In today’s fast-paced business world, effective communication remains the cornerstone of professional success. Whether you’re a financial analyst, a business owner, a real estate appraiser, or an M&A advisor, the ability to articulate complex financial concepts clearly and professionally is paramount. A valuation letter, in particular, is far more than just a formal document; it’s a critical communication tool that conveys expert opinion, justifies financial conclusions, and often forms the basis for significant strategic decisions. Crafting such a letter from scratch, while ensuring accuracy, compliance, and clarity, can be a time-consuming and often daunting task, even for seasoned professionals.

This is where a robust and well-designed valuation letter template becomes an invaluable asset. It acts as a foundational framework, providing a structured approach to presenting intricate valuation analyses in a digestible and professional manner. For anyone in the business and communication niche who regularly deals with asset assessments, business sales, investment decisions, or financial reporting, understanding and utilizing such a template can dramatically enhance efficiency, maintain consistency, and elevate the perceived professionalism of their correspondence. It serves not just as a time-saver, but as a quality control mechanism, ensuring that all essential information is included and presented effectively to the intended recipient.

The Enduring Power of Polished Correspondence

Despite the rise of informal digital communication, the significance of a well-written, properly formatted letter in the business world has not diminished; it has, in fact, become even more critical. A formal letter signifies respect for the recipient, meticulous attention to detail, and a commitment to professionalism. In the context of valuations, where financial stakes are often high and legal implications significant, the clarity, precision, and professional layout of a letter can build trust and reinforce credibility.

A meticulously crafted document speaks volumes about the sender’s organization and expertise. It demonstrates that the valuation was conducted with rigor and that its findings are presented thoughtfully. Conversely, a poorly structured or grammatically flawed letter can undermine confidence, raise questions about the underlying analysis, and potentially damage professional relationships. In an environment where first impressions matter immensely, particularly when dealing with investors, lenders, or regulatory bodies, a polished piece of correspondence ensures your message is taken seriously and your expertise is recognized.

Unlocking Efficiency with a Pre-built Framework

The primary benefit of adopting a ready-made letter template is the considerable saving of time and resources. Instead of drafting each valuation letter from the ground up, professionals can leverage a pre-structured document that already incorporates the standard elements and best practices. This drastically reduces the effort involved in initial drafting, allowing more focus on the actual valuation analysis rather than the document’s construction.

Beyond time savings, a template ensures consistency across all outgoing correspondence. This uniformity in presentation strengthens brand identity and ensures that every valuation presented adheres to a consistent professional standard. It also acts as an invaluable training tool for new team members, guiding them through the necessary components and acceptable formats for official communications. Furthermore, a template minimizes the risk of overlooking crucial details or regulatory requirements, as all essential sections are pre-allocated, acting as a checklist for completeness. Using a valuation letter template thus elevates overall output quality and operational efficiency.

Adapting Your Message for Diverse Audiences

While a template provides a standardized structure, its true power lies in its adaptability. A well-designed valuation letter template isn’t rigid; it offers a flexible framework that can be extensively customized to suit various purposes, specific valuation scenarios, or the unique needs of different recipients. For instance, the level of detail required for an internal management report might differ significantly from that needed for a public company’s financial disclosure or a legal dispute.

The template can be modified to reflect the specific asset being valued (e.g., real estate, intellectual property, a business entity), the valuation approach used (e.g., income, market, asset-based), and the intended use of the valuation. You can tailor the opening paragraphs to directly address the client’s request, adjust the scope of work section to precisely define the engagement, and refine the summary of findings to emphasize the most pertinent information for that particular stakeholder. This personalization ensures that while the underlying structure is consistent, the content is always relevant, precise, and highly impactful for its specific context.

