In a world brimming with financial uncertainties and the constant pull of consumerism, achieving true command over your money can feel like an elusive dream. Many of us navigate our finances with a vague sense of where our money goes, often finding ourselves surprised at the end of the month, wondering why our bank account isn’t reflecting our income. This common struggle highlights a fundamental gap in our financial planning: a lack of clear, intentional allocation for every single dollar we earn.

Imagine a budgeting approach where every dollar has a name and a job before it ever leaves your account. This is the core philosophy of zero-based budgeting – a powerful strategy that shifts your financial perspective from passive tracking to active decision-making. And while the concept itself is transformative, implementing it effectively often hinges on having the right tools. That’s where a well-crafted Zero Based Budget Template becomes not just an aid, but a critical cornerstone for financial clarity and control.

What is Zero-Based Budgeting (and Why It Matters)?

Zero-based budgeting, or ZBB, is an approach where you allocate every dollar of your income to an expense, saving goal, or debt repayment until your income minus your outgo equals zero. Unlike traditional budgeting, which often rolls over previous spending habits and focuses on incremental adjustments, ZBB requires you to justify every expense category from scratch for each budgeting period, typically a month. This means you literally start from “zero.”

This method forces a deep dive into your spending habits, challenging you to question whether each expenditure aligns with your current priorities and goals. It eliminates the "autopilot" spending that often leads to financial leakage and fosters a mindset of intentionality. The result is a budget that truly reflects your current financial reality and aspirations, not just a historical record of where your money used to go. It’s an empowering shift from reactive spending to proactive financial design.

The Power of a Structured Approach: Why Use a Budgeting Tool?

While the concept of zero-based budgeting is straightforward, the execution can be daunting without a proper system. Manually tracking every dollar, categorizing expenses, and ensuring nothing is left unassigned can be time-consuming and prone to error. This is precisely where the power of a structured budgeting tool, like a comprehensive financial planning template, truly shines. It transforms an abstract financial philosophy into an actionable, manageable process.

A dedicated template saves you countless hours of setup, providing a pre-designed framework that guides you through the necessary steps. It ensures consistency in your calculations, helps visualize your financial allocations, and minimizes the risk of overlooking crucial expense categories or income sources. Essentially, it provides the roadmap, allowing you to focus your energy on making smart financial decisions rather than building the infrastructure from the ground up.

Key Components of an Effective Zero Based Budget Template

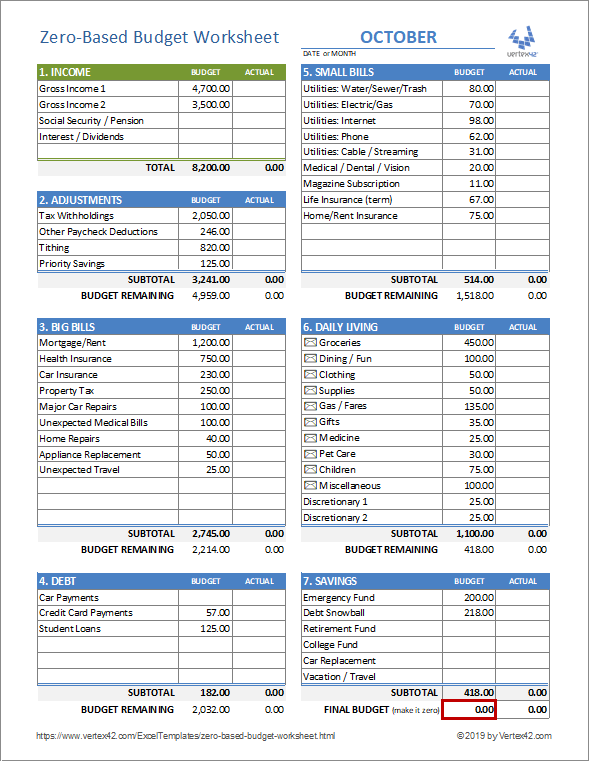

The ideal Zero Based Budget Template should be comprehensive yet intuitive, allowing for easy input and clear visualization of your financial landscape. It needs to capture all essential elements to ensure every dollar is accounted for and assigned a purpose. When evaluating or creating your own, look for these crucial sections:

- **Income Sources:** A clear area to list all your net income streams for the budgeting period, ensuring you know your total available funds.

- **Fixed Expenses:** Categorization for recurring expenses that generally stay the same each month, such as your **rent/mortgage**, loan payments, and insurance premiums.

- **Variable Expenses:** This is the heart of zero-based budgeting. Sections for flexible spending like **groceries**, dining out, entertainment, utilities (which can fluctuate), and transportation. This is where you actively decide how much to allocate.

- **Savings & Investments:** Dedicated lines for contributions to your emergency fund, retirement accounts, specific savings goals (e.g., a down payment, vacation), and investments. Treat these as non-negotiable expenses.

- **Debt Repayment:** Space to plan for additional payments towards credit cards, student loans, or personal loans beyond minimums, aligning with your debt reduction goals.

- **”Every Dollar Has a Job” Section:** A summary or calculation area that confirms your total allocated expenses and savings perfectly equal your total income, bringing your budget to zero.

