Navigating the dynamic landscape of retail can often feel like steering a ship through a constantly changing sea. From managing inventory and staff to marketing efforts and customer service, the demands on a retail business owner are immense. Amidst this whirlwind of daily operations, one crucial element frequently determines the difference between thriving success and struggling survival: effective financial planning. Without a clear roadmap for your money, even the most innovative products or prime locations can fall short of their potential.

This is precisely where a well-structured approach to financial oversight becomes not just beneficial, but absolutely essential. It provides clarity, control, and a strategic foundation for every decision you make, from stocking shelves to planning seasonal promotions. For US retail store owners, managers, and aspiring entrepreneurs, understanding the flow of income and expenses is the bedrock of sustainable growth.

The Indispensable Role of Financial Planning in Retail

In the fast-paced retail sector, cash flow is king, and a robust financial plan is its most loyal subject. It transforms abstract numbers into actionable insights, allowing you to anticipate challenges, seize opportunities, and allocate resources wisely. Many independent stores, while rich in passion and product, falter due to a lack of precise financial forecasting and management. This isn’t just about cutting costs; it’s about optimizing every dollar spent and earned.

Effective financial management provides a bird’s-eye view of your business’s economic health, identifying areas of strength and potential weakness. It allows you to move beyond guesswork, replacing it with data-driven strategies for purchasing, staffing, and marketing. Ultimately, a solid understanding of your financial position empowers you to make proactive decisions rather than reactive ones, safeguarding your investment and securing your future.

What Exactly is a Retail Store Budget Template and Why Do You Need One?

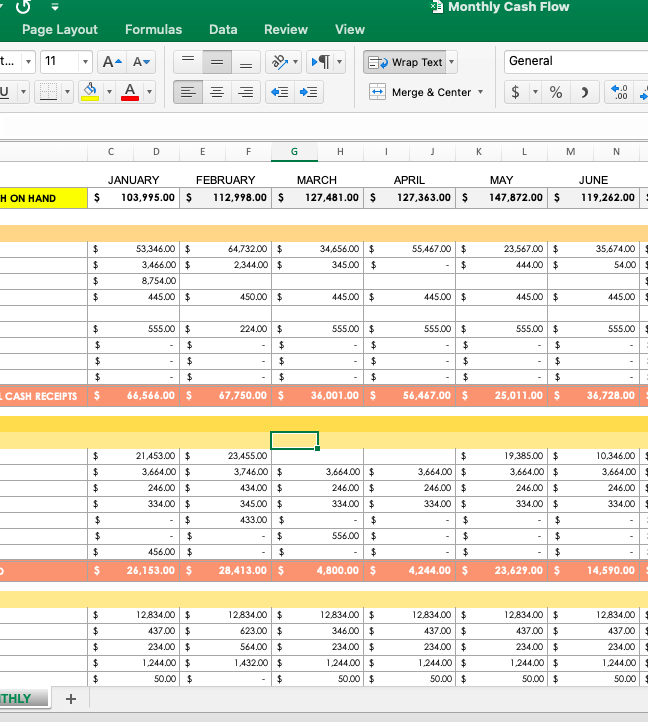

A Retail Store Budget Template is essentially a pre-designed framework that organizes your expected income and expenses over a specific period, typically a month, quarter, or year. It’s a structured document, often in a spreadsheet format, that guides you through the process of outlining your financial projections. Rather than starting from scratch, it provides categories and formulas to help you track where your money comes from and where it goes.

This systematic approach is invaluable for several reasons, offering clear and measurable benefits to any retail operation, regardless of its size or specialization.

- **Clarity and Insight:** It provides a comprehensive picture of your financial situation, highlighting **revenue streams** and **expenditure categories**.

- **Informed Decision-Making:** With a clear financial overview, you can make smarter choices about **inventory levels**, staffing, marketing spend, and pricing strategies.

- **Goal Setting and Tracking:** A budget allows you to set **realistic financial targets** and monitor your progress towards them, fostering accountability.

- **Resource Optimization:** It helps identify where resources are being overspent or underutilized, leading to more **efficient allocation**.

