Stepping out of college and into the professional world is an exhilarating, often dizzying, transition. You’ve traded lecture halls for corporate offices, ramen for actual groceries, and perhaps campus debt for student loan payments. While the newfound independence is thrilling, it also comes with a significant shift in financial responsibility. Suddenly, managing your money isn’t just about making it to the next payday; it’s about building a foundation for your future.

This is where a solid financial plan becomes your best friend. Far from being a restrictive chore, a well-crafted spending framework is a powerful tool for navigating your early career, making smart financial choices, and setting yourself up for long-term success. It’s about taking control, rather than letting your finances control you, and ensuring that your hard-earned income works as hard as you do.

The Foundation of Financial Freedom: Why Budgeting Matters Now More Than Ever

For many recent college graduates, the concept of a formal budget might feel overwhelming or unnecessary. After years of living on a shoestring student budget, the temptation is often to enjoy the fruits of your first professional salary. However, this period is precisely when establishing sound financial habits is most crucial. Without a clear picture of your income and expenses, it’s all too easy for “new adult” costs—like rent, utilities, loan payments, and a burgeoning social life—to quickly outpace your earnings.

Implementing a robust spending plan early on allows you to understand where every dollar goes, identify areas for saving, and prevent the accumulation of high-interest debt. It’s not just about tracking; it’s about intentional spending, conscious saving, and strategic debt repayment. This proactive approach lays the groundwork for achieving significant financial milestones, from building an emergency fund to saving for a down payment on a home, or even starting to invest for retirement.

Furthermore, having a clear financial roadmap provides peace of mind. It reduces stress related to money, empowers you to make informed decisions about your purchases, and allows you to allocate funds towards experiences and goals that truly matter to you. Think of it as your personal GPS for financial well-being, guiding you through the often-complex terrain of adult finances right from the start of your career journey.

Key Components of an Effective Budget for New Graduates

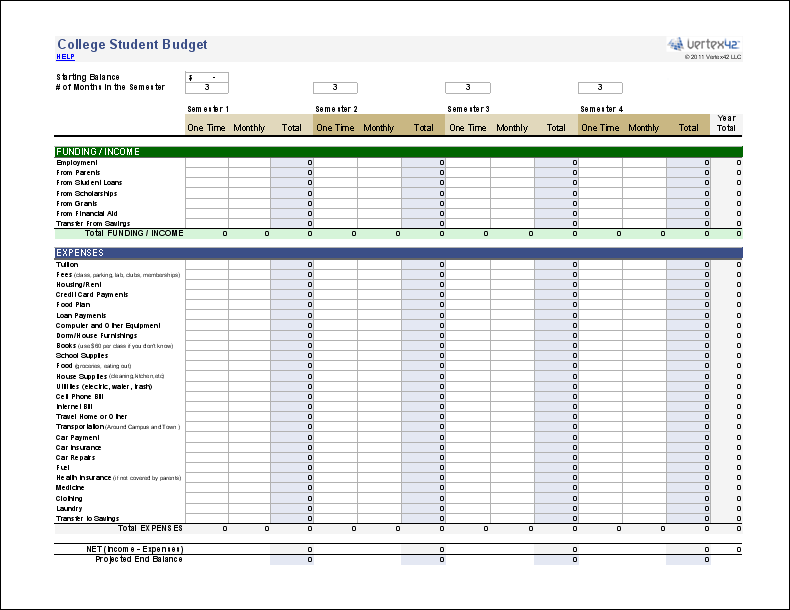

Creating a functional financial plan for recent college graduates involves more than just jotting down numbers. It requires categorizing your income and expenses in a way that provides clarity and actionable insights. Understanding these core components is the first step towards building a sustainable financial structure that works for your unique situation.

Your budgeting framework should always start with your net income—what you actually take home after taxes, insurance, and other deductions. This is the realistic figure you have to work with each month. From there, you’ll divide your expenditures into different categories, often broadly split into fixed and variable costs, with a keen eye on your financial goals.

Here are the essential elements your post-college spending plan should include:

- **Income:** Your monthly take-home pay from your job, plus any other consistent income sources.

- **Fixed Expenses:** These are costs that typically remain the same each month. Examples include:

- **Rent/Mortgage:** Your largest housing payment.

