Navigating the dynamic landscape of small business ownership is an exhilarating journey, often filled with unpredictable twists and turns. While passion and innovation fuel your venture, sustained success hinges on a robust financial compass. Without clear direction, even the most promising ideas can falter amidst unforeseen expenses or missed opportunities.

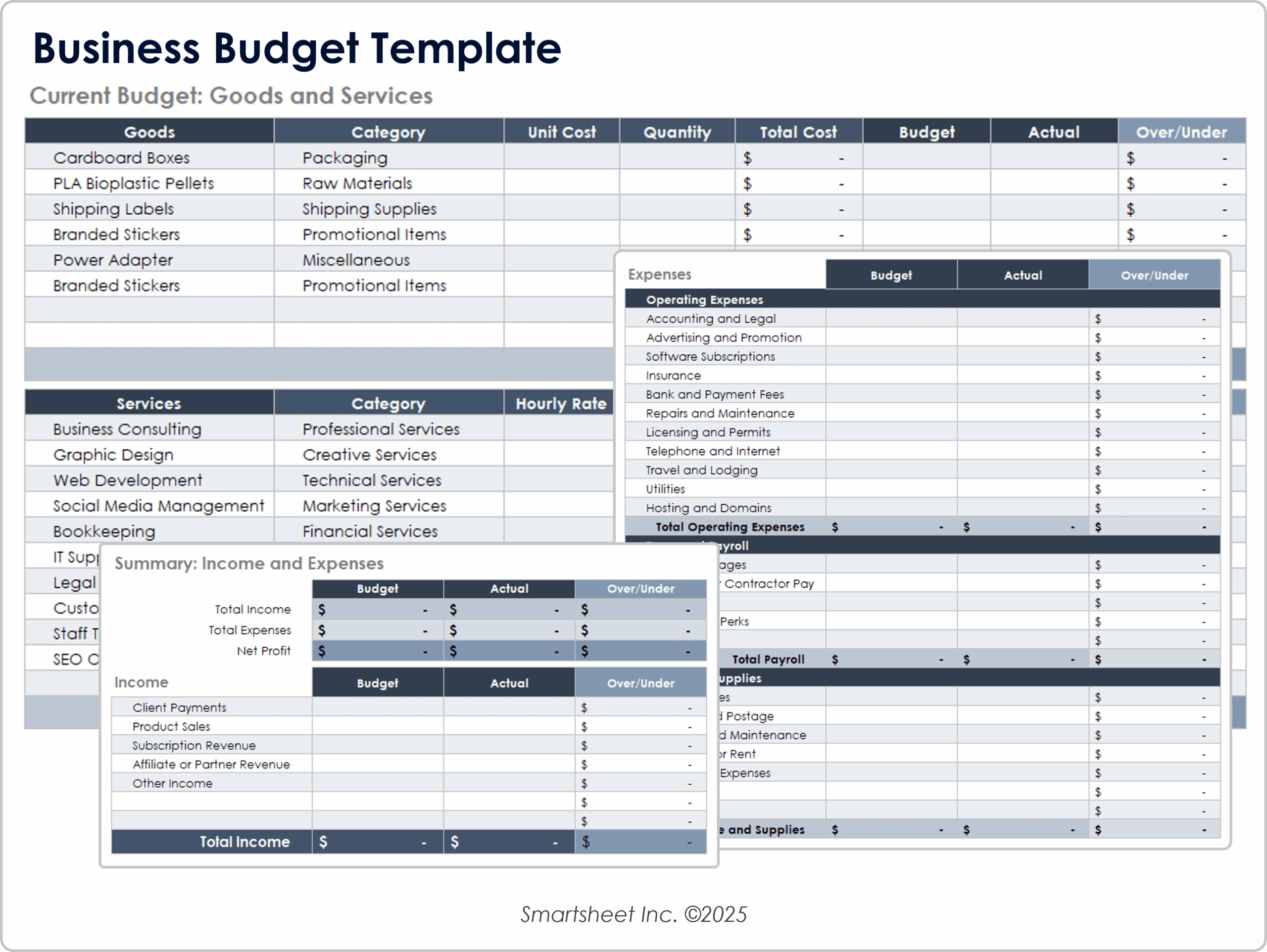

This is where the **Small Business Annual Budget Template** emerges not just as a financial tool, but as a strategic necessity. It’s the blueprint that transforms aspirations into actionable financial targets, empowering entrepreneurs, freelancers, and small enterprise owners alike to make informed decisions, optimize cash flow, and build a resilient foundation for growth.

The Power of Proactive Planning

Many entrepreneurs view budgeting as a restrictive exercise, a tedious chore that limits flexibility. In reality, a well-crafted annual business budget is quite the opposite. It’s an empowering act of foresight, allowing you to allocate resources strategically rather than reacting to financial surprises. It provides a clear roadmap for where your money will come from and, more importantly, where it will go.

Proactive financial planning enables small businesses to anticipate seasonal fluctuations, plan for major investments, and even prepare for economic downturns. It shifts the focus from merely tracking past spending to actively shaping future financial outcomes. This strategic approach ensures your business isn’t just surviving but is positioned to thrive and expand.

