In the intricate world of finance and property, clear and precise communication isn’t just a nicety; it’s a necessity. Whether you’re a homeowner navigating loan terms, a real estate professional coordinating complex transactions, or a financial institution managing a portfolio of assets, the ability to convey information accurately and professionally is paramount. Documents related to mortgages, in particular, carry significant weight, impacting financial futures and legal obligations.

This is where the strategic use of well-crafted correspondence becomes invaluable. Leveraging pre-designed structures, like mortgage letter templates, empowers individuals and organizations to communicate with clarity, efficiency, and confidence. These tools serve as more than just a starting point; they are a foundation for effective engagement, ensuring that critical messages are delivered effectively, understood completely, and acted upon appropriately by all recipients involved.

The Power of Precise Communication

In today’s fast-paced digital landscape, the importance of a meticulously written and properly formatted letter might seem old-fashioned to some. However, in high-stakes fields like real estate and finance, formal written correspondence retains its undeniable power and authority. A well-constructed letter projects an image of professionalism, attention to detail, and a serious approach to the matter at hand.

When dealing with mortgage-related issues, ambiguities or miscommunications can lead to significant financial repercussions, legal disputes, or prolonged administrative headaches. Clear, concise, and unambiguous language helps prevent misunderstandings, sets accurate expectations, and provides a tangible record of communication. This documentation is crucial for accountability and reference, should any questions arise in the future.

Furthermore, a professionally presented document fosters trust. It signals to the recipient, whether a lender, a borrower, or a regulatory body, that the sender is organized, credible, and takes their responsibilities seriously. This level of professionalism can significantly influence the outcome of a request, negotiation, or inquiry, ensuring smoother processes and more favorable results.

Streamlining Your Correspondence

The sheer volume and complexity of mortgage-related communications can be daunting. From initial loan applications and pre-approvals to refinancing requests, payment inquiries, and dispute resolutions, each interaction requires specific information and a particular tone. Crafting each of these documents from scratch can be a time-consuming and error-prone endeavor.

This is where the main benefits of utilizing ready-made mortgage letter templates truly shine. Firstly, they are incredible time-savers. Instead of staring at a blank page, you start with a structured framework that already includes the essential sections and common phrasing. This allows you to focus solely on inserting the unique details relevant to your specific situation, dramatically cutting down drafting time.

Secondly, templates ensure consistency and reduce the likelihood of overlooking critical information. They act as a checklist, prompting the sender to include all necessary data points, contact information, and specific requests. This consistency is vital for maintaining a professional brand image and ensuring that all correspondence adheres to a high standard of quality and completeness. Moreover, by reducing manual errors and ensuring a polished layout, mortgage letter templates significantly elevate the professionalism of your outbound communication, fostering trust and clarity.

Tailoring Your Message for Impact

While templates provide a solid foundation, their true power lies in their adaptability. No two mortgage situations are identical, and an effective letter must reflect the unique nuances of its purpose and recipient. Customization is not just about filling in blanks; it’s about strategically shaping the message to achieve a specific outcome.

For instance, a general payment inquiry template can be customized with specific account numbers, payment dates, and precise questions about a particular transaction. A request for a loan modification would require detailed personal financial information, an explanation of hardship, and a proposed repayment plan—all integrated seamlessly into the template’s structure. Similarly, a pre-approval letter for a new home purchase needs to include specific loan amounts, interest rates, and conditions.

The process involves identifying the core purpose of your letter, then meticulously adding relevant names, dates, addresses, account numbers, and any unique circumstances. You might also adjust the opening and closing remarks to better suit the specific relationship with the recipient. Effective personalization ensures that the communication feels direct and relevant, rather than generic, significantly increasing its impact and the likelihood of a positive response. This level of detail transforms a standard document into a powerful, personalized tool for effective communication.

