In the complex world of finance, where risk and reward constantly intertwine, the non-recourse loan stands out as a unique and often preferred financing mechanism, particularly in real estate and project finance. Unlike traditional recourse loans, which hold a borrower personally liable for the debt, non-recourse loans limit the lender’s recovery exclusively to the collateral pledged. This fundamental distinction makes the underlying agreement an exceptionally critical document, shaping the financial landscape for both borrower and lender.

Having a meticulously crafted non recourse loan agreement template is not merely a convenience; it is an indispensable tool for ensuring clarity, managing risk, and solidifying the terms of such a significant financial arrangement. It serves as the bedrock upon which trust and legal enforceability are built, offering a structured framework for defining obligations, outlining protections, and addressing potential contingencies. For developers, investors, corporate entities, and financial institutions navigating these specific loan structures, a robust template provides both a starting point and a comprehensive guide to navigating complex financial instruments.

The Imperative of Documented Understanding

In today’s fast-paced business environment, clarity in contractual agreements is paramount. A well-drafted legal document acts as the definitive roadmap for all parties involved, delineating rights, responsibilities, and expectations with precision. This is particularly true for non-recourse arrangements, where the scope of liability is intentionally limited. Without a clear, written agreement, ambiguities can lead to misunderstandings, costly disputes, and potential legal challenges that undermine the very purpose of the loan.

Beyond mere clarity, a comprehensive loan document serves as a powerful risk mitigation tool. It protects both the lender by clearly defining the collateral and the conditions for default, and the borrower by explicitly limiting their personal exposure to the asset. Moreover, it ensures compliance with relevant financial regulations and commercial laws, providing a legally sound framework that stands up to scrutiny. In an era where transactions are increasingly scrutinized, a professionally prepared agreement is a testament to due diligence and professional conduct.

Advantages of a Standardized Agreement Form

Utilizing a high-quality, standardized non recourse loan agreement template offers a multitude of benefits that extend far beyond simple efficiency. Firstly, it provides a consistent and legally sound foundation, developed to incorporate best practices and common provisions found in similar financial arrangements. This consistency helps to streamline the negotiation process, as key terms and definitions are pre-established, allowing parties to focus on deal-specific customizations rather than foundational legal language.

Secondly, a robust template significantly reduces legal costs and turnaround times. Instead of drafting a complex agreement from scratch for each transaction, legal teams can adapt an existing, proven structure, saving valuable time and resources. For borrowers, this means faster access to financing; for lenders, it translates to a more efficient deployment of capital. Critically, for non-recourse loans, such a template clearly articulates the limited liability provisions, providing both parties with an unequivocal understanding of the risk allocation and the exact circumstances under which collateral can be seized without recourse to other borrower assets. This specificity is a core protective feature that a generic loan agreement might lack.

Adapting the Framework for Diverse Applications

The utility of a flexible agreement template lies in its capacity for customization, allowing it to serve a broad spectrum of industries and financial scenarios. While the core principle of non-recourse financing remains constant, the specific terms and conditions often need to be tailored to the unique characteristics of the underlying asset, the industry, or the project being financed. For instance, a loan agreement for a commercial real estate development will require different specifications regarding property covenants, environmental regulations, and construction milestones than one for a renewable energy project that involves power purchase agreements and specialized equipment collateral.

Developers in the real estate sector might customize clauses related to rental income, lease agreements, and property management. Project finance entities could focus on cash flow waterfalls, completion guarantees, and the specific operational risks associated with an infrastructure project. Even in corporate finance, where a specific asset or subsidiary is collateralized without general corporate recourse, the template can be adapted to reflect the nature of that asset and the corporate structure. This adaptability ensures that while the foundation is standardized, the final document is perfectly aligned with the nuanced requirements of each unique transaction, ensuring that a non recourse loan agreement template is a versatile tool, not a rigid constraint.

