In an era where every dollar counts and economic uncertainties can shift landscapes overnight, businesses are constantly seeking more agile and effective ways to manage their finances. Traditional budgeting, often relying on incremental adjustments to previous year’s figures, can inadvertently perpetuate inefficiencies and outdated spending habits. This is where zero-based budgeting (ZBB) emerges as a powerful alternative, forcing a fresh, critical look at every line item.

Zero-based budgeting demands that all expenses be justified for each new period, starting from a "zero base" regardless of whether they were approved in the past. It’s a fundamental shift in mindset from "what did we spend last year?" to "what do we absolutely need to spend this year to achieve our strategic goals?" Implementing such a rigorous approach, however, requires structure, precision, and a clear framework – elements perfectly delivered by a well-designed Zero Based Budget Template For Business.

Understanding Zero-Based Budgeting: A Paradigm Shift

Zero-based budgeting (ZBB) is not merely a financial exercise; it’s a strategic process that challenges the status quo. Unlike incremental budgeting, which often inflates existing budgets by a small percentage, ZBB requires every department or function to justify its entire budget from scratch. This means every expense, every activity, and every project must be evaluated for its necessity and cost-effectiveness in relation to current business objectives.

This rigorous approach encourages a culture of accountability and innovation. Managers are compelled to critically assess their operational needs, identify opportunities for cost reduction, and ensure that all allocated resources directly contribute to the company’s strategic priorities. It’s a proactive method that can uncover hidden inefficiencies and reallocate funds to areas of higher return, driving significant financial discipline across the organization.

Why Your Business Needs Zero-Based Budgeting

Adopting a zero-based financial planning methodology offers a multitude of benefits that extend far beyond simple cost cutting. It fundamentally transforms how a business views its expenditures and allocates its precious resources. This strategic budgeting blueprint allows companies to be more responsive and resilient in dynamic market conditions.

The advantages are clear for businesses aiming for sustainable growth and operational excellence:

- **Enhanced Cost Control:** By justifying every expense, businesses can eliminate wasteful spending and identify areas for significant savings. This leads to a tighter control over operational expenditures.

- **Improved Resource Allocation:** Funds are directed towards activities that offer the highest value and directly support strategic goals, rather than being allocated based on historical precedent. This ensures optimal utilization of capital.

- **Greater Accountability:** Managers become more responsible for their departmental budgets, as they must articulate and defend every expense request. This fosters a sense of ownership.

- **Increased Operational Efficiency:** The process encourages a deep dive into workflows and processes, often revealing opportunities for streamlining operations and boosting productivity. This leads to more efficient use of both time and money.

- **Adaptability to Change:** Zero-based financial planning allows businesses to quickly re-evaluate and adjust spending in response to market shifts, new opportunities, or economic downturns, making them more agile. This flexibility is crucial in today’s fast-paced environment.

- **Strategic Alignment:** Every budget item is directly linked to the company’s overarching strategic objectives, ensuring that financial decisions support the long-term vision. This creates a cohesive financial strategy.

Key Elements of an Effective Zero-Based Budgeting Approach

Implementing a comprehensive ZBB framework involves several critical steps, each designed to ensure thorough evaluation and justification of all spending. A robust expense justification process ensures that every dollar spent serves a clear purpose. These elements form the backbone of any successful ZBB adoption.

Here’s how a typical zero-based budget cycle unfolds:

- **Identify Decision Units:** Define the specific operational units or departments that will be responsible for creating their budgets. These are often functional areas like marketing, HR, R&D, or specific projects. Each unit will be treated as its own cost center.

- **Formulate Decision Packages:** For each decision unit, create “decision packages” that detail specific activities, the resources required to perform them, their associated costs, and the benefits they provide to the organization. This requires managers to clearly articulate their needs.

- **Evaluate and Rank Decision Packages:** All decision packages are then evaluated and ranked based on their importance to the company’s strategic goals and their cost-benefit analysis. This process often involves cross-functional teams and senior management. High-priority items receive funding first.

- **Allocate Resources:** Based on the rankings and the total available funding, resources are allocated to the approved decision packages. Low-ranking packages may be cut or scaled back if funds are insufficient, forcing tough choices.

- **Monitor and Review:** Continuously track actual expenditures against the approved budget and regularly review the effectiveness of the funded activities. This ongoing monitoring ensures compliance and allows for in-period adjustments if necessary.

