In the dynamic and often demanding world of legal practice, financial acumen is just as crucial as legal expertise. Managing a law firm, whether a burgeoning startup or an established enterprise, requires a robust understanding of its financial health. Without a clear financial roadmap, even the most successful firms can find themselves adrift in a sea of unforeseen expenses or missed revenue opportunities. This is where a meticulously crafted financial plan becomes not just beneficial, but absolutely essential for sustainable growth and operational efficiency.

A comprehensive budget serves as your firm’s financial compass, guiding decisions from hiring new associates to investing in cutting-edge legal tech. It empowers managing partners, administrators, and even individual practice group leaders to make informed choices, allocate resources wisely, and anticipate future challenges. For any legal professional dedicated to their firm’s longevity and prosperity, understanding and implementing a structured financial framework is a non-negotiable step toward achieving long-term success and strategic advantage in a competitive market.

The Indispensable Role of Financial Planning for Law Firms

Effective financial planning transcends mere bookkeeping; it’s a strategic imperative that underpins every aspect of a law firm’s operation. A well-defined budget helps firms allocate resources efficiently, identify potential shortfalls or surpluses, and measure performance against strategic goals. It’s a proactive tool that allows you to steer your firm rather than simply react to financial fluctuations. Without a clear financial plan, decisions often become reactive, leading to inefficiencies, stress, and missed opportunities for growth.

Beyond internal management, a solid financial framework instills confidence in stakeholders, including partners, lenders, and potential investors. It demonstrates a commitment to fiscal responsibility and a clear vision for the firm’s future. This level of transparency and foresight is invaluable, fostering trust and providing a stable foundation upon which to build lasting success. Ultimately, robust financial planning isn’t just about managing money; it’s about managing the future of your legal practice.

Understanding Your Firm’s Financial Landscape

Before diving into the specifics of a budget, it’s critical to gain a holistic view of your firm’s current financial standing. This involves a thorough analysis of both revenue streams and expenditure patterns. On the revenue side, consider all sources of income: billable hours across different practice areas, contingency fees, retainers, and any other income-generating activities. Segmenting this by practice group or even by individual attorney can provide deeper insights into profitability.

Equally important is a granular understanding of expenses. These often fall into various categories, from fixed costs like rent and salaries to variable costs such as marketing campaigns, continuing legal education, and litigation support. A detailed breakdown allows you to identify areas where costs can be optimized or where investments might yield greater returns. This initial diagnostic step is fundamental to creating a realistic and effective legal practice financial plan.

Key Components of an Effective Law Firm Financial Plan

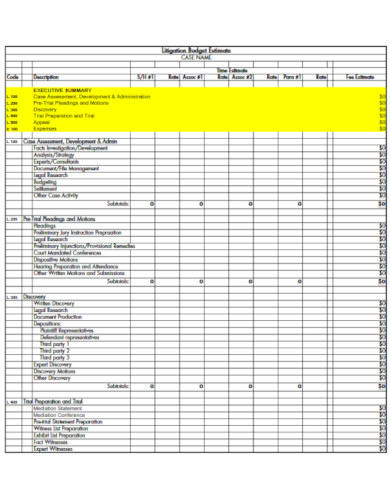

A robust financial framework for a law firm isn’t just a simple spreadsheet; it’s a comprehensive document that meticulously breaks down all income and expenditures. It needs to be detailed enough to offer insights, yet flexible enough to adapt to the unpredictable nature of legal work. Understanding these core components is the first step toward building an accurate and useful annual financial plan for your practice.

Here are the critical elements that should be included in any effective financial management framework:

- Revenue Projections: Detailed forecasts of income from various sources, including billable hours, contingency fees, flat fees, and retainers. This should be broken down by practice area and ideally by individual attorney or client type.

- Operating Expenses: All the costs associated with running the firm day-to-day. This category is broad and can be further segmented:

- Personnel Costs: Salaries, bonuses, benefits (health insurance, retirement contributions), payroll taxes for attorneys, paralegals, administrative staff, and support personnel.

- Office Overhead: Rent, utilities (electricity, water, internet), office supplies, cleaning services, property insurance, and maintenance.

- Technology and Software: Licenses for practice management software, legal research tools, document management systems, cybersecurity solutions, hardware upgrades, and IT support.

- Marketing and Business Development: Advertising, website development, SEO, public relations, professional memberships, networking events, and client entertainment.

- Professional Development: Continuing Legal Education (CLE) courses, seminars, conferences, and specialized training for staff.

- Insurance: Malpractice insurance, general liability, workers’ compensation, and other relevant policies.

- Administrative Costs: Bank fees, postage, courier services, printing, and sundry office expenses.

- Capital Expenditures: Investments in significant assets that will benefit the firm for more than one year, such as new office furniture, major IT infrastructure, or renovations.

- Debt Service: Payments on any loans or lines of credit the firm may have.

