Embarking on the entrepreneurial journey is exhilarating, filled with groundbreaking ideas, sleepless nights, and the boundless potential of innovation. Amidst this whirlwind of creation and development, one crucial element often determines a startup’s longevity and success: its financial health. Without a clear understanding of where money comes from and where it goes, even the most brilliant concept can falter. This is precisely where a meticulously crafted financial plan becomes your compass in the often-turbulent waters of the business world.

Imagine building a house without a blueprint; it’s a recipe for disaster. Similarly, launching a startup without a robust financial framework is akin to sailing into a storm without a map. A well-designed Startup Company Budget Template acts as that essential blueprint, providing structure, foresight, and control over your precious resources. It’s not just about tracking expenses; it’s about strategic planning, resource allocation, and ensuring your dream has the financial runway it needs to take flight and soar.

The Unshakeable Foundation: Why a Budget Matters for Your Startup

For nascent businesses, capital is often finite, and every dollar must be stretched to its maximum potential. A detailed startup budget serves as more than just a ledger; it’s a dynamic strategic tool. It forces founders to confront financial realities, make informed decisions, and prioritize spending. This proactive approach helps avoid common pitfalls such as running out of cash prematurely, overspending on non-essential items, or underestimating critical operational costs.

Beyond survival, a comprehensive financial plan instills confidence. It provides clarity to founders, potential investors, and even early team members about the company’s financial trajectory. When you can articulate your financial needs, projections, and spending habits with precision, it signals professionalism and competence. This transparency is invaluable, whether you’re seeking seed funding, attracting talent, or simply trying to sleep better at night knowing your finances are in order.

Navigating the Financial Labyrinth: What a Good Budget Template Provides

A robust financial planning tool simplifies the complex world of startup finance. It breaks down overwhelming financial data into manageable, understandable categories, making it easier to see where your money is going and where it needs to go. Rather than staring at a blank spreadsheet, a pre-structured framework gives you a head start, guiding you through the essential line items every new venture needs to consider. It’s a roadmap, not a guessing game.

The true power of a well-designed template lies in its ability to foster proactive financial management. It allows you to model different scenarios, project future cash flows, and identify potential shortfalls before they become crises. This foresight enables quick adjustments, whether it’s scaling back on marketing, re-negotiating supplier contracts, or accelerating fundraising efforts. It transforms budgeting from a dreaded chore into an empowering strategic exercise.

