In the journey toward financial independence, many of us start with good intentions, sketching out our income and expenses on a napkin or a basic spreadsheet. While a simple budget is a commendable first step, true financial mastery demands a more sophisticated approach: one that not only plans for the future but also rigorously tracks the present. This is where a robust annual budget template, specifically designed to compare projected figures with actual outcomes, becomes an indispensable tool. It transforms budgeting from a mere estimation exercise into a powerful, data-driven strategy for financial growth and stability.

Imagine having a clear, comprehensive roadmap for your entire year’s finances, capable of highlighting exactly where you’re on track and where deviations occur. This level of insight empowers you to make proactive adjustments, identify spending patterns, and ultimately achieve your monetary goals faster. Whether you’re saving for a down payment, paying off debt, or simply aiming for greater financial peace of mind, implementing a well-structured Personal Annual Budget Template With Projected And Actual is the critical step that moves you from hopeful planning to effective execution.

Why a Projected vs. Actual Budget is Your Financial Game Changer

Traditional budgeting often falls short because it lacks a built-in mechanism for reflection and adjustment. You might set a budget at the start of the month, but without actively comparing what you *thought* you’d spend against what you *actually* spent, it’s difficult to learn and improve. This oversight leads to recurring financial surprises and missed opportunities to optimize your spending and saving habits. A projected vs. actual budget addresses this fundamental flaw by creating a feedback loop that is essential for financial growth.

This comprehensive budgeting system provides a vivid snapshot of your financial health at any given moment. It allows you to see not just the "what" of your spending, but the "why." For instance, if your projected grocery bill was $400 but your actual was $600, this template immediately flags that discrepancy. It prompts you to investigate whether it was due to unexpected price increases, more meals eaten at home, or perhaps impulse purchases. This analytical depth fosters greater financial awareness and accountability, turning abstract numbers into actionable insights.

