Embarking on the journey of a tech startup is an exhilarating venture, filled with innovation, passion, and the promise of disruption. Yet, beneath the veneer of groundbreaking ideas and ambitious roadmaps lies a fundamental truth: financial viability is the bedrock upon which every successful enterprise is built. Without a clear understanding of your fiscal landscape, even the most brilliant concept can falter. This is where a meticulously crafted financial plan, often anchored by a robust Tech Startup Budget Template, becomes not just useful, but absolutely essential.

Imagine your startup as a high-performance vehicle. Your vision is the destination, your team is the engine, and your budget is the fuel gauge and navigation system. It tells you how much fuel you have, how far you can go, and helps you plot the most efficient route. For founders, particularly those navigating the often-turbuous early stages, an organized approach to financial planning provides clarity, reduces uncertainty, and empowers strategic decision-making. It’s the difference between blindly hoping for success and actively engineering it.

Why a Meticulous Financial Plan is Your Startup’s North Star

In the fast-paced world of technology, where new ideas emerge daily and market conditions shift rapidly, financial oversight is paramount. A comprehensive financial plan serves multiple critical functions. Firstly, it offers a realistic projection of your capital needs, helping you understand how much runway you have before needing additional funding. This foresight is invaluable, allowing you to proactively seek investment rather than reacting in a crisis. It also forces you to prioritize spending, distinguishing between essential expenditures and nice-to-haves, a crucial discipline for any lean startup.

Secondly, a well-defined financial roadmap acts as a powerful communication tool. When engaging with potential investors, a clear and convincing presentation of your startup’s financial projections demonstrates your understanding of the business, your strategic thinking, and your commitment to fiscal responsibility. It builds trust and confidence, showcasing that you’re not just dreaming big, but also planning smart. Moreover, it empowers your internal team by providing transparency regarding resource allocation and performance targets, aligning everyone towards common financial goals.

Key Elements of a Robust Startup Financial Plan

A comprehensive financial plan for an early-stage company isn’t just a simple list of expenses; it’s a dynamic document that encompasses various crucial components. Understanding these elements is the first step towards building an effective budget. It forces you to think holistically about your business operations and potential costs.

Here are the core components you should integrate into your startup’s budget:

- **Revenue Projections:** Don’t just guess; base your revenue forecasts on market research, target audience size, pricing strategy, and conversion rates. Include different scenarios (best, worst, most likely).

- **Operating Expenses:** These are the ongoing costs of running your business. Break them down into detailed categories:

- **Personnel Costs:** Salaries, benefits, taxes for founders, employees, and contractors. Often the largest expense for a tech startup.

- **Technology & Infrastructure:** Software licenses, cloud hosting (AWS, Azure, GCP), development tools, hardware, cybersecurity.

- **Marketing & Sales:** Advertising campaigns, content creation, PR, sales tools, customer acquisition costs.

- **Office & Administrative:** Rent (if applicable), utilities, insurance, legal fees, accounting services, office supplies.

- **Research & Development:** Prototyping costs, testing, specialized equipment.

- **One-Time & Setup Costs:** Initial legal incorporation fees, brand development, initial equipment purchases, website design, app development from scratch.

- **Capital Expenditure (CapEx):** Investments in assets that provide long-term benefits, such as significant server infrastructure or proprietary machinery.

- **Cash Flow Statement:** A crucial projection showing money coming in and going out over a specific period, highlighting potential cash shortages or surpluses.

- **Balance Sheet Projections:** A snapshot of your company’s assets, liabilities, and equity at a given point in time.

- **Burn Rate Calculation:** How quickly your startup is spending its cash reserves. Understanding your burn rate is vital for managing your runway.

- **Funding Requirements:** Based on your projections, how much capital you’ll need and when.