Core Components of Your Startup’s Financial Blueprint

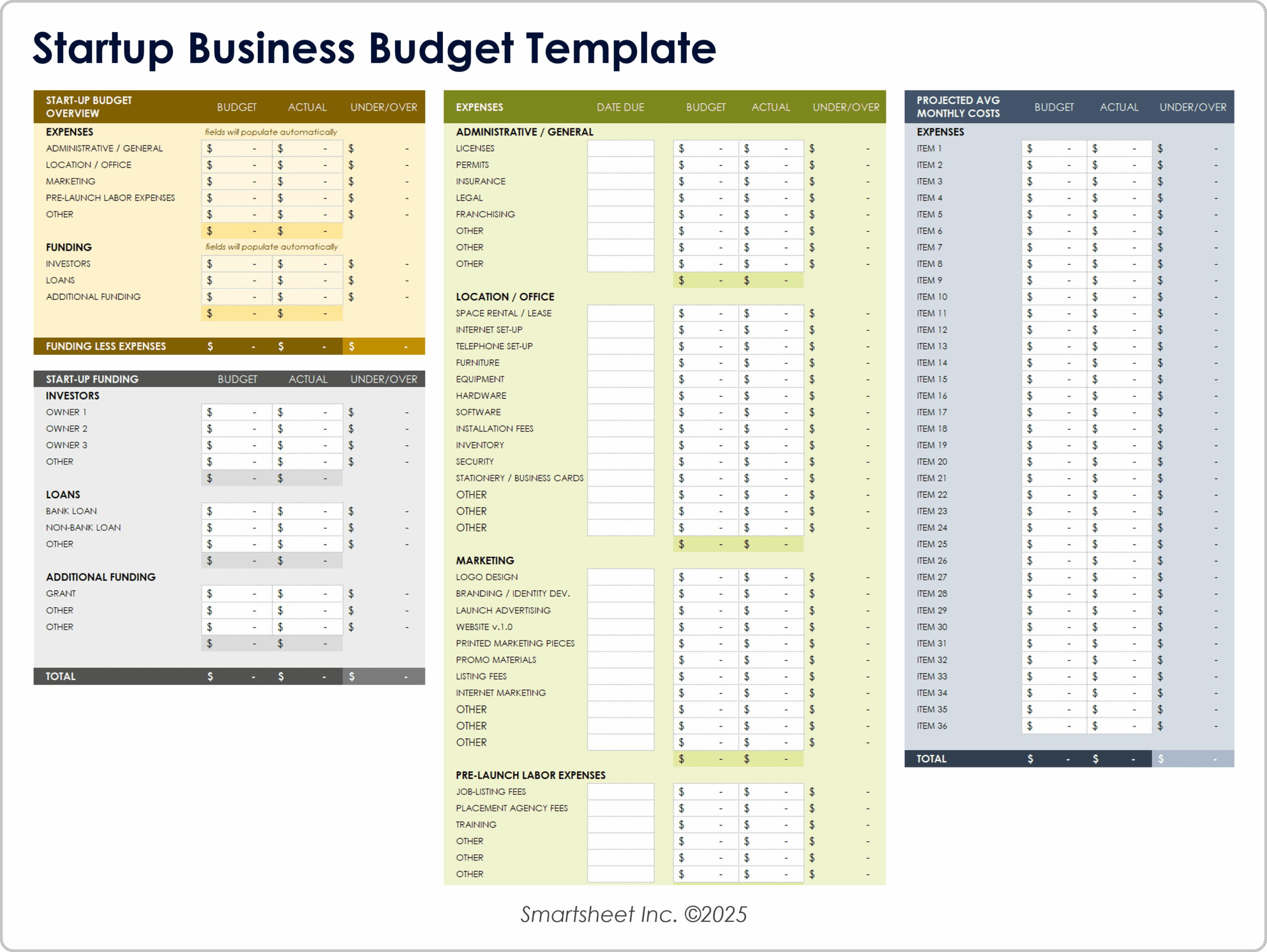

While every business is unique, certain categories are universal to almost every initial business budget. Understanding these components is the first step towards creating an effective financial model. A good Startup Company Budget Template will logically categorize these elements, making them easy to fill out and track.

Here are the critical sections you’ll typically find:

- Revenue Projections: This section estimates how much money your startup expects to generate. It should break down revenue by product, service, or customer segment, along with pricing models and sales volume assumptions. Be realistic and consider different growth scenarios.

-

Startup Costs (One-Time Expenses): These are the initial investments required to get your business off the ground.

- Legal & Accounting: Business registration, legal fees for incorporation, trademarking, initial accounting setup.

- Technology & Software: Initial hardware purchases (laptops, servers), essential software licenses, website development, domain registration.

- Office Setup: Furniture, office supplies, security deposits, initial utility connections (if applicable).

- Product Development: Prototyping costs, initial inventory, R&D expenses.

- Initial Marketing: Branding, logo design, launch campaign costs.

-

Operating Expenses (Monthly/Recurring): These are the costs to keep your business running day-to-day.

- Salaries & Wages: Employee salaries, founder salaries, benefits, payroll taxes.

- Rent & Utilities: Office space rent, electricity, internet, water.

- Marketing & Advertising: Ongoing campaigns, social media ads, content creation, PR.

- Software Subscriptions: CRM, project management tools, cloud services.

- Professional Services: Ongoing legal counsel, accounting services, consultants.

- Travel & Entertainment: Business trips, client meetings, team events.

- Supplies & Inventory: Raw materials, office supplies, cost of goods sold.

- Insurance: Business liability, property, health insurance.

- Loan Repayments: Principal and interest on any business loans.

- Miscellaneous: A small buffer for unexpected costs.

