For many artists, the journey from passion to profession is a thrilling, often winding road filled with creative exploration and unexpected opportunities. However, behind every captivating performance and acclaimed recording lies a less glamorous but equally vital component: financial stability. Without a clear understanding of income and expenses, even the most talented musician can find their artistic ambitions hampered by financial stress, making the pursuit of a sustainable career an uphill battle.

This is where a dedicated financial framework becomes not just helpful, but essential. It transforms the abstract idea of "making it" into a tangible, measurable path forward. Whether you’re a gigging guitarist, a studio producer, a touring vocalist, or an independent composer, having a robust system to track your money empowers you to make informed decisions, invest in your craft, and ultimately, achieve greater creative freedom.

Why a Dedicated Financial Plan Is Crucial for Artists

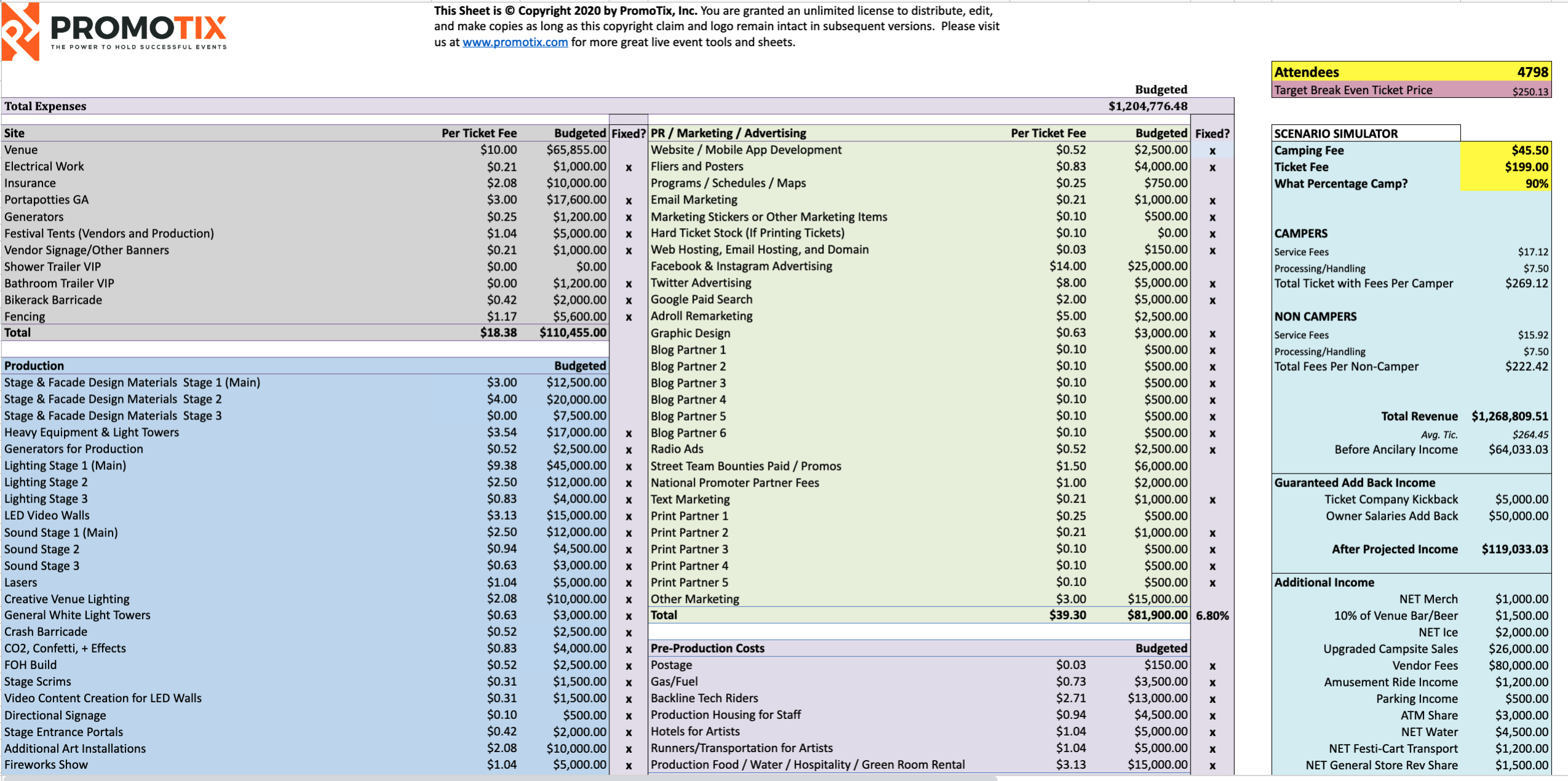

The life of a musician is rarely a predictable 9-to-5 scenario. Income streams can be incredibly varied and often sporadic, flowing from live performances, royalties, merchandise sales, teaching, session work, streaming, and more. Expenses, too, are unique to the industry, ranging from instrument maintenance and studio time to marketing campaigns, travel costs, and specialized software. Navigating this financial landscape without a map can lead to significant stress and missed opportunities.

A well-structured financial plan provides clarity in the chaos. It allows you to see exactly where your money is coming from and where it’s going, empowering you to identify trends, anticipate lean periods, and allocate resources effectively. Beyond just tracking, it becomes a powerful tool for strategic planning, enabling you to invest in new gear, fund your next album, or save for that dream tour without jeopardizing your daily needs. This proactive approach cultivates peace of mind, freeing up mental energy to focus on what you do best: creating and performing music.

Key Elements of a Smart Financial Framework

Understanding the core components of any sound financial tracking system is the first step toward building a robust Musician Budget Template. This isn’t just about listing numbers; it’s about categorizing and understanding the nature of your income and expenses to paint a comprehensive picture of your financial health. A detailed financial blueprint for performers allows you to analyze profitability, identify areas for cost reduction, and pinpoint growth opportunities.

