In the intricate world of modern business, clarity and precision in communication are not merely desired but absolutely essential. For professional service providers, especially those in the critical field of bookkeeping, establishing a clear understanding with clients from the outset is paramount. This is where a robust letter of engagement steps in, serving as the foundational contract that delineates responsibilities, scope, and expectations for both parties.

A thoughtfully constructed letter of engagement acts as a beacon, guiding the professional relationship by clearly outlining the services to be rendered, the terms of engagement, and the specific duties of both the bookkeeper and the client. It’s a vital document that protects all involved by preventing misunderstandings, ensuring legal compliance, and fostering a relationship built on transparency and mutual respect. For bookkeepers and accounting professionals, as well as businesses seeking these services, leveraging a well-designed bookkeeping letter of engagement template offers unparalleled advantages in efficiency and professionalism.

The Imperative of Professional Correspondence

In today’s fast-paced business environment, the significance of a well-crafted professional document cannot be overstated. For bookkeepers, establishing clear boundaries and expectations from the very first interaction is crucial for long-term client satisfaction and risk mitigation. A detailed letter of engagement serves as a legally binding agreement, offering a clear reference point should any disputes or ambiguities arise regarding the scope of work or financial arrangements.

Beyond its legal implications, a professional engagement letter profoundly impacts the perception of your bookkeeping practice. It signals a commitment to high standards, meticulous planning, and client protection, thereby enhancing your firm’s reputation for professionalism and trustworthiness. This foundational document sets the tone for the entire relationship, ensuring that both the bookkeeper and the client are aligned on the objectives and operational procedures of the engagement.

Unlocking Efficiency with a Standardized Framework

The prospect of drafting a comprehensive letter of engagement from scratch for every new client can be daunting and time-consuming. This is precisely where the value of a ready-made template becomes evident. Utilizing a standardized framework for your client agreements offers a multitude of benefits, streamlining your onboarding process and allowing you to focus more on delivering exceptional service.

Firstly, a template ensures consistency across all your client engagements, guaranteeing that no critical clauses or information are inadvertently omitted. This standardization helps in maintaining compliance and reduces potential liabilities. Secondly, it significantly reduces the time and effort spent on administrative tasks, freeing up valuable resources that can be reallocated to core bookkeeping functions or business development. Furthermore, a professionally designed template inherently projects an image of competence and organization, reinforcing client confidence in your services before the engagement even officially begins. It allows your practice to scale efficiently, offering a predictable and polished client experience every time.

Adapting Your Engagement Document

While the core purpose of an engagement letter remains consistent, the specific needs of each client and the scope of services can vary significantly. Therefore, a truly effective bookkeeping letter of engagement template is one that is flexible enough to be customized for different purposes or situations without losing its fundamental structure. This adaptability is key to serving a diverse client base effectively.

Consider the variations: one client might require comprehensive payroll services alongside general ledger maintenance, while another may only need monthly reconciliation and financial statement preparation. The template should allow for easy modification of the scope of services section, fee structures (e.g., fixed monthly fee versus hourly rates), and specific client responsibilities. You might also need to tailor clauses related to industry-specific regulations or software requirements. The ability to personalize this correspondence ensures that each client receives an agreement that precisely reflects their unique engagement, while still benefiting from the robust framework of the template. It’s about finding the balance between standardization and individual client focus.

