Embarking on the journey of wedding planning is an exhilarating time, filled with dreams of perfect dresses, breathtaking venues, and unforgettable moments. Amidst the excitement of choosing color palettes and tasting cake samples, there’s a crucial, often overlooked, yet profoundly empowering step: establishing a clear financial plan. Many couples feel daunted by the perceived complexity and expense of weddings, but with the right approach, managing your finances for the big day can be straightforward and stress-free.

This is where a structured financial framework becomes your best friend. Far from being a restrictive chore, a well-thought-out expenditure planner provides clarity, prevents overspending, and ensures your wedding reflects your priorities without leading to post-nuptial financial strain. It empowers you to make informed decisions, negotiate confidently, and ultimately, enjoy the planning process with peace of mind.

Why Every Couple Needs a Financial Roadmap

Planning a wedding is not just about aesthetics; it’s about making a significant financial investment in your future together. Without a defined financial roadmap, it’s all too easy for costs to spiral out of control, leading to unexpected stress and even disagreements between partners. A comprehensive wedding budget serves as a foundational tool, guiding every decision from the moment you start envisioning your special day.

It helps you align your expectations with your financial reality, fostering open communication about money—a vital skill for any successful marriage. By setting boundaries and understanding where every dollar is allocated, you can avoid common pitfalls like impulsive spending or discovering hidden costs too late in the process. This proactive approach ensures your wedding day is a celebration of love, not a source of financial anxiety.

Understanding Your Priorities: The Foundation of Your Wedding Spending Plan

Before you even think about numbers, the most important step in creating your wedding spending plan is to discuss and align on your priorities as a couple. Every couple has different visions for their wedding, and what might be a top priority for one, like a gourmet meal, might be less important to another, who prioritizes a live band or elaborate floral arrangements.

Start by imagining your ideal day and identifying the elements that are non-negotiable for both of you. Is it the guest experience, the photography, the dress, or the honeymoon that truly matters most? Once you have a clear picture of what you value, you can strategically allocate your funds. This initial conversation forms the bedrock of your financial guide for wedding planning, ensuring that your spending reflects your deepest desires and brings the most joy.

Key Categories for Your Wedding Spending Plan

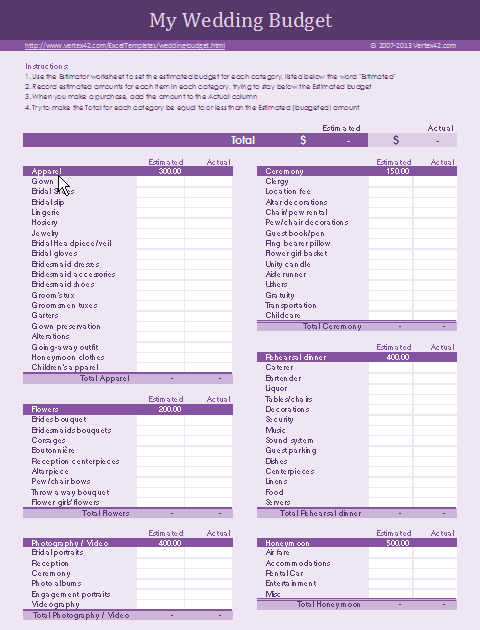

To build an effective financial plan, you need to break down the overall cost into manageable categories. While every wedding is unique, there are standard areas where most of your budget will be allocated. Understanding these categories is the first step in customizing your own Basic Wedding Budget Template.

- Venue & Catering: Often the largest portion of your budget, covering the event space, food, beverages, and service staff.

- Photography & Videography: Capturing memories is priceless, so allocate funds for a professional who matches your style.

- Attire & Accessories: The wedding dress, tuxedo or suit, shoes, jewelry, and any bridal party attire you might cover.

- Music & Entertainment: DJ, live band, ceremony musicians, photo booths – set the mood for your celebration.

- Flowers & Decor: Bouquets, centerpieces, ceremony decor, lighting, and any rental items that enhance the ambiance.

- Stationery: Save-the-dates, invitations, RSVPs, menus, escort cards, and thank-you notes.

- Officiant: The person who legally marries you and conducts your ceremony.

- Transportation: For the wedding party, guests, or special vehicles for the couple.

- Favors & Gifts: Small tokens for guests, gifts for the wedding party, and parents.