Building Your Startup’s Budget: A Step-by-Step Guide

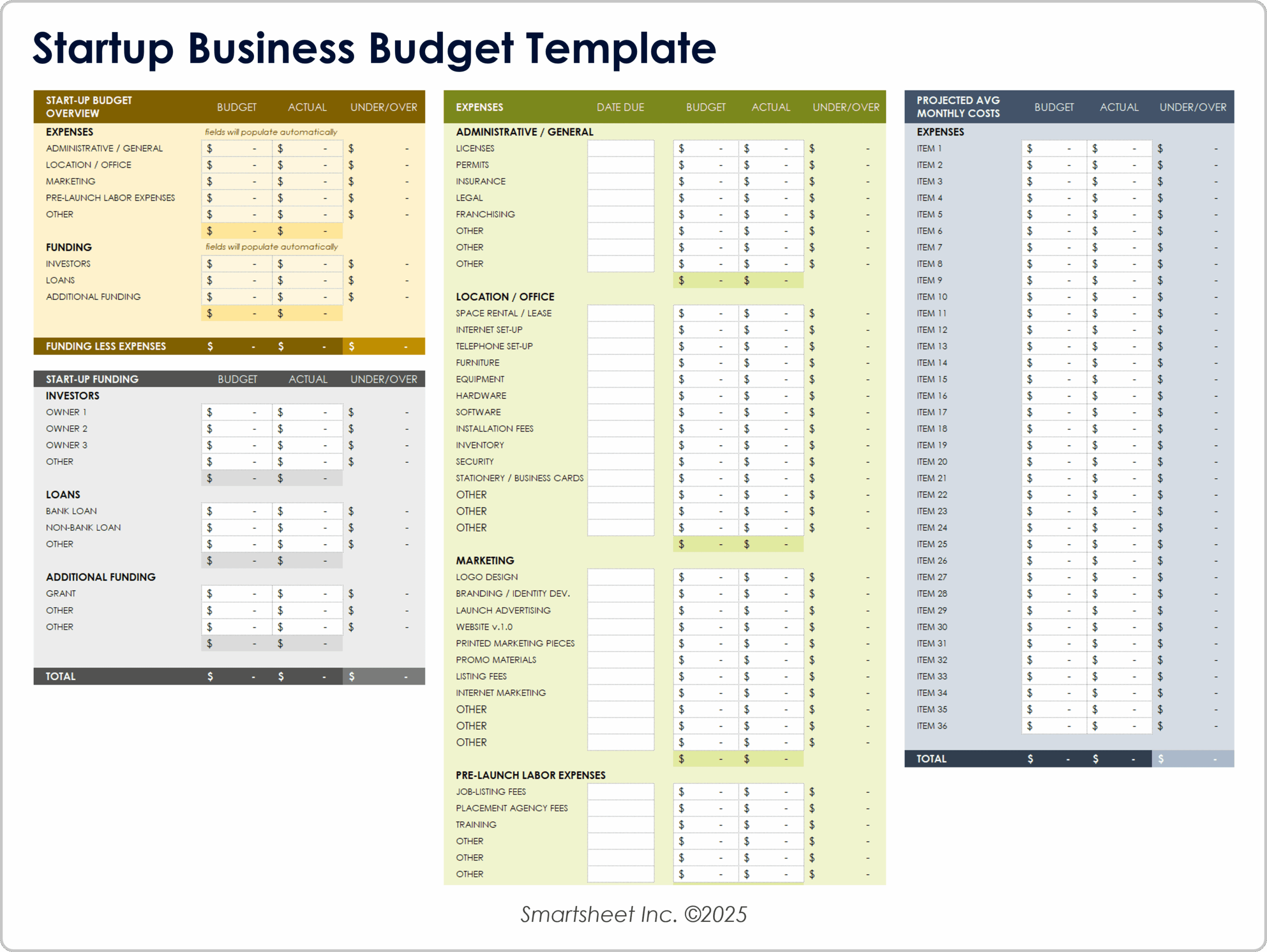

Crafting a detailed startup budget involves more than just plugging numbers into a spreadsheet; it’s an iterative process of research, estimation, and refinement. Start with a foundational framework, such as a **Tech Startup Budget Template**, and then personalize it to reflect your unique business model and operational specifics. The goal is to create a dynamic document that evolves with your company.

Begin by identifying all potential revenue streams, even if they’re theoretical in the early stages. For expenses, categorize everything. Think about your minimum viable product (MVP) — what absolutely must you spend to get it off the ground and prove your concept? Then, consider what comes next: scaling, hiring, marketing. Don’t forget to include a contingency fund, typically 15-20% of your total expenses, to account for unforeseen costs or delays. This financial planning tool should be reviewed and updated regularly, perhaps monthly or quarterly, especially in the initial growth phase, as assumptions change and new opportunities or challenges arise.

Beyond the Numbers: Strategic Considerations

While the quantitative aspects of financial planning are critical, a truly effective budget for tech startups extends beyond mere number crunching. It involves strategic thinking about resource allocation, risk management, and long-term sustainability. For instance, consider the trade-off between hiring full-time employees versus contractors. Contractors might offer flexibility and specialized skills without the overhead of benefits, but long-term employees foster company culture and institutional knowledge.

