Managing personal finances effectively often feels like navigating a dense jungle without a compass. The myriad of income streams, expenses, savings goals, and debt obligations can quickly become overwhelming, leading to stress, missed opportunities, and a lack of clarity about one’s financial future. For many, the idea of creating a budget conjures images of complex spreadsheets or restrictive rules, making the crucial step towards financial freedom seem daunting before it even begins.

Yet, a well-structured budget is not just about tracking where your money goes; it’s about empowering you to make informed decisions, align your spending with your values, and build a secure financial foundation. Recognizing this need for a user-friendly, powerful, and accessible solution, Apple’s Numbers application provides an ideal platform. With its intuitive interface and robust capabilities, a thoughtfully designed Numbers budget template can transform financial management from a chore into an enlightening and empowering experience, guiding you through the financial jungle with confidence.

Why a Dedicated Budget Template Matters

In today’s fast-paced world, understanding your financial landscape is more critical than ever. Without a clear picture of your income and expenditures, it’s easy for money to slip through your fingers, leaving you wondering where it all went. A dedicated budget template serves as your financial roadmap, illuminating your spending habits and highlighting areas where adjustments can lead to significant savings or accelerated debt repayment. It transforms abstract numbers into actionable insights.

Many attempt budgeting with pen and paper or generic spreadsheet programs, only to abandon the effort due to complexity or lack of engagement. What sets a specialized budget template apart is its structured approach, designed to categorize, visualize, and analyze your financial data efficiently. It eliminates the guesswork, providing a consistent framework that makes the process less intimidating and far more effective. The peace of mind that comes from knowing exactly where you stand financially is immeasurable, freeing up mental energy for other aspects of life.

Unpacking the Power of Numbers for Personal Finance

Apple Numbers is more than just a spreadsheet application; it’s a dynamic canvas designed for clarity and ease of use, making it an excellent choice for personal finance tracking. Unlike some other spreadsheet programs that can feel overly complex, Numbers boasts a clean, intuitive interface with pre-built templates and visually engaging charts that turn raw data into compelling stories. This accessibility significantly lowers the barrier to entry for those new to budgeting or spreadsheet software.

Its powerful functions and flexible table structures allow for sophisticated financial modeling without requiring advanced technical skills. You can easily create multiple tables on a single sheet, linking them to track different aspects of your financial life—from daily expenses to long-term investment goals. The ability to add interactive controls, use categories, and generate stunning charts makes your personal finance tracking in Numbers not just functional, but genuinely insightful and even enjoyable. It transforms the mundane task of data entry into a visually rewarding process that keeps you motivated.

Getting Started with Your Personal Spending Plan

Embarking on your budgeting journey with a Numbers spreadsheet for budgeting is a straightforward process that lays the groundwork for financial clarity. The first step involves gathering all relevant financial information: your monthly income from all sources, and a comprehensive list of your recurring expenses. This includes everything from rent or mortgage payments and utility bills to subscriptions and loan repayments. Accuracy here is key to building a realistic and effective personal spending plan.

Once you have your data, begin populating the template’s designated sections. Start by entering your total net income for the month. Then, systematically list all your fixed expenses, which are those that typically remain constant each month. Next, allocate funds for variable expenses such as groceries, dining out, entertainment, and transportation, estimating amounts based on past spending or desired limits. The beauty of this digital budget organizer is its adaptability; you can refine these figures as you gain a clearer understanding of your actual spending habits.

Key Features and Customization Options

The true strength of a robust financial management tool in Apple’s spreadsheet app lies in its comprehensive features and the flexibility it offers for personalization. A well-designed Numbers budget solution will typically include several core components, each serving a vital role in your overall financial strategy. These elements are not static; they are built to be adapted to your unique financial situation and evolving goals.

Here are some essential features you can expect and how to customize them:

- Income Tracker: A dedicated section to log all sources of income, whether it’s your primary salary, freelance earnings, or passive income. This allows for a clear overview of your total financial inflow.

- Customization: Add rows for specific income streams, and include columns for tracking bi-weekly or irregular payments.