- **Early Warning System:** By tracking actual performance against projections, you can quickly spot potential **cash flow problems** or budget deviations.

- **Securing Funding:** Lenders and investors often require a detailed financial plan, making a well-crafted store budget framework a crucial tool for **obtaining capital**.

- **Contingency Planning:** It allows for the allocation of funds towards a **rainy day fund** or unexpected emergencies, providing a safety net.

Key Components of an Effective Retail Financial Plan

Building a robust operational budget for your store involves dissecting your business into its fundamental financial parts. Each component plays a vital role in painting an accurate picture of your fiscal health and guiding your future strategy. Understanding these elements is the first step toward gaining mastery over your retail finances.

Revenue Streams

This section outlines all the ways your store generates income. For most retailers, the primary source is sales of products, but it can also include services, gift card sales, and even rental income if you sublease a portion of your space. Detailed projections here should account for seasonality, historical sales data, promotional impacts, and future market trends. Breaking down sales by product category or department can offer even deeper insights into what drives your top line.

Cost of Goods Sold (COGS)

COGS represents the direct costs attributable to the production or purchase of the goods sold by your business. For a retailer, this primarily means the wholesale cost of the inventory you sell. Calculating COGS accurately is crucial for determining your gross profit margin. It includes the purchase price, freight-in costs, and any other expenses directly related to getting the product ready for sale. Meticulously tracking COGS helps optimize purchasing and pricing strategies.

Operating Expenses

These are the ongoing costs associated with running your retail business that are not directly tied to the creation or purchase of products. This broad category encompasses a multitude of expenditures, and a well-detailed store spending plan will break these down further.

- **Rent or Mortgage:** Your largest fixed cost, often paid monthly.

- **Utilities:** Electricity, gas, water, internet, and phone services.

- **Payroll and Benefits:** Wages, salaries, commissions, bonuses, employer-paid taxes, health insurance, and retirement contributions for your staff.

- **Marketing and Advertising:** Costs associated with promoting your store, including social media ads, local print ads, website maintenance, email marketing platforms, and promotional events.

- **Insurance:** General liability, property insurance, workers’ compensation, and potentially specialized retail policies.

- **Supplies:** Office supplies, cleaning supplies, packaging materials, bags, and point-of-sale consumables.

- **Technology and Software:** POS systems, inventory management software, e-commerce platform fees, and other essential retail technologies.

- **Maintenance and Repairs:** Upkeep of the store premises, equipment repairs, and routine servicing.

- **Professional Services:** Accounting fees, legal advice, consulting, or specialized training.

- **Taxes:** Property taxes (if applicable), sales tax remittances, and business income taxes.

Capital Expenditures (CapEx)

These are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, or equipment. For a retail business, CapEx might include purchasing new display fixtures, upgrading your POS system, renovating the store interior, or investing in a new delivery vehicle. While not a recurring operational expense, it’s vital to budget for these investments as they contribute to the long-term health and growth of your business.

Putting Your Budget Template to Work: A Step-by-Step Guide

Once you understand the essential components, the next step is to actively implement and utilize your retail financial model. This isn’t a one-time exercise but an ongoing process that requires commitment and regular attention.

1. Gather Historical Data

Start by compiling your financial records from previous years or months. This includes sales reports, expense receipts, payroll records, and bank statements. Historical data provides a realistic baseline for projecting future revenue and expenses, helping you identify trends and seasonal fluctuations.

2. Forecast Sales Realistically

Projecting your income is often the most challenging part. Consider past performance, market trends, economic outlook, planned marketing campaigns, and any upcoming product launches or promotions. Be conservative in your sales estimates; it’s better to under-promise and over-deliver than the other way around.

3. Estimate and Categorize Expenses

Go through each expense category, distinguishing between fixed costs (like rent) and variable costs (like COGS or marketing, which fluctuate with sales volume). For variable costs, estimate their percentage of sales. Don’t forget to include one-off or annual expenses that might not appear monthly, like insurance premiums or software subscriptions.

4. Allocate a Contingency Fund

Unexpected expenses are an inevitable part of business. It’s prudent to allocate a percentage of your total budget (e.g., 5-10%) for unforeseen circumstances, such as emergency repairs, unpredicted inventory issues, or sudden market shifts. This emergency fund provides a crucial buffer.