Furthermore, factor in the iterative nature of tech product development. Your initial budget might cover the MVP, but subsequent versions, feature expansions, and technical debt will require ongoing investment. A good financial model accounts for these future development cycles. Also, think about your pricing strategy – how does it align with your cost structure and market value? This detailed cost management framework informs not just your expenditures but also your revenue generation, creating a symbiotic relationship between income and outlay.

Customizing Your Financial Blueprint for Growth

No two tech startups are exactly alike, and therefore, no single budget will perfectly fit every scenario. The true value of a **Tech Startup Budget Template** lies in its adaptability. Once you have a foundational structure, you must tailor it to your specific industry niche, business model, and growth trajectory. For instance, a SaaS company will have different cloud infrastructure and customer acquisition costs than a hardware startup or a mobile app developer.

Consider the unique phases of your startup: pre-seed, seed, Series A, and beyond. Each phase will have different funding needs, expense priorities, and revenue expectations. Your financial blueprint should reflect these stages, potentially offering different budget scenarios for each. Don’t be afraid to experiment with different assumptions in your forecasts. What if customer acquisition costs are higher than expected? What if your sales cycle is longer? Running multiple scenarios helps you prepare for various outcomes and adjust your resource allocation plan accordingly. This flexibility ensures your budget remains a living, breathing document that supports, rather than restricts, your innovation.

Leveraging Your Budget for Fundraising and Growth

A meticulously prepared financial document is more than just an internal tracking tool; it’s a cornerstone for attracting investment and demonstrating growth potential. When engaging with venture capitalists or angel investors, your startup’s financial model will be scrutinized closely. They want to see a clear, realistic, and defensible projection of how you plan to spend their money and how that spending will lead to significant returns. A well-articulated investment allocation guide shows you’ve done your homework and understand the path to profitability.

Beyond fundraising, your economic planning tool acts as a powerful internal barometer for growth. By regularly comparing actual performance against your budgeted figures, you can identify areas of overspending or underperformance, allowing for timely course corrections. It helps in making informed decisions about scaling operations, expanding into new markets, or even pivoting your product. This continuous feedback loop ensures that your expenditures are always aligned with your strategic objectives, propelling your tech venture forward efficiently and sustainably.

Frequently Asked Questions

What is the primary benefit of using a specific template for a tech startup budget?

The primary benefit is that it provides a structured framework tailored to the unique cost categories and revenue models often found in the tech sector, ensuring critical elements like cloud hosting, software licenses, and R&D are considered, which might be overlooked in a generic business budget.

How often should I review and update my startup’s financial plan?

In the early stages, it’s advisable to review and update your startup budget monthly. As your company matures and stabilizes, quarterly reviews might suffice. Rapid market changes or significant business milestones (like a new funding round or product launch) should always trigger an immediate review.

Should I include my salary as a founder in the budget?

Yes, absolutely. Founder salaries, even if minimal initially, are a legitimate operating expense. Including them provides a more accurate picture of your personnel costs and burn rate, and it also reflects a sustainable model for yourself and future hires.

What if my actual expenses consistently exceed my budget?

If actual expenses consistently exceed your budget, it’s a clear signal to conduct a thorough analysis. Identify the root causes (e.g., inaccurate initial estimates, unforeseen costs, inefficient spending, scope creep) and adjust your future projections and spending habits accordingly. This could involve cutting non-essential costs or revisiting your revenue generation strategies.

Can a startup budget help me secure funding?

Yes, a well-researched and clearly presented startup budget is a crucial component of any pitch deck or business plan for investors. It demonstrates your financial acumen, your understanding of your business’s needs, and your realistic pathway to profitability, significantly increasing your credibility and chances of securing investment.

Navigating the intricate financial landscape of a tech startup can seem daunting, but it’s a challenge that becomes manageable with the right tools and approach. A well-structured budget is more than just a list of numbers; it’s a strategic weapon, a communication bridge, and a safeguard for your entrepreneurial dream. It provides the clarity needed to make confident decisions, the foresight to avoid pitfalls, and the foundation to build a scalable and sustainable business.

Embrace the discipline of meticulous financial planning from day one. By proactively managing your resources, understanding your cash flow, and continuously refining your financial blueprint, you’re not just tracking expenses; you’re actively steering your startup towards long-term success. So, take the first step, craft that robust budget, and empower your innovative vision with sound financial strategy.