Embarking on a new business venture is an exhilarating journey, often fueled by passion, innovation, and a shared vision among co-founders. However, as the initial enthusiasm takes hold, it’s easy to overlook the critical importance of establishing clear legal frameworks. One of the most foundational documents for any startup with multiple founders is a robust founders shareholder agreement, a contract designed to delineate the rights, responsibilities, and obligations of each co-owner from the outset.

This comprehensive guide delves into the essential elements and immense value of a well-crafted founders shareholder agreement template. It serves as an indispensable tool for entrepreneurs, legal professionals, and anyone involved in the early stages of a business formation, offering a structured approach to prevent future disputes, ensure operational clarity, and protect the interests of all parties involved. By providing a customizable blueprint, such a template empowers founders to build a strong, legally sound foundation for their enterprise, enabling them to focus on growth and innovation rather than internal conflicts.

The Imperative of Documenting Early Agreements

In today’s fast-paced business landscape, where partnerships can form rapidly and ideas evolve quickly, the need for clear, written agreements has never been more critical. The informal “handshake deal,” once a common practice, is a recipe for disaster in complex ventures involving equity, intellectual property, and significant financial stakes. Without a formal document, misunderstandings about roles, responsibilities, and equity splits can quickly escalate into debilitating disputes, jeopardizing the entire enterprise.

A detailed contract provides an unequivocal record of the initial understanding and subsequent agreements made between founders. It acts as a compass, guiding decisions and actions, and more importantly, as a shield, protecting all parties from ambiguity and potential litigation. Investing time upfront in formalizing these relationships via a comprehensive document is far more cost-effective and less stressful than trying to resolve conflicts born from unwritten expectations down the line.

Advantages of a Standardized Equity Holder’s Pact

Leveraging a well-designed agreement template offers a multitude of benefits and crucial protections for all co-founders. Firstly, it provides a structured approach to defining ownership percentages, capital contributions, and the rights associated with different share classes. This clarity is paramount for investor relations and future funding rounds, as investors often scrutinize the stability of a company’s internal structure.

Secondly, such a template helps mitigate risks by outlining mechanisms for dispute resolution, exit strategies for departing founders, and processes for transferring shares. This foresight can prevent protracted legal battles and ensure a smoother transition should a founder decide to leave or if disagreements arise. Furthermore, the document often includes provisions for intellectual property ownership, ensuring that the company retains rights to creations developed by its founders, a vital asset for any startup. It effectively establishes a governance framework, clarifying decision-making processes and outlining the duties expected from each party, fostering accountability and reducing operational friction.

Adapting the Framework for Diverse Ventures

While a core structure remains consistent, a robust founders shareholder agreement template is inherently flexible and can be customized to suit a wide array of industries, business models, and unique founder scenarios. Whether you’re launching a tech startup, a service-based agency, a manufacturing firm, or a non-profit organization, the underlying principles of equity division, governance, and dispute resolution apply. The key lies in adapting the specific clauses to reflect the nuances of your particular venture.

For instance, a tech startup might emphasize intellectual property assignment and vesting schedules for equity, while a service business might focus more on non-compete clauses and client ownership. The template allows for the insertion of industry-specific terms, performance metrics, and compliance requirements. It can accommodate varying levels of capital contribution, sweat equity, and operational involvement, ensuring that the final agreement accurately reflects the unique contributions and expectations of each founder. This adaptability ensures that the document remains relevant and legally sound, regardless of the business context.

