Managing your money effectively doesn’t have to be a daunting task, especially when your pay schedule dictates a particular rhythm. For many Americans, income arrives twice a month, often on fixed dates like the 1st and the 15th, or the 15th and the last day of the month. This consistent income flow presents a unique opportunity to align your financial planning perfectly with your earnings, creating a seamless system that empowers you to take control of your spending and savings goals.

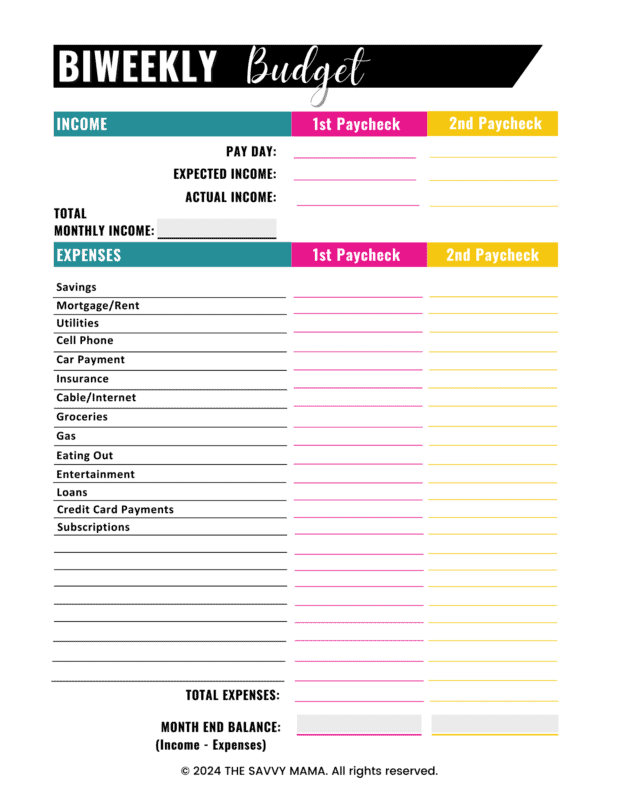

A well-structured Bi Monthly Budget Template is more than just a spreadsheet; it’s a strategic tool designed to mirror this exact pay cycle. It eliminates the guesswork of making a single "monthly" budget stretch across uneven income distributions or waiting periods. Instead, it provides a clear, actionable roadmap for each half of the month, ensuring that every dollar earned has a purpose and every bill is accounted for before it’s due. This approach is particularly beneficial for those who find a traditional monthly budget too broad, or who struggle with cash flow management between paychecks.

Understanding the Bi-Monthly Rhythm

The term "bi-monthly" in the context of personal finance typically refers to a payment or budgeting cycle that occurs twice a month. This is distinct from "bi-weekly," which means every two weeks, resulting in 26 paychecks a year. For many salaried professionals, especially in the US, being paid bi-monthly means receiving exactly two paychecks per calendar month, equating to 24 paychecks annually. This predictable schedule is the foundation upon which an effective twice-a-month budgeting strategy is built.

Adopting a financial strategy that matches this rhythm can significantly enhance your ability to manage expenses. Instead of trying to make a single monthly budget stretch across a full 30 or 31 days, you divide your financial planning into two more manageable segments. This allows for a more granular view of your income and outflow, making it easier to track progress and adjust spending on the fly. It’s about bringing immediate relevance to your financial decisions, aligning them directly with the funds available from each specific paycheck.

Why a Bi-Monthly Budget Aligns with Your Paycheck

The primary advantage of budgeting twice a month is the direct correlation it creates between your income and your spending plan. When your paychecks arrive on consistent dates, such as the 1st and the 15th, you can allocate those funds specifically to the expenses that fall within that half of the month. This proactive approach helps to prevent that "end of the month" crunch where funds might run low before the next paycheck arrives.

This alignment also fosters a greater sense of financial mindfulness. You’re not just looking at a large sum of money for an entire month; you’re consciously distributing smaller, more frequent amounts. This can make larger, annual expenses feel less intimidating when you know exactly which half-month period each portion of savings or payment will come from. It’s a powerful method for managing cash flow and reducing financial stress, ensuring that your budget is always current and relevant to your immediate financial situation.

