In the dynamic world of entrepreneurship, few ventures offer the immediate demand and potential for growth quite like a cleaning business. From residential sparkle to commercial shine, the opportunities are vast. However, the sparkle behind the scenes, the financial health of your operation, often determines its longevity and success. Without a clear financial roadmap, even the most dedicated cleaning professional can find themselves lost in a maze of expenses and fluctuating revenues. This is precisely where a robust financial plan becomes not just helpful, but absolutely essential for steering your business towards sustainable profitability.

Understanding where every dollar comes from and where it goes is the bedrock of smart business management. Whether you’re just starting your journey or looking to scale an existing cleaning service, a meticulously crafted financial plan serves as your compass. It allows you to make informed decisions, anticipate challenges, and seize opportunities. It’s more than just tracking money; it’s about strategic foresight, ensuring your efforts translate into tangible financial gains and a secure future for your cleaning enterprise.

Why a Solid Financial Blueprint is Non-Negotiable

Every successful business, regardless of its size or industry, operates with a clear understanding of its financial position. For cleaning companies, this means knowing your break-even point, understanding your profit margins for different services, and identifying areas for cost optimization. A comprehensive financial plan helps you prevent cash flow crises, set realistic growth targets, and make data-driven decisions about everything from equipment purchases to staffing levels. It transforms guesswork into calculated strategy.

Moreover, a well-defined financial roadmap is crucial for securing financing. Lenders and investors want to see a clear picture of your projected revenues, expenses, and profitability. A detailed budgeting tool demonstrates your professionalism and your understanding of the business’s economic viability, significantly increasing your chances of approval for loans or lines of credit. It’s the tangible evidence of your business’s potential and your capability to manage it responsibly.

What Your Cleaning Business Budget Template Should Include

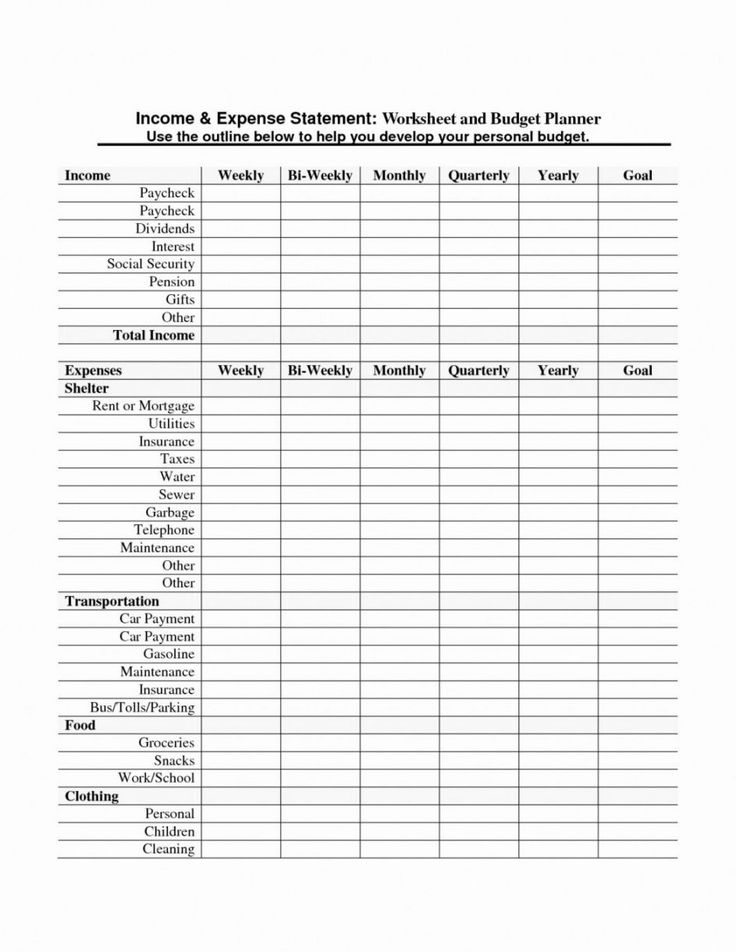

A well-designed financial planning document is more than just a list of numbers; it’s a living document that reflects the financial pulse of your business. It should categorize your financial inflows and outflows in a way that provides clarity and actionable insights.

