In the dynamic world of hospitality, where every season brings new challenges and opportunities, effective financial management isn’t just a best practice—it’s the bedrock of sustainable success. For hotel owners, general managers, and financial controllers, navigating the complex interplay of revenue streams and operational expenses can feel like steering a ship through ever-changing tides. A clear, well-structured financial plan is essential for charting a profitable course.

This is where a robust framework for financial foresight becomes indispensable. Far more than just a spreadsheet, a comprehensive approach to managing your hotel’s finances provides a detailed roadmap, allowing you to anticipate costs, project revenues, and make informed decisions that drive profitability and enhance guest experiences. It’s the strategic tool that transforms uncertainty into actionable insights, ensuring your property remains competitive and financially sound in a bustling market.

Why a Robust Hotel Budget is Non-Negotiable

Creating an annual hotel operating budget might seem like a daunting task, but its benefits far outweigh the initial effort. This critical document serves multiple purposes beyond mere compliance; it’s a strategic asset that influences every aspect of your property’s performance. From day-to-day operations to long-term growth initiatives, a well-defined financial blueprint acts as a guiding star.

Firstly, it provides unparalleled clarity on your financial health. By meticulously detailing expected income and expenditures, an operating budget for hotels offers a realistic snapshot of where your money comes from and where it goes. This transparency is crucial for identifying areas of overspending or underperformance, enabling proactive adjustments rather than reactive damage control. Secondly, it empowers strategic decision-making. With a clear understanding of your financial parameters, you can confidently evaluate investment opportunities, set competitive pricing, and allocate resources efficiently to departments that need it most. Lastly, it fosters accountability across your organization. When department heads are involved in the budgeting process and have clear targets, they become more invested in achieving financial goals, fostering a culture of fiscal responsibility throughout the hotel.

What Your Hotel Operating Budget Template Should Encompass

A truly effective Hotel Operating Budget Template is more than just a collection of numbers; it’s a living document that captures the essence of your hotel’s financial ecosystem. It needs to be comprehensive enough to cover all potential income and outgoings, yet flexible enough to adapt to market fluctuations. Structuring this financial planning tool thoughtfully is key to its utility.

