The dream of owning a recording studio, whether it’s a professional commercial facility or a meticulously crafted home setup, often starts with a passion for sound and music. Visions of perfectly tuned acoustics, gleaming microphones, and a console bristling with possibilities fill the mind, promising endless creative output. However, turning this dream into a sustainable reality requires more than just technical prowess and artistic vision; it demands a solid foundation of financial planning.

Without a clear financial roadmap, even the most promising studio ventures can quickly hit unforeseen hurdles, from unexpected equipment costs to overlooked operational expenses. This is where a strategic approach to your finances becomes not just helpful, but absolutely essential. Understanding your expenditures, anticipating future costs, and allocating resources wisely ensures your creative hub remains solvent and thriving.

The Imperative of Financial Planning for Your Studio

Embarking on the journey of establishing or even just upgrading a recording studio is an exciting endeavor, but it’s one fraught with potential financial pitfalls if not approached systematically. Many creatives, driven by passion, might underestimate the true cost involved, leading to budget overruns, compromises on essential equipment, or even the premature closure of their operations. A well-considered financial plan acts as your compass, guiding your investment decisions and safeguarding your long-term viability.

This isn’t about stifling creativity with rigid numbers; it’s about empowering your vision with sustainable resources. By developing a comprehensive financial plan for your recording facility, you gain clarity on where your money is going, where it needs to go, and how to optimize every dollar spent. It transforms abstract ideas of expenditure into concrete, manageable figures, allowing you to make informed decisions that support your artistic goals.

Deconstructing Studio Costs: What Goes Into Your Budget?

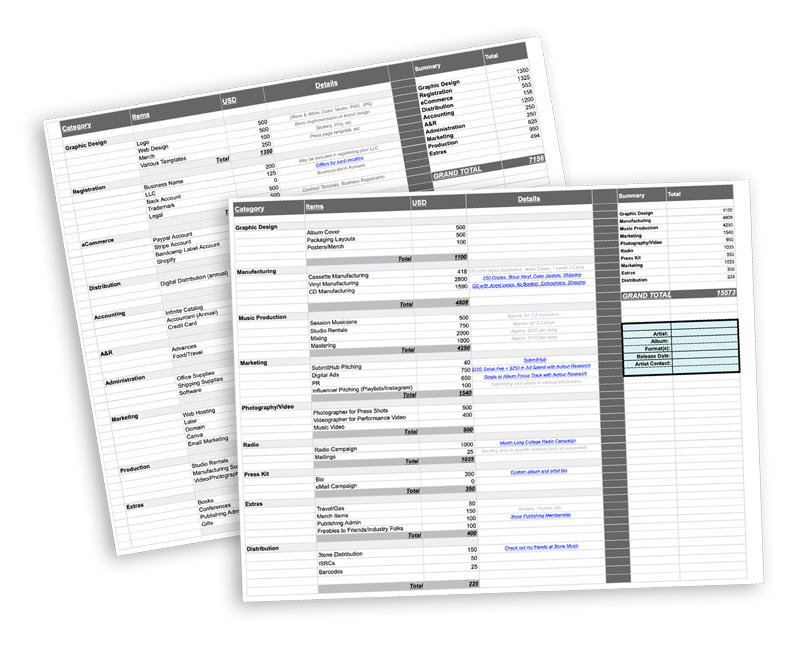

Building or operating a recording studio involves a myriad of expenses, many of which can be surprising if not accounted for upfront. A robust budget framework for audio production breaks down these costs into manageable categories, ensuring nothing slips through the cracks. Thinking beyond just the immediate equipment purchase is crucial for a complete financial picture.

Here’s a breakdown of common categories you’ll encounter when developing your sound studio cost planning tool:

- **Initial Setup Costs**: This includes everything needed to get the physical space ready. Think about **acoustical treatment**, studio furniture, **electrical wiring upgrades**, soundproofing materials, and any necessary construction or renovation.

- **Equipment Investment**: The core of any studio. This encompasses **microphones**, preamps, audio interfaces, **monitors (speakers)**, headphones, **cables**, digital audio workstations (DAW) software, plugins, **controllers**, and any specialized instruments or outboard gear. Don’t forget **computer hardware** capable of handling demanding audio tasks.

- **Software & Licensing**: Beyond your DAW, consider **virtual instruments**, advanced mixing and mastering plugins, **licensing fees** for commercial music use, and operating system licenses. These can often be subscription-based, so factor in recurring costs.

- **Operational Expenses**: These are the ongoing costs of keeping your studio running day-to-day. This category includes **rent/mortgage**, utilities (electricity, internet), **insurance**, maintenance and repairs, **cleaning services**, and general office supplies.

- **Marketing & Business Development**: Getting clients in the door requires investment. Budget for **website hosting**, advertising, **social media promotion**, networking event costs, and professional photography/videography for your portfolio.

- **Personnel & Professional Services**: If you hire staff, include **salaries**, benefits, and payroll taxes. Also, consider fees for **accountants**, legal advisors, **mixing/mastering engineers** if outsourced, or session musicians.

- **Contingency Fund**: This is perhaps the most overlooked but critical category. Always allocate a percentage (typically 10-20%) of your total budget for **unexpected repairs**, emergency replacements, or unforeseen market changes.

Key Benefits of a Structured Financial Plan

Implementing a detailed Recording Studio Budget Template offers far more than just tracking expenses; it provides a strategic advantage for both creative and business success. The clarity and control gained from such a financial blueprint are invaluable, guiding decisions and fostering growth.

One of the primary benefits is enhanced financial visibility. You’ll understand exactly where your money is going, allowing for better allocation of resources and identification of areas where savings can be made without compromising quality. This transparency empowers you to make informed decisions about future investments, upgrades, or operational adjustments. Secondly, a robust financial plan helps in setting realistic goals and expectations. It clarifies what your budget can truly afford, preventing overspending or underestimating project costs. This realism extends to pricing your services appropriately, ensuring profitability.

