The vibrant sounds of a high school band — the powerful brass, the intricate woodwinds, the driving percussion — are more than just notes; they are the culmination of dedication, passion, and, perhaps less romantically, meticulous financial planning. Behind every successful marching band show, every concert performance, and every inspiring student experience lies a well-managed budget that ensures resources are available when and where they are needed most. For many band directors and booster clubs, navigating the financial landscape of a comprehensive music program can feel like conducting an orchestra without a score.

From instrument maintenance and uniform dry-cleaning to competition fees and travel expenses, the financial needs of a high school band are as diverse as the instruments themselves. Without a clear, organized approach, funds can quickly become a source of stress rather than a tool for success. This is where a robust High School Band Budget Template becomes an invaluable asset, transforming complex financial data into an understandable and actionable plan. It provides the structure necessary to manage funds efficiently, ensuring the program’s sustainability and continued growth, ultimately enriching the educational experience for countless students.

The Unsung Hero: Why a Band Budget Matters

A well-structured financial plan is often the unsung hero of any thriving high school band program. It offers more than just a ledger of income and expenses; it provides a roadmap for the entire year, enabling proactive decision-making rather than reactive problem-solving. This clarity empowers band directors to focus on musical instruction and student development, while booster clubs can channel their efforts into effective fundraising and logistical support, knowing precisely where their contributions are making an impact.

Financial transparency, facilitated by a clear budget, builds trust among parents, school administration, and the community. When stakeholders can see how funds are allocated and utilized, they are more likely to offer their support, whether through donations, volunteer hours, or advocacy. Furthermore, a comprehensive band program financial plan acts as a historical record, allowing future leadership to learn from past trends, predict upcoming needs, and make informed adjustments, ensuring the program’s long-term health and ability to consistently provide high-quality musical education.

Beyond the Basics: What a Comprehensive Template Offers

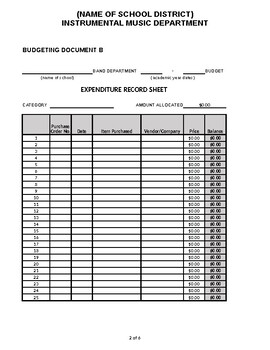

Moving beyond a simple spreadsheet, a dedicated template for school band finances provides a framework tailored to the unique requirements of a music department. It anticipates common revenue streams and expenditure categories, guiding users through the often-overlooked details that can impact a budget. This structured approach helps prevent surprises, allowing for better allocation of resources and fostering a more stable financial environment for the band.

Such a school band financial tool facilitates not only planning but also ongoing monitoring. It becomes a living document that can be updated throughout the year to reflect actual income and expenses, offering real-time insights into the band’s financial health. This dynamic capability is crucial for making timely adjustments, whether it’s reallocating funds to cover unexpected repairs or identifying surplus funds that can be invested in new opportunities for students. The benefits extend to improved accountability, better forecasting, and ultimately, a more secure foundation for every musical endeavor.

Key Components of an Effective Band Financial Plan

An effective budget for a high school music program will meticulously detail both sources of income and categories of expenditure. Understanding these components is the first step toward creating a reliable financial blueprint for a band. It ensures that every dollar earned and spent is accounted for, aligning with the program’s goals.

Common revenue sources for a music ensemble budget guide often include:

- **School District Allocation**: Funds provided directly by the school or district.

- **Booster Club Fundraising**: Income generated from events like car washes, bake sales, spirit wear, and direct solicitations.

- **Student Fees/Dues**: Contributions from students for participation, uniforms, or specific activities.

- **Performance Fees**: Income from paid performances, such as community events or private functions.

- **Donations and Sponsorships**: Contributions from individuals, local businesses, or grants.

- **Concessions/Merchandise Sales**: Profits from selling food or band-branded items at events.

Typical expenditure categories that a detailed band budget management system should cover include:

- **Instrument Purchase/Repair**: Cost of new instruments, repairs, and annual maintenance.

- **Uniforms**: Purchase, cleaning, and maintenance of marching band and concert attire.

- **Instructional Staff**: Stipends for auxiliary staff, clinicians, and private lesson teachers.

- **Music & Arrangements**: Purchase of sheet music, scores, and custom arrangements.

- **Competition & Festival Fees**: Entry fees for marching band competitions, concert festivals, and regional events.

- **Travel & Transportation**: Costs associated with buses, fuel, and lodging for trips.

- **Equipment & Supplies**: Percussion equipment, music stands, sound systems, basic office supplies.

- **Boosters & Fundraising Costs**: Expenses related to running fundraising events.

- **Awards & Recognition**: Trophies, pins, senior gifts, banquet costs.

- **Concert Production**: Venue rental, sound/lighting, programs, guest artists.

