In today’s fast-paced business world, where transactions often involve complex terms and extended payment schedules, the importance of clear, documented agreements cannot be overstated. Relying on verbal promises or informal understandings is a recipe for potential disputes, financial losses, and strained professional relationships. For businesses, freelancers, and individuals alike, establishing clear payment terms upfront is not just good practice—it’s essential for protecting interests and ensuring smooth operations.

This is where a robust and reliable notarized payment agreement template becomes an invaluable asset. Designed to formalize financial commitments, it provides a legally sound framework that outlines the exact terms of payment, the obligations of each party, and the recourse available should those terms not be met. Whether you’re extending credit, agreeing to an installment plan, or structuring payment for services rendered, a well-crafted template offers peace of mind, clarity, and a solid foundation for any financial transaction.

The Indispensable Role of Written Agreements

The landscape of commerce has grown increasingly intricate, making the clarity offered by written agreements more critical than ever before. From intricate supply chains to remote service delivery and the myriad of digital transactions, opportunities for misinterpretation or disagreement are abundant. A written agreement transcends the limitations of memory and subjective interpretation, providing an objective record that both parties can reference.

Beyond merely recording intentions, a meticulously drafted document serves as a powerful preventative measure against future conflicts. It forces all parties to consider and agree upon every pertinent detail, from payment amounts and schedules to late fees and default clauses. In a litigious society, having a signed and notarized document isn’t just a suggestion; it’s a fundamental safeguard that can save substantial time, money, and stress down the line. It clarifies expectations, defines responsibilities, and minimizes ambiguity.

Core Advantages of a Standardized Document

Utilizing a high-quality notarized payment agreement template offers a multitude of benefits, extending beyond mere documentation. Firstly, it imbues your agreements with a professional standard, indicating seriousness and attention to detail. This can foster greater trust and confidence between transacting parties, setting a positive tone for the entire relationship.

Secondly, a standardized template dramatically enhances efficiency. Instead of drafting each agreement from scratch, you begin with a pre-structured, legally informed document that covers all essential aspects. This saves considerable time and legal fees, allowing you to focus on your core business activities. Moreover, the notarization aspect adds an additional layer of authenticity and legal weight, affirming the identities of the signatories and their voluntary execution of the document, making it significantly harder for a party to later deny their signature or the terms agreed upon. This legal enforceability provides crucial protection for both the payer and the payee.

Tailoring Your Payment Framework

One of the most powerful features of a well-designed notarized payment agreement template is its adaptability. While providing a solid structural backbone, it allows for extensive customization to suit the unique requirements of various industries, scenarios, and individual circumstances. This flexibility ensures that the document remains relevant and effective, regardless of the specific transaction.

Consider, for example, a construction project requiring milestone payments, a freelancer establishing a phased payment schedule for a large project, or a small business offering an installment plan for a high-value product. The core template can be adjusted to specify different payment triggers, varying interest rates for overdue payments, or unique grace periods. Similarly, for loan repayments or debt restructuring, provisions for collateral, guarantor clauses, or specific event-based acceleration clauses can be seamlessly integrated. This capacity for tailored modification makes the template a versatile tool across sectors, including service industries, retail, B2B transactions, and even personal financial arrangements.

Anatomy of a Robust Payment Accord

To ensure comprehensive protection and clarity, every payment agreement should contain several critical clauses and sections. These elements work together to form a legally sound and unambiguous document, covering all foreseeable aspects of the financial arrangement. A solid notarized payment agreement template will already include these, ready for your specific details.