Why Every Small Business Needs an Annual Budget

An annual budget for a small business offers a multitude of benefits, extending far beyond simple expense tracking. It serves as a comprehensive financial health check and a guiding star for your operational decisions throughout the fiscal year. Understanding its profound impact is the first step toward embracing its potential.

- Achieve Financial Clarity: A detailed budget provides a clear snapshot of your expected revenues and expenses, eliminating guesswork and offering a transparent view of your financial standing. You’ll know exactly where every dollar is projected to land.

- Set Realistic Goals: By forecasting income and outflow, you can establish achievable financial objectives. Whether it’s expanding market reach, investing in new equipment, or increasing profit margins, your yearly financial plan grounds these goals in reality.

- Make Informed Decisions: With a robust financial blueprint, every operational decision—from hiring new staff to launching a marketing campaign—can be evaluated against its budgetary impact. This leads to smarter, more strategic choices.

- Optimize Resource Allocation: Limited capital is a common challenge for small businesses. A budgeting framework helps you prioritize spending, directing funds to areas that promise the highest return on investment and aligning expenditures with core business objectives.

- Measure Performance: Your budget becomes a benchmark against which you can compare actual financial performance. This allows for timely adjustments and highlights areas of success or concern, fostering continuous improvement in financial management.

- Mitigate Risks: By forecasting potential cash flow gaps or identifying periods of low revenue, a comprehensive annual business budget helps you prepare for financial challenges before they become crises. This proactive approach builds resilience.

Key Components of an Effective Financial Blueprint

To truly leverage the power of a small business annual budget template, you need to understand its essential building blocks. Think of these components as the ingredients that make up your comprehensive financial roadmap, each playing a critical role in painting an accurate picture of your financial future.

Revenue Streams: This section details all anticipated income sources. It includes sales of products or services, subscription fees, consulting income, interest earned, and any other money flowing into your business. Be as specific as possible, considering historical data, market trends, and planned growth initiatives.

Fixed Costs: These are expenses that generally remain constant regardless of your business activity level, at least in the short term. Examples include monthly rent or mortgage payments, insurance premiums, loan repayments, and salaries for permanent staff. These are often easier to predict.

Variable Costs: Unlike fixed costs, variable expenses fluctuate directly with your business activity. This category includes the cost of goods sold (COGS), raw materials, packaging, shipping, sales commissions, and hourly wages for temporary staff. Accurately estimating these requires careful consideration of sales volume projections.

Operating Expenses: These are the day-to-day costs of running your business that aren’t directly tied to producing goods or services. They encompass utilities, office supplies, software subscriptions, professional services (accounting, legal), marketing and advertising costs, travel, and maintenance. These can often be adjusted.

One-Time/Capital Expenditures: This section accounts for significant, non-recurring purchases that benefit the business over the long term, such as new equipment, machinery, vehicle purchases, or major office renovations. These often require substantial upfront investment and should be planned well in advance.

Cash Flow Projections: While closely related to revenue and expenses, cash flow projections specifically track the actual movement of cash in and out of your business over a period. It highlights potential liquidity issues, ensuring you have enough cash on hand to meet obligations, even if you’re profitable on paper. This is a critical element for day-to-day operations.

Profit & Loss Projections: This component summarizes your anticipated revenues, costs, and expenses over the year to forecast your net profit or loss. It’s a forward-looking income statement that helps assess the overall financial viability and profitability of your business plan.

Crafting Your Business’s Financial Roadmap: Step-by-Step

Creating a comprehensive annual business budget might seem daunting, but by breaking it down into manageable steps, you can build a robust financial plan that serves your business effectively. This process is about thoughtful estimation, strategic allocation, and continuous refinement.

1. Review Historical Financial Data: Start by looking back. Gather your past year’s profit and loss statements, balance sheets, and cash flow reports. Analyzing previous performance will provide a realistic baseline for projecting future revenues and expenses. Identify trends, seasonal variations, and any anomalies.

2. Define Clear Financial Goals: Before you allocate a single dollar, determine what you want your business to achieve financially in the coming year. Are you aiming for a certain revenue growth percentage, a specific profit margin, reduced operational costs, or perhaps funding a new product launch? Your goals will drive your budgeting decisions.

3. Estimate All Revenue Streams: Based on historical data, market research, sales pipeline, and your growth goals, project your income for each month of the year. Be realistic, erring on the side of caution. Consider different scenarios for sales volume and pricing.

4. List and Categorize All Expenses: Go through every single expense your business incurs, from the smallest subscription to the largest salary. Categorize them into fixed costs, variable costs, and operating expenses. This meticulous approach ensures nothing is overlooked and provides clarity on where your money is going.

5. Allocate Funds According to Goals and Priorities: Now, align your estimated expenses with your financial goals. If a goal is to expand marketing efforts, dedicate a specific portion of your budget to it. If reducing operating costs is a priority, identify areas where spending can be trimmed without impacting quality or growth.