Key Components of an Effective Bi-Monthly Budget

Crafting a robust twice-a-month spending plan involves breaking down your financial landscape into clear, actionable categories. The goal is to ensure every dollar from each paycheck is assigned a job, whether it’s for immediate needs, future goals, or debt reduction. Understanding these core components is crucial for building a sustainable and effective financial framework.

Here are the essential elements you’ll need to consider for each half-month period:

- Income: Clearly list all sources of income received within that specific half of the month. For most, this will be a single paycheck, but it could also include other regular income streams like side gig payments or child support. Be sure to use your net income (after taxes and deductions).

- Fixed Expenses: These are bills that generally don’t change much from month to month and often have specific due dates. Examples include your rent/mortgage payment, car loan, insurance premiums, and subscriptions. Strategically assign these to the paycheck that arrives closest to their due date to avoid late fees.

- Variable Expenses: This category covers costs that fluctuate, such as groceries, dining out, entertainment, and transportation. These are often the areas where you have the most control and can make adjustments. Allocating a specific amount from each paycheck for these items helps prevent overspending.

- Savings and Investments: Even with a bi-monthly plan, setting aside money for savings should be a priority. Whether it’s for an emergency fund, retirement, a down payment, or a specific goal, decide how much you’ll contribute from each paycheck. Automating transfers on payday is highly recommended.

- Debt Repayment (Beyond Minimums): If you’re actively working to pay down debt, allocate extra funds from one or both paychecks towards these goals. This could be credit card debt, student loans, or personal loans.

Crafting Your Personalized Bi-Monthly Budget Template

Building your own financial blueprint for twice-a-month income doesn’t require specialized software, though many digital tools can certainly help. The most important step is to start, whether with a simple spreadsheet, a notebook, or a dedicated budgeting app. The key is customization to fit your unique financial situation and spending habits.

Here’s a step-by-step guide to developing your personal bi-monthly budget:

- Gather Your Financial Information: Collect statements for all income sources, bank accounts, credit cards, loans, and recurring bills. You’ll need a clear picture of what’s coming in and going out.

- Determine Your Two Pay Periods: Identify the exact dates your paychecks arrive each month. Label these as "Pay Period 1" (e.g., 1st-14th) and "Pay Period 2" (e.g., 15th-end of month).

- List All Income for Each Period: For each pay period, record the net amount of money you expect to receive. This clarity is fundamental to your entire plan.

- Categorize and Assign Expenses:

- Fixed Bills: Go through all your fixed expenses and assign them to the pay period where their due date falls. For example, if rent is due on the 1st, allocate that expense to Pay Period 1. If your car payment is due on the 20th, assign it to Pay Period 2.

- Variable Expenses: Divide your typical monthly variable expenses (groceries, gas, entertainment) evenly between the two pay periods, or adjust based on your lifestyle. For example, if you spend $600 on groceries a month, budget $300 for each pay period.

- Savings/Debt Payments: Decide how you’ll split your savings contributions or extra debt payments across the two paychecks. You might contribute more from one paycheck if another has fewer large bills.

- Calculate and Adjust: For each pay period, subtract your total expenses (fixed + variable + savings/debt) from your total income.

- If you have a surplus, rejoice! You can allocate more to savings, debt, or a fun splurge.

- If you have a deficit, you need to make adjustments. Look for areas in your variable spending where you can cut back, or explore ways to increase income.

- Create a Digital or Physical Template: Set up your chosen method (spreadsheet, app, notebook) with two distinct columns or sections for Pay Period 1 and Pay Period 2. This visual separation is vital for maintaining clarity.

- Review and Iterate: Your financial life isn’t static. Review your budget regularly (at least monthly) and make adjustments as income or expenses change. This iterative process ensures your plan remains relevant and effective.

