Running a political campaign is a whirlwind of strategy, communication, and tireless effort, but beneath the visible fervor lies a critical backbone: financial management. Without a clear understanding of where every dollar comes from and, more importantly, where it goes, even the most promising campaigns can falter. It’s not enough to have a compelling message or a dedicated team; you need a robust financial framework to translate enthusiasm into votes. This framework provides the clarity and control essential for navigating the complex and often unpredictable landscape of electoral politics.

A well-constructed financial plan serves as your campaign’s financial compass, guiding every decision from staff hires to ad buys. It’s the difference between a reactive, crisis-driven operation and a proactive, strategically focused one. For candidates, campaign managers, and treasurers alike, mastering this aspect is non-negotiable. It ensures accountability, optimizes resource allocation, and ultimately, maximizes your chances of success. This guide will explore the essential elements and strategic advantages of a meticulously planned spending blueprint, helping you transform your campaign’s financial aspirations into achievable realities.

Why a Campaign Budget is Your Blueprint for Victory

In the high-stakes world of political campaigning, every dollar counts, and how those dollars are managed can dictate the outcome. A comprehensive campaign financial plan isn’t merely an accounting tool; it’s a strategic document that underpins every operational decision. It provides a transparent overview of expected income and expenses, allowing the campaign to allocate resources effectively and identify potential shortfalls before they become critical issues. This proactive approach minimizes financial surprises and helps maintain stability throughout the election cycle.

Moreover, a detailed spending plan fosters accountability within the campaign team and builds trust with donors. When contributors see that their investments are being managed judiciously and strategically, they are more likely to continue their support. It demonstrates professionalism and a serious commitment to fiscal responsibility, which resonates deeply with those who fund your cause. From the initial exploratory phase to the final Election Day push, a clear financial roadmap ensures that resources are aligned with strategic objectives, transforming potential into tangible results.

