Taking control of your finances might seem like a daunting task, often conjuring images of complex spreadsheets, endless calculations, and perhaps a touch of anxiety. Yet, the path to financial clarity doesn’t have to be opaque or overwhelming. In an increasingly visual world, presenting information in an understandable and engaging format is key, and personal finance is no exception. Imagine being able to clearly see your financial landscape, identify opportunities, and track progress, all laid out intuitively.

This is precisely where a well-designed framework for presenting your financial data comes into play. A structured approach, like utilizing a Personal Budget Powerpoint Presentation Template, transforms abstract numbers into a compelling visual narrative. It’s not just about crunching figures; it’s about understanding your money story, making informed decisions, and sharing your financial goals with partners, advisors, or even just yourself in a way that truly resonates. This article will explore how such a template can empower you on your journey to financial mastery.

Why Visualizing Your Finances Matters

The human brain is wired for visuals. We process images significantly faster than text, and a well-crafted visual can convey complex information in a fraction of the time it takes to read a detailed report. When it comes to personal finance, this ability to quickly grasp the big picture is invaluable. Instead of getting lost in rows and columns of numbers, a visual financial planning template allows you to instantly identify trends, categorize spending, and pinpoint areas for improvement or celebration.

Moreover, visualizing your budget makes it more engaging and less like a chore. It shifts the perception of budgeting from a restrictive activity to an empowering one, where you are actively designing your financial future. This visual clarity fosters better decision-making, helping you allocate resources more effectively towards your short-term needs and long-term aspirations. It’s about building a sustainable relationship with your money, rather than just managing it.

The Core Benefits of a Budget Presentation

Adopting a dedicated slide deck for your personal finances offers a multitude of advantages that go beyond simple number crunching. It elevates the budgeting process from a solitary, often tedious, task into an engaging exercise in financial self-awareness and strategic planning. These benefits extend to improved communication, enhanced tracking, and greater motivation towards achieving financial milestones.

One of the primary advantages is the ability to present a cohesive narrative. You can illustrate how various financial elements interrelate, such as income streams, fixed expenses, discretionary spending, and savings goals. This holistic view is often hard to achieve with static spreadsheets alone. A well-structured budget visualization tool helps you articulate your financial situation with precision and confidence, whether to a spouse, a financial advisor, or simply to yourself during a monthly review.

Key Components of an Effective Personal Budget Presentation

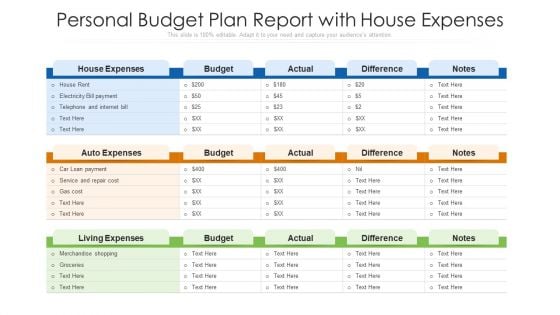

A truly impactful financial overview presentation template will typically integrate several critical sections, each designed to shed light on a different facet of your financial life. While customization is always encouraged, these fundamental elements form the backbone of a comprehensive and understandable financial health presentation. They guide the user through a logical progression, building a complete picture of their monetary situation.

These core components ensure that all crucial aspects of your income and expenditure slideshow are covered, providing a balanced and detailed perspective. By organizing your data into these categories, you can easily identify strengths, weaknesses, and opportunities within your financial landscape. A robust personal budget Powerpoint presentation template provides the framework; your data fills it with meaning.

- **Income Sources:** Clearly outline all forms of income, including your primary salary, freelance earnings, passive income, and any other regular inflows. This helps in understanding your total earning potential.

- **Fixed Expenses:** Detail all recurring costs that remain relatively constant each month, such as **rent/mortgage**, loan payments, insurance premiums, and subscriptions. These are the non-negotiables.

- **Variable Expenses:** Track spending that fluctuates month-to-month, like groceries, utilities, transportation, and entertainment. This category often reveals areas for potential savings.

- **Savings & Investments:** Dedicate slides to your savings goals (emergency fund, down payment, retirement) and investment portfolio performance. This highlights progress toward future security.

- **Debt Management:** Provide an overview of any outstanding debts, including credit cards, student loans, or personal loans. Visualizing these liabilities is crucial for **debt reduction strategies**.

