Securing grant funding can be a transformative step for any organization, whether you’re a burgeoning nonprofit, an academic research team, or a community-focused initiative. Yet, the journey from a brilliant idea to a funded project often hinges on one critical, often daunting, document: the project budget. Many promising proposals falter not due to a lack of merit in their mission, but because their financial outlines are unclear, incomplete, or simply too complex for funders to quickly grasp.

The good news is that navigating this financial labyrinth doesn’t have to be an overwhelming ordeal. With the right approach, building a compelling budget can be straightforward, clear, and even empowering. This article delves into how a well-structured, easy-to-understand financial framework can be your most powerful ally in attracting the resources your project deserves, transforming a potentially confusing task into a strategic advantage.

The Power of Clarity in Grant Applications

When a grant reviewer sifts through dozens, if not hundreds, of applications, their time and attention are precious commodities. A cluttered or confusing budget will, at best, slow them down, and at worst, raise red flags about your organization’s financial acumen. Conversely, a clear, concise, and logical project budget immediately signals professionalism and preparedness. It demonstrates that you have a firm grasp not only of your project’s goals but also of the practical resources required to achieve them. This transparency builds trust, assures funders that their investment will be managed responsibly, and significantly enhances your proposal’s credibility.

A well-articulated financial plan isn’t just about listing numbers; it’s about telling a story of responsible resource allocation. It visually translates your project’s activities into quantifiable needs, making it easier for funders to connect the dots between their investment and your intended impact. Essentially, a clear budget acts as a financial roadmap, guiding the reviewer through your proposed expenditures and demonstrating a direct link between every dollar requested and every project objective.

What Makes a Budget Template “Simple” and Effective?

A simple grant project budget template isn’t about cutting corners or omitting vital information; it’s about intelligent organization and user-friendliness. The core principle is to provide all necessary details in a format that is intuitive for both the creator and the reviewer. This means avoiding overly complex formulas or jargon, and instead focusing on clear categories and easily understandable justifications. An effective template streamlines the budgeting process, reducing the time and stress often associated with financial planning for grants.

What makes such a template truly effective is its adaptability and ease of use. It should allow you to quickly input costs, automatically calculate totals, and provide spaces for clear justifications without requiring advanced spreadsheet skills. The goal is to demystify the budget creation process, making it accessible to individuals and organizations regardless of their financial expertise. By focusing on simplicity, you ensure that the effort goes into accurately reflecting your project’s needs, rather than wrestling with an unwieldy document.

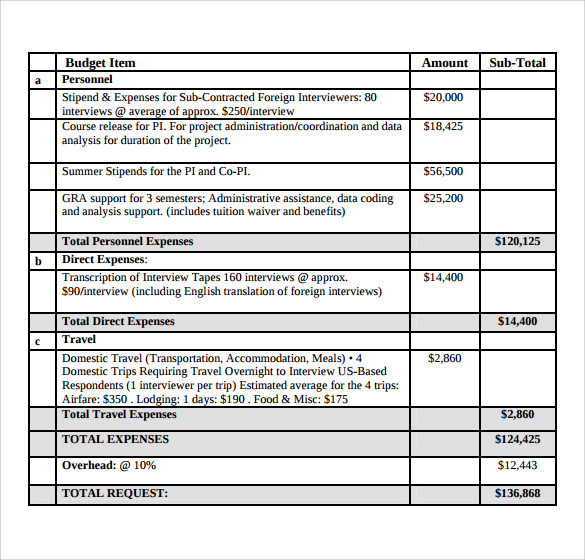

Key Components of a Robust Project Budget

A comprehensive project budget, even a simple one, must account for all anticipated costs associated with your grant-funded activities. While specific categories may vary slightly depending on the funder and the nature of your project, most grant budgets will include the following essential line items. Each category should be detailed enough to justify the expense clearly, yet presented simply to ensure readability.

- Personnel: This includes salaries, wages, and stipends for individuals directly working on the project. For each position, specify the name (if known), role, annual salary, and the percentage of effort dedicated to the project.