- **Tracking vs. Planning:** Often, effective templates include separate tabs or sections for initial budget planning and then actual expense tracking throughout the month, allowing for easy comparison and adjustment.

Customizing Your Spending Plan Framework for Success

No two financial situations are exactly alike, which is why the flexibility to customize your spending plan framework is paramount. A generic budgeting tool is a good starting point, but its true utility emerges when you tailor it to your unique income, expenses, and financial aspirations. This personalization is key to long-term adoption and success.

Consider adapting categories to reflect your lifestyle accurately. If you have unique hobbies or specific family needs, create specific line items for them rather than lumping them into broad categories. Adjust the frequency of your budget review – while monthly is standard, you might prefer a bi-weekly or weekly check-in if your income or expenses are irregular. Explore features like built-in calculators for debt payoff or savings growth, or integrations with bank accounts if you’re using a more advanced digital budget spreadsheet. Making it feel like your tool, designed by you for you, significantly boosts adherence and effectiveness.

Getting Started: Implementing Your New Budgeting Approach

Embarking on your zero-based budgeting journey might seem like a large undertaking, but breaking it down into manageable steps makes it much less intimidating. Your financial roadmap is within reach with a systematic approach.

First, gather all your financial data. This includes bank statements, pay stubs, credit card statements, and any bills for the past one to three months. This will give you a realistic picture of your income and where your money has been going. Next, accurately list all your sources of income for the upcoming budgeting period, focusing on your net (after-tax) earnings. Then, meticulously list every single expense you anticipate, starting with your fixed costs and then moving to your variable expenses. Assign a specific dollar amount to each category. Finally, and crucially, review your entire budget. If your income doesn’t equal your expenses (meaning you haven’t assigned every dollar), go back and adjust your variable spending or savings allocations until the balance is zero.

Mastering Your Money: Advanced Tips for Zero-Based Budgeters

Once you’ve grasped the fundamentals of zero-based budgeting and are consistently using your financial management tool, you can elevate your strategies for even greater impact. These advanced tips can help you optimize your money management and accelerate your financial goals.

- **Build Sinking Funds:** Beyond an emergency fund, create separate savings goals (sinking funds) for irregular but anticipated expenses like **car maintenance**, holiday gifts, annual insurance premiums, or a future vacation. Allocate a small amount each month so you’re never caught off guard.

- **Integrate Debt Repayment Strategies:** Use your budget to strategically implement debt payoff methods like the **debt snowball** (paying smallest debt first) or **debt avalanche** (paying highest interest debt first) by allocating extra funds to specific debts.

- **Automate Your Savings:** Set up automatic transfers from your checking to your savings or investment accounts immediately after payday. Treat these allocations in your budget as non-negotiable expenses that are paid first.

- **Conduct Regular Budget Reviews:** Don’t just set it and forget it. Schedule weekly or bi-weekly check-ins to compare your actual spending against your planned budget. This allows you to make **real-time adjustments** and course corrections before issues become significant.

- **Plan for Irregular Income:** If your income fluctuates, consider budgeting based on your **lowest expected income**. Any additional income can then be allocated towards savings, debt, or specific financial goals, providing a buffer and preventing overspending.

Frequently Asked Questions

Is zero-based budgeting only for businesses?

Absolutely not! While zero-based budgeting originated in corporate settings, its principles are incredibly powerful and applicable to personal and family finances. Many individuals and households find it to be the most effective way to gain clarity, reduce debt, and build wealth.

How often should I update my zero-based budget?

A zero-based budget is typically created at the beginning of each month, accounting for that month’s income and expenses. However, it’s beneficial to review and make small adjustments weekly to track actual spending against your plan and ensure you’re staying on course.

What if my income is irregular?

For those with irregular income, it’s often best to budget based on your lowest expected income for the month. Any income received above that baseline can then be allocated to savings, debt repayment, or specific financial goals, providing a buffer and reducing financial stress.

Is a digital template better than a pen-and-paper one?

While a pen-and-paper budget works for some, a digital budgeting tool (like a spreadsheet or app) generally offers more flexibility. It allows for easier calculations, automatic summing, quick adjustments, and often provides visual graphs or charts that can enhance your understanding of your financial situation.

What’s the biggest challenge with zero-based budgeting?

The biggest challenge is often the initial time investment and the discipline required to consistently track and allocate every dollar. It demands a shift in mindset and consistent effort, but the long-term rewards of financial clarity and control far outweigh these initial hurdles.

Embracing zero-based budgeting, particularly with the aid of a well-designed template, is more than just a financial exercise; it’s a profound commitment to your financial future. It’s about empowering yourself to make intentional choices with every dollar, transforming vague hopes into concrete actions. This method strips away the ambiguity of where your money goes, replacing it with purpose and clarity.

By actively engaging with your money and ensuring every dollar has a job, you’re not just creating a budget; you’re designing a life where your finances serve your goals, rather than the other way around. Taking the step to utilize a structured financial management tool can be the catalyst for achieving unprecedented control, freedom, and peace of mind in your financial journey. Start today, and watch your financial landscape transform.