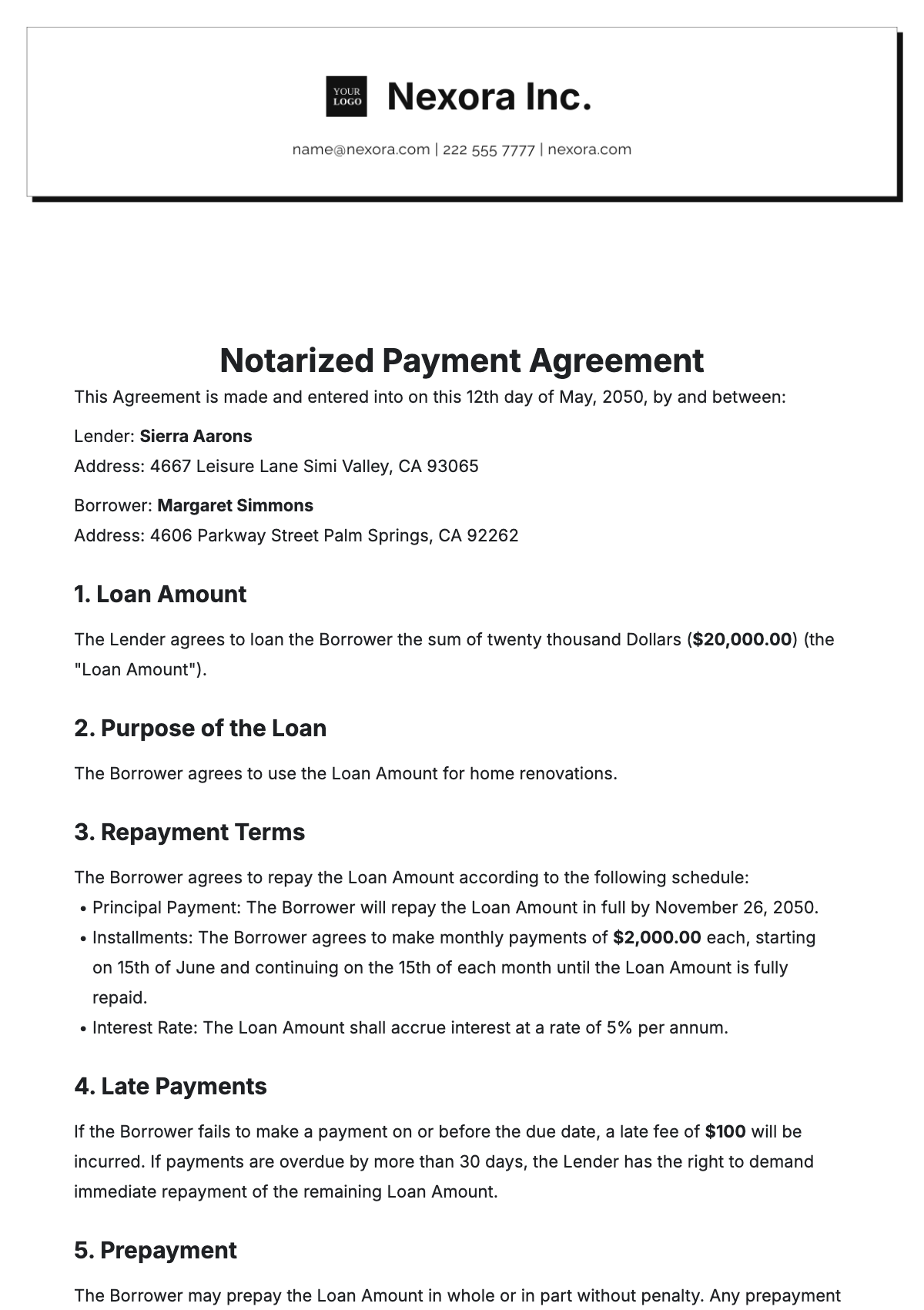

- Identification of Parties: Clearly state the full legal names, addresses, and contact information for all parties involved in the agreement (payer and payee). If businesses are involved, include their legal entity names and registration details.

- Payment Amount and Schedule: Precisely define the total amount due, currency, and the specific schedule for payments (e.g., lump sum, monthly installments, milestone-based). Include start and end dates if applicable.

- Interest and Late Fees: Detail any interest rates applicable to the outstanding balance and specific penalties or late fees for missed or delayed payments. Clearly state how these are calculated and when they are applied.

- Default and Remedies: Outline what constitutes a default (e.g., missed payment, breach of other terms) and the actions the non-defaulting party can take, such as demanding full immediate payment, pursuing collection, or terminating services.

- Governing Law: Specify the jurisdiction whose laws will govern the agreement. For US readers, this typically means stating the relevant state law that will apply in case of disputes.

- Dispute Resolution: Include a clause detailing the preferred method for resolving disputes, such as mediation, arbitration, or litigation, and the venue for such proceedings.

- Confidentiality (if applicable): If the payment terms or related information are sensitive, a confidentiality clause can prevent unauthorized disclosure.

- Entire Agreement Clause: States that the written agreement constitutes the complete and final agreement between the parties, superseding all prior oral or written understandings.

- Amendment Clause: Specifies how the agreement can be modified, typically requiring a written amendment signed by all parties.

- Waiver: A clause explaining that the waiver of a breach by one party does not constitute a waiver of any subsequent breach.

- Severability: Ensures that if any part of the agreement is found to be unenforceable, the remaining parts remain valid and binding.

- Signatures and Notarization Block: Dedicated spaces for the dated signatures of all parties, along with a notary public’s seal and signature, affirming the identities of those signing and the date of signing.

Optimizing for Clarity and Utility

Beyond the legal content, the physical and digital presentation of your payment agreement plays a crucial role in its effectiveness and usability. A document that is difficult to read or navigate can lead to misunderstandings, even if the underlying legal language is sound. Prioritizing readability and organization enhances both professional perception and practical utility.

When formatting your document, employ clear, legible fonts (such as Arial, Calibri, or Times New Roman) in an appropriate size (10-12pt for body text). Utilize ample white space, distinct headings, and bullet points or numbered lists to break up dense text and guide the reader’s eye. Logical section breaks and consistent formatting across the entire notarized payment agreement template ensure that information is easily digestible. For digital use, consider features like fillable fields for customization and ensuring the document is exportable to common formats like PDF for secure sharing and archiving. Implementing version control is also critical to track changes and ensure all parties are working from the most current agreement.

The use of simple, unambiguous language whenever possible, while maintaining legal precision, is also vital. Avoid overly complex jargon where simpler terms suffice. The goal is to create a document that is both legally robust and easily understandable by all parties involved, regardless of their legal background.

In the complex tapestry of modern business and personal finance, a well-executed payment agreement is more than just a formality; it’s a foundational element of trust, clarity, and legal security. Leveraging a professionally designed notarized payment agreement template equips you with a powerful tool to manage financial obligations, mitigate risks, and foster transparent relationships. It simplifies the often-daunting task of legal document creation, offering a streamlined path to formalized agreements.

By adopting such a template, you are not merely filling in blanks; you are investing in peace of mind, protecting your assets, and setting clear expectations for all parties. It stands as a testament to professional conduct, ensuring that every financial transaction is underpinned by a clear, legally recognized, and mutually understood commitment, ultimately saving time, preventing disputes, and safeguarding your interests for the long term.