Key Provisions Every Founders’ Accord Should Encompass

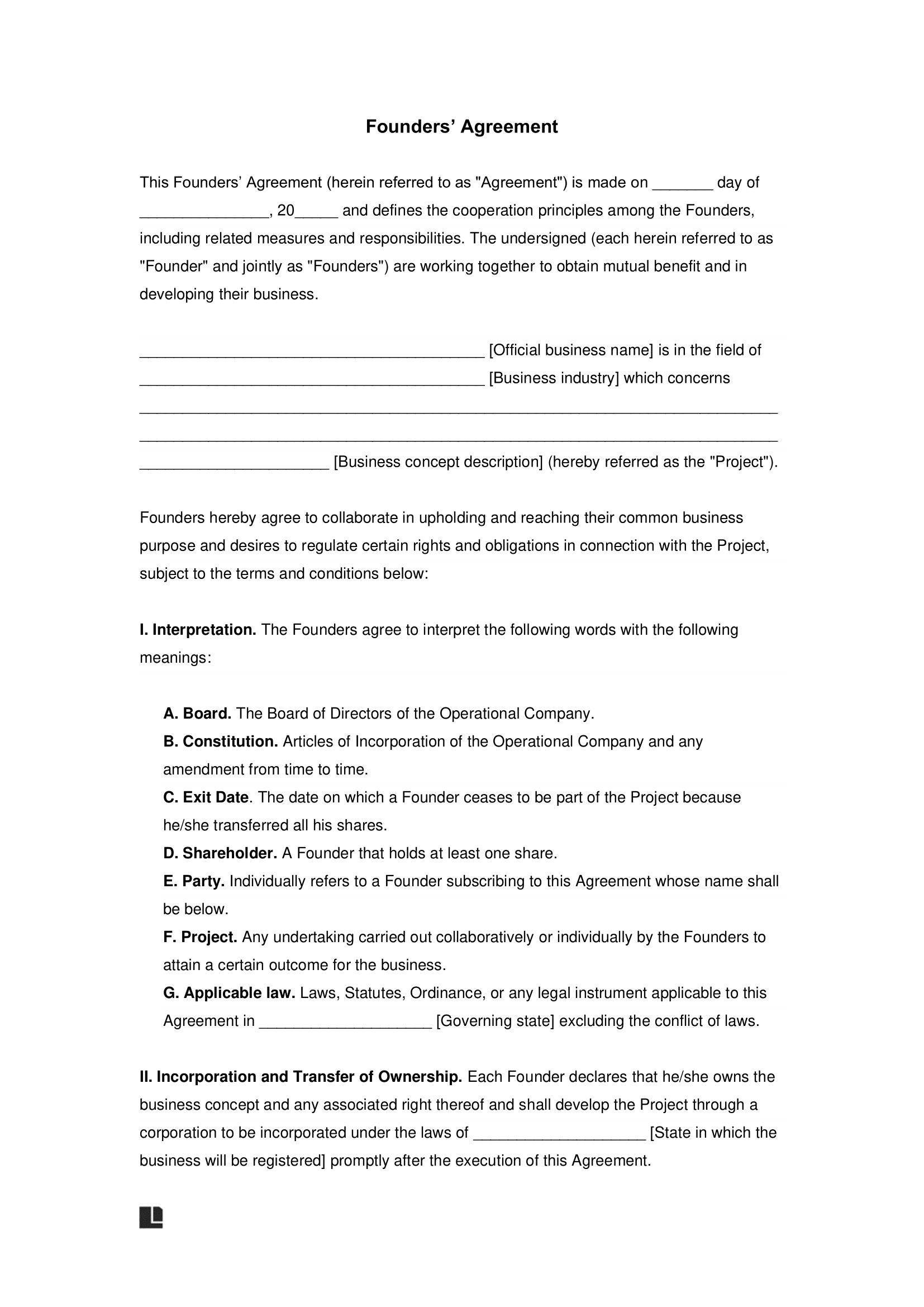

A comprehensive founders shareholder agreement is built upon several critical clauses, each designed to address a specific aspect of the co-founder relationship and business operation. These provisions ensure clarity, protect interests, and provide a roadmap for various eventualities.

- Identification of Parties and Company Details: Clearly names all founders and provides full legal details of the company, including its legal structure and registration information.

- Capital Contributions and Equity Ownership: Specifies the initial capital or sweat equity contributed by each founder and their corresponding ownership percentage, including any preferred shares or special rights.

- Vesting Schedule: Details how and when founders earn full ownership of their shares over time, typically tied to continued service to the company. This prevents an early departure from unfairly impacting remaining founders.

- Roles, Responsibilities, and Duties: Outlines the specific roles, duties, and expected contributions of each founder, ensuring alignment on operational responsibilities and strategic direction.

- Decision-Making Authority: Establishes how critical business decisions will be made, including voting rights, required majorities for certain actions, and procedures for breaking deadlocks.

- Intellectual Property (IP) Assignment: Ensures that all IP developed by founders in the course of the business belongs to the company, protecting its core assets.

- Confidentiality and Non-Disclosure: Obligates founders to keep sensitive company information confidential and outlines penalties for breaches.

- Non-Compete and Non-Solicitation Clauses: Prevents founders from competing with the company or soliciting its employees/clients for a defined period after their departure.

- Share Transfer Restrictions (Right of First Refusal, Co-Sale Rights): Defines conditions under which shares can be sold, typically giving existing founders or the company the first option to buy, and ensuring fair treatment if a founder sells to a third party.

- Valuation Method: Prescribes a method for valuing the company or shares in specific scenarios, such as buyouts or exits, ensuring fairness and transparency.

- Drag-Along and Tag-Along Rights: Drag-along rights allow majority shareholders to force minority shareholders to join in a sale, while tag-along rights protect minority shareholders by allowing them to sell their shares alongside a majority sale.

- Exit Strategies and Buyout Provisions: Addresses scenarios like founder death, disability, termination, or voluntary departure, outlining how shares will be bought back or handled.

- Dispute Resolution: Specifies procedures for resolving conflicts, often beginning with mediation and escalating to arbitration or litigation, to avoid costly court battles.

- Governing Law: Designates the jurisdiction whose laws will govern the interpretation and enforcement of the agreement. For US readers, this will typically be a specific state.

Enhancing Readability and Practical Application

A legally sound document is only effective if it’s easily understood and practically applicable by those it governs. When preparing or customizing a founders shareholder agreement template, attention to formatting, usability, and readability is crucial. Start by using clear, concise language, avoiding overly complex legal jargon where simpler terms suffice. Where legal terms are necessary, consider adding a glossary or brief explanations.

Organize the document with logical headings and subheadings, using a consistent numbering system for clauses and paragraphs. This structure not only makes the agreement easier to navigate but also facilitates future references and amendments. Incorporate a table of contents for longer documents. For digital use, ensure the file is in a widely accessible format (like PDF or Word document), is searchable, and can be easily shared and signed electronically. For print, use a legible font, appropriate line spacing, and sufficient margins. Ultimately, the goal is to create a contract that serves as a practical, living document, understood and respected by all founders throughout the lifecycle of the business.

A Professional Solution for Sustainable Growth

In the dynamic world of startups, the initial excitement of launching a new venture can often overshadow the critical need for meticulous legal groundwork. A well-structured founders shareholder agreement template serves as an invaluable resource, transforming potentially ambiguous co-founder relationships into clear, legally defined partnerships. By addressing key areas such as equity ownership, responsibilities, decision-making, and exit strategies, it lays a resilient foundation that protects all parties and promotes long-term stability.

Utilizing such a professional template is not just about legal compliance; it’s about strategic foresight. It empowers founders to anticipate challenges, mitigate risks, and establish a transparent framework for collaboration, allowing them to channel their energies into innovation and growth. This proactive approach minimizes future disputes, fosters trust, and ultimately contributes to the sustainable success of the enterprise, making it an indispensable asset for any aspiring or established entrepreneur.