Furthermore, a well-defined budget acts as a powerful tool for securing funding or investment. Lenders and investors are far more likely to support a venture that demonstrates a clear understanding of its financial needs and a viable plan for sustainability. It showcases professionalism and foresight. Lastly, consistent use of a financial management system for recording spaces fosters long-term stability and growth. By proactively managing costs and forecasting income, you can plan for expansion, new equipment acquisitions, or even the hiring of additional talent, ensuring your studio evolves strategically.

Crafting Your Studio’s Financial Blueprint: Practical Steps

Developing your studio’s expenditure blueprint doesn’t have to be an intimidating task. It’s an iterative process that begins with careful research and honest assessment. Think of it as mapping out the financial journey of your creative space.

Start by clearly defining your studio’s purpose and scope. Are you building a professional commercial facility, a high-end project studio, or a comfortable home recording setup? The answer to this question will significantly influence your initial and ongoing costs. Research industry standards for equipment, construction, and operational costs within your desired niche. Gather quotes from contractors, equipment vendors, and service providers to get the most accurate figures.

Next, populate your chosen financial framework with all identified expenses, breaking them down into granular detail within the categories discussed earlier. Don’t just list "equipment"; specify each microphone, interface, and software license with its estimated cost. Be thorough, even for small items, as these can accumulate quickly. Review your initial estimates, compare them against your available capital and projected income, and adjust as necessary. Remember to factor in a contingency fund to absorb unexpected expenses.

Customizing Your Budget for Success

No two recording studios are exactly alike, and neither should their financial plans be. A crucial aspect of effective financial planning is the ability to customize your budget to reflect your unique operational model, scale, and specific aspirations. What works for a multi-room commercial facility will differ greatly from a home-based voice-over booth.

For a home studio, your budget might heavily focus on personal equipment purchases and software subscriptions, with minimal overhead for rent or utilities beyond what you already pay. Conversely, a commercial studio budget will feature significant line items for property leases, robust insurance policies, extensive acoustical build-outs, and dedicated staffing salaries. A project studio might sit somewhere in between, prioritizing a core set of professional gear and perhaps renting space as needed. Regularly review your financial model to ensure it remains aligned with your studio’s evolving needs and market conditions. This flexibility ensures your investment strategy for a sound environment remains relevant and effective.

Tips for Managing Your Studio’s Finances Effectively

Once you have your financial blueprint in place, the real work of managing studio finances begins. It’s an ongoing process that requires discipline and regular attention to ensure your studio remains on sound economic footing.

Firstly, track every single expense and income. Utilize accounting software, spreadsheets, or even dedicated studio management platforms to log all transactions. This detailed record-keeping is vital for understanding your cash flow and for tax purposes. Secondly, conduct regular budget reviews. Schedule monthly or quarterly sessions to compare your actual spending against your budgeted figures. This helps identify discrepancies early, allowing you to make timely adjustments and prevent overspending. Thirdly, always maintain your contingency fund. This financial buffer is your safety net against the inevitable unforeseen costs that arise in any business. Finally, don’t hesitate to seek professional advice. An accountant specializing in small businesses or the entertainment industry can offer invaluable insights, help with tax planning, and ensure you’re compliant with all financial regulations.

Frequently Asked Questions

Why is a Recording Studio Budget Template better than just estimating costs in my head?

Estimating costs mentally often leads to underestimation and overlooks numerous small, yet significant, expenses that accumulate quickly. A structured template forces a comprehensive review of all potential expenditures, from initial setup to ongoing operational costs, providing a realistic and detailed financial picture. It minimizes surprises and helps in making informed decisions.

What if my studio’s costs fluctuate constantly? How can a budget remain useful?

Budgets are dynamic tools, not static documents. If costs fluctuate, your budget should be revisited and adjusted regularly. Think of it as a living document. Quarterly reviews, or even monthly if you’re in a high-growth or volatile phase, allow you to update figures, account for new expenses, and adapt your financial strategy to current realities, ensuring it remains an effective economic model for creative production.

Is a financial plan only for new recording studios, or is it useful for established ones too?

A financial plan is crucial for both new and established recording studios. For new studios, it’s essential for initial setup and launch planning. For established studios, it helps monitor profitability, plan for upgrades, manage cash flow, identify areas for cost reduction, and strategically plan for expansion or new services. It’s a continuous tool for financial health and growth.

How often should I update my studio’s budget?

Ideally, you should review your studio’s budget at least once a quarter to compare actuals against projections. A more significant update or reforecasting might be necessary annually, or whenever there are major changes in your business operations, equipment purchases, staffing, or market conditions. Regular review ensures your cost tracking for audio projects remains accurate and relevant.

Can I include projected income in my Recording Studio Budget Template?

While the primary focus of a budget template is often expenditures, integrating projected income streams is highly recommended. This transforms it into a full cash flow projection. Understanding both your expected income and outgoings gives you a clearer picture of your profitability, helps with financial forecasting, and enables better strategic business planning for your studio.

Bringing a recording studio to life or sustaining its operations is a journey fueled by passion, but grounded in practicality. The financial blueprint you create is not a limitation; it’s an enabler, providing the clarity and control necessary to navigate the complexities of business ownership while fostering your artistic endeavors. It’s the difference between a fleeting dream and a lasting legacy in the audio world.

By taking the time to outline your expenses, anticipate challenges, and strategically plan your investments, you are building a resilient foundation for your creative space. Embrace the process of financial planning, and watch as your recording studio not only survives but thrives, becoming the vibrant hub of sound production you always envisioned. Your musical journey deserves a robust financial partner every step of the way.