Essential Components of a Solid Agreement

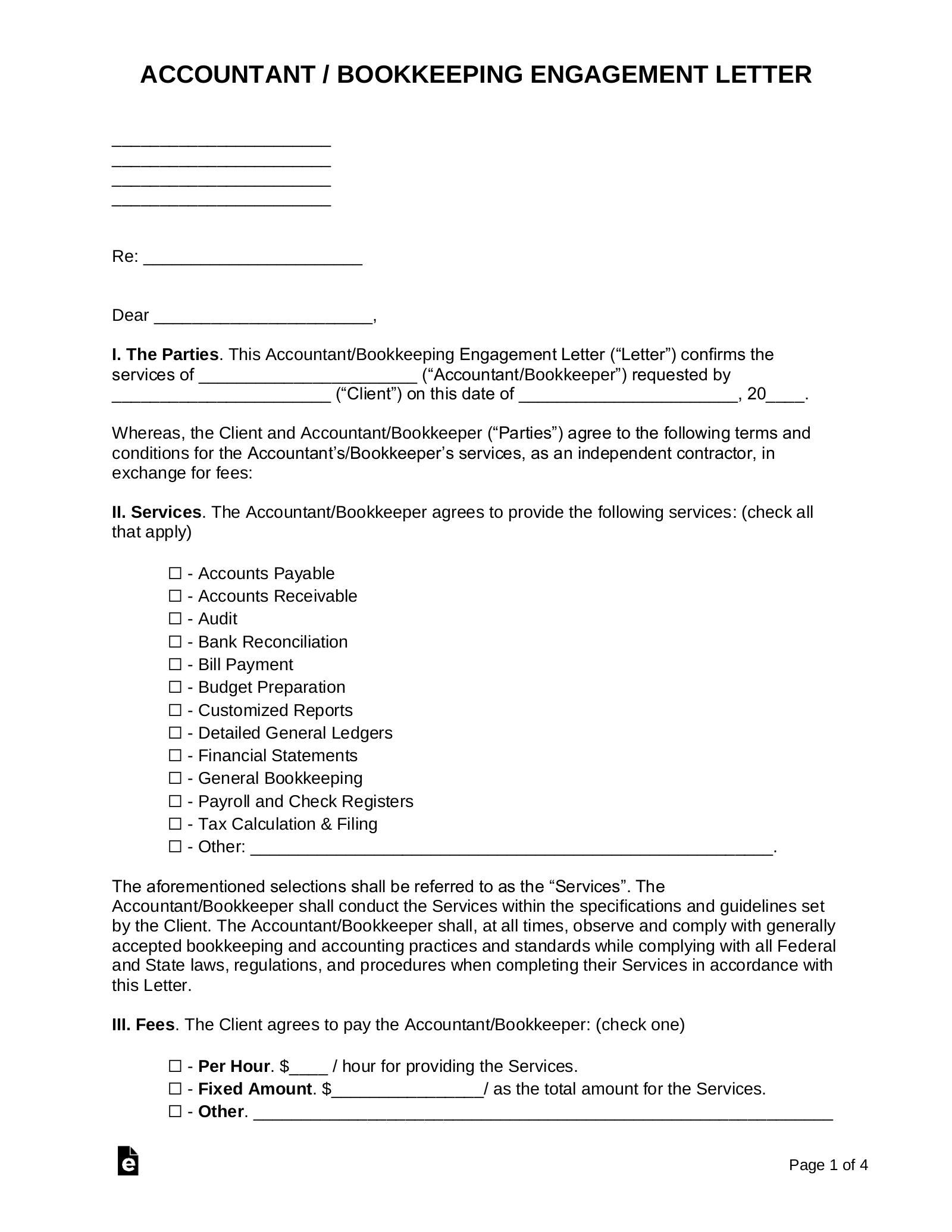

Every effective engagement letter, particularly in the detailed field of bookkeeping, must incorporate a series of critical sections to ensure absolute clarity and comprehensive coverage. These components form the backbone of the agreement, leaving no room for ambiguity between the service provider and the recipient. When preparing your document, ensure these key parts are meticulously addressed:

- Sender and Recipient Information: Clearly state the full legal names, addresses, and contact details of both your bookkeeping firm and the client entity.

- Date of Issuance: The precise date the letter is prepared and sent, crucial for document control and record-keeping.

- Purpose of Engagement: A concise introductory paragraph stating the intention of the letter – to formally engage bookkeeping services.

- Scope of Services: This is perhaps the most critical section. It must explicitly detail all services to be provided (e.g., general ledger, accounts payable/receivable, payroll, bank reconciliation, financial reporting) and, equally important, any services excluded from the engagement (e.g., tax preparation, auditing, legal advice).

- Client Responsibilities: Clearly outline what the client is expected to provide, such as timely access to financial records, bank statements, receipts, and prompt responses to inquiries.

- Bookkeeper Responsibilities: Detail your firm’s commitments, including adherence to professional standards, confidentiality, and the timely delivery of agreed-upon services.

- Fees and Payment Terms: Specify the billing structure (e.g., fixed monthly fee, hourly rate), payment schedule, accepted payment methods, and any clauses regarding late payments, additional charges for out-of-scope work, or retainer requirements.

- Term of Engagement: Define the start date of the services and whether the agreement is for a fixed period or ongoing until terminated by either party.

- Termination Clause: Provide conditions under which either party may terminate the agreement, including required notice periods and procedures for final billing and record handover.

- Confidentiality Clause: Reassure the client that all financial and business information shared will be kept strictly confidential.

- Limitation of Liability: Outline the extent of the bookkeeper’s liability in the event of errors or omissions, within legal and professional guidelines.

- Dispute Resolution: Establish a clear process for handling disagreements, such as mediation or arbitration, before resorting to litigation.

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Acceptance and Signature Block: A dedicated section for the authorized representatives of both the client and the bookkeeping firm to sign and date, formally acknowledging their agreement to the terms.

Mastering Presentation and Tone

The effectiveness of any professional correspondence extends beyond its content to include its presentation and the tone it conveys. Even with a stellar bookkeeping letter of engagement template, careful attention to these details can significantly enhance its impact and perceived professionalism. For both digital and printable versions, these elements are paramount.

The tone of your engagement letter should consistently be professional, clear, and confident, yet always respectful. Avoid overly technical jargon where plain language suffices, ensuring the recipient fully understands all terms and conditions. The language should be unambiguous, leaving no room for misinterpretation, and should maintain a balanced formality that inspires trust without being overly stiff. The overall impression should be one of competence and reliability.

In terms of formatting and layout, a clean and organized structure is crucial for readability. Use clear headings and subheadings within the document itself to break up large blocks of text and guide the reader. Ample white space around text and between sections improves visual appeal and reduces reader fatigue. Opt for legible, standard business fonts like Arial, Calibri, or Times New Roman. For digital versions, ensure the document is delivered as a secure, uneditable PDF, often with options for electronic signatures. For printable correspondence, use high-quality paper and ensure consistent branding, such as your firm’s logo and contact information, is tastefully incorporated. Meticulous proofreading for any grammatical errors or typos is non-negotiable, as even minor mistakes can undermine your credibility. A polished presentation reinforces the message that your firm pays attention to detail, a quality highly valued in bookkeeping.

The strategic implementation of a robust bookkeeping letter of engagement template is more than a mere administrative formality; it’s a cornerstone of professional excellence and risk management. By establishing clear expectations and responsibilities from the very beginning, this vital document serves to protect both your bookkeeping practice and your clients, fostering a relationship built on trust and mutual understanding. It streamlines your onboarding process, allowing you to allocate more time to value-added services rather than repetitive document creation.

Ultimately, a well-utilized bookkeeping letter of engagement template empowers you to present your services with confidence and clarity, ensuring that every client interaction is underpinned by a strong, legally sound agreement. It not only saves invaluable time and effort but also elevates your firm’s professional image, providing peace of mind and setting the stage for enduring and successful client partnerships. Embracing this efficient, polished, and time-saving communication tool is an investment in the stability and growth of your bookkeeping business.