Navigating the financial landscape as a single individual presents a unique blend of freedom and responsibility. Without a partner to share expenses or financial burdens, every dollar earned and spent rests solely on your shoulders. This autonomy can be incredibly empowering, offering complete control over your financial destiny, but it also means there’s no safety net of a second income or shared savings to fall back on when unexpected costs arise. Understanding your money habits and charting a clear financial course becomes not just beneficial, but absolutely essential for long-term stability and achieving personal goals.

Embracing a structured approach to your finances doesn’t mean sacrificing spontaneity; rather, it provides the solid foundation upon which that freedom can truly thrive. A well-crafted financial plan offers clarity, reduces stress, and empowers you to make informed decisions about your spending, saving, and investing. It’s about building a personalized roadmap that reflects your unique lifestyle, aspirations, and financial realities, allowing you to confidently pursue everything from daily necessities to ambitious future plans.

Why a Personalized Financial Plan is Essential for Singles

For individuals managing their finances solo, the stakes are undeniably higher. There’s no splitting the rent, utility bills, or grocery tabs, nor is there a dual income stream to buffer against economic downturns or unexpected expenses. This means that every financial decision, from a morning coffee to a major investment, directly impacts your personal bottom line. A robust personal spending plan for one becomes your most powerful tool, providing a panoramic view of your financial health.

Having a clear individual financial blueprint helps in more ways than just tracking expenses. It fosters a sense of control, reduces financial anxiety, and highlights areas where you can save more or adjust your spending to align with your values. Whether your goal is to save for a down payment on a home, travel the world, pay off student loans, or simply build a substantial emergency fund, a dedicated money management system for individuals brings those aspirations within reach by showing you exactly where your money is going and where it needs to go.

Key Elements of an Effective Personal Spending Plan

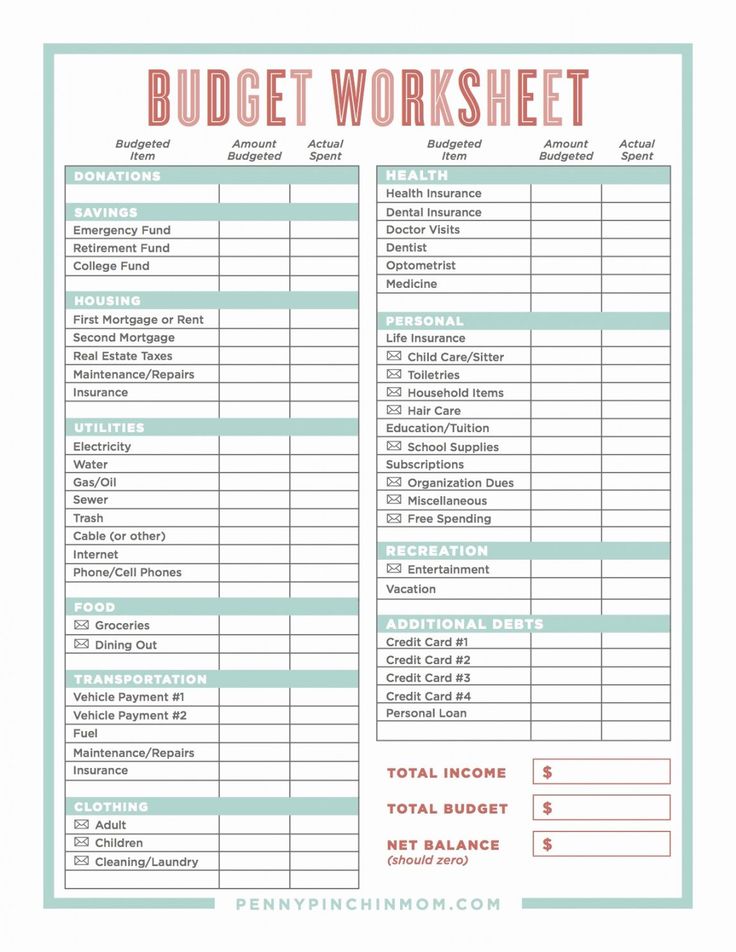

A comprehensive financial plan, designed specifically for a single income household budget, must encompass all aspects of your financial life. It’s more than just a list of debits and credits; it’s a living document that captures your entire financial picture. Understanding and categorizing these elements is the first step toward gaining mastery over your money.