Deconstructing the Personal Annual Budget Template With Projected And Actual

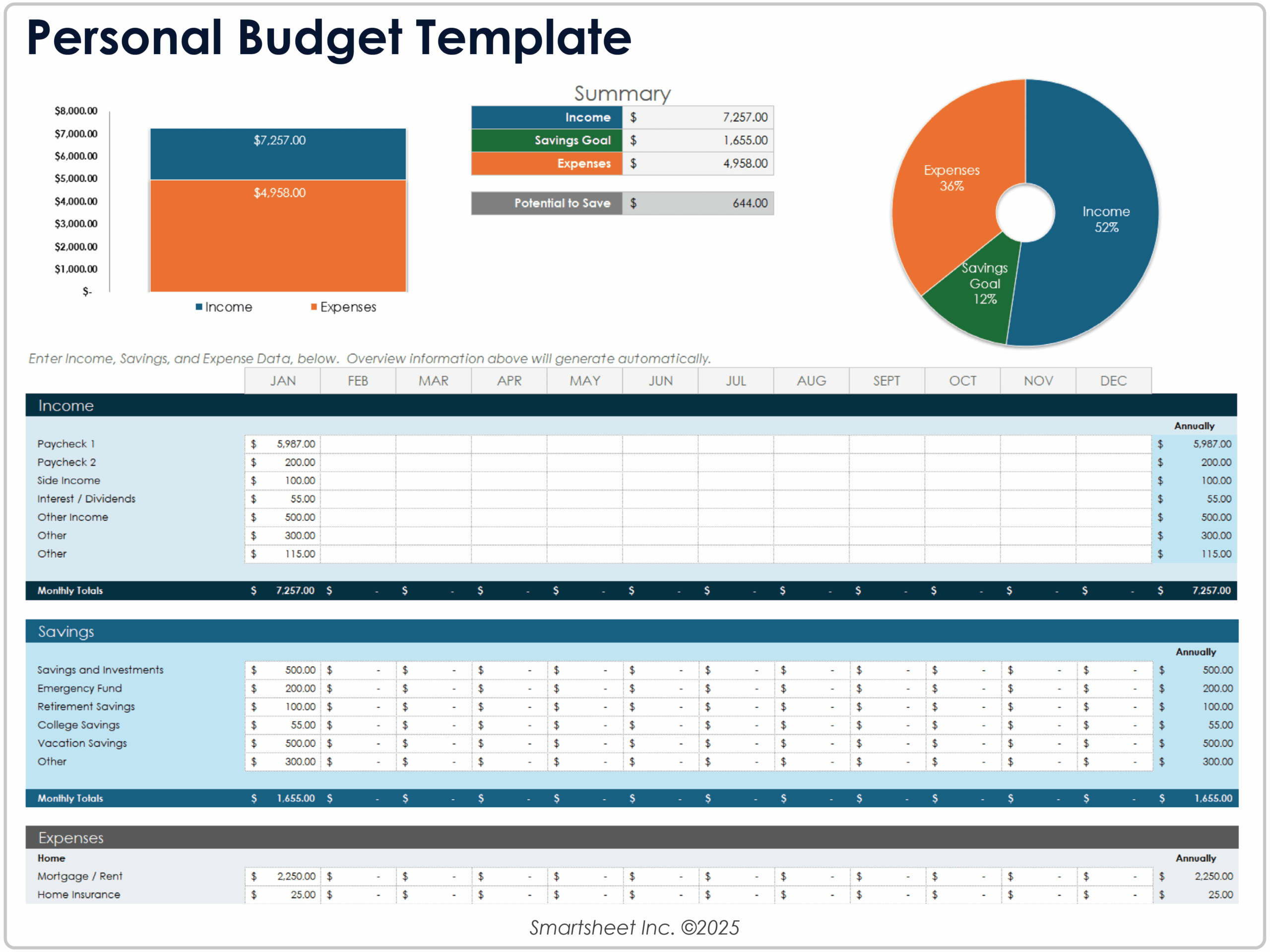

At its core, a robust annual budget template is organized to capture all aspects of your financial life over a 12-month period. It moves beyond simple monthly tracking by consolidating all data into an overarching yearly view, which helps in anticipating seasonal expenses or annual bonuses. The magic lies in its dual-column approach for every single line item: one column for your **projected** financial figures and another for your **actual** figures.

This structured financial tracking template typically breaks down into several key categories, each with its own projected and actual columns. These categories ensure that no aspect of your income or expenditure goes unexamined, providing a holistic view of your financial landscape.

- **Income:** This includes your net take-home pay, bonuses, freelance earnings, interest, dividends, or any other money flowing into your accounts. It’s crucial to project and then track the **actual** amounts received.

- **Fixed Expenses:** These are costs that generally stay the same each month or year, such as **rent/mortgage**, loan payments (car, student), insurance premiums, and subscriptions. They are predictable and often easier to project accurately.

- **Variable Expenses:** This category covers costs that fluctuate, like **groceries**, utilities, transportation, and entertainment. These are often the areas where significant discrepancies between projected and actual spending occur, making their tracking particularly valuable.

- **Savings & Debt Repayment:** This section tracks contributions to savings accounts (emergency fund, retirement, specific goals), investments, and extra payments made towards **debt reduction**. It highlights progress towards long-term financial goals.

- **Discretionary Spending:** Think of this as your “wants” vs. “needs.” It includes dining out, hobbies, travel, shopping, and gifts. This category often provides the most flexibility for adjustment when actual spending exceeds projections elsewhere.

Each category is further broken down into specific line items, ensuring granular detail. For example, “Utilities” might have sub-items for electricity, gas, water, and internet, each with its own projected and actual spending record.

Setting Up Your Annual Financial Blueprint

Implementing a Personal Annual Budget Template With Projected And Actual might seem daunting initially, but the process is straightforward and incredibly rewarding. The first step involves choosing your platform. While sophisticated budgeting software and apps exist, a simple spreadsheet (like Google Sheets or Excel) can be highly effective and easily customizable.

Begin by gathering all your financial statements: bank statements, credit card statements, pay stubs, and any loan documents from the past year. This historical data is invaluable for making realistic projections. Average your monthly spending for various categories to get a baseline for your initial projections. Don’t worry about perfection; the beauty of this system is its adaptability.

Next, populate your template. Start with your projected income for the year, accounting for any expected raises or bonuses. Then, list all your fixed expenses, projecting their annual cost. For variable expenses, use your historical averages as a starting point, but consider any upcoming life changes that might influence these figures (e.g., a new baby, a change in commute). Finally, allocate amounts for savings and debt repayment based on your financial goals. Remember to be honest and realistic with your initial estimations; overly optimistic projections can lead to early frustration.