- Cash Flow Statement: This vital component tracks the actual movement of cash in and out of your business over a period. It helps you understand your liquidity and predict when you might need additional funding.

- Balance Sheet: A snapshot of your company’s financial health at a specific point in time, showing assets, liabilities, and owner’s equity.

Beyond the Numbers: Practical Tips for Budgeting Success

Creating an initial business budget is just the beginning. The real value comes from actively using and refining it. Think of your financial model not as a static document, but as a living guide that evolves with your company. Regular review and adjustment are paramount for effective cost management.

Firstly, embrace realism. While optimism is a founder’s superpower, it can be a pitfall in financial forecasting. Always err on the side of caution with revenue projections and be generous with expense estimates. It’s far better to have a surplus than a shortfall. Secondly, categorize meticulously. The more granular you are with your expenses, the easier it will be to identify areas for optimization or potential waste. Don’t lump “miscellaneous” expenses together too broadly.

Thirdly, monitor your actual spending against your projections regularly—at least monthly. This comparison highlights discrepancies early, allowing you to investigate the causes and make necessary adjustments. Maybe your marketing spend isn’t yielding the expected ROI, or a vendor’s costs have increased. A comprehensive expense tracking system will inform these reviews. Lastly, build in a contingency fund. Unexpected costs are a certainty in startups. Aim for at least 3-6 months of operating expenses saved as an emergency buffer. This financial strategy for growth provides a crucial safety net.

Choosing and Customizing Your Ideal Budget Tool

While the concept of a financial planning tool for startups is universal, the format can vary. Many founders start with a simple spreadsheet, like Google Sheets or Microsoft Excel, which offers immense flexibility for customization. There are countless free and paid templates available online that provide a solid starting point, ranging from basic expense trackers to sophisticated financial forecasting templates with built-in formulas and charts.

When selecting an early-stage business budget, consider its ease of use, scalability, and how well it aligns with your specific industry and business model. A software-as-a-service (SaaS) startup will have different cost structures than a product-based e-commerce venture. Don’t be afraid to modify a template to fit your unique needs. Add specific revenue streams, create new expense categories, or integrate metrics that are particularly relevant to your venture. The goal is a tool that empowers you, not one that constrains you.

Frequently Asked Questions

How often should I update my startup budget?

You should review your budget at least monthly, comparing actual spending to your projections. Adjustments should be made quarterly or whenever significant changes occur in your business model, market conditions, or financial outlook.

What’s the difference between a budget and a cash flow forecast?

A budget is a plan for future income and expenses, often set for a specific period (e.g., annual or quarterly). A cash flow forecast specifically tracks the actual movement of cash in and out of your business over time, ensuring you have enough liquidity to meet short-term obligations.

Can I use a free online template, or do I need specialized software?

For most early-stage startups, a well-structured free online template (often spreadsheet-based) is perfectly adequate. As your company grows and becomes more complex, you might consider specialized accounting or financial management software for more robust features and automation.

How far into the future should my startup budget project?

Typically, a startup budget should project at least 12 months out, with detailed monthly breakdowns for the first year. For strategic planning and fundraising, you might extend projections to 3-5 years, but these longer-term forecasts will be less granular and more conceptual.

What if my actual spending consistently differs from my budget?

Consistent discrepancies indicate a need for a deeper review. It could mean your initial assumptions were flawed, your spending is out of control, or market conditions have changed. Use these deviations as learning opportunities to refine your financial model and spending habits.

Developing a clear and actionable financial plan is not just good practice; it’s a fundamental pillar of entrepreneurial success. A robust Startup Company Budget Template transforms abstract financial concepts into concrete, manageable actions, providing the clarity and control you need to make informed decisions. It empowers you to allocate resources strategically, identify potential risks, and confidently communicate your financial vision to all stakeholders.

Embrace the discipline of budgeting, and you’ll equip your startup with one of the most powerful tools for sustainable growth. It’s an investment of time that pays dividends in stability, foresight, and ultimately, the realization of your entrepreneurial dreams. Start building your financial roadmap today, and pave the way for a resilient and thriving future for your venture.