- Fringe Benefits: These are costs associated with personnel beyond their direct salary, such as health insurance, retirement contributions, FICA (Social Security and Medicare taxes), and unemployment insurance. They are often calculated as a percentage of salaries.

- Travel: Encompasses all project-related travel, including airfare, accommodation, per diem for meals, ground transportation, and conference registration fees. Clearly state the purpose of travel, destination, and number of travelers.

- Equipment: Costs for durable goods with a useful life of more than one year and a specified minimum value (e.g., $5,000, as per federal guidelines). List each item, its quantity, unit cost, and a brief justification for its necessity.

- Supplies: Consumable items necessary for the project, such as office supplies, laboratory materials, educational resources, or specific software licenses. Group similar items and provide an estimated total cost.

- Contractual/Consultant Services: Payments to individuals or organizations providing specialized services that are not directly employed by your organization. Include a description of the service, the contractor’s name (if known), and the hourly/flat rate.

- Other Direct Costs: A catch-all for direct expenses not fitting into the above categories, such as printing, postage, communication costs, facility rental, or publication fees. Each item should be clearly defined and justified.

- Indirect Costs (or Facilities & Administrative Costs – F&A): These are costs that are incurred for common or joint objectives and cannot be readily identified with a particular project activity. Examples include administrative salaries, utilities, rent, and general office expenses. These are often calculated as a negotiated percentage of direct costs (or a specific subset of direct costs, like Modified Total Direct Costs – MTDC). If you have a federally negotiated indirect cost rate, use it. If not, some funders may allow a de minimis rate (e.g., 10% of MTDC) or have specific limitations.

Building Your Budget: Step-by-Step Guidance

Populating your Simple Grant Project Budget Template effectively requires a methodical approach. Start by thoroughly dissecting your project’s work plan. Every activity, deliverable, and milestone should correspond to a potential cost. Begin with personnel, as this is often the largest component. Identify who will be working on the project, their roles, and the precise percentage of their time dedicated to grant-related tasks.

Next, move through the other categories, estimating costs as accurately as possible. For travel, research current airfares and hotel rates. For supplies and equipment, obtain quotes from vendors. Don’t be afraid to make reasonable estimates, but be prepared to justify them. Always include a column for "Justification" or "Basis of Calculation" next to each line item. This is where you explain why that expense is necessary and how you arrived at the cost. For instance, for a line item like "Project Coordinator Salary," your justification might state, "100% FTE for a full-time project coordinator dedicated to managing project activities, participant recruitment, and reporting. Based on current market rates for similar positions."

Finally, review your entire budget. Does it align perfectly with your project narrative? Is every expense essential and clearly justified? Are there any hidden costs you’ve overlooked? Is the total amount reasonable for the proposed scope of work? Many funders look for evidence of cost-sharing or in-kind contributions, which demonstrate your organization’s commitment to the project. While not always directly funded, these can be included in a separate column or section to showcase additional resources your organization brings to the table.

Customizing Your Budget Plan for Any Grant Opportunity

No two grant opportunities are exactly alike, and neither should be your project budget. While a Simple Grant Project Budget Template provides a solid foundation, the key to success lies in its adaptability. Funders often have specific requirements for budget formats, allowable costs, and even the level of detail they expect. Before you even begin populating your template, carefully read the grant guidelines, Request for Proposals (RFP), or Notice of Funding Opportunity (NOFO).

Pay close attention to sections on "Allowable Costs" and "Unallowable Costs." Some funders may cap administrative expenses, require specific formats for personnel breakdowns, or limit travel expenditures. Your grant budget plan must reflect these nuances precisely. For instance, a federal grant might require very detailed breakdowns for fringe benefits and indirect costs, whereas a private foundation might prefer a more narrative budget with broader categories. Customize your template by adding or removing columns, adjusting category names to match funder terminology, and ensuring all required certifications (e.g., regarding federal funding restrictions) are addressed. This meticulous tailoring not only shows diligence but also makes the reviewer’s job easier, significantly improving your chances of securing funding.

