In the intricate tapestry of local governance, managing public funds is arguably the most critical thread. It’s not just about balancing books; it’s about allocating resources to build stronger communities, maintain essential services, and plan for a sustainable future. Every street light, every park bench, every school program, and every emergency service hinges on a well-thought-out financial strategy.

However, the complexity of public finance—with its myriad revenue streams, departmental expenditures, and regulatory requirements—can be daunting for any city, town, or county administration. This is where a standardized financial planning document steps in as an indispensable tool, streamlining the process and providing clarity.

The Bedrock of Local Governance

At its heart, a municipal budget template provides a structured framework for local governments to meticulously plan and track their financial activities. It’s more than just a spreadsheet; it’s a living document that reflects the priorities, challenges, and aspirations of a community. Without such a guide, financial planning can quickly become fragmented, leading to inefficiencies, misallocations, and a lack of accountability.

Imagine trying to build a complex structure without blueprints. That’s akin to running a municipality without a robust financial framework. A well-designed city budget model acts as that blueprint, ensuring every dollar collected and spent is purposeful, transparent, and aligned with public interest. It helps leadership make informed decisions, communicates fiscal realities to residents, and serves as a vital tool for long-term strategic planning.

Why a Structured Financial Framework Matters

The benefits of utilizing a comprehensive local government financial framework extend far beyond simple accounting. It fosters a culture of responsibility and strategic foresight, crucial for navigating the ever-changing economic landscape. From property taxes to grant funding, and from public works to healthcare, every aspect requires precise financial consideration.

A robust spending guide enables municipalities to articulate their financial needs clearly, justify expenditure proposals, and track performance against fiscal targets. This level of detail empowers elected officials to govern more effectively and ensures that taxpayer money is used judiciously. Furthermore, it enhances public trust by making the complex world of municipal finance accessible and understandable to the very people it serves.

Key Components of an Effective City Budget Model

A truly effective urban planning financial tool incorporates a wide array of elements, designed to capture the full scope of a city’s fiscal operations. It must be flexible enough to accommodate unique local circumstances yet structured enough to ensure consistency and clarity. Understanding these core components is the first step toward building a resilient financial future for any community.

Here are the essential building blocks typically found within a comprehensive community financial blueprint:

- **Revenue Sources:** Details all anticipated income, including property taxes, sales taxes, utility fees, licenses and permits, state and federal grants, and investment earnings. This section provides a clear picture of the funds available.

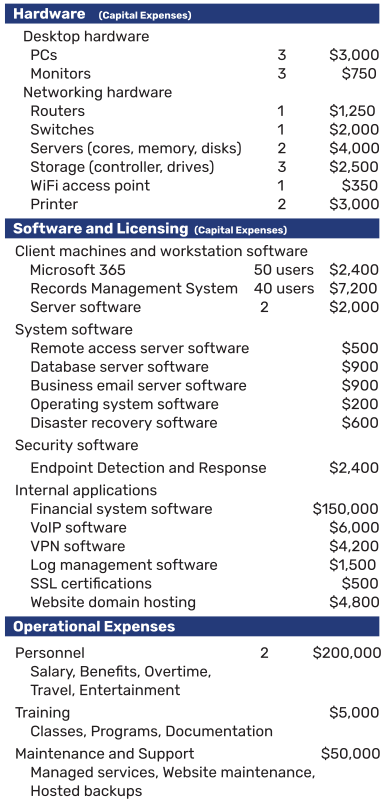

- **Expenditure Categories:** Outlines all planned spending by department (e.g., police, fire, public works, parks and recreation, administration) and by type (e.g., salaries, benefits, supplies, capital improvements, debt service). Categorization helps in understanding where money is being spent.

- **Personnel Costs:** Often the largest portion of any municipal budget, this section breaks down salaries, wages, health insurance, retirement contributions, and other employee-related expenses.

- **Capital Improvement Plan (CIP):** A long-term plan for major infrastructure projects, such as road repairs, new building construction, or equipment purchases. It typically spans several years and details funding sources for each project.

- **Debt Service:** Information on payments for outstanding municipal bonds or loans, including principal and interest. Effective management of debt is crucial for fiscal health.

- **Fund Balance/Reserves:** Details the amount of money a municipality has set aside for emergencies or future projects. Maintaining adequate reserves is a sign of fiscal prudence.

- **Performance Metrics:** While not strictly financial, many advanced financial planning tools for cities include sections for linking budget allocations to departmental goals and key performance indicators (KPIs).

- **Budget Narrative/Summary:** A plain-language overview that explains the budget’s highlights, priorities, and significant changes from previous years, making it accessible to the general public.