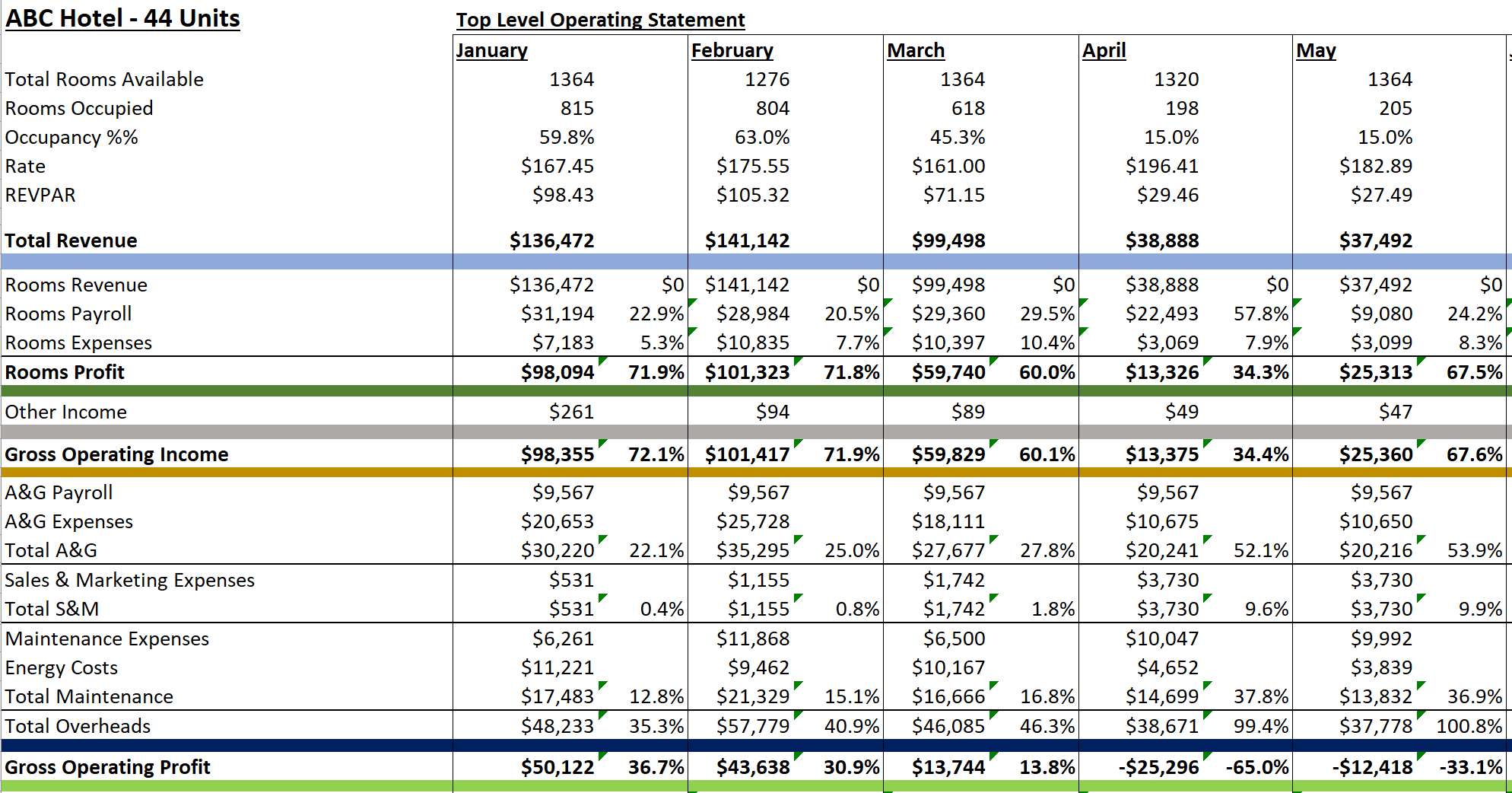

At its core, a robust framework for hotel operations will meticulously detail both revenue projections and expense categories. On the revenue side, this includes projections for room nights sold, average daily rate (ADR), food and beverage sales, meeting and event space rentals, and any other ancillary income streams like spa services, parking, or retail. Each of these components requires careful forecasting based on historical data, market trends, and anticipated occupancy rates. On the expense side, the template should break down costs into granular categories, allowing for precise tracking and control.

Key elements typically found in a well-structured operating budget for hotels include:

- Revenue Streams: Detailed forecasts for room revenue, broken down by segment (transient, group, contract), and other departmental revenues like food and beverage, spa, golf, and other operated departments.

- Payroll and Related Expenses: The single largest expense for most hotels, encompassing salaries, wages, benefits, and payroll taxes for all staff, from front desk to housekeeping to management. Requires careful planning around staffing levels and hourly rates.

- Departmental Operating Expenses: Costs directly related to each department’s function, such as guest supplies, laundry, cleaning supplies, uniforms, and food and beverage cost of goods sold.

- Undistributed Operating Expenses: Overheads not tied to a specific revenue-generating department, including administrative and general, sales and marketing, utilities, and property operations and maintenance.

- Fixed Charges: Non-operating expenses like property taxes, insurance, rent, and interest expense on debt.

- Capital Expenditures: While separate from the operating budget, a forward-looking financial template might include a section for planned large-scale investments in property upgrades or equipment, as these impact long-term operational efficiency.

- Key Performance Indicators (KPIs): Essential metrics like Occupancy Rate, ADR, RevPAR (Revenue Per Available Room), and GOPPAR (Gross Operating Profit Per Available Room), which help measure operational success against budget targets.

Crafting Your Financial Roadmap: A Step-by-Step Guide

Developing a comprehensive financial plan for your hotel involves a systematic approach, transforming raw data into actionable insights. It’s a cyclical process that begins with historical analysis and culminates in ongoing monitoring and adjustment. Here’s how to effectively build and utilize your hotel budget planning tool.

First, gather historical data. Look back at least three to five years of profit and loss statements, occupancy reports, and revenue summaries. This data provides a baseline for understanding seasonal trends, peak performance periods, and recurring expenses. Analyze variances between previous budgets and actual results to learn from past successes and missteps.

Next, forecast revenue realistically. This is perhaps the most challenging yet crucial step. Consider market conditions, local events, anticipated competitor activity, and your hotel’s unique selling propositions. Collaborate with your sales and marketing teams to project room nights, average daily rates, and ancillary revenues. Be conservative in your estimates to avoid over-optimistic projections that can derail financial stability.

Third, project operating expenses. Work with each department head to estimate their specific costs for the coming period. Encourage them to be thorough, detailing everything from staffing needs and supply costs to marketing initiatives and maintenance schedules. Categorize expenses as either fixed (e.g., insurance, property taxes) or variable (e.g., guest supplies, utility consumption based on occupancy) to better understand their flexibility.

Fourth, incorporate capital expenditures and debt service. While capital expenditures (CapEx) are often budgeted separately, it’s vital to consider their impact on overall financial health and future operational costs. Include scheduled debt payments to ensure cash flow can support these obligations.