Anatomy of an Effective Letter

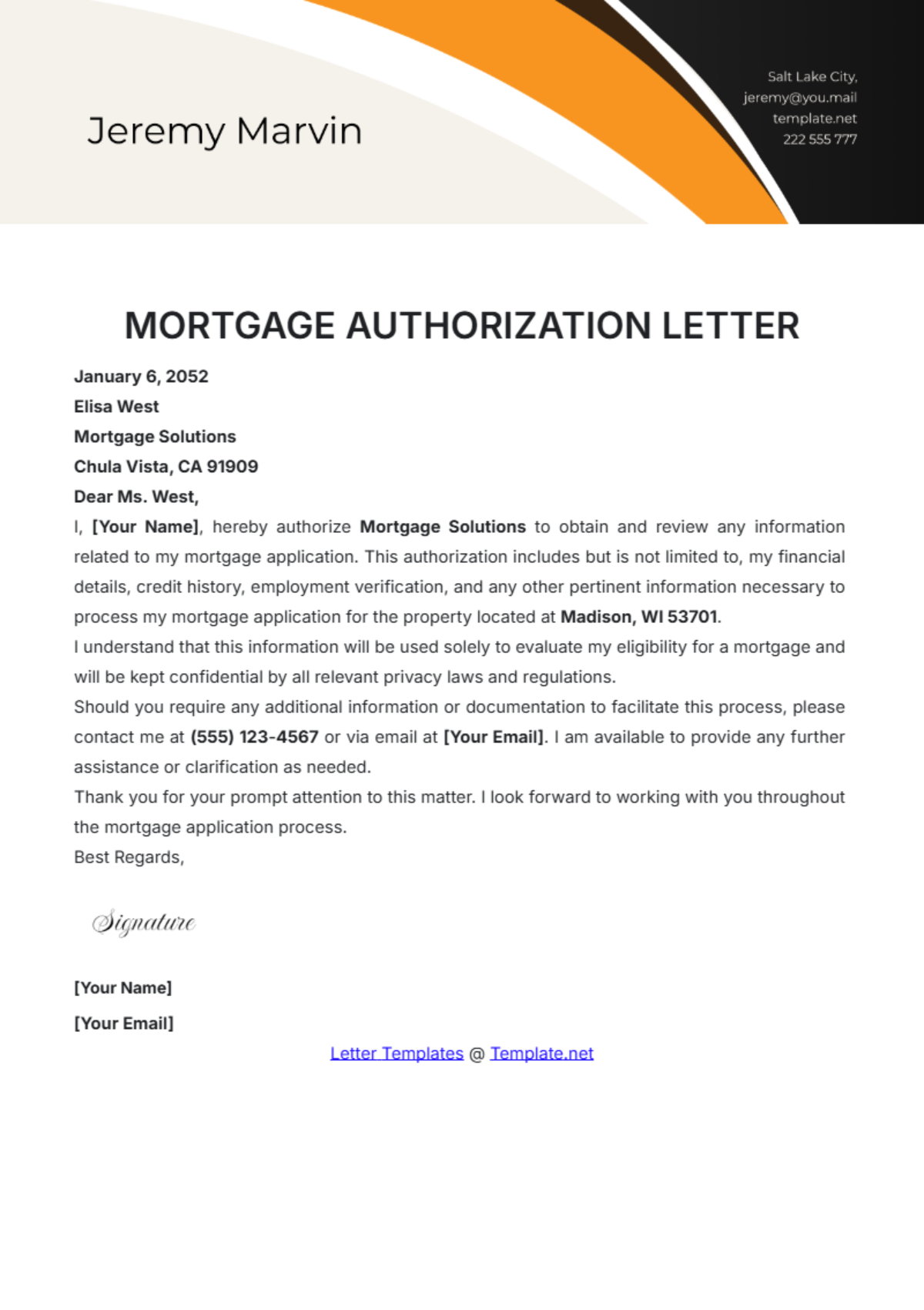

Regardless of its specific purpose, every formal letter, especially those pertaining to significant financial matters like mortgages, shares a common structure designed to ensure clarity, professionalism, and completeness. Understanding these essential components is key to utilizing any template effectively.

- Sender’s Information: Your full name, address, phone number, and email. For businesses, include the company name and logo.

- Date: The date the letter is written. Crucial for establishing a timeline.

- Recipient’s Information: The full name, title, and address of the person or department receiving the letter. Accuracy here prevents misdirection.

- Salutation: A formal greeting, such as "Dear Mr./Ms. [Last Name]" or "To Whom It May Concern," if the specific contact is unknown.

- Subject Line: A concise, clear statement of the letter’s purpose (e.g., "Inquiry Regarding Mortgage Account #12345," "Request for Loan Modification – [Your Name]"). This helps the recipient immediately understand the context.

- Opening Paragraph: Briefly states the reason for writing and establishes the main point of the correspondence.

- Body Paragraphs: Provide detailed information, explanations, evidence, or specific requests. Each paragraph should focus on a single idea for clarity.

- Call to Action/Closing Paragraph: Clearly states what you expect or request the recipient to do next, or summarizes the desired outcome.

- Closing: A formal closing, such as "Sincerely," "Regards," or "Respectfully."

- Signature: Your handwritten signature (for printed letters) or a digital signature (for electronic documents).

- Typed Name: Your full typed name below your signature.

- Enclosures/Attachments: A notation indicating any additional documents included with the letter (e.g., "Enclosures: Bank Statement, Hardship Letter").

Polishing Your Professional Output

Beyond the content itself, the tone, formatting, and presentation of your letter significantly influence its reception. These elements are the final polish that elevate a good letter to an excellent one, ensuring your message is not only understood but also respected.

Regarding tone, aim for professionalism and clarity. Maintain a respectful and objective voice, even when addressing difficult issues. Avoid emotional language, slang, or overly casual phrasing. Be direct and concise, getting straight to the point without unnecessary jargon or verbosity. A confident and composed tone signals competence and helps convey authority and seriousness.

Formatting plays a crucial role in readability. Stick to standard, professional fonts like Times New Roman, Arial, or Calibri, typically in 10-12 point size. Ensure adequate margins (usually 1 inch on all sides) and consistent line spacing. Use paragraph breaks to separate distinct ideas, making the document easier to scan and digest. Headings or subheadings within longer letters can also guide the reader through complex information.

For presentation, always proofread meticulously for any grammatical errors, typos, or factual inaccuracies. Even minor mistakes can detract from your credibility. When sending digital versions, save your letter as a PDF to preserve its layout and ensure it looks the same on any device. For printable versions, use good quality paper and ensure your printer’s ink levels are sufficient for a crisp, clear print. A well-presented letter, whether digital or physical, reflects positively on the sender and reinforces the professional nature of the communication.

In the complex ecosystem of mortgage transactions, effective communication is the bedrock of successful outcomes. By utilizing carefully constructed mortgage letter templates, individuals and professionals gain an immediate advantage, transforming what could be a cumbersome task into a streamlined process. These tools not only save valuable time but also instill confidence that every vital piece of information is conveyed with precision and professionalism.

Ultimately, the strategic application of these templates empowers you to navigate the intricacies of mortgage-related correspondence with greater ease and assurance. They serve as an invaluable resource, ensuring your messages are always clear, polished, and impactful, fostering smoother interactions and more favorable results for all parties involved in the journey of homeownership and financial management. Embrace the power of structured communication, and let your professional correspondence reflect the high standards you uphold.