Maximizing the Impact of Your Financial Tracking Template

Creating the budget is just the beginning; the real power of this financial blueprint comes from consistent engagement. Make it a habit to regularly review your actual spending against your projected spending. For most people, a **weekly or bi-weekly check-in** is ideal. This frequent review allows you to catch overspending early and make timely adjustments before it derails your entire month or year.

When you notice a significant difference between actual spending vs. planned spending, investigate it. Did you go over budget on dining out? Was there an unexpected car repair? Understanding the cause is crucial for learning and adapting your financial outlook. This might mean reallocating funds from one category to another, reducing discretionary spending for the remainder of the period, or even adjusting future projections if a new recurring expense has emerged.

Don’t be afraid to adjust your projections as the year progresses. Life is unpredictable, and your budget should reflect that. If your income changes, or you incur a large, unforeseen expense, update your annual spending plan accordingly. This flexibility is a key strength of an adaptable budgeting system. The goal isn’t to stick rigidly to your initial projections no matter what, but to use them as a guide and continuously refine your financial management system.

Transforming Your Financial Future with Consistent Budgeting

Adopting a Personal Annual Budget Template With Projected And Actual isn’t merely about tracking numbers; it’s about fundamentally changing your relationship with money. By consistently monitoring your actual spending against your planned spending, you gain an unparalleled level of control and foresight over your finances. This shift from reactive financial behavior to proactive strategic planning is where true wealth building begins.

The long-term benefits are profound. You’ll gain a deeper understanding of your financial habits, identifying areas of strength and weakness. This knowledge empowers you to make informed decisions, whether it’s choosing to save more aggressively, strategically pay down debt, or plan for significant life events with confidence. This yearly financial plan becomes a living document, evolving with your life and helping you navigate financial challenges while celebrating successes. It moves you from simply spending money to purposefully allocating your resources towards the life you envision.

Frequently Asked Questions

How often should I update my projected vs. actual budget?

While the template is annual, it’s best to update your actual spending at least once a week or every two weeks. This allows you to stay current with your financial flows, catch discrepancies early, and make timely adjustments to your spending habits. Reviewing your overall progress monthly is also highly recommended.

What if my actual spending is consistently higher than my projections?

If your actuals frequently exceed your projections, it’s a sign that your initial projections might have been unrealistic, or your spending habits need adjustment. First, re-evaluate your projected figures for accuracy. Then, identify categories where you consistently overspend and brainstorm ways to reduce those costs, perhaps by cutting back on discretionary items or finding more affordable alternatives.

Is this annual budget template suitable for someone with irregular income?

Absolutely. For those with irregular income, a projected vs. actual budget is even more critical. You’ll need to be more conservative with your projected income, perhaps basing it on your lowest expected monthly earnings. When actual income exceeds projections, prioritize saving the surplus, paying down debt, or building an emergency fund to smooth out future lean periods. The “actual” column will be vital in showing your true income fluctuations.

Can I customize this type of financial management system?

Yes, customization is a major strength. Whether you use a spreadsheet or a dedicated app, you can tailor categories, add or remove line items, and even change the frequency of tracking to suit your unique financial situation and goals. The core principle of projected vs. actual tracking remains, but the details are entirely flexible to your needs.

What are the primary advantages of an annual budget over a monthly one?

An annual budget template provides a broader, more strategic view of your finances. It helps you anticipate yearly expenses (like insurance premiums, property taxes, or holiday spending) that might get overlooked in a monthly budget. It also allows for long-term goal planning, debt repayment strategies, and identifying seasonal spending patterns that are less apparent when viewed month-to-month. While you’ll still track monthly, the annual overview provides context and foresight.

Embracing a Personal Annual Budget Template With Projected And Actual is more than just good financial hygiene; it’s an investment in your future self. It empowers you with the knowledge and control necessary to navigate economic uncertainties, achieve ambitious financial milestones, and cultivate a sense of security and freedom. By diligently tracking where you intend to go and where you actually stand, you unlock the potential for continuous improvement and sustainable financial success.

Don’t let your financial aspirations remain abstract goals. Take the definitive step today to implement this powerful tool. The clarity, control, and confidence you’ll gain are invaluable, paving the way for a future where your money works harder for you, guided by informed decisions and a clear understanding of your financial reality. Begin building your detailed financial blueprint, and watch your financial future transform before your eyes.