Leveraging Technology for Financial Planning

In today’s digital age, the concept of a financial guide has evolved far beyond static spreadsheets. Modern technology offers sophisticated tools that can transform the budgeting process from a manual, error-prone task into a dynamic, insightful exercise. Specialized municipal financial software, cloud-based platforms, and advanced analytical dashboards can significantly enhance efficiency and accuracy.

These technological solutions allow for real-time tracking of expenditures, automated revenue forecasting, and complex scenario planning. They facilitate collaboration across departments, streamline approval workflows, and can even integrate with geographic information systems (GIS) to visualize the impact of capital projects. Embracing these tools means moving towards a more proactive and responsive fiscal management framework.

Tips for Customizing Your Local Government Budget Guide

While a standardized expenditure and revenue outline provides an excellent starting point, effective implementation requires customization to reflect the unique characteristics and needs of your specific locality. No two municipalities are exactly alike, and their financial planning documents should mirror their individual identities. Tailoring your public funds allocation tool ensures it remains relevant and useful.

Consider the following strategies when adapting a general framework for your community:

- Align with Strategic Goals: Ensure every section of your spending plan directly supports your city’s long-term vision and strategic objectives. Is there a new initiative for sustainable development? Make sure it’s reflected in the budget.

- Incorporate Local Context: Account for specific local revenue sources (e.g., tourism taxes, unique local fees) and expenditure drivers (e.g., a large aging population, a growing youth demographic, or specific environmental challenges).

- Engage Stakeholders Early: Involve department heads, elected officials, community leaders, and even citizens in the early stages of budget development. Their input can identify critical needs and foster a sense of ownership.

- Build in Flexibility: While structure is important, a rigid financial template can become obsolete quickly. Include provisions for unforeseen circumstances and allow for adjustments throughout the fiscal year, with proper oversight.

- Simplify for Public Consumption: Create a summary version of the comprehensive financial blueprint that is easy for the average citizen to understand. Use infographics, charts, and clear language to demystify municipal finances.

Common Pitfalls to Avoid

Even with the best intentions and tools, missteps can occur during the budgeting process. Being aware of common challenges can help municipalities navigate potential issues and create a more robust financial plan. A strong fiscal management framework aims to mitigate these risks.

One frequent error is failing to adequately account for unfunded mandates or rapidly escalating costs, such as healthcare premiums or pension obligations. Another pitfall is relying too heavily on overly optimistic revenue projections, which can lead to significant shortfalls if economic conditions change. Moreover, a lack of transparency or insufficient public engagement can erode trust and lead to political backlash. Effective use of a Municipal Budget Template, combined with careful planning and public involvement, can help avoid these common traps.

Frequently Asked Questions

What is the primary purpose of a standardized financial planning document?

The primary purpose is to provide a comprehensive, organized framework for a local government to plan, allocate, and track its financial resources. It ensures transparency, accountability, and effective decision-making regarding public funds, aligning spending with community priorities.

How often should a municipality update its budget guide?

Most municipalities develop and approve an annual budget. However, elements like the Capital Improvement Plan (CIP) might be updated less frequently (e.g., every 3-5 years) but revisited annually for adjustments. Mid-year reviews and amendments are also common to address unforeseen circumstances.

Who typically uses a city budget model?

A wide range of stakeholders utilize it, including city managers, finance directors, department heads, elected officials (mayor, city council), budget committees, and even grant writers. It also serves as a crucial document for residents, businesses, and oversight bodies interested in how public funds are managed.

Can a smaller town use the same type of financial framework as a large city?

While the core components remain similar (revenues, expenditures, capital planning), the complexity and level of detail will vary significantly. A smaller town might use a simpler version of a general expenditure and revenue outline, while a large city would require a much more intricate and granular financial planning tool to manage diverse departments and extensive services.

What role does public input play in the budget process?

Public input is vital. It helps ensure the budget reflects community needs and priorities, fosters transparency, and builds public trust. Municipalities often hold public hearings, workshops, and publish budget summaries to encourage citizen engagement and feedback throughout the planning cycle.

In conclusion, the careful development and implementation of a robust municipal budget template are foundational to the health and prosperity of any local government. It transcends simple accounting, evolving into a powerful instrument for strategic planning, resource allocation, and fostering unwavering public confidence. By providing a clear, comprehensive overview of fiscal operations, it empowers leaders to make data-driven decisions that directly enhance the quality of life for residents.

The journey of sound municipal finance is continuous, requiring vigilance, adaptability, and a commitment to transparency. Embracing a structured approach, leveraging appropriate tools, and actively engaging the community in the process will ensure that every dollar collected and spent serves its highest purpose, building a resilient and thriving future for all.