Your revenue streams will likely include performance fees, digital streaming royalties, sync licensing, merchandise sales, music lessons, grants, and potentially even day-job income if you’re building your career. On the expenditure side, you’ll need to account for instrument purchases and maintenance, recording studio costs, marketing and promotion, travel for gigs, membership fees to performance rights organizations, website hosting, and professional development workshops. Don’t forget to include critical but often overlooked items like insurance, accounting software subscriptions, and estimated tax payments.

Setting Up Your Personalized Financial Plan

Creating your own practical financial management tool doesn’t have to be daunting. The goal is to build a system that works for your unique situation, providing actionable insights without consuming too much of your valuable time. Think of it as developing a bespoke financial planning for artists solution, tailored to your specific income patterns and spending habits.

Here’s a step-by-step approach to get your artist financial framework up and running:

- **Assess** your current financial situation by gathering all bank statements, receipts, and income records from the past few months. This provides a realistic baseline.

- **Categorize** all income sources clearly. Distinguish between active income (gigs, lessons) and passive income (royalties, streaming), as this distinction can inform future strategies.

- **Identify** and list all expenses, separating them into fixed (rent, subscriptions) and variable (travel, marketing, gear repairs). This helps you see where you have flexibility.

- **Set** realistic financial goals. These could be short-term (saving for a new microphone) or long-term (funding an album, building an emergency fund).

- **Implement** a consistent tracking system. Whether it’s a simple spreadsheet, an app, or dedicated software, choose a method you’ll stick with daily or weekly.

- **Review** and adjust your money management for independent artists monthly. Life changes, and so should your financial document. Flexibility is key to long-term success.

Tips for Mastering Your Financial Flow

Beyond the initial setup, maintaining and optimizing your financial tracking requires consistent effort and smart habits. These tips are designed to help you not just track your money, but truly master your financial flow, turning your budget framework into a dynamic tool for growth and stability. Adopting these practices will ensure your income and expense tracker for musicians remains a powerful asset.