6. Build in a Contingency Fund: Unexpected expenses are inevitable. Whether it’s a sudden equipment repair, a legal fee, or an unforeseen dip in sales, having a buffer is crucial. Allocate 5-10% of your total budget as a contingency to absorb these surprises without derailing your entire financial plan.

7. Regular Review and Adjustment: Your annual budget is not a static document; it’s a living tool. Schedule monthly or quarterly reviews to compare actual performance against your budgeted figures. This comparison allows you to identify discrepancies, understand their causes, and make necessary adjustments to your spending or revenue strategies. This flexibility is key to effective fiscal planning.

Leveraging Your Budget for Growth and Stability

A comprehensive financial plan, like a well-executed Small Business Annual Budget Template, isn’t just about control; it’s a powerful engine for growth and stability. Once your yearly financial plan is in place, it transforms from a static document into an active management tool that informs every strategic decision. It allows you to confidently assess opportunities and navigate challenges.

By consistently monitoring your financial blueprint, you can pinpoint areas ripe for investment, such as a marketing channel delivering high ROI, or identify inefficiencies that are draining resources. This data-driven approach empowers you to make proactive adjustments, reallocate funds to more promising ventures, and ensure your business’s financial health remains robust. It fosters a culture of financial accountability and transparency, laying the groundwork for sustainable scaling and long-term success.

Tips for Maintaining a Dynamic Financial Plan

An effective annual business budget is never truly “finished.” It requires ongoing attention and flexibility to remain relevant and useful throughout the year. Adopting these practices will help ensure your budgeting tool continues to serve your business effectively.

- Automate Tracking: Utilize accounting software (e.g., QuickBooks, Xero, FreshBooks) to automatically track income and expenses. This significantly reduces manual data entry, minimizes errors, and keeps your financial records up-to-date, making budget comparisons much easier.

- Conduct Monthly Reviews: Set aside dedicated time each month to compare your actual revenue and expenses against your budgeted figures. This frequent check-in allows you to identify variances early and understand their root causes, giving you time to course-correct.

- Engage Your Team: Foster financial literacy within your team, where appropriate. When employees understand the budget and their role in achieving financial targets, they can contribute to cost-saving measures and revenue-generating initiatives.

- Be Flexible and Adaptable: The market is constantly changing, and your business might encounter unexpected opportunities or challenges. Don’t be afraid to revise your budget throughout the year if circumstances warrant it. A rigid budget is less useful than a responsive one.

- Seek Expert Advice: If you’re struggling with complex financial projections or tax implications, don’t hesitate to consult with an accountant or financial advisor. Their expertise can provide valuable insights and ensure your financial plan is sound and compliant. They can help you optimize your business budgeting framework.

- Document Assumptions: Keep a record of the key assumptions you made when creating your budget (e.g., expected sales growth, inflation rates, customer acquisition costs). This documentation helps in future analysis and makes it easier to understand why variances occurred.

Frequently Asked Questions

How often should I update my annual budget?

While an annual budget is set for the year, it’s crucial to review and potentially adjust it monthly or quarterly. Regular reviews allow you to compare actual performance against your projections, identify discrepancies, and make necessary changes to keep your financial plan realistic and effective. Treat it as a living document, not a static one.

What’s the biggest mistake small businesses make with budgeting?

One of the most common mistakes is treating the budget as a one-time exercise rather than an ongoing management tool. Failing to review it regularly, neglecting to track actual performance against it, or being too rigid to adjust it in response to market changes can render even the best financial plan ineffective. Another pitfall is underestimating expenses or overestimating revenue.

Can a startup use an annual budget template effectively?

Absolutely. A startup especially benefits from an annual business budget. While historical data might be limited, it forces new businesses to make realistic projections, understand their burn rate, identify funding needs, and prioritize spending from day one. It’s a critical tool for securing funding and demonstrating financial foresight to investors.

Should I include personal finances in my business budget?

No, it’s essential to keep business finances separate from personal finances. Commingling funds can lead to confusion, inaccurate financial reporting, and potential legal issues. Your business budgeting framework should focus solely on the income and expenses directly related to your business operations. Ensure you establish clear boundaries between the two for accurate financial management.

Where can I find a good budget template for my business?

Many resources offer templates, including accounting software providers, financial planning websites, and business development organizations. Excel or Google Sheets are excellent starting points for customizable templates. Look for one that allows for detailed categorization of revenue and expenses, includes sections for cash flow and P&L projections, and can be easily adapted to your specific industry and business size.

Embracing a robust financial planning tool is one of the most impactful decisions you can make for your small business. It transforms uncertainty into clarity, empowering you to navigate the complexities of the market with confidence and precision. By actively engaging with your annual budget, you gain unparalleled insight into your operations, enabling you to optimize every dollar and strategically position your venture for long-term prosperity.

Don’t let financial management be an afterthought. Invest the time and effort into developing a comprehensive annual financial management plan for your business. It’s not just about numbers; it’s about gaining control, fostering sustainable growth, and ultimately, realizing the full potential of your entrepreneurial vision. Start building your business’s financial future today, and watch your hard work translate into tangible, lasting success.