Key Components of an Effective Campaign Financial Plan

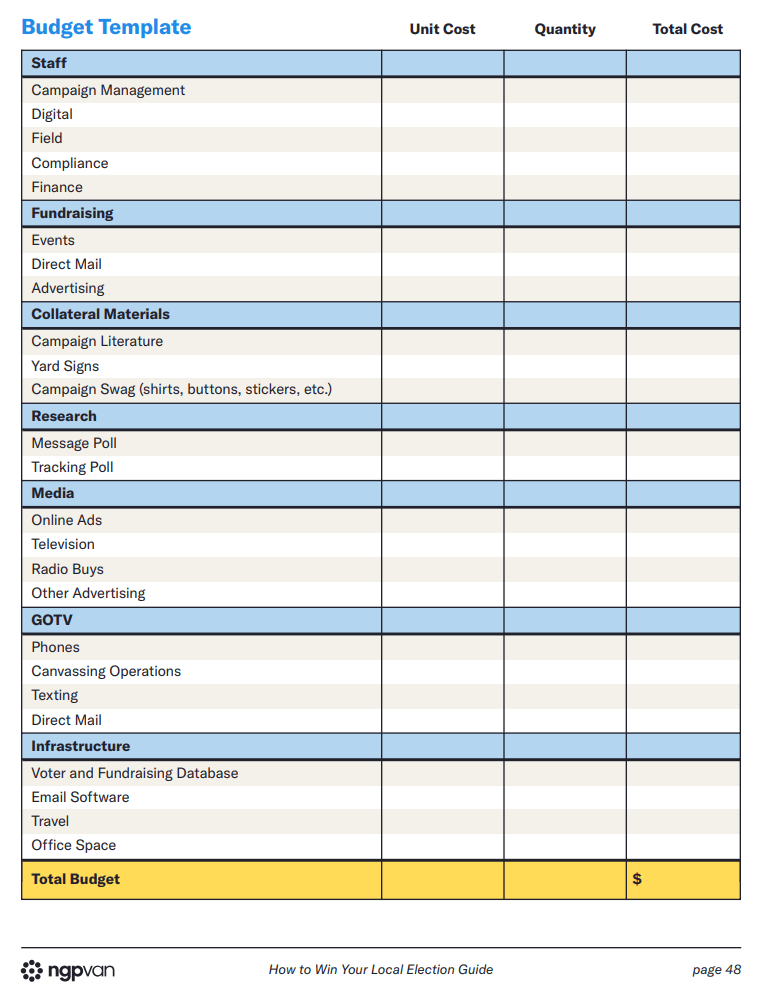

An effective political financial roadmap needs to be granular, covering all potential income and expenditure categories. It should reflect the unique needs and scale of your campaign, whether it’s a local school board race or a congressional bid. Breaking down the budget into distinct, manageable sections allows for more accurate forecasting and better control over spending. Here are the core components you’ll want to include in your electoral budget framework:

- Revenue Projections: This section estimates all expected income. It should detail funds from various sources, including individual donations (broken down by expected donor tiers), PAC contributions, fundraising events, and potential grants. Realistic projections are crucial; overestimating income can lead to overspending.

- Staffing and Personnel Costs: Covers salaries for campaign managers, political directors, field organizers, communications staff, and administrative support. Don’t forget to include costs for consultants (e.g., polling, media, digital), payroll taxes, and benefits if applicable.

- Advertising and Media Buy: Often the largest expenditure, this includes costs for television, radio, print, and digital advertisements. Also account for direct mail campaigns, robocalls, text messaging services, and social media promotions. Specify costs per ad type and expected reach.

- Campaign Events and Travel: Budgets for rallies, town halls, meet-and-greets, fundraising dinners, and volunteer appreciation events. Include venue rentals, catering, security, equipment, and travel expenses for the candidate and key staff (transportation, lodging).

- Technology and Data Management: Essential for modern campaigns, this covers subscriptions to voter file databases, CRM software, email marketing platforms, website hosting, graphic design tools, and data analytics services.

- Field Operations: Beyond staffing, this includes materials for canvassing (walk lists, literature), phone bank supplies, volunteer recruitment costs, and any specific costs associated with voter registration drives or get-out-the-vote (GOTV) efforts.

- Administrative and Compliance: This category encompasses office rent, utilities, supplies, legal fees, accounting services, and, critically, compliance costs related to campaign finance reporting (e.g., FEC or state ethics commission filings).

- Contingency Fund: Always allocate a percentage (typically 10-15%) of your total budget for unexpected expenses or opportunities. Campaigns are dynamic, and having a reserve prevents major disruptions when unforeseen costs arise.

Building Your Campaign’s Financial Roadmap

Constructing your campaign’s financial roadmap begins with a clear understanding of your strategic goals and the resources required to achieve them. Start by outlining your campaign’s timeline and key milestones, such as primary dates, debate schedules, and major fundraising deadlines. Each milestone often brings specific associated costs. Research local market rates for services like advertising, printing, and venue rentals to ensure your estimates are as accurate as possible. Don’t assume; verify.

Once you have a rough idea of costs, prioritize your spending based on strategic impact. For instance, a grassroots local campaign might prioritize field operations and direct mail, while a larger race might allocate more to media buys and digital advertising. Remember, this isn’t a static document. Your political campaign budget template should be a living, breathing tool that you review and adjust regularly. As fundraising targets are met or missed, and as campaign needs evolve, your spending plan must adapt. Transparency and adaptability are key to its efficacy.

Leveraging Your Budget for Strategic Advantage

A well-executed budget goes far beyond merely tracking inflows and outflows; it becomes a powerful strategic asset. By meticulously planning and monitoring your expenditures, you gain insights into the return on investment (ROI) for different campaign activities. For example, by tracking the cost per vote or cost per volunteer recruited across various outreach methods, you can optimize future spending, shifting resources to the most effective channels. This data-driven approach to resource management ensures that your campaign’s precious funds are working as hard as possible.