Core Elements of a Robust Loan Document

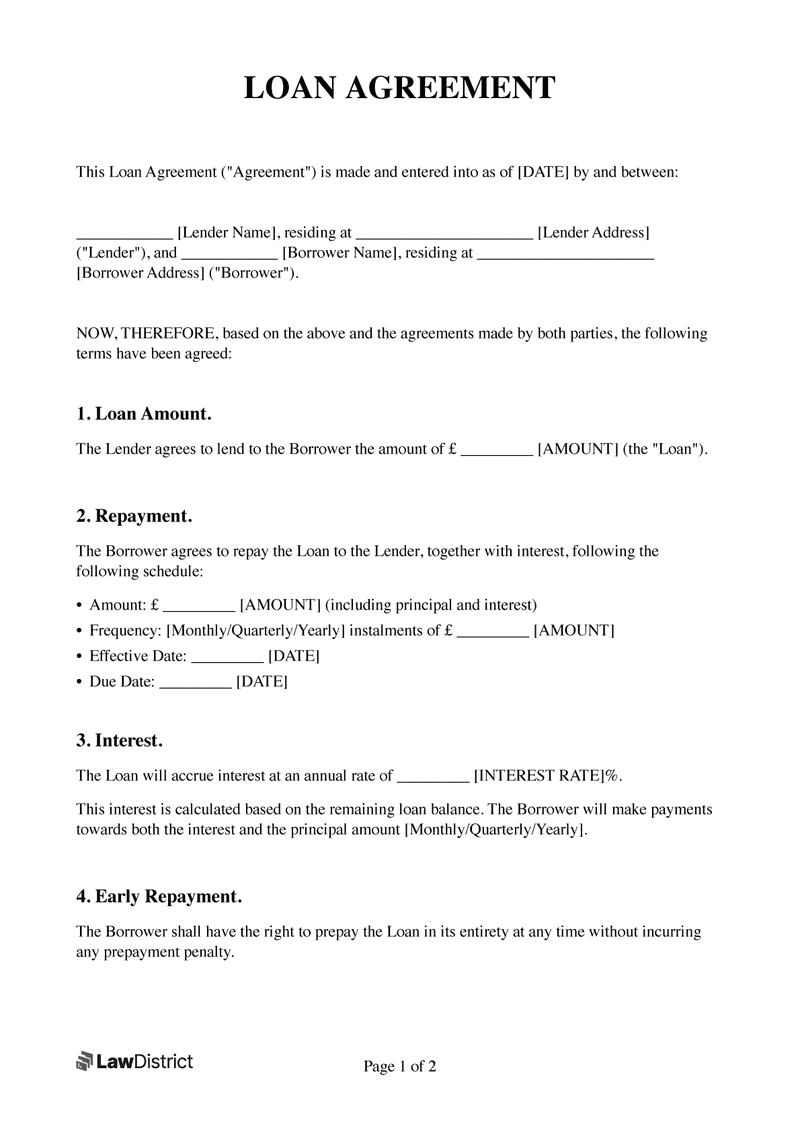

A comprehensive non-recourse loan agreement must contain several essential clauses to effectively manage expectations, mitigate risks, and ensure legal enforceability. Each section plays a vital role in defining the scope and parameters of the loan.

- Identification of Parties: Clearly names the borrower(s) and lender(s) with their legal entities and addresses.

- Loan Amount and Terms: Specifies the principal sum, currency, interest rate (fixed or variable), and any fees associated with the loan.

- Repayment Schedule: Details the frequency, amount, and method of loan repayments, including maturity date and any balloon payments.

- Collateral Description: Precisely identifies the specific assets pledged as security for the loan, which the lender can seize in case of default. For non-recourse loans, this section is particularly critical as it defines the limit of the lender’s recovery.

- Non-Recourse Provision: This is the cornerstone clause. It explicitly states that the lender’s sole recourse in the event of a default is to the specified collateral, and the borrower bears no personal liability beyond the collateral’s value. Any "bad boy" carve-outs, which would trigger recourse under specific fraud or gross negligence scenarios, should also be meticulously detailed here.

- Representations and Warranties: Statements made by both parties about the accuracy of facts and the legality of the transaction, such as the borrower’s legal capacity or the condition of the collateral.

- Covenants: Obligations or restrictions placed on the borrower during the loan term, such as maintaining collateral insurance, providing financial reports, or refraining from selling specific assets.

- Events of Default: Defines the specific circumstances under which the loan is considered in default, triggering the lender’s right to pursue remedies. These often include failure to pay, breach of covenants, or insolvency.

- Remedies on Default: Outlines the actions the lender can take if an event of default occurs, focusing specifically on their rights concerning the collateral in a non-recourse context.

- Governing Law and Jurisdiction: Specifies which state or country’s laws will govern the agreement and where any legal disputes will be resolved.

- Indemnification: Clauses detailing how one party compensates the other for specific losses or damages.

- Confidentiality: Provisions protecting sensitive information shared between the parties.

- Miscellaneous Provisions: Covers standard contractual elements like notices, assignments, amendments, waivers, and severability.

Enhancing Document Clarity and Accessibility

Beyond the legal substance, the practical presentation and usability of a loan agreement are crucial for its effectiveness. A well-formatted document enhances readability, reduces the likelihood of misinterpretation, and facilitates efficient review by all stakeholders. Prioritizing clear, concise language is fundamental; avoid jargon where possible, or ensure technical terms are adequately defined. Using active voice and straightforward sentence structures can significantly improve comprehension.

Logical organization with clear headings and subheadings (like the <h2> and <h3> elements used here) helps readers navigate complex information quickly. Bullet points and numbered lists, as demonstrated in the "Core Elements" section, are excellent for breaking down intricate details into digestible chunks. For digital use, ensure the document is accessible, perhaps by using consistent styling and fonts, and considering compatibility across different platforms. For print, adequate margins and legible font sizes are essential. Furthermore, implementing version control and clear naming conventions for digital files prevents confusion and ensures that all parties are working from the most current iteration of the agreement, reinforcing trust and professionalism.

The journey of securing or providing non-recourse financing demands not just a thorough understanding of financial principles but also a robust legal framework. A meticulously drafted non recourse loan agreement template transcends being a mere legal document; it is a strategic asset that underpins trust, manages expectations, and decisively limits risk for all parties involved. It empowers businesses and financial institutions to engage in complex transactions with confidence, knowing their interests are clearly defined and legally protected.

By leveraging such a comprehensive and customizable solution, both borrowers and lenders can significantly reduce the time, cost, and potential for disputes associated with crafting bespoke agreements from the ground up. It represents a commitment to professionalism and due diligence, providing a clear path forward for successful project execution and financial stability. Ultimately, investing in a high-quality non recourse loan agreement template is an investment in peace of mind, ensuring that the terms of engagement are unambiguous, enforceable, and aligned with the unique risk profile of non-recourse financing.