In the intricate landscape of modern commerce and personal finance, clear communication is not merely a courtesy; it’s a fundamental necessity. Transactions, whether between businesses or individuals, often extend beyond a simple one-time exchange, evolving into structured relationships defined by ongoing financial commitments. When these commitments involve installment payments, deferred settlements, or other agreed-upon financial arrangements, the need for a robust, understandable, and legally sound document becomes paramount. This is precisely where a well-crafted financial payment plan agreement template steps in, serving as an indispensable tool for establishing transparent terms, protecting all parties involved, and fostering trust.

For entrepreneurs, small business owners, legal professionals, and financial advisors, the value of such a template cannot be overstated. It acts as a standardized blueprint, saving countless hours of drafting from scratch while ensuring that all critical elements of a payment plan are covered. From healthcare providers negotiating patient payment schedules to B2B suppliers managing outstanding invoices, or even individuals formalizing a loan repayment with a friend, the utility of a pre-structured, customizable agreement is universally beneficial, simplifying complex financial undertakings into clear, actionable steps.

The Imperative of Documented Financial Terms

In today’s fast-paced business environment, relying on verbal agreements is an increasingly perilous strategy. Memories fade, interpretations diverge, and without a written record, disputes can quickly escalate into costly legal battles, eroding relationships and financial stability. A formal written agreement serves as the unequivocal source of truth, establishing the specific terms and conditions governing a financial obligation. It eliminates ambiguity, leaving no room for misinterpretation regarding payment amounts, due dates, interest rates, or consequences of default.

Beyond dispute resolution, a well-documented payment arrangement underscores professionalism and good governance. It signals to all parties that the transaction is being handled with diligence and seriousness, fostering confidence and reducing perceived risk. Furthermore, in many jurisdictions, certain financial agreements may require written form to be legally enforceable. Adhering to this principle not only protects your interests but also demonstrates adherence to best practices in financial and legal compliance.

Key Benefits and Safeguards of a Standardized Agreement

Utilizing a comprehensive financial payment plan agreement template offers a multitude of advantages that extend beyond mere convenience. Firstly, it provides legal clarity and enforceability, laying out the rights and responsibilities of each party in a structured format. This clear articulation helps prevent misunderstandings from arising in the first place, and if they do, offers a definitive reference point for resolution. It shields both the creditor and the debtor by clearly outlining expectations and recourse options.

Secondly, a standardized document ensures consistency across similar transactions. Businesses dealing with multiple payment plans can maintain uniform policies, which simplifies administration, training, and compliance efforts. This consistency also builds trust with clients or customers, as they understand the process is fair and predictable. Moreover, the template acts as a crucial record for auditing, accounting, and tax purposes, providing an accessible archive of financial commitments. It also facilitates easier collection processes, as the terms for late payments or defaults are pre-defined and acknowledged.

Tailoring the Blueprint for Diverse Needs

One of the significant strengths of a robust financial payment plan agreement template lies in its adaptability. While providing a solid foundational structure, it is designed to be customized to suit an extensive range of industries, financial products, and specific scenarios. For instance, a healthcare provider might adapt it to outline patient responsibilities for medical bills, incorporating details about insurance claims and co-pays. A retail business could modify it for layaway plans or installment sales, specifying product return policies alongside payment terms.

In the B2B sector, the template can be adjusted for vendor payment schedules, project-based invoicing, or equipment leasing agreements, often requiring clauses for performance metrics or service level agreements. Even in personal contexts, such as lending money to a friend or family member, tailoring the document ensures that even informal arrangements are treated with the necessary formality, protecting personal relationships from financial strain. Key adjustments might include varying interest rates, collateral requirements, payment frequency, or even specific conditions for early repayment or deferment.

Essential Components of a Comprehensive Payment Plan

Every effective payment arrangement, regardless of its specific application, must contain a set of core clauses to ensure its completeness and legal standing. These components are the backbone of the agreement, articulating the precise terms and conditions that govern the financial transaction.