Furthermore, a comprehensive spending blueprint empowers campaign leadership to make swift, informed decisions. If an unexpected opportunity arises – perhaps a rival’s gaffe creates a window for a targeted ad buy – having a clear picture of available funds and projected spending allows for rapid assessment and reallocation without jeopardizing other critical areas. It provides the financial agility necessary to capitalize on fleeting moments and respond effectively to challenges, transforming financial planning into a competitive edge. This fiscal discipline builds a foundation of stability, enabling the campaign to stay on message and on track towards victory.

Common Pitfalls and How to Avoid Them

Even with the best intentions, campaigns can stumble when it comes to financial management. One of the most common pitfalls is **over-optimistic fundraising projections**. Assuming a torrent of donations will flow in can lead to premature spending and crippling debt. Always err on the side of caution with income estimates and build in contingencies. Another frequent mistake is **neglecting small, recurring costs**. These seemingly minor expenses, like office supplies, subscription services, or travel incidentals, can accumulate quickly and drain resources if not carefully tracked.

Failing to track actual spending against the budget is another significant error. A budget is useless if it’s not regularly compared to real expenditures. This review process helps identify deviations early, allowing for course correction. Many campaigns also fall short by underestimating compliance costs and legal fees. Adhering to campaign finance laws is complex and often requires legal expertise, which comes at a cost. Lastly, not allocating a contingency fund leaves a campaign vulnerable to unforeseen events, forcing difficult choices and potentially derailing critical initiatives. Regularly reviewing, updating, and being realistic are your best defenses against these common traps.

Frequently Asked Questions

How often should I review and update my campaign’s spending plan?

You should review your campaign’s spending plan at least monthly, if not bi-weekly, especially during peak campaign season. This allows you to compare actual spending against projections, identify discrepancies, and make necessary adjustments to stay on track. Regular reviews are critical for maintaining financial health and strategic flexibility.

Is a professional accountant necessary for a local campaign?

While not always strictly “necessary” for very small local campaigns, a professional accountant or bookkeeper is highly recommended for most. They ensure compliance with campaign finance laws, accurately track donations and expenditures, and handle financial reporting, which can be complex. Their expertise frees up campaign staff to focus on voter outreach and strategy.

What’s the most common mistake campaigns make with their budget?

The most common mistake is failing to consistently track and update the budget against actual spending. Many campaigns create an initial financial roadmap but then don’t regularly monitor it, leading to unexpected shortfalls, overspending in certain areas, and an inability to make informed financial decisions when faced with new opportunities or challenges.

Can I use a basic spreadsheet as my electoral budget framework?

Yes, for many smaller or local campaigns, a well-organized spreadsheet can serve as an effective electoral budget framework. Key is to ensure it includes all necessary categories, allows for easy tracking of actuals vs. planned, and is regularly updated. As campaigns grow, specialized software might offer more robust features, but a spreadsheet is a solid starting point.

How do I account for unexpected expenses?

Always include a contingency fund in your budget, typically 10-15% of your total projected expenses. This reserve is specifically for unforeseen costs, such as emergency ad buys, unexpected legal fees, or equipment repairs. Having this buffer prevents these surprises from derailing other critical campaign activities and ensures financial stability.

In the dynamic and demanding world of political campaigns, robust financial planning isn’t just good practice—it’s a non-negotiable prerequisite for success. The journey to Election Day is fraught with challenges, and a well-managed budget provides the stability and clarity needed to navigate them effectively. It empowers your team to make data-driven decisions, demonstrate accountability to your supporters, and strategically deploy resources where they will have the greatest impact.

Embracing the principles outlined here will transform your approach to campaign finance, turning what can often be a source of stress into a powerful tool for strategic advantage. By implementing a detailed spending blueprint and committing to its regular review and adjustment, you build a foundation of fiscal discipline that frees the campaign to focus on its core mission: connecting with voters and earning their trust. Begin crafting your comprehensive financial plan today, and set your campaign on a trajectory for success.