In today’s dynamic work environment, where remote work, hybrid models, and the deployment of advanced technology are commonplace, businesses and organizations face increasing challenges in managing their physical assets. Laptops, being essential tools for productivity, represent a significant investment and carry critical data. The casual lending or assignment of these devices without clear guidelines can lead to costly misunderstandings, data security risks, and administrative headaches. This is precisely where a robust framework for device management becomes indispensable.

A well-drafted document provides the necessary clarity and legal protection for both the lending entity and the recipient. It sets forth the terms under which a laptop is issued, used, and ultimately returned, ensuring accountability and safeguarding valuable company assets. For businesses, educational institutions, or even individuals regularly lending out equipment, leveraging a professionally designed laptop loan agreement template is not merely a formality but a strategic necessity for maintaining order, mitigating risks, and fostering transparent relationships. It acts as a foundational document, outlining expectations and responsibilities from the outset.

The Modern Necessity of Formal Device Lending

The era of digital transformation has made laptops more central to operations than ever before. From enterprise-level organizations equipping their entire workforce to small businesses providing specialized tools, the distribution of high-value portable computing devices is routine. However, this ubiquity also brings inherent risks. Without a formal process, companies expose themselves to potential financial losses due to lost or damaged equipment, security vulnerabilities from unmanaged devices, and compliance issues related to data handling.

A clear, written agreement addresses these modern challenges head-on. It establishes a verifiable record of who possesses which asset, under what conditions, and for what duration. This formalization is crucial for internal auditing, inventory management, and ensuring regulatory compliance, especially concerning data privacy and security mandates like GDPR or CCPA. Furthermore, it sets a professional tone, clearly communicating the value of the equipment and the seriousness of the responsibilities associated with its use.

Safeguarding Your Assets and Relationships

The primary purpose of any borrowing contract is to protect the interests of all parties involved. A comprehensive laptop loan agreement template serves this function by explicitly defining the rights and obligations of both the lender and the borrower. This clarity helps prevent disputes, as expectations are transparently laid out and agreed upon before any asset changes hands.

Beyond financial protection, such a document fortifies the professional relationship. It demonstrates the organization’s commitment to responsible asset management and employee accountability. By clearly outlining acceptable use policies, maintenance responsibilities, and return procedures, the agreement acts as a reference point for any queries or concerns that may arise during the loan period. This proactive approach minimizes ambiguity, enhances trust, and ultimately contributes to a more organized and secure operational environment.

Tailoring Your Lending Policy

No two organizations are exactly alike, and neither are their needs for equipment lending. A significant advantage of using a professionally designed template is its inherent flexibility and adaptability. While providing a solid legal foundation, the structure of a good agreement allows for extensive customization to fit various specific scenarios and industries.

Consider a tech company loaning high-performance laptops for software development versus a school district providing Chromebooks for student learning. The terms, responsibilities, and even liability clauses will differ significantly. Similarly, an agreement for an employee’s long-term remote work setup will vary from one for a short-term contractor or a device loaned for a specific project. The template serves as a robust skeleton, enabling users to insert industry-specific clauses, adjust timelines, specify device configurations, or modify conditions of use without having to draft every legal nuance from scratch. This adaptability ensures that the final document is not just legally sound but also perfectly aligned with the unique operational context.

Core Components of a Robust Device Agreement

While specific details will vary, every effective lending contract should contain certain fundamental clauses to ensure comprehensive coverage and legal enforceability. These sections form the backbone of the agreement, providing clarity and protection.

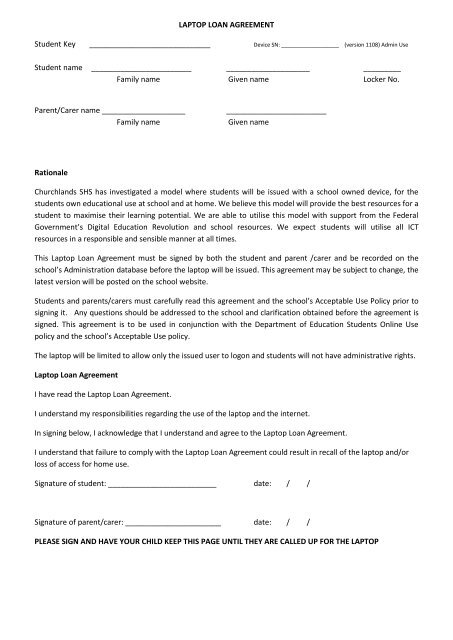

- Identification of Parties: Clearly states the full legal names and addresses of both the lending entity (e.g., company, institution) and the borrowing party (e.g., employee, contractor, student).

- Device Description: A detailed identification of the loaned laptop, including make, model, serial number, asset tag, and any pre-installed software or accessories. This ensures there is no ambiguity about which specific device is being loaned.

- Terms of Loan: Specifies the commencement date, expected duration of the loan, and any conditions for extension or early termination.

- Permitted Use and Restrictions: Outlines how the laptop may and may not be used (e.g., for work purposes only, no illegal activities, no unauthorized software installations).

- Care and Maintenance: Defines the borrower’s responsibilities for the physical care, maintenance, and security of the device, including protection against damage, loss, or theft.

- Liability for Loss or Damage: Clearly stipulates who is responsible for costs associated with repair or replacement if the laptop is damaged, lost, or stolen, and under what circumstances.

- Data Security and Confidentiality: Addresses the handling of company data, personal information, and proprietary software, emphasizing the importance of protecting sensitive information stored on the device.

- Return Policy: Details the procedure for returning the laptop, including its condition upon return, any required data wipe procedures, and consequences for late or non-return.

- Acceptance and Acknowledgment: A statement confirming the borrower has read, understood, and agrees to all terms and conditions of the agreement.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement, typically the state where the lending entity operates.

- Signatures: Spaces for authorized representatives of both the lending and borrowing parties to sign and date the agreement, making it legally binding.

Crafting a User-Friendly and Effective Document

A comprehensive legal document is only truly effective if it is understandable and accessible to its users. While precision is paramount, readability should not be sacrificed. When customizing your laptop loan agreement template, consider not just the legal content but also its presentation and usability.

Employ clear, concise language, avoiding overly complex legal jargon wherever possible. Organize the document with logical headings and subheadings to guide the reader through different sections. Short paragraphs, bullet points, and numbered lists, as demonstrated above for essential clauses, significantly enhance readability and make it easier to digest critical information. For documents that may be used digitally, ensure they are screen-reader friendly and properly formatted for various devices. If printed, adequate margins and legible fonts are crucial. Including a version control system (e.g., "Version 1.0, May 2023") on the document helps track revisions and ensures that only the most current version is in circulation. The goal is to create a document that is not only legally sound but also user-friendly, encouraging compliance through clarity.

Implementing a well-structured laptop loan agreement template is a proactive step toward minimizing operational risks and fostering a culture of accountability within any organization. It transforms the often-overlooked process of device deployment into a clear, legally sound transaction, protecting both the financial investment in technology and the integrity of sensitive data. By laying out explicit terms and conditions, this essential document eliminates ambiguity, sets realistic expectations, and provides a clear framework for resolution should issues arise.

Ultimately, leveraging a professional laptop loan agreement template empowers businesses and institutions to manage their technological assets with confidence and precision. It saves invaluable time and resources that would otherwise be spent drafting bespoke agreements or, worse, dealing with the aftermath of unmanaged equipment. Investing in such a template is an investment in operational efficiency, legal security, and the establishment of transparent, professional relationships with all who utilize your organization’s vital computing resources.