- **Contingency Fund**: A buffer for unexpected expenses or emergencies.

Putting Your Financial Blueprint to Work: Practical Tips

Having a robust template is only the first step; effectively utilizing it requires ongoing effort and strategic thinking. Treating your band program funding structure as a dynamic tool rather than a static document will yield the best results for your high school music department budgeting. Regular engagement with the numbers helps maintain financial health and supports the band’s overall mission.

Firstly, customize your template. No two band programs are exactly alike, so adapt the categories to fit your specific needs, school policies, and local fundraising opportunities. Add or remove line items as necessary to ensure it truly reflects your program’s financial reality. Secondly, review frequently. Don’t let your budget sit untouched after its initial creation. Schedule monthly or quarterly reviews with key stakeholders, such as the band director, booster club treasurer, and perhaps a school administrator. This ensures that actual spending aligns with projections and allows for timely adjustments.

Thirdly, involve stakeholders. Share the financial plan with the booster club and relevant school personnel. Open communication fosters transparency and collaborative problem-solving. When everyone understands the financial goals and constraints, they can contribute more effectively. Finally, forecast strategically. Use historical data from previous years to make more accurate predictions for the upcoming year’s income and expenses. Anticipating major purchases, capital improvements, or significant travel helps integrate these items seamlessly into the annual financial plan, avoiding last-minute budget crises.

Maximizing Your Resources: Strategic Budgeting Approaches

Beyond simply tracking numbers, an effective band budget management strategy involves making deliberate choices that maximize available resources. It’s about ensuring that every dollar spent contributes directly to the band’s educational mission and student experience. This proactive approach to financial planning ensures longevity and continued excellence for the music program.

Integrating fundraising efforts directly into the financial plan is crucial. Rather than fundraising as a separate activity, identify specific budgetary needs that fundraising events will address. This gives fundraisers clear targets and helps communicate the impact of their efforts to donors. Prioritization is another key aspect; not every desired item can be funded every year. Use your budget as a tool to make informed decisions about what expenditures are most vital for the program’s immediate goals and long-term vision.

Finally, always include a contingency fund within your financial planning. Unexpected instrument repairs, last-minute competition changes, or unforeseen transportation issues can quickly derail a tight budget. A dedicated reserve provides a buffer against these surprises, allowing the program to handle challenges without compromising other essential areas. This ensures that the band can maintain its operational stability and continue providing exceptional opportunities for students regardless of minor financial setbacks.

Frequently Asked Questions

Who typically manages the band’s financial plan?

The management of a high school band’s financial plan is often a collaborative effort. Typically, the band director provides input on program needs, while the booster club treasurer or a dedicated financial committee handles the day-to-day tracking, reporting, and reconciliation. School administration may also have oversight or direct management of certain district-allocated funds.

How often should we review our band’s budget?

It is highly recommended to review your band’s budget at least monthly, especially during active performance and fundraising seasons. A comprehensive review should be conducted quarterly, and a full annual reconciliation and planning session is essential before the start of each new school year. Regular reviews allow for timely adjustments and better financial control.

Can a band financial planner help with fundraising?

Absolutely. A detailed financial planner or template for school band finances is an invaluable tool for fundraising. It clearly outlines the program’s financial needs, allowing booster clubs to set specific, measurable fundraising goals. By demonstrating precisely where funds are needed and how they will be used, a well-articulated budget can significantly enhance fundraising appeals and attract more support.

What if our actual spending deviates from the budget?

Deviation from the budget is common and not necessarily a sign of failure. The key is to address it promptly. If spending is higher than anticipated in one area, look for opportunities to reduce spending in another or identify potential new revenue streams. If there’s a significant surplus, consider reallocating funds to other program needs or adding to a contingency fund. Regular reviews make these adjustments manageable.

Is it hard to set up a new budget system for a band?

Starting a new budget system can seem daunting, but it doesn’t have to be. Utilizing a pre-designed High School Band Budget Template significantly simplifies the process by providing a structured framework and pre-defined categories. The initial setup requires gathering financial data and making projections, but once established, the system becomes easier to maintain with consistent input and review.

Embracing a structured financial approach, guided by a well-designed High School Band Budget Template, empowers everyone involved in the music program. It transforms the often-overwhelming task of managing funds into a clear, manageable process, fostering a sense of control and foresight. This proactive financial stewardship ensures that every dollar contributes to the enrichment of student lives and the continued growth of a vibrant musical community.

Ultimately, a strong financial foundation allows band directors to focus on their primary mission: inspiring young musicians. It frees up booster clubs to channel their energy into impactful support, knowing that their efforts are being maximized. By providing transparency, accountability, and a clear path forward, a dedicated budgeting tool elevates the entire high school band experience, making every note, every performance, and every student achievement possible.