- Beauty & Wellness: Hair, makeup, nails, and any pre-wedding pampering.

- Wedding Cake: A sweet centerpiece and traditional treat.

- Miscellaneous & Buffer: Crucial for unexpected costs or last-minute additions, ideally 5-10% of your total budget.

How to Use and Customize Your Basic Wedding Budget Template

Once you’ve identified your overall budget and key priority areas, it’s time to put your Basic Wedding Budget Template to work. This isn’t a static document; it’s a living tool that you’ll revisit and update throughout your planning process. Start by estimating costs for each category based on your research and priorities.

Many couples find it helpful to assign percentages to categories initially, and then fill in actual dollar figures as they get quotes. For example, if your top priority is an incredible dining experience, you might allocate a higher percentage to catering than if a simple buffet would suffice. As you receive quotes and sign contracts, meticulously record the committed amounts and track your actual spending against your estimates. This active management allows you to see where you stand at all times and make adjustments before you overspend. If you find one area is costing more than anticipated, look for opportunities to save in another, less critical category.

Tips for Staying on Track with Your Financial Guide for Wedding Planning

Maintaining discipline with your expenditure planner can feel challenging amidst the excitement, but it’s entirely achievable with a few strategic habits. Open and honest communication with your partner is paramount; regularly review your wedding finance management together to ensure you’re both aligned and aware of the current financial status.

Research thoroughly before making commitments. Obtain multiple quotes for major services to ensure you’re getting competitive pricing and to understand what’s included. Always get agreements and payment schedules in writing to avoid misunderstandings down the line. Remember to account for hidden costs like taxes, service charges, gratuities, and delivery fees, which can quickly add up and impact your overall cost breakdown. Don’t be afraid to ask vendors for itemized lists. Finally, use that buffer you’ve built into your budget. It’s there to absorb minor overages or last-minute necessities without derailing your entire fiscal plan for the big day.

Frequently Asked Questions

When should we start creating our wedding budget?

Ideally, you should start working on your wedding budget as soon as you get engaged and before you book any vendors. This allows you to set realistic expectations for your entire planning journey and make informed decisions from the outset, aligning your dreams with your financial capacity.

What’s a realistic percentage breakdown for wedding categories?

While breakdowns vary greatly by region and personal preferences, a general guideline often suggests: Venue & Catering (40-50%), Photography & Videography (10-15%), Attire (5-10%), Flowers & Decor (8-10%), Music & Entertainment (5-8%), Stationery (2-3%), and a 5-10% buffer for miscellaneous costs. Remember, these are flexible, and your priorities will dictate your specific allocations.

How do we handle unexpected costs or going over budget in one area?

This is precisely why your financial allocation tool includes a buffer. For minor overages, dip into this contingency fund. If a major category exceeds its allocation significantly, you’ll need to re-evaluate other areas and identify where you can cut back. This might mean fewer flowers, a simpler cake, or choosing a different entertainment option. Communication with your partner is key during these adjustments.

Can we plan a beautiful wedding on a tight budget?

Absolutely! A smaller budget simply means more creative problem-solving and prioritizing. Consider off-peak seasons, weekday weddings, smaller guest lists, DIY elements, or focusing on just a few high-impact details. The core of a beautiful wedding is the love shared, not the amount spent.

Should we include the honeymoon in our wedding budget?

While some couples keep wedding and honeymoon budgets separate, including it in your overall financial planning for the event can provide a clearer picture of your total post-engagement expenditures. If it’s a priority, allocate a specific amount for it within your broader spending plan to ensure it’s not an afterthought that strains your finances.

Navigating the financial aspects of wedding planning might seem daunting initially, but with a structured approach, it transforms into an empowering process. By utilizing a robust budgeting framework and consistently tracking your expenses, you’re not just managing money; you’re actively shaping the wedding of your dreams responsibly. This diligent planning minimizes stress, maximizes enjoyment, and sets a healthy precedent for your financial future as a married couple.

Embrace the journey with confidence, knowing that every dollar spent is aligned with your values and priorities. A well-managed wedding budget isn’t just about saving money; it’s about investing wisely in memories that will last a lifetime, ensuring that your big day is everything you imagined, without any lingering financial regrets. Start building your financial guide today, and step into marriage on solid, well-planned ground.