- **Financial Goals:** Articulate both short-term (e.g., new gadget, vacation) and long-term goals (e.g., homeownership, early retirement) with projected timelines and required savings.

- **Net Worth Snapshot:** A summary slide showcasing your assets minus your liabilities, offering a **big-picture view** of your overall financial standing at a given point in time.

Customizing Your Financial Story

The true power of a budgeting tool for presentations lies not just in its pre-built structure, but in its adaptability. A high-quality personal finance presentation template is a starting point, a canvas upon which you paint your unique financial journey. Customization allows you to tailor the visual elements, categories, and level of detail to perfectly match your individual needs and preferences. This personalization ensures the template remains relevant and engaging over time.

You might want to adjust color schemes to reflect your personal brand or simply to make it more visually appealing. Adding custom icons, graphs, and charts can further enhance comprehension, transforming raw data into easily digestible insights. Perhaps you have a unique income stream or a specific type of expense that isn’t covered in a generic template; the flexibility to add or modify sections is paramount. This level of customization makes the slide deck truly yours, increasing your engagement and commitment to the budgeting process.

Practical Applications: Who Can Benefit?

While the term “personal budget” often suggests individual use, the utility of a well-crafted financial overview template extends far beyond a single person. Its ability to clearly communicate complex financial data makes it an indispensable tool for a variety of individuals and scenarios, fostering transparency and shared understanding. From young professionals to established families, the applications are broad and impactful.

For individuals, it serves as a powerful accountability partner, making it easier to track progress and stay motivated. Couples can use it to align on shared financial goals, facilitating open discussions about income, spending, and savings, thereby reducing potential conflicts. Financial advisors might leverage such a template to provide clear, concise financial updates to their clients, enhancing client understanding and engagement. Educators can even use it as a teaching aid to demonstrate effective monetary management to students.

Tips for Delivering Your Budget Overview with Confidence

Creating a comprehensive budgeting slide deck is only half the battle; presenting it effectively is just as important. Whether you’re reviewing it solo or sharing it with others, a confident delivery enhances understanding and reinforces your commitment to financial discipline. Think of it as telling your money story, with you as the narrator and the slides as your visual aids.

Practice is key. Familiarize yourself with each slide, understanding the data points and the message you want to convey. Don’t just read the text; elaborate on the insights and implications of the figures. Use the visual elements to your advantage, pointing out trends in graphs or highlights in charts. Maintain eye contact, if presenting to others, and be prepared to answer questions. Presenting your financial health presentation should be an empowering experience, showcasing your mastery over your money.

Frequently Asked Questions

What is a Personal Budget Powerpoint Presentation Template?

It is a pre-designed set of slides that provides a structured framework for organizing, visualizing, and presenting your personal financial information, including income, expenses, savings, and debts, in an understandable format.

Who should use a financial planning template for presentations?

Anyone looking to gain better control over their finances, track their spending, set financial goals, or communicate their financial situation clearly can benefit. This includes individuals, couples, and even financial advisors working with clients.

How does a budget visualization tool differ from a spreadsheet?

While spreadsheets are excellent for data entry and calculations, a budget visualization tool focuses on presenting that data in an easily digestible visual format using charts, graphs, and structured layouts. It emphasizes communication and understanding over raw data processing.

Can I customize the income and expenditure slideshow?

Absolutely. Most templates are designed to be highly customizable, allowing you to change colors, fonts, layouts, and add or remove sections to perfectly align with your specific financial categories, goals, and personal aesthetic.

What are the main benefits of using a budgeting slide deck?

Key benefits include enhanced financial clarity, improved tracking of income and expenses, better communication with financial partners or advisors, increased motivation to achieve financial goals, and the ability to make more informed financial decisions.

Harnessing the power of a visual financial tool is a game-changer in personal finance. It transforms what can often feel like an arduous chore into an empowering and enlightening exercise. By making your financial data accessible and engaging, a dedicated presentation template helps you not only track where your money goes but also strategically plan where you want it to go in the future.

Embrace the clarity and control that comes with visualizing your monetary management. Whether you’re just starting your financial journey or looking to refine existing habits, a structured, visual approach can unlock new levels of understanding and drive positive change. Take the first step towards a more transparent and goal-oriented financial future by exploring how a robust framework for presenting your finances can serve as your ultimate guide.