To effectively manage your individual financial blueprint, consider these core components:

- **Income**: This includes your net pay from your primary job, any income from side hustles, freelance work, investments, or other sources. It’s crucial to use your *after-tax* income to ensure realistic budgeting.

- **Fixed Expenses**: These are the costs that generally remain the same each month and are often contractual. Examples include **rent or mortgage payments**, loan repayments (car, student), insurance premiums, and subscription services (streaming, gym memberships).

- **Variable Expenses**: Unlike fixed costs, these fluctuate from month to month. Categories here typically include **groceries**, dining out, entertainment, personal care, clothing, and transportation (gas, public transport fares). These are often the areas where you have the most flexibility to adjust spending.

- **Savings & Investments**: This critical component includes contributions to your emergency fund, retirement accounts (401k, IRA), investment portfolios, and specific savings goals (down payment, vacation, new car). Always aim to pay yourself first.

- **Debt Repayment**: Beyond fixed loan payments, this category covers any additional payments you make towards credit card balances, personal loans, or other forms of consumer debt. Aggressively tackling high-interest debt can free up significant funds in the long run.

- **Discretionary Spending**: This is your “fun money” for hobbies, social activities, gifts, and spontaneous purchases. While important for quality of life, it’s also the first place to look for adjustments if you need to cut back.

By clearly delineating these areas, you start to see patterns and opportunities. A solo budgeting framework provides the structure to ensure every dollar has a job, bringing clarity to your financial journey.

Building Your Own Single Person Monthly Budget Template

Creating a personalized budgeting tool for single people might seem daunting, but it’s a straightforward process that grants immense financial empowerment. The goal is to design a system that works for *you*—one that is easy to maintain and genuinely reflects your spending habits and financial aspirations. This will be the foundation of your very own Single Person Monthly Budget Template.

Begin by gathering all your financial statements: bank accounts, credit cards, loan statements, and pay stubs. This data is essential for understanding your actual income and expenditure over the past few months. Don’t guess; accuracy is key for an effective financial plan for singles. Once you have your data, you can start inputting numbers into your chosen format, be it a spreadsheet, a budgeting app, or even a simple notebook.

Next, categorize your income and expenses using the elements outlined above. For income, list all sources and their net amounts. For expenses, break them down into fixed, variable, and discretionary. Many people find the 50/30/20 rule to be a helpful starting point: allocate 50% of your after-tax income to needs (fixed expenses and essential variable costs), 30% to wants (discretionary spending), and 20% to savings and debt repayment. However, this is a guideline, not a rigid law. Adjust these percentages to fit your unique circumstances and financial priorities.

Finally, review your allocations. Do your expenses exceed your income? If so, identify areas where you can reduce spending, particularly in the variable and discretionary categories. Are you allocating enough to your savings goals? This initial setup might take some time, but it’s a crucial investment in your financial future. Remember, this customizable financial tracker is a living document, so be prepared to revisit and refine it as your life evolves.

Tracking and Adapting Your Financial Blueprint

Setting up your financial plan is only half the battle; the real power comes from consistently tracking your spending and adapting your individual financial blueprint over time. Think of your budget not as a restrictive diet, but as a dynamic financial guide that helps you navigate economic realities and personal aspirations. Regular engagement with your money management system for individuals ensures it remains relevant and effective.

There are numerous ways to track your spending. Many find budgeting apps incredibly useful, as they often link directly to your bank accounts and automatically categorize transactions. For those who prefer a more hands-on approach, a simple spreadsheet or even a dedicated notebook can work wonders. The key is to choose a method you’ll stick with. Daily or weekly check-ins on your spending can help you stay on course and prevent overspending in any given category.