When developing your cleaning business budget, ensure it captures these critical components:

- **Revenue Streams:** Detail all sources of income, such as residential cleaning contracts, commercial cleaning contracts, specialized services (e.g., carpet cleaning, window washing), and one-off deep cleans. Be specific about **pricing models** and **average job value**.

- **Fixed Costs:** These are expenses that typically don’t change month-to-month, regardless of your service volume. Examples include:

- Rent for office space or storage (if applicable)

- **Insurance premiums** (liability, workers’ comp)

- Vehicle lease payments or depreciation

- Salaries for administrative staff

- Software subscriptions (scheduling, accounting)

- **Variable Costs:** These fluctuate directly with the volume of services you provide. Higher demand means higher variable costs. Key items include:

- **Cleaning supplies** (detergents, disinfectants, gloves)

- Fuel for company vehicles

- Hourly wages for cleaning staff (tied to hours worked per job)

- Equipment maintenance per usage

- **Marketing and advertising** costs (which might have a variable component based on campaigns)

- **One-Time or Startup Expenses:** If you’re new, include initial costs like business registration fees, initial equipment purchases (vacuums, buffers), website development, and initial marketing blitzes. For existing businesses, this might include large equipment upgrades or expansion-related costs.

- **Profit & Loss Projections:** This section consolidates your expected revenues and expenses to project your net profit or loss over a specific period (monthly, quarterly, annually). This is where you see the **bottom line**.

- **Cash Flow Statement:** Essential for understanding the actual movement of cash in and out of your business, ensuring you have enough liquidity to cover immediate expenses.

Building Your Budget: A Step-by-Step Guide

Creating an effective financial plan for a cleaning company doesn’t have to be an intimidating task. By breaking it down into manageable steps, you can build a robust tool that serves your business well.

1. **Gather Historical Financial Data:** If you’re an existing business, collect past bank statements, receipts, and income records from the last 6-12 months. This data provides a realistic baseline for your spending and earning patterns. For startups, research industry averages and get quotes for all your anticipated expenses.

2. **Identify All Revenue Streams:** List every service you offer and how you charge for it (per hour, per square foot, flat rate). Estimate the volume for each service based on current client numbers or market research. Be realistic in your projections.

3. **List and Categorize All Expenses:** Go through every single expenditure, no matter how small. Group them into fixed, variable, and one-time costs as outlined above. Don’t forget licenses, permits, and professional development.

4. **Project Your Numbers:** Forecast your revenue and expenses for the upcoming fiscal year, broken down by month or quarter. Be conservative with revenue estimates and slightly generous with expense estimates to build a buffer.

5. **Analyze and Adjust:** Once you have your initial projections, analyze them. Are your profit margins where you want them to be? Are there any unexpected shortfalls? Look for areas where you can cut costs without compromising service quality or areas where you can boost revenue. This iterative process is crucial.

6. **Monitor and Update Regularly:** A budget is not a one-and-done task. It needs to be a living document. Review your actual financial performance against your projections monthly. Adjust your Cleaning Business Budget Template as market conditions change, new clients are acquired, or expenses shift.

Leveraging Your Budget for Growth and Profitability

Your financial planning document is far more than a simple ledger; it’s a strategic asset. By actively engaging with your financial plan, you can unlock significant opportunities for growth and enhance your profitability. It provides the clarity needed to make confident decisions about the future of your cleaning firm.

One key benefit is the ability to optimize your pricing strategy. By understanding your costs per service and desired profit margins, you can set competitive yet profitable rates. If your financial plan reveals that a particular service line is underperforming, you can adjust pricing or evaluate its efficiency. This precision in pricing ensures you’re not leaving money on the table or unknowingly operating at a loss.