Essential Elements of an Effective Letter

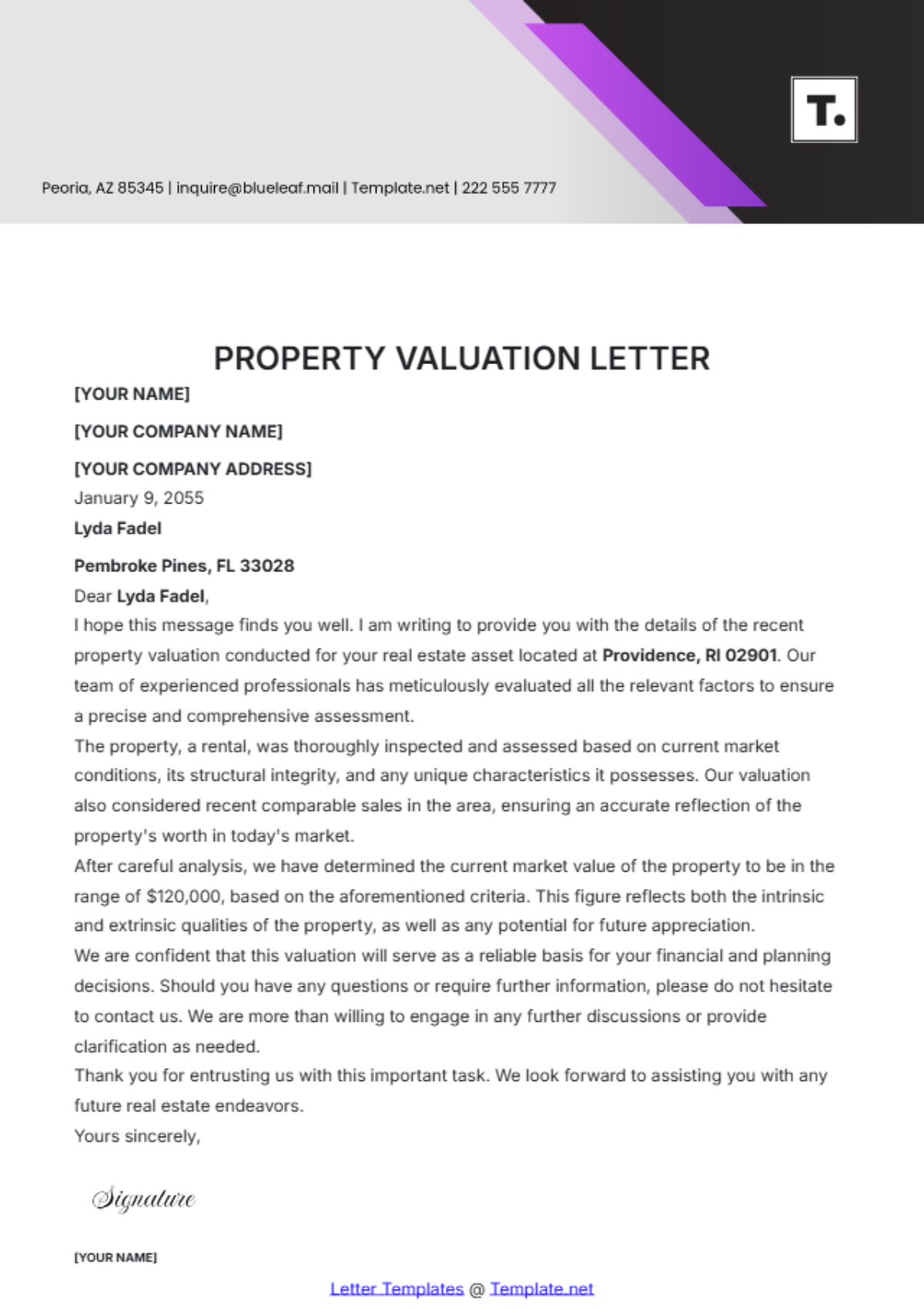

Regardless of its specific application, every professional letter, particularly one detailing a valuation, must include several key components to ensure clarity, completeness, and professionalism. Adhering to these elements ensures that the recipient receives all necessary information in an organized manner. Here are the core sections that a comprehensive valuation letter template should feature:

- Sender’s Contact Information: Full name, title, company name, address, phone number, and email.

- Date: The precise date the letter is issued.

- Recipient’s Contact Information: Full name, title, company name, and address of the individual or entity receiving the letter.

- Salutation: A formal and appropriate greeting.

- Subject Line/Reference: A clear, concise statement identifying the purpose of the letter (e.g., "Valuation of [Asset Name] as of [Date]").

- Opening Paragraph: Briefly state the purpose of the letter, the asset being valued, and the effective date of the valuation.

- Scope of Work/Engagement: Detail the specific work performed, the information reviewed, and any limitations or assumptions made during the valuation process.

- Valuation Methodology: Explain the approach(es) and method(s) used (e.g., Discounted Cash Flow, Market Multiples, Cost Approach) and why they were deemed appropriate.

- Summary of Findings/Conclusion of Value: Clearly state the concluded value or value range of the asset, often presented numerically.

- Limiting Conditions and Disclaimers: Important statements outlining any specific conditions under which the valuation was performed, or disclaimers regarding its use, external factors, or uncertainties.

- Supporting Documentation/Appendices (if applicable): Reference any attached exhibits, schedules, or detailed analyses that provide further backing for the valuation.

- Closing: A professional closing remark.

- Signature Block: The sender’s handwritten signature (for printed versions), followed by their typed name, title, and company.

- Enclosures (if applicable): A note indicating any additional documents included with the letter.

Mastering Tone and Presentation

Beyond the factual content, the tone and overall presentation of your correspondence play a significant role in how your message is received. For a valuation letter, the tone should always be professional, objective, and authoritative. Avoid overly casual language, jargon that the recipient might not understand, or emotional phrasing. The goal is to convey expertise and confidence without being arrogant or dismissive. Clarity and conciseness are paramount; every sentence should serve a purpose, contributing to the overall understanding of the valuation.

Formatting and layout are equally crucial for readability and impact, whether the document is digital or a printable version.

- Digital Presentation: For digital documents (e.g., PDF), ensure consistent font usage (professional, easy-to-read fonts like Arial, Calibri, or Times New Roman are ideal), appropriate font sizes (10-12pt for body text), and ample white space. Use headings and subheadings to break up large blocks of text, making the document scannable. Embed any charts or graphs clearly, ensuring they are high-resolution and properly labeled.

- Printable Version: For printed letters, maintain standard business letter margins (typically 1 inch on all sides). Use high-quality paper if applicable. Ensure that the signature block provides enough space for a physical signature, which adds a layer of authenticity and formality. Proofread meticulously for any typos, grammatical errors, or formatting inconsistencies before finalizing. A clean, organized layout enhances readability and reinforces the professional image of the sender.

Ultimately, leveraging a robust valuation letter template is more than just a convenience; it’s a strategic move for any professional seeking to enhance their communication efficacy. It streamlines the creation of complex financial documents, ensuring every piece of correspondence is not only accurate and compliant but also impeccably presented. This dedication to detail, facilitated by a comprehensive template, safeguards professional credibility and strengthens relationships with clients, investors, and all key stakeholders.

By adopting a well-structured valuation letter template, businesses and individuals can consistently deliver high-quality, professional communications that reflect their expertise and commitment to excellence. It’s an investment in efficiency, accuracy, and brand reputation, ensuring that critical financial messages are always delivered with clarity and impact. In a competitive landscape, such a tool becomes indispensable for maintaining a polished, authoritative presence.