Leveraging a Zero Based Budget Template For Business: Practical Application

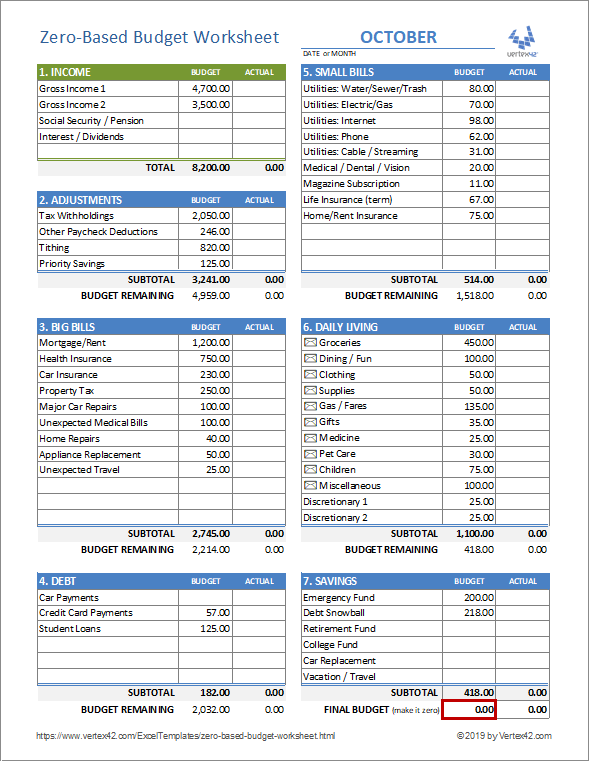

While the concept of budgeting from scratch might seem daunting, a well-designed **Zero Based Budget Template For Business** significantly streamlines the process. This financial planning tool provides the necessary structure to capture, categorize, and justify every expense, turning a complex undertaking into a manageable task. It acts as a guide, ensuring consistency across departments and simplifying data aggregation for senior management.

A robust business expenditure template typically includes sections for:

- **Department/Decision Unit:** Clearly identifying who owns the budget request.

- **Activity/Program Description:** A detailed explanation of the proposed activity.

- **Objective/Benefit:** How the activity aligns with strategic goals and what value it delivers.

- **Required Resources:** Listing personnel, materials, software, or services needed.

- **Detailed Cost Breakdown:** Itemizing every cost associated with the activity (e.g., salaries, supplies, travel, subscriptions).

- **Justification/Rationale:** A compelling argument for why this expenditure is necessary and cannot be cut.

- **Priority Ranking:** Allowing managers to rank their own items, which aids in the overall consolidation and review process.

By standardizing these inputs, a template makes comparing and evaluating different decision packages much easier. It ensures that all relevant information is captured upfront, reducing back-and-forth communication and accelerating the approval cycle.

Overcoming Challenges in Zero-Based Budget Implementation

While the benefits of zero-based financial planning are substantial, its implementation is not without potential hurdles. Organizations often face resistance to change, the perception of increased workload, and the initial complexity of the process. However, these challenges can be effectively managed with careful planning and communication.

One common challenge is the time and effort required, especially during the initial cycle. To mitigate this, businesses should clearly communicate the long-term benefits and provide adequate training and support to managers. Another hurdle can be the subjectivity in ranking decision packages. Establishing clear, objective criteria for evaluation and involving multiple stakeholders in the review process can help ensure fairness and alignment. Leadership buy-in and consistent reinforcement of the process’s strategic importance are also crucial for success, ensuring that all employees understand that this cost management solution is integral to business health.

The Transformative Impact on Business Decision-Making

Beyond the immediate financial benefits, adopting a zero-based budget can profoundly impact a business’s decision-making culture. It fosters a mindset where every expenditure is viewed as an investment that must yield a return, rather than an entitlement. This encourages a more strategic and forward-looking approach to financial planning.

Companies that successfully implement ZBB often report enhanced agility and a clearer understanding of their true cost drivers. This transparency allows for more informed and data-driven decisions about where to invest, where to scale back, and how to innovate within fiscal constraints. Ultimately, it equips leaders with the insights needed to navigate competitive markets and sustain growth through intelligent resource allocation and rigorous operational expenditure planning.

Frequently Asked Questions

What is the core principle of zero-based budgeting?

The core principle of zero-based budgeting (ZBB) is that all expenses for the upcoming period must be justified from a “zero base.” This means no spending is automatically approved based on previous budgets; every cost needs to be re-evaluated and approved based on its necessity and contribution to current strategic goals.

How often should a business implement a ZBB cycle?

While some businesses implement a full ZBB cycle annually, many find it more practical to conduct a comprehensive zero-based financial planning review every 3-5 years, or for specific departments on a rotating basis. For high-growth or rapidly changing environments, a more frequent full review might be beneficial, supplemented by annual incremental adjustments for stable areas.

Is zero-based budgeting suitable for all business sizes?

Yes, zero-based budgeting can be adapted for businesses of all sizes, from startups to large corporations. While larger organizations might employ specialized software and dedicated teams, smaller businesses can effectively use a simplified ZBB framework or a customizable expenditure tracking form to manage their spending with the same core principles.

What are the main benefits of using a dedicated ZBB template?

A dedicated ZBB template provides a structured and standardized framework for all departments to submit their budget requests. This consistency simplifies the data collection, evaluation, and aggregation processes, making it easier to compare expenses, identify redundancies, and ensure all justifications are captured systematically. It significantly reduces the administrative burden of implementing a budget from scratch.

What common mistakes should businesses avoid when adopting ZBB?

Common mistakes include underestimating the time and effort required, failing to secure strong leadership buy-in, not clearly defining decision units or packages, and neglecting to provide adequate training to managers. Businesses should also avoid making ZBB a one-off event; instead, it should be integrated into an ongoing financial re-evaluation tool and strategic planning cycle for sustained benefit.

The disciplined approach of zero-based budgeting, particularly when supported by a robust Zero Based Budget Template For Business, offers a clear pathway to financial clarity and strategic efficiency. It’s more than just a method for cutting costs; it’s a strategic imperative that empowers businesses to continually optimize their spending, align resources with objectives, and respond dynamically to market demands.

By embracing this rigorous yet rewarding financial discipline, companies can foster a culture of accountability and innovation, ensuring every dollar spent contributes meaningfully to their growth trajectory. The power to build a budget from the ground up, justifying every single expenditure, ultimately leads to a leaner, more agile, and strategically focused organization ready to thrive in any economic climate.