- Profit Distribution/Partner Draws: Planned disbursements to partners or owners, which should be clearly defined and budgeted for.

- Contingency Fund: An essential component for unexpected expenses or downturns, typically a percentage of total operating expenses.

Building Your Customized Financial Framework

Creating a practical budget begins with historical data. Look back at the past 12-24 months of financial statements, profit and loss reports, and balance sheets. This historical insight provides a realistic baseline for predicting future income and expenses. Don’t just copy numbers; analyze trends. Did certain expenses spike? Did a particular practice area see a significant jump in revenue? Use these insights to inform your projections.

Next, engage key stakeholders. Partners, practice group leaders, and even administrative staff often have valuable perspectives on resource needs and potential efficiencies within their departments. Their input can ensure the budget is realistic and gains wider buy-in. Finally, choose a budgeting method that suits your firm: zero-based budgeting (starting from scratch each year), incremental budgeting (adjusting last year’s budget), or activity-based budgeting (linking costs to specific activities). The right financial planning tool, like a sophisticated Law Firm Budget Template, can significantly streamline this process, allowing for easy customization and scenario planning.

Leveraging Your Budget for Strategic Growth

A budget is far more than an accounting tool; it’s a powerful instrument for strategic growth and decision-making. By meticulously tracking income and expenditures, a firm can identify its most profitable practice areas and allocate resources to further capitalize on these strengths. Conversely, it can highlight underperforming segments, prompting a review of strategies or resource reallocation to improve efficiency. This analytical insight is crucial for optimizing your legal practice’s financial plan.

Beyond performance analysis, the budget serves as a foundational element for forecasting. It enables firms to project future cash flows, anticipate financial needs, and plan for significant investments or expansions. Want to open a new office? Hire more attorneys? Invest in AI legal tech? Your firm’s financial blueprint will guide these decisions, ensuring they are fiscally sound and aligned with your long-term objectives. It transforms financial data into actionable intelligence, driving sustainable growth.

Common Pitfalls and How to Avoid Them

Even with the best intentions, firms can stumble when it comes to financial planning. One common pitfall is the "set it and forget it" mentality. A budget is a living document, not a static report. It needs to be reviewed and adjusted regularly, at least quarterly, to reflect changes in the market, client demands, or internal operations. Failing to do so can quickly render it irrelevant and misleading.

Another mistake is underestimating expenses or overestimating revenue. This often stems from an overly optimistic outlook or a lack of granular data. Be realistic, even conservative, in your projections, and always build in a contingency fund for the unexpected. Ignoring indirect costs like depreciation, professional development, or the hidden costs of staff turnover can also distort the true financial picture. Finally, lack of accountability among partners or department heads for their budgeted line items can derail the entire process. Clearly define roles and responsibilities to ensure everyone is invested in the firm’s financial health.

Frequently Asked Questions

What is the primary benefit of having a dedicated budget for a law firm?

The primary benefit is gaining clear visibility into your firm’s financial health, enabling proactive decision-making, strategic resource allocation, and improved profitability. It moves a firm from reactive spending to strategic financial management.

How often should a law firm’s budget be reviewed and adjusted?

While an annual budget is standard, it should be reviewed at least quarterly. Monthly checks of actuals versus budget are highly recommended for immediate course correction, especially for critical revenue and expense categories.

Can a smaller law firm truly benefit from a detailed budget, or is it just for large firms?

Absolutely, smaller firms often benefit even more! With tighter margins and fewer resources, meticulous financial planning is crucial for survival and growth. A detailed budget helps smaller firms identify efficiencies, manage cash flow, and avoid costly mistakes, providing a competitive edge.

What role does technology play in modern law firm budgeting?

Technology is pivotal. Practice management software, accounting platforms, and dedicated budgeting tools can automate data collection, generate detailed reports, facilitate scenario planning, and ensure greater accuracy and efficiency in the budgeting process, saving significant time and reducing errors.

Is it necessary to include partner compensation and draws in the budget?

Yes, absolutely. Partner compensation, whether salary, draws, or profit distributions, represents a significant outlay for the firm and must be clearly defined and budgeted for. It allows for a complete and accurate financial picture and ensures sustainable distribution practices.

Embracing a structured approach to financial planning is a transformative step for any law firm. A well-constructed and diligently maintained financial management framework doesn’t just manage money; it manages the trajectory of your entire practice. It provides the clarity needed to navigate economic shifts, capitalize on new opportunities, and mitigate potential risks, ensuring that your firm remains resilient and competitive in a challenging legal landscape.

By investing the time and effort into creating a robust budget, you’re not just crunching numbers; you’re building a stronger, more sustainable future for your firm. This proactive financial stewardship empowers you to make confident decisions, foster growth, and secure the long-term success that every legal professional aspires to achieve. Start planning today to pave the way for a more prosperous tomorrow.