- **Student Loan Payments:** A significant expense for most new grads.

- **Car Payment:** If you have one.

- **Insurance:** Health, car, renter’s, etc.

- **Subscriptions:** Streaming services, gym memberships, software.

- **Variable Expenses:** These fluctuate month-to-month and offer opportunities for adjustment. Examples include:

- **Groceries:** Essential, but controllable.

- **Utilities:** Electricity, gas, water, internet (can vary seasonally).

- **Transportation:** Gas, public transit, ride-shares.

- **Dining Out/Socializing:** A common area for overspending.

- **Personal Care:** Haircuts, toiletries, clothing.

- **Entertainment:** Movies, concerts, hobbies.

- **Savings & Debt Repayment:** Dedicated allocations for your future.

- **Emergency Fund:** Crucial for unexpected costs.

- **Retirement Contributions:** Even a small amount adds up over time.

- **Other Savings Goals:** Down payment, travel, large purchases.

- **Extra Debt Payments:** Beyond minimums, especially high-interest debt.

By breaking down your finances into these categories, you gain a panoramic view of your financial landscape, enabling you to make informed decisions and allocate funds effectively. This structure is the backbone of any successful Recent College Graduate Budget Template.

Building Your Personalized Financial Roadmap: A Step-by-Step Guide

Creating a personalized financial roadmap for your post-graduation life might seem daunting, but it’s a straightforward process that empowers you to take control. This isn’t about rigid deprivation; it’s about mindful allocation. Follow these steps to tailor a plan that fits your life and helps you achieve your aspirations.

First, gather all your financial documents. This includes pay stubs, bank statements, student loan statements, and any bills for rent, utilities, and subscriptions. Having all this information in one place makes the initial setup much easier and ensures you don’t miss any critical expenses. Accuracy is key to creating a truly effective money management system.

- **Calculate Your Net Monthly Income:** Start by determining exactly how much money hits your bank account each month after all taxes and deductions. This is your baseline for all spending and saving.

- **List All Fixed Expenses:** Write down every expense that is the same every month. This includes rent, student loan minimums, car payments, insurance premiums, and any recurring subscriptions. Don’t forget about services like internet and phone bills.

- **Track Your Variable Expenses:** For a month or two, meticulously track every dollar you spend on categories like groceries, dining out, transportation, entertainment, and personal care. This step is vital for understanding your actual spending habits before you try to adjust them. Many banking apps and budgeting tools can automate this for you.

- **Identify Savings & Debt Repayment Goals:** Decide what you want to save for (emergency fund, travel, down payment) and how you want to tackle any debt beyond minimum payments. Assign specific amounts to these goals each month.

- **Allocate Funds and Create a Draft:** Based on your income and tracked expenses, begin to assign specific amounts to each category. A popular guideline is the **50/30/20 rule**:

- **50%** of your income for needs (rent, utilities, groceries, transportation, loan minimums).

- **30%** for wants (dining out, entertainment, hobbies, shopping).

- **20%** for savings and debt repayment (emergency fund, retirement, extra loan payments).

Adjust these percentages to fit your unique circumstances. If your student loan payments are high, your “needs” category might be larger, requiring you to reduce “wants” or find ways to increase income.

- **Review and Adjust Regularly:** Your first budget will likely not be perfect. Life happens! Regularly review your spending against your plan, perhaps once a week or bi-weekly. If you consistently overspend in one area, adjust your allocation for the next month or look for ways to reduce that expense. Your financial plan should be a living document, evolving as your income, expenses, and goals change.

By diligently following these steps, you’ll transform a generic spending framework into a powerful, personalized tool that guides your financial decisions and helps you build a secure future.

Leveraging Technology and Tools for Seamless Money Management

Gone are the days when managing your money meant endless spreadsheets and manual calculations. Today, a plethora of apps and online tools can simplify the process of financial management, making it accessible and even enjoyable for new professionals. Embracing these digital aids can transform how you interact with your money, providing real-time insights and automating tedious tasks.

Many budgeting apps link directly to your bank accounts and credit cards, automatically categorizing your transactions. This eliminates the need for manual data entry and provides an up-to-the-minute overview of your spending. Tools like Mint, YNAB (You Need A Budget), or Personal Capital offer various features, from basic expense tracking to net worth analysis, investment monitoring, and goal setting.