5. Monitor and Adjust Regularly

A budget is a living document, not a static one. Review your actual income and expenses against your budget projections monthly or quarterly. Identify discrepancies, understand the reasons behind them, and adjust your future spending or income strategies accordingly. This continuous feedback loop is critical for maintaining financial control.

6. Leverage Technology and Expert Advice

While a simple spreadsheet can be effective, modern accounting software or specialized budgeting tools can automate much of the tracking and reporting. Consider consulting with an accountant or a financial advisor specializing in retail to fine-tune your financial planning and identify potential tax efficiencies.

Common Pitfalls to Avoid When Managing Your Retail Finances

Even with the best intentions and a detailed budget template, certain missteps can derail your financial planning efforts. Being aware of these common pitfalls can help you navigate around them.

- **Over-Optimistic Sales Forecasts:** Basing your budget on unrealistic revenue projections can lead to overspending and cash flow crises. Always err on the side of caution.

- **Underestimating Hidden Costs:** Don’t forget smaller, less obvious expenses like bank fees, software subscription renewals, or minor repairs. These can add up quickly.

- **Ignoring Seasonality:** Retail sales are often cyclical. Failing to account for peaks and troughs in demand can lead to inventory gluts or shortages, and financial strain during slow periods.

- **Lack of Regular Review:** Creating an annual budget is only half the battle. Neglecting to review it against actual performance means you miss opportunities to adapt and correct course.

- **Failing to Track Inventory Costs Accurately:** Inventory is a significant asset and expense for retailers. Inaccurate tracking can distort COGS and overall profitability.

- **Not Allocating for Marketing:** While an expense, marketing is an investment in growth. Cutting this budget too deeply can stifle future sales.

- **Using Outdated Data:** Relying on old financial records or general industry benchmarks without adjusting for your unique business context can lead to inaccurate budgeting.

Frequently Asked Questions

How often should I review my store budget?

Ideally, you should review your store’s financial blueprint at least monthly. This allows you to track actual performance against your projections, identify variances early, and make timely adjustments. A quarterly comprehensive review is also recommended to assess larger trends and update longer-term forecasts.

Can a small boutique really benefit from a detailed budget?

Absolutely. A detailed store financial plan is perhaps even more crucial for small boutiques. With fewer resources, every dollar counts, and a budget ensures optimal allocation, prevents overspending, and provides the clarity needed to compete with larger retailers. It’s the roadmap to sustainable growth for any small business.

What’s the difference between a budget and a forecast?

A budget is a specific financial plan for a future period, outlining expected income and expenses, and is a statement of what you *intend* to happen. A forecast, on the other hand, is an estimate of future financial outcomes based on historical data and current trends, and is a prediction of what *will* likely happen. Forecasts can inform budgets, and budgets are often updated with new forecasts.

How do I handle unexpected expenses in my budget?

The best way to handle unexpected expenses is to anticipate them by including a contingency fund within your retail operational budget. This allocated buffer provides a financial cushion for unforeseen costs without disrupting your core operations. For very large, truly unexpected events, you may need to re-evaluate your entire budget and make significant adjustments.

Is it possible to find a free retail financial planning tool?

Yes, many basic budget templates are available for free online, often in spreadsheet formats like Excel or Google Sheets. These can be a great starting point for small businesses. However, as your business grows, you might consider investing in more robust accounting software or specialized budgeting platforms that offer advanced features, integrations, and automation.

Mastering your retail finances through a well-crafted budget template is more than just an accounting exercise; it’s an empowering strategic advantage. It shifts your perspective from merely reacting to market conditions to actively shaping your store’s financial destiny. By meticulously tracking your income and outgoings, you gain the foresight to invest wisely, the resilience to weather economic shifts, and the clarity to pursue ambitious growth goals.

Embracing this level of financial discipline positions your retail business for long-term success and stability. It allows you to transform abstract financial data into tangible plans, paving the way for informed decisions that drive profitability and ensure a thriving future. Take the proactive step today to build and maintain a detailed financial blueprint, and watch your retail venture flourish.