Maximizing Your Funding Potential with a Clear Financial Plan

A well-developed financial plan for grant applications is more than just a list of expenditures; it’s a strategic tool. By presenting a clear, coherent, and justifiable budget, you not only meet the funder’s requirements but also enhance your project’s overall attractiveness. A carefully constructed budget demonstrates fiscal responsibility and a deep understanding of your project’s operational needs. This foresight inspires confidence in potential funders, reassuring them that their investment will be managed effectively and efficiently, leading to the desired impact.

Beyond compliance, a strong financial plan allows you to anticipate challenges and plan for contingencies, even if those contingencies aren’t explicitly detailed for the funder. It forces you to think through every aspect of project implementation from a financial perspective, which can proactively identify potential gaps or resource shortfalls. This strategic budgeting approach maximizes your funding potential by presenting a proposal that is not only compelling in its mission but also robust and realistic in its financial foundation, ultimately increasing your likelihood of securing the resources needed to bring your vision to life.

Frequently Asked Questions

Why can’t I just use a basic spreadsheet from scratch?

While you certainly *can* use a basic spreadsheet, a dedicated project budget template offers significant advantages. It provides a pre-structured framework with essential categories already defined, prompts for justifications, and often includes built-in formulas for calculations. This saves time, reduces the chance of overlooking critical budget components, and ensures consistency in presentation, which is highly valued by grant reviewers. It acts as a guide, helping you organize your financial information logically and comprehensively.

How often should I update my project budget?

Your project budget should be considered a living document. It’s crucial to update it at several key stages: initially during the proposal development, again once funding is awarded (to reflect actual award amounts and any funder-mandated changes), and throughout the project’s implementation. Regular monitoring and periodic updates (e.g., quarterly or semi-annually) help track actual expenditures against planned spending, allowing for timely adjustments and ensuring you stay within budget and meet reporting requirements.

What’s the difference between direct and indirect costs?

**Direct costs** are expenses that can be specifically and clearly identified with a particular project, program, or activity. Examples include salaries of project staff, supplies purchased for the project, and travel directly related to project activities. **Indirect costs**, also known as Facilities & Administrative (F&A) costs, are expenses incurred for common or joint objectives that cannot be readily identified with a particular project. These include general administrative expenses, utilities, rent for shared facilities, and general IT support. Funders often cap or define how indirect costs can be charged.

Can I use this budget template for federal grants?

Yes, a well-designed grant budget template can absolutely be adapted for federal grants, but with important considerations. Federal grants often have very specific and stringent requirements regarding budget categories, allowable costs, indirect cost rates (e.g., federally negotiated rates or the de minimis 10% rate on Modified Total Direct Costs), and detailed justifications. While the core structure of a simple budget template remains useful, you will need to meticulously tailor it to align with the specific agency’s guidelines and cost principles (e.g., 2 CFR Part 200, Uniform Guidance), ensuring full compliance.

What if my project budget needs to include matching funds or in-kind contributions?

Many funders, especially federal agencies, encourage or require matching funds (cash or in-kind contributions) to demonstrate your organization’s commitment and leverage additional resources. Your budget template should have dedicated sections or columns to clearly delineate these contributions. For **cash match**, list the source and amount of funds your organization or partners are providing directly. For **in-kind contributions**, detail the services, volunteer time, or donated materials and assign a reasonable, justifiable monetary value to them, often requiring specific documentation or valuation methods.

Crafting a compelling grant proposal requires more than just a brilliant idea; it demands a clear, credible, and comprehensive financial plan. By embracing the principles of a simple grant project budget template, you transform a potential hurdle into a powerful asset. This isn’t just about filling out a form; it’s about strategically communicating your fiscal responsibility and operational foresight to those who hold the keys to your project’s success.

Armed with a well-organized budget, you’ll not only meet the demands of rigorous grant applications but also empower your team with a transparent roadmap for resource management. Embrace the clarity and confidence that a thoughtfully constructed budget brings, and propel your visionary projects from concept to impactful reality. Your next successful grant application is within reach, built on the strong foundation of a clear financial vision.