Finally, review, refine, and approve. Present the draft financial blueprint to key stakeholders, including ownership and executive management. Facilitate discussions, challenge assumptions, and make necessary revisions. Once approved, the budget becomes your hotel’s financial constitution for the coming year. Remember, this isn’t a static document; it requires ongoing monitoring and periodic adjustments to remain relevant throughout the operating period.

Leveraging Your Budget for Strategic Growth

Beyond its role in financial control, an astute operating budget for hotels serves as a powerful instrument for strategic growth and sustained profitability. It moves beyond a simple accounting exercise to become a dynamic tool that informs decision-making at every level of the organization. By consistently tracking performance against the budget, hoteliers can identify trends, capitalize on opportunities, and mitigate risks before they escalate.

This detailed financial planning tool enables you to identify high-performing segments and allocate additional resources to maximize their potential. Conversely, it highlights underperforming areas, prompting investigation into their causes and the implementation of corrective actions, such as repricing strategies or operational efficiency improvements. Furthermore, a well-managed budget supports investment in property enhancements or new technologies, ensuring these expenditures align with financial goals and contribute to guest satisfaction and competitive advantage. It acts as a compass, guiding your hotel towards financial stability and helping to build a resilient business model capable of weathering economic shifts and market pressures.

Common Pitfalls and How to Avoid Them

Even the most meticulously crafted financial planning for hospitality can falter if common pitfalls aren’t anticipated and avoided. Successful budget management is as much about foresight as it is about number crunching. Recognizing these traps allows hoteliers to build more robust and resilient financial plans.

One frequent mistake is failing to involve key department heads in the budgeting process. Without their input, projections can be unrealistic, leading to resentment and a lack of ownership. Another pitfall is overly optimistic revenue forecasting without sufficient market research or historical backing. This can lead to inflated expectations and subsequent financial shortfalls. Conversely, underestimating expenses, particularly for maintenance, marketing, or unforeseen operational challenges, can quickly deplete contingency funds. Moreover, some hotels fail to build in a contingency or reserve fund for unexpected events, leaving them vulnerable to market disruptions or emergencies. Finally, treating the budget as a static, one-time exercise rather than a living document that requires ongoing monitoring and adjustment is a critical error. Regularly compare actual performance against budget, investigate variances, and be prepared to make informed revisions throughout the year.

Frequently Asked Questions

What is the primary difference between an operating budget and a capital budget?

An operating budget focuses on the day-to-day revenues and expenses required to run the hotel over a specific period, typically a year. It covers items like payroll, supplies, and utilities. A capital budget, on the other hand, deals with long-term investments in assets like new furniture, property renovations, or major equipment purchases, which have a useful life beyond one year and are capitalized on the balance sheet.

How frequently should a hotel operating budget be reviewed and adjusted?

While the annual budget is set once, it should be reviewed at least monthly against actual performance. This allows management to identify variances quickly. Significant deviations may warrant quarterly or bi-annual adjustments (reforecasting) to ensure the budget remains a relevant and accurate planning tool in response to changing market conditions or operational challenges.

Who should be involved in preparing the hotel’s financial plan?

Budget preparation should be a collaborative effort. The General Manager and Director of Finance typically lead the process, but input from all department heads (e.g., Rooms, F&B, Sales & Marketing, Engineering, HR) is crucial. Their operational expertise ensures realistic expense projections and revenue goals, fostering greater accountability and buy-in.

Can a small boutique hotel truly benefit from a detailed operating budget template?

Absolutely. While the scale may differ, the principles of financial planning remain the same. A detailed budget provides small boutique hotels with the same advantages: clear financial visibility, improved decision-making, better cost control, and a strategic roadmap for growth. It helps even small properties maximize profitability and remain competitive.

What are the most critical line items to monitor closely in a hotel budget?

The most critical line items typically include revenue from rooms and food & beverage, as these are the primary income drivers. On the expense side, payroll and related expenses are usually the largest cost, followed by utility costs and direct departmental expenses. Monitoring these closely can reveal significant opportunities for cost control and revenue enhancement.

Mastering your hotel’s financial landscape is no small feat, but with a well-designed financial planning tool, it becomes an achievable and empowering endeavor. This isn’t just about crunching numbers; it’s about gaining foresight, achieving financial stability, and ultimately, delivering exceptional value to both your guests and your stakeholders. By embracing a systematic approach to budgeting, you transform potential financial complexities into clear, strategic advantages.

Remember, a budget is not a prison; it’s a compass. It provides direction, allowing you to adapt to market shifts while keeping your long-term financial goals in sight. Invest the time and effort into developing a robust budgeting framework, involve your team, and commit to continuous monitoring and adjustment. This proactive financial management will not only safeguard your hotel’s assets but also unlock new opportunities for growth, innovation, and sustained success in the competitive hospitality industry.