- Expense Categories: Pre-defined categories for common expenses like housing, transportation, food, entertainment, and utilities. These are crucial for understanding where your money goes.

- Customization: Tailor categories to match your lifestyle. For example, if you have a significant pet budget, create a specific "Pet Care" category instead of lumping it into "Miscellaneous." You can also break down broad categories, like "Food" into "Groceries" and "Dining Out."

- Budget vs. Actual Comparison: This feature allows you to set an anticipated budget for each category and then track your actual spending against it. It’s the cornerstone of effective budgeting.

- Customization: Implement conditional formatting to visually highlight categories where you are over budget or under budget, providing immediate feedback.

- Savings Goals: Sections dedicated to tracking progress towards specific financial objectives, such as a down payment for a house, a new car, or an emergency fund.

- Customization: Create multiple savings goal tabs, each with a clear target amount and deadline, and link them to your cash flow.

- Debt Management: A component to monitor outstanding debts, including principal, interest rates, and payment schedules.

- Customization: Add a column to track extra payments made towards debt reduction, or calculate interest savings over time.

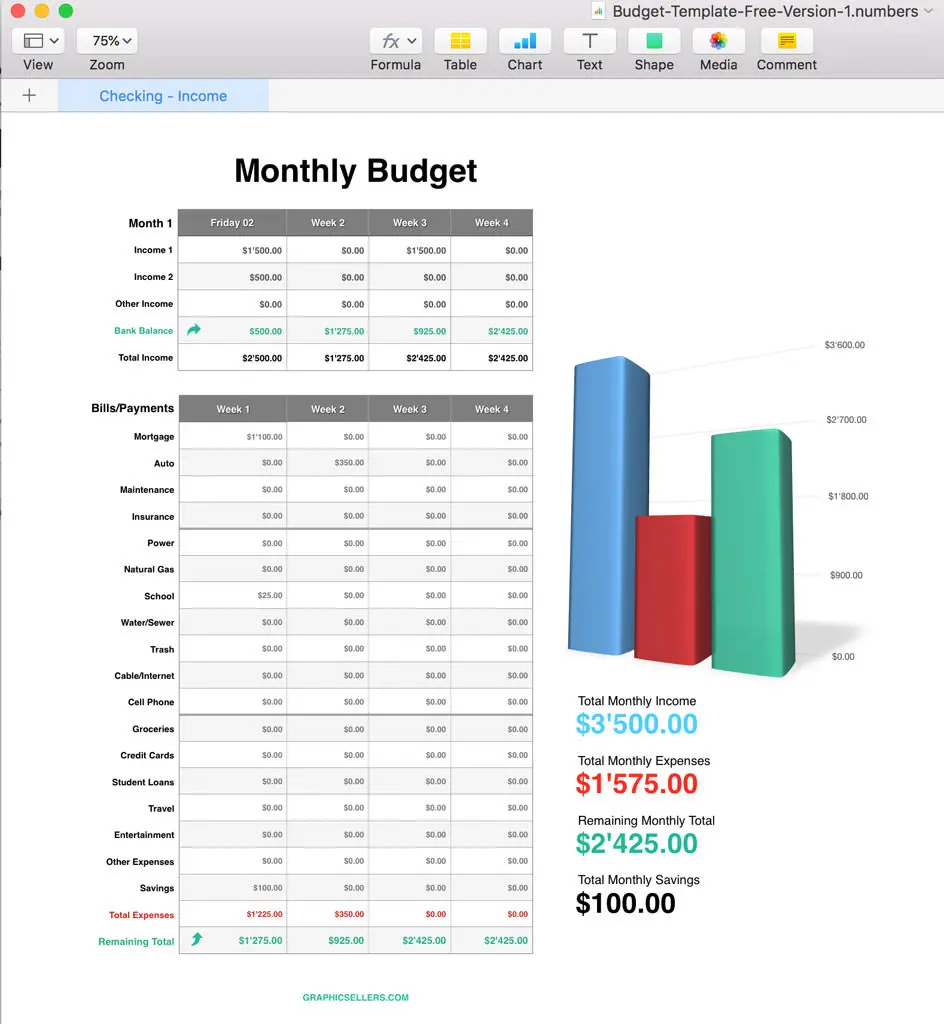

- Cash Flow Summary: A dashboard or summary page that provides an at-a-glance view of your financial health, including net income, total expenses, and remaining funds.