Furthermore, a detailed financial plan helps in identifying cost-saving opportunities. Perhaps you notice that a specific cleaning supply is eating into your profits. Your financial breakdown allows you to explore alternative suppliers, negotiate better deals, or even reformulate your cleaning processes. It also guides investment decisions, helping you determine if a new piece of equipment will genuinely increase efficiency and pay for itself over time, rather than just being an additional expense.

Finally, a robust financial plan supports informed hiring and expansion. When you understand your projected cash flow, you can confidently decide when to bring on new staff, invest in additional vehicles, or expand your service area. It transforms speculative growth into calculated, sustainable expansion, ensuring your cleaning business scales intelligently and remains financially sound.

Common Pitfalls to Avoid When Managing Your Finances

Even with a well-structured financial plan, cleaning business owners can encounter common pitfalls that derail their financial health. Awareness is the first step toward prevention.

One major mistake is underestimating initial and ongoing costs. Many new entrepreneurs overlook small but accumulating expenses like licensing renewals, minor equipment repairs, or continuous professional development. These can quickly add up and strain your budget. Another pitfall is failing to separate personal and business finances. Commingling funds makes it impossible to accurately track your business’s performance, leading to confusion and potential tax issues.

Another critical error is ignoring seasonality. The demand for cleaning services can fluctuate throughout the year. If your financial plan doesn’t account for these dips and peaks, you might face cash flow shortages during slower periods. Equally damaging is the lack of regular review. A budget is not static; it requires constant monitoring and adjustment. Neglecting to compare actual performance against your financial projections means you miss opportunities to correct course before minor issues become major problems.

Frequently Asked Questions

Why can’t I just track expenses in a spreadsheet?

While a basic spreadsheet is a start, a comprehensive financial planning document goes beyond simple expense tracking. It integrates revenue projections, categorizes fixed and variable costs, allows for profit and loss analysis, and helps you understand cash flow. It’s a strategic planning tool that provides a holistic view, enabling smarter decision-making and long-term financial health, rather than just a historical record of spending.

How often should I review my cleaning company’s budget?

Ideally, you should review your cleaning company’s financial performance against your plan **monthly**. This allows you to identify discrepancies quickly, adjust your strategies as needed, and ensure you stay on track with your financial goals. A quarterly deep dive for more significant adjustments and an annual comprehensive review are also highly recommended.

What’s the biggest mistake new cleaning businesses make with their finances?

One of the most significant mistakes is **underpricing their services**. New businesses often aim to be the cheapest to attract clients, without fully understanding their operating costs. This can lead to working for little to no profit, or even at a loss, making sustainable growth impossible. A proper financial planning document helps you set competitive yet profitable prices.

Can a budgeting tool help with pricing my services?

Absolutely. By meticulously tracking all your variable and fixed costs, and understanding the time and resources invested in each service, a robust financial plan allows you to calculate your true cost of doing business. This clarity is essential for setting profitable prices that cover your expenses and provide a healthy profit margin.

Is it worth hiring a bookkeeper or accountant for this?

For many cleaning business owners, especially as they grow, hiring a professional bookkeeper or accountant is a wise investment. They can ensure accuracy, optimize tax strategies, and free up your time to focus on operations and client service. While you can start with a template yourself, a professional can provide expert guidance and ensure compliance, saving you stress and potential costly errors in the long run.

Embarking on the journey of entrepreneurship, particularly in the competitive cleaning industry, demands more than just a mop and bucket; it requires a sharp business mind and an even sharper financial strategy. The path to building a thriving cleaning business is paved with informed decisions, and at the heart of every smart decision lies a clear understanding of your finances. This is the power that a well-executed financial plan brings to your operations, transforming potential chaos into structured growth.

By dedicating the time and effort to develop and consistently update your financial blueprint, you’re not just organizing numbers—you’re investing in the longevity and prosperity of your cleaning business. It empowers you to navigate economic fluctuations, seize opportunities, and build a resilient enterprise that not only cleans homes and offices but also cleans up financially. Start building your financial foundation today and watch your business sparkle from the inside out.