Firstly, separate your business and personal finances. This is crucial for clarity, tax purposes, and professional credibility. Open a dedicated bank account for your music career. Secondly, automate savings. Even small, regular transfers to a dedicated savings account can build up significantly over time, creating a buffer for emergencies or future investments in your career. Thirdly, plan for irregular income. If your revenue fluctuates, consider setting aside a portion of larger payments to smooth out income during leaner months. Fourthly, don’t forget about taxes! As an independent contractor, you’re responsible for self-employment taxes. Set aside a percentage of every payment for this purpose to avoid a nasty surprise. Finally, invest in yourself wisely. Not all expenses are bad; some are investments. A new instrument, professional mixing, or a marketing campaign can generate significant returns, but ensure these align with your overall financial strategy and goals.

Leveraging Your Financial Document for Growth

A comprehensive financial document is far more than just a ledger; it’s a strategic asset. Once you have a clear picture of your finances, you can use this information to make smarter decisions that propel your music career forward. This data-driven approach to revenue management for creatives can illuminate pathways to expansion and sustained success.

For instance, understanding your average monthly expenses and income allows you to confidently decide when you can afford to invest in a new piece of studio equipment or take on a major marketing push for a new release. When applying for grants or loans, a detailed financial history and clear projections can significantly strengthen your application, demonstrating your professionalism and commitment. Furthermore, your personalized finance sheet helps you set realistic performance goals – if you know how many streams or gigs it takes to cover your costs, you can strategize your efforts more effectively. It transforms abstract aspirations into concrete financial targets, making your artistic goals more attainable and your growth more measurable.

Frequently Asked Questions

How often should I update my artist financial framework?

Ideally, you should review and update your artist financial framework at least once a month. This allows you to catch discrepancies early, adjust for unexpected expenses or income, and ensure your budget remains relevant to your current financial situation and career goals.

What if my income is highly unpredictable?

For musicians with unpredictable income, a “zero-based budget” or an “envelope system” can be very effective. With a zero-based budget, you allocate every dollar of your income to a specific expense or savings category. For irregular income, focus on setting aside enough during high-income months to cover essential fixed expenses during leaner times, creating an emergency fund or income smoothing buffer.

Should I include personal expenses in my music career budget?

While it’s crucial to keep business and personal finances separate for tax and clarity purposes, your music career must ultimately support your personal living expenses. Therefore, your comprehensive financial plan for musicians should project how much income your music needs to generate to cover your personal living costs, even if those are tracked in a separate personal budget.

Are there specific tools beyond a spreadsheet for this?

Yes, many tools are available beyond traditional spreadsheets. Popular options include budgeting apps like Mint or YNAB (You Need A Budget), accounting software like QuickBooks Self-Employed or FreshBooks, or industry-specific platforms if available. The best tool is the one you find easiest to use consistently.

How can a financial plan help me get more gigs?

A clear financial plan helps you understand your profitability per gig or project, allowing you to price your services more strategically. It also frees up mental space from financial worry, enabling you to focus more on networking and performance quality. Furthermore, by identifying areas for investment (e.g., better marketing materials, new equipment), your budget can directly support activities that lead to more opportunities.

Embracing the structure of a Musician Budget Template doesn’t mean sacrificing your artistic spirit; it means fortifying it. It’s about taking control of your financial narrative so that your creative journey can be sustained, resilient, and ultimately, more fulfilling. By understanding and managing your financial resources, you equip yourself with the power to chase bigger dreams, take calculated risks, and invest confidently in your artistic future.

Don’t let financial uncertainty overshadow your talent. Start building your personalized financial blueprint today, even if it’s just by tracking your first few income streams and expenses. This small step can lead to profound clarity, greater independence, and the sustained ability to share your unique musical voice with the world for years to come.