- Customization: Integrate interactive charts and graphs to visualize spending trends or your net worth growth over time.

By taking the time to customize these features, your personal financial worksheet becomes a truly bespoke tool, reflecting your personal habits and aspirations. This level of detail and personalization is what transforms a generic template into a powerful engine for achieving your financial objectives.

Maximizing Your Financial Management Tool in Apple’s Spreadsheet App

Having a powerful Numbers budget solution is only the first step; consistently using and optimizing it is where the real gains are made. To truly harness the potential of this financial planning document, it’s essential to integrate it into your regular financial routine. Make it a habit to log all your transactions as they occur, or at least several times a week. This ensures accuracy and prevents the overwhelming task of catching up on weeks of spending all at once.

Regularly review your spending tracker in Numbers against your budget. This isn’t just about identifying overspending; it’s also about finding areas where you’re consistently under budget, which might indicate opportunities to reallocate funds towards savings or debt reduction. Consider setting a weekly or bi-weekly check-in specifically for your household budget template. Use this time to adjust categories, update projections, and reflect on your financial progress. Remember, budgeting is an iterative process; what works one month might need slight tweaks the next.

Leverage Numbers’ visual capabilities to your advantage. Create charts that show your spending by category, visualize your savings progress, or track the reduction of your debt over time. Seeing your financial journey unfold in colorful graphs can be incredibly motivating and provide a clearer perspective than raw numbers alone. This Apple ecosystem budgeting approach encourages you to engage with your finances more deeply, fostering a greater sense of control and empowerment over your money.

Frequently Asked Questions

Is this budget template suitable for beginners?

Absolutely. The intuitive nature of Apple Numbers combined with a well-structured personal financial worksheet makes it ideal for anyone new to budgeting. The clear categories and straightforward input fields simplify the process, helping beginners quickly grasp the fundamentals of managing their money without feeling overwhelmed.

Can I sync my banking data directly with this Numbers spreadsheet?

Direct, automated syncing of banking data into Apple Numbers templates is not a standard feature of Numbers itself, unlike some dedicated budgeting apps. However, many banks and financial institutions allow you to download transaction data as CSV or OFX files, which can then be imported into your Numbers budget solution. While this requires a manual step, it streamlines data entry significantly.

How often should I update my personal finance tracking in Numbers?

For optimal results and to maintain a clear picture of your finances, it’s recommended to update your spending tracker in Numbers at least once a week. Some users prefer daily updates, particularly when first starting out or during periods of high spending activity. Regular updates prevent data backlog and keep your financial insights current.

What if I have multiple income sources or irregular income?

A flexible Numbers spreadsheet for budgeting is perfectly capable of handling multiple and irregular income sources. You can create separate rows or even a dedicated tab for each income stream. For irregular income, estimate conservatively and adjust your budget mid-month as actual income arrives, or focus on a “zero-based budget” approach that allocates every dollar received.

Is this compatible with older versions of Apple Numbers?

Generally, a well-designed Numbers budget template created in a newer version of Apple Numbers should be backward compatible with slightly older versions, though very old versions might encounter some formatting or function limitations. For the best experience, using a reasonably current version of Numbers on your Mac, iPad, or iPhone is recommended.

Taking control of your finances no longer needs to be a source of stress or confusion. With the right tools and a commitment to understanding your money, financial clarity and freedom are well within reach. The Numbers Iwork Personal Budget Template offers a clear, actionable path to achieving this, transforming the often-daunting task of financial management into an empowering journey.

Embrace the clarity and control provided by this comprehensive template. It’s more than just a place to log numbers; it’s a dynamic guide that adapts to your life, helps you visualize your progress, and empowers you to make smarter financial decisions. Start your journey towards financial confidence today, and witness the profound impact a well-managed budget can have on your peace of mind and future prosperity.