Additionally, many banks offer their own integrated budgeting features within their online banking platforms. These can be a great starting point, especially if you prefer to keep all your financial information consolidated. Experiment with a few options to find one that aligns with your comfort level and financial goals. The key is to choose a tool you’ll actually use consistently, as the best system is one that you stick with.

Navigating Common Financial Pitfalls and Staying on Track

The journey of financial independence as a recent grad is rarely without its bumps. There are common pitfalls that many new professionals encounter, but being aware of them can help you steer clear and maintain your financial health. A robust entry-level professional budget acts as your early warning system, but vigilance is still required.

One of the biggest challenges is **lifestyle inflation**. As your income increases, there’s a natural tendency to upgrade your living situation, dining habits, and shopping choices. While some improvements are well-deserved, letting your expenses rise in lockstep with your income can stifle your ability to save and invest. Remember the 50/30/20 rule; try to save a significant portion of any pay raises. Another common pitfall is **carrying credit card debt**. High-interest debt can quickly spiral out of control, eroding your financial progress. Use credit cards responsibly, paying off the full balance every month to avoid interest charges.

Furthermore, many young professionals neglect to **build an emergency fund**. Life is unpredictable, and unexpected expenses—car repairs, medical bills, job loss—can derail even the most carefully constructed financial plan. Aim to save at least three to six months’ worth of essential living expenses in an easily accessible savings account. Finally, don’t ignore **student loan interest**. While you might be focusing on minimum payments, understanding how interest accrues can motivate you to make extra payments whenever possible, significantly reducing the total cost of your loans over time. Regular reviews of your financial template for young professionals will help you catch these issues early.

Frequently Asked Questions

How often should I review and adjust my budget?

It’s advisable to review your budget at least once a month, typically before your next pay cycle, to ensure it aligns with your current income and spending habits. A more thorough review, perhaps quarterly or semi-annually, is beneficial to account for bigger changes like salary increases, new recurring expenses, or shifts in your financial goals.

What if I consistently go over budget in a specific category?

If you find yourself consistently exceeding your allocated amount in a particular category, it’s a sign that your initial allocation might be unrealistic. You have two main options: either find ways to genuinely reduce spending in that area (e.g., cook more instead of dining out) or adjust your budget by reallocating funds from a less critical category. The goal is realistic, sustainable spending.

Is it okay to use a credit card if I’m trying to stick to a budget?

Yes, using a credit card can be fine and even beneficial for building a good credit history, as long as you pay off the *entire balance* every single month. Treat your credit card like a debit card—only spend money you already have in your bank account. Avoid carrying a balance, as the interest charges can quickly undermine your money management efforts.

How much should I aim to save for an emergency fund as a new graduate?

As a recent graduate, aim to save at least three to six months’ worth of your essential living expenses in a separate, easily accessible savings account. This fund provides a crucial safety net for unexpected events like job loss, medical emergencies, or unforeseen major repairs, preventing you from going into debt during difficult times.

What’s the easiest way to start tracking my expenses?

The easiest way to start tracking expenses is by leveraging technology. Link your bank accounts and credit cards to a reputable budgeting app like Mint, YNAB, or Personal Capital. These apps automatically categorize your transactions, giving you a clear picture of where your money is going without manual input. If you prefer a simpler approach, many banks offer built-in expense tracking within their online banking platforms.

Embarking on your post-college journey with a clear financial plan in hand is one of the smartest decisions you can make. It’s not just about managing money; it’s about empowering yourself to make intentional choices that align with your values and aspirations. This comprehensive guide and the principles of a Recent College Graduate Budget Template provide the framework, but the true power comes from your commitment to regularly engage with your finances.

Remember, financial planning is an iterative process. Your first financial plan won’t be perfect, and that’s perfectly normal. Life changes, goals evolve, and your budget should adapt alongside them. By consistently reviewing, adjusting, and learning from your financial journey, you’ll cultivate habits that lead to lasting financial security and the freedom to pursue the life you envision.

Take that first step today. Start tracking your income and expenses, set some realistic goals, and watch as your confidence in managing your money grows. The foundation you build now will serve as a launchpad for a lifetime of financial well-being and success.