Tips for Success with Your Bi-Monthly Financial Plan

Implementing a new financial system, even one as intuitive as a twice-a-month spending plan, requires discipline and strategic thinking. To truly master your money and make this budgeting approach work for you, consider these invaluable tips. They’re designed to enhance the effectiveness of your financial efforts and foster long-term success.

- Prioritize Bill Allocation: When assigning bills to specific paychecks, always ensure that critical expenses like rent, mortgage, and loan payments are covered first. If a bill is due shortly after your first paycheck, make sure enough funds from that check are allocated.

- Build a Buffer: Aim to have a small "buffer" in your checking account, ideally enough to cover a few days’ worth of expenses. This helps smooth out any timing issues between your paycheck landing and bills clearing, preventing overdrafts.

- Automate Savings: The easiest way to ensure you’re consistently saving is to automate it. Set up automatic transfers from your checking account to your savings or investment accounts to occur on each payday. This "pay yourself first" strategy is incredibly powerful.

- Track Your Spending Diligently: A budget is only as good as your adherence to it. Use a tracking app, a spreadsheet, or even a pen and paper to log every expense. This will highlight areas where you might be overspending and help you stay within your allocated categories.

- Be Realistic with Variable Expenses: Don’t under-budget for categories like groceries or entertainment, as this will lead to frustration and abandonment of your budget. Start with realistic numbers based on past spending, and adjust as needed.

- Plan for Irregular Expenses: Think about those quarterly or annual bills (car registration, insurance premiums, holiday gifts). Factor these into your overall financial plan by setting aside a small amount from each bi-monthly paycheck into a dedicated sinking fund.

- Communicate with Household Members: If you share finances with a partner or family, ensure everyone is on board with the budgeting strategy. Open communication about spending and financial goals is crucial for collective success.

Frequently Asked Questions

What’s the difference between bi-monthly and bi-weekly budgeting?

Bi-monthly budgeting aligns with receiving income twice a month, typically on fixed dates like the 1st and 15th, or 15th and 30th/31st. This results in 24 paychecks per year. Bi-weekly budgeting, on the other hand, means receiving a paycheck every two weeks, resulting in 26 paychecks per year, with two “bonus” months having three paychecks. This article focuses on the bi-monthly approach.

Is a Bi Monthly Budget Template suitable for everyone?

It’s particularly effective for individuals or households who receive their primary income twice a month. It provides a natural rhythm for financial planning that mirrors their income flow. Those paid weekly or bi-weekly might find a weekly or bi-weekly budgeting system more appropriate for their specific pay schedule.

How do I handle larger, less frequent bills with this budget?

For larger bills that don’t occur every month (e.g., car insurance every six months, annual subscriptions), it’s best to create “sinking funds.” Divide the total cost of the bill by the number of paychecks until it’s due, then set aside that small amount from each bi-monthly paycheck into a separate savings account. This way, the money is ready when the bill arrives.

What if I consistently run out of money before the next paycheck?

If you’re consistently facing a deficit, it’s a clear sign that your expenses are exceeding your income. You’ll need to critically review your variable spending categories first, looking for areas to reduce costs. If cuts aren’t enough, consider exploring ways to increase your income or re-evaluate your fixed expenses for potential savings.

Can I use an app instead of a spreadsheet for this type of budget?

Absolutely. Many personal finance apps offer flexible budgeting features that can be adapted for a bi-monthly cycle. Look for apps that allow you to set custom budgeting periods or allocate funds per paycheck, rather than just monthly. The key is to find a tool that helps you consistently track your income and expenses for each half-month period.

Embracing a tailored Bi Monthly Budget Template can be a transformative step in your financial journey. It provides clarity, reduces stress, and empowers you to make intentional decisions with your money, rather than simply reacting to bills as they arrive. By aligning your spending plan directly with your income flow, you create a harmonious system that fosters financial stability and progress towards your goals.

Take the time to personalize this powerful tool, making it a reflection of your unique financial situation and aspirations. Consistency is key; regularly review, track, and adjust your budget to ensure it remains a dynamic and effective guide. With this strategic approach, you’ll not only manage your finances but truly master them, paving the way for a more secure and prosperous future.