Student loan payments should be treated as a fixed expense. Know your minimum monthly payment and budget for it. If you have extra funds, consider making additional payments to reduce the principal faster, especially on high-interest loans. Research repayment plans to ensure you choose one that fits your current income and long-term goals.

The journey after college is a thrilling adventure, full of new experiences and opportunities. By embracing a structured approach to your finances with a well-utilized Budget Template For College Graduate, you’re not just managing money; you’re investing in your peace of mind, your freedom, and your ability to pursue the life you envision. It’s an empowering tool that removes guesswork and replaces it with clarity, giving you the confidence to make smart financial choices every day.

Starting your financial journey with a clear financial blueprint isn’t about restriction; it’s about liberation. It allows you to understand your capacity for saving, identify areas where you can comfortably spend, and strategically tackle any debt. Take the initiative now to build your personalized financial planning sheet for new degree holders, and you’ll unlock a powerful advantage, setting yourself up for a lifetime of financial stability and success. Your future self will thank you for taking control today.