Life is constantly changing, and your financial plan should too. A significant pay raise, a job loss, an unexpected major expense, or a new long-term goal (like buying a car or starting a family) all necessitate a review and adaptation of your budget. Make it a habit to sit down once a month or quarter to formally review your spending against your plan. Are you meeting your savings goals? Are certain categories consistently over budget? These reviews provide valuable insights and allow you to make necessary adjustments, ensuring your solo budgeting framework continues to serve your evolving needs.

Leveraging Tools and Resources

In today’s digital age, managing your finances has never been easier, thanks to a plethora of tools and resources available specifically designed for a single person’s financial guide. From intuitive mobile apps to comprehensive spreadsheet templates, these aids can streamline the budgeting process, making it less tedious and more engaging. Choosing the right tools can significantly enhance your ability to maintain a robust financial plan for singles.

Budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital offer sophisticated features that can link all your financial accounts, track spending in real-time, categorize transactions, and even set financial goals. Many provide visual dashboards that give you an instant overview of your financial health, making it easier to see where your money is going and how you’re progressing toward your goals. Some even offer bill reminders and investment tracking, adding another layer of convenience to your financial management.

For those who prefer a more hands-on approach or simply want to avoid subscription fees, spreadsheet templates are an excellent option. Google Sheets and Microsoft Excel offer a vast array of free templates that can be customized to create a detailed financial plan for singles. These allow for complete control over categories, formulas, and visual presentation. Additionally, there are numerous online forums and communities dedicated to personal finance where you can seek advice, share strategies, and gain support from others on a similar financial journey. Leveraging these resources can transform your approach to money management, making it an empowering and informed experience.

Frequently Asked Questions

How often should I review my budget?

While daily or weekly tracking of expenses is beneficial for staying on track, a comprehensive review of your entire budget should ideally happen once a month. This allows you to compare your actual spending to your plan, assess your progress toward financial goals, and make any necessary adjustments based on your income and expenses for the past month.

What if my income is irregular?

Budgeting with irregular income requires a slightly different approach. Consider using the “buffer” method, where you save enough to cover one month’s expenses in advance. You can also prioritize essential expenses first, allocate funds to savings and debt, and then use any remaining income for discretionary spending. Focusing on an “average” income and being prepared for leaner months is crucial.

Is it okay to spend on wants?

Absolutely! A sustainable budget should include allocations for discretionary spending and wants. Depriving yourself entirely can lead to burnout and make your budget unsustainable in the long run. The key is to allocate a realistic and responsible portion of your income to these categories, ensuring you’re still meeting your needs and savings goals first.

How much should I save for an emergency fund?

Most financial experts recommend saving 3 to 6 months’ worth of essential living expenses in an easily accessible, separate savings account. For single individuals, this cushion is particularly important as there’s no secondary income to fall back on during unexpected job loss, medical emergencies, or other unforeseen circumstances. Aim for the higher end of that range if your job stability is uncertain or you have significant responsibilities.

Are there free resources to help me start?

Yes, many excellent free resources are available. Most banks offer budgeting tools within their online platforms. Google Sheets and Microsoft Excel provide free budget templates. Numerous reputable personal finance websites (like NerdWallet, Investopedia, or The Balance) offer free articles, guides, and downloadable templates. Public libraries also often have books on personal finance that can be invaluable.

Embarking on the journey of disciplined financial management as a single person is one of the most proactive steps you can take toward securing your future and living a life of greater peace and possibility. A thoughtfully constructed personal spending plan is far more than just a ledger; it’s a declaration of your financial independence, a tool for achieving your most ambitious dreams, and a shield against unexpected challenges. It offers the clarity needed to make confident decisions, knowing exactly where you stand and where you’re headed.

The power of having a well-defined financial roadmap cannot be overstated. It empowers you to turn abstract goals into concrete achievements, whether that’s building substantial wealth, eliminating debt, or simply enjoying the freedom that comes with financial stability. By taking the time to understand, implement, and consistently refine your individual financial blueprint, you are not just managing money; you are actively designing the life you want to live, one informed decision at a time. Seize this opportunity to gain full command of your financial future today.