In the intricate dance of business transactions, securing commitment and mitigating risk are paramount. Whether you’re a service provider, a landlord, an event planner, or a merchant, the concept of a non-refundable deposit often serves as a crucial safeguard. It ensures that initial investments, time, and resources expended by one party are protected, while simultaneously signaling a serious intent from the other. However, the efficacy of such a deposit hinges entirely on the clarity and legality of the terms governing it.

This is where a robust non refundable deposit agreement template becomes an invaluable asset. It’s more than just a piece of paper; it’s a foundational legal tool designed to prevent misunderstandings, resolve disputes before they escalate, and provide a clear framework for both parties involved. For professionals operating in the dynamic US business landscape, having a well-drafted, easily customizable template is not merely convenient—it’s a strategic imperative that underpins financial security and fosters transparent relationships.

The Indispensable Value of a Clear Contract

In today’s fast-paced commercial environment, relying on verbal agreements or vague understandings is a recipe for potential conflict. A written agreement transcends the limitations of memory and interpretation, providing an undeniable record of expectations and obligations. This clarity is especially vital when dealing with financial commitments that are designated as non-refundable.

A formal contract establishes a professional standard, signaling to clients or customers that your business operates with diligence and respect for agreed-upon terms. It acts as a preventative measure against disputes, as all parties are clearly informed of the conditions under which a deposit will not be returned. This transparency builds trust and sets the stage for a smoother working relationship from the outset.

Moreover, in the event that disagreements do arise, a comprehensive written agreement serves as the primary evidence of what was agreed upon. This can significantly streamline any mediation or legal processes, saving considerable time, expense, and stress for all involved. Without such a document, proving the intent or scope of an agreement becomes a challenging and often frustrating endeavor.

Protecting Your Business with Robust Documentation

The adoption of a specialized non refundable deposit agreement template offers a multitude of benefits, extending significant protections to your business operations. First and foremost, it minimizes financial risk by ensuring that the initial efforts or resources expended in preparation for a project, service, or rental are compensated, even if the client later withdraws. This helps cover opportunity costs and administrative expenses that are often incurred upfront.

Beyond financial safeguards, such a template provides legal clarity, outlining the specific circumstances under which the deposit becomes non-refundable. This prevents ambiguous situations and provides a solid legal footing should a dispute over the deposit’s return arise. Both parties have a clear understanding of their rights and responsibilities, reducing the likelihood of litigation.

Furthermore, leveraging a pre-designed template streamlines your administrative processes. Instead of drafting a new agreement from scratch for every client or transaction, you have a standardized, legally sound document ready for customization. This efficiency not only saves valuable time but also ensures consistency across all your engagements, enhancing professionalism and reducing the potential for oversight.

Tailoring Terms for Diverse Business Needs

One of the most powerful aspects of a well-designed agreement template is its inherent flexibility. While the core concept of a non-refundable deposit remains consistent, the specific details and clauses need to adapt to a vast array of industries and unique scenarios. A versatile non refundable deposit agreement template can be effortlessly customized to suit these varied requirements, making it an indispensable tool for many professionals.

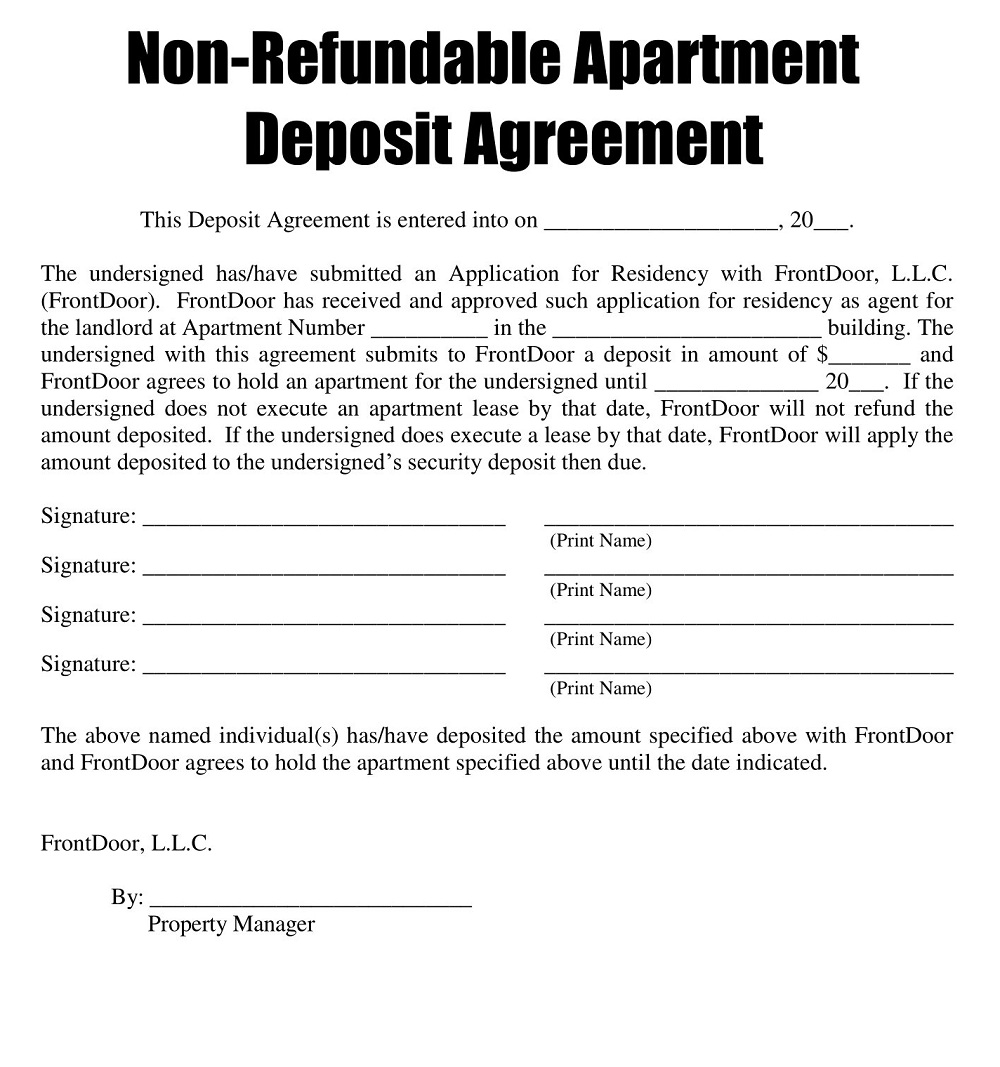

Consider the event planning industry, where deposits secure venues, caterers, and entertainers far in advance. The template can specify cancellation timelines, force majeure clauses relevant to events, and the exact services the deposit covers. In the realm of property rentals, it might detail application fees, security deposit components, and initial holding fees for a lease.

For contractors and consultants, a deposit can act as a retainer for project commencement, covering initial planning, material procurement, or research. The template can be adjusted to reflect project milestones, payment schedules, and the scope of work tied to the initial commitment. This adaptability ensures that the document remains relevant and legally sound, regardless of the specific business context, allowing for precise definition of terms for each unique engagement.

Essential Elements of an Effective Deposit Agreement

A comprehensive non-refundable deposit agreement is built upon a foundation of critical clauses and sections, each serving a distinct purpose in defining the terms and safeguarding both parties. Including these essential elements ensures the document is legally robust and leaves no room for ambiguity.

Here are the key provisions every agreement should contain:

- Identification of Parties: Clearly state the full legal names and contact information of all parties entering into the agreement (e.g., your business and the client/customer).

- Deposit Amount and Purpose: Specify the exact monetary amount of the deposit and explicitly state what it is for (e.g., booking fee, retainer, down payment for services).

- Non-Refundability Clause: This is the cornerstone. It must unequivocally state that the deposit is non-refundable and detail the specific conditions or events under which it will not be returned.

- Terms of Service/Scope of Work: Briefly describe the services or goods being provided, or the nature of the transaction the deposit pertains to. This context is crucial.

- Payment Schedule (if applicable): If the deposit is part of a larger payment plan, outline the remaining payments, due dates, and methods.

- Cancellation Policy: Beyond the non-refundability of the deposit, clarify any other cancellation terms, such as fees for late cancellations or requirements for written notice.

- Default and Remedies: Outline what constitutes a default by either party and the actions or remedies available to the non-defaulting party.

- Dispute Resolution: Include a clause detailing how disputes will be resolved, such as through mediation, arbitration, or litigation in a specified jurisdiction.

- Governing Law: State which state’s laws will govern the interpretation and enforcement of the agreement, which is particularly important for US businesses.

- Entire Agreement Clause: This clause states that the written agreement constitutes the entire understanding between the parties, superseding any prior discussions or verbal agreements.

- Severability: A clause stating that if any part of the agreement is found to be unenforceable, the remaining parts will still be valid.

- Amendments: How any changes to the agreement must be made (typically in writing and signed by all parties).

- Signatures and Date: Spaces for all parties to sign and date the agreement, affirming their understanding and acceptance of the terms.

Crafting for Clarity, Readability, and Digital Use

The legal soundness of an agreement is paramount, but its practical effectiveness also relies heavily on its presentation and accessibility. An impeccably drafted document can fall short if it’s difficult to read or understand. Therefore, careful attention to formatting, usability, and readability, whether for print or digital distribution, is crucial for any non-refundable deposit agreement.

Firstly, prioritize clear and concise language. Avoid legal jargon where simpler terms suffice, and when legal terms are necessary, ensure they are explained or used in context. Use active voice and straightforward sentence structures to enhance comprehension for all readers. This approach reduces the chances of misinterpretation and makes the agreement more approachable.

Visually, break up long blocks of text with headings, subheadings, and bullet points, as seen in this article. Ample white space around text and between sections improves readability. Use a legible font size (typically 10-12pt for body text) and a professional font choice. For digital versions, ensure the document is easily viewable on various devices, from desktop computers to mobile phones, without requiring excessive scrolling or zooming. Incorporating fillable fields for digital signatures and data input can also significantly enhance usability and efficiency.

Implementing these practical tips ensures that your agreement not only holds up legally but also serves as a user-friendly tool that facilitates smooth transactions and clear communication between all involved parties.

Leveraging a well-constructed non refundable deposit agreement template is more than just a legal formality; it’s an essential strategic decision for any business operating in today’s complex market. It provides a robust framework that safeguards your financial interests, clearly defines expectations, and preemptively addresses potential points of contention. The ability to customize a professional, legally sound document saves invaluable time and resources that would otherwise be spent on bespoke legal drafting.

Ultimately, by integrating such a template into your operational workflow, you are investing in professionalism, transparency, and peace of mind. It fosters stronger relationships built on clear understanding and mutual respect, allowing you to focus on delivering excellent services or products, confident that your foundational business agreements are solid and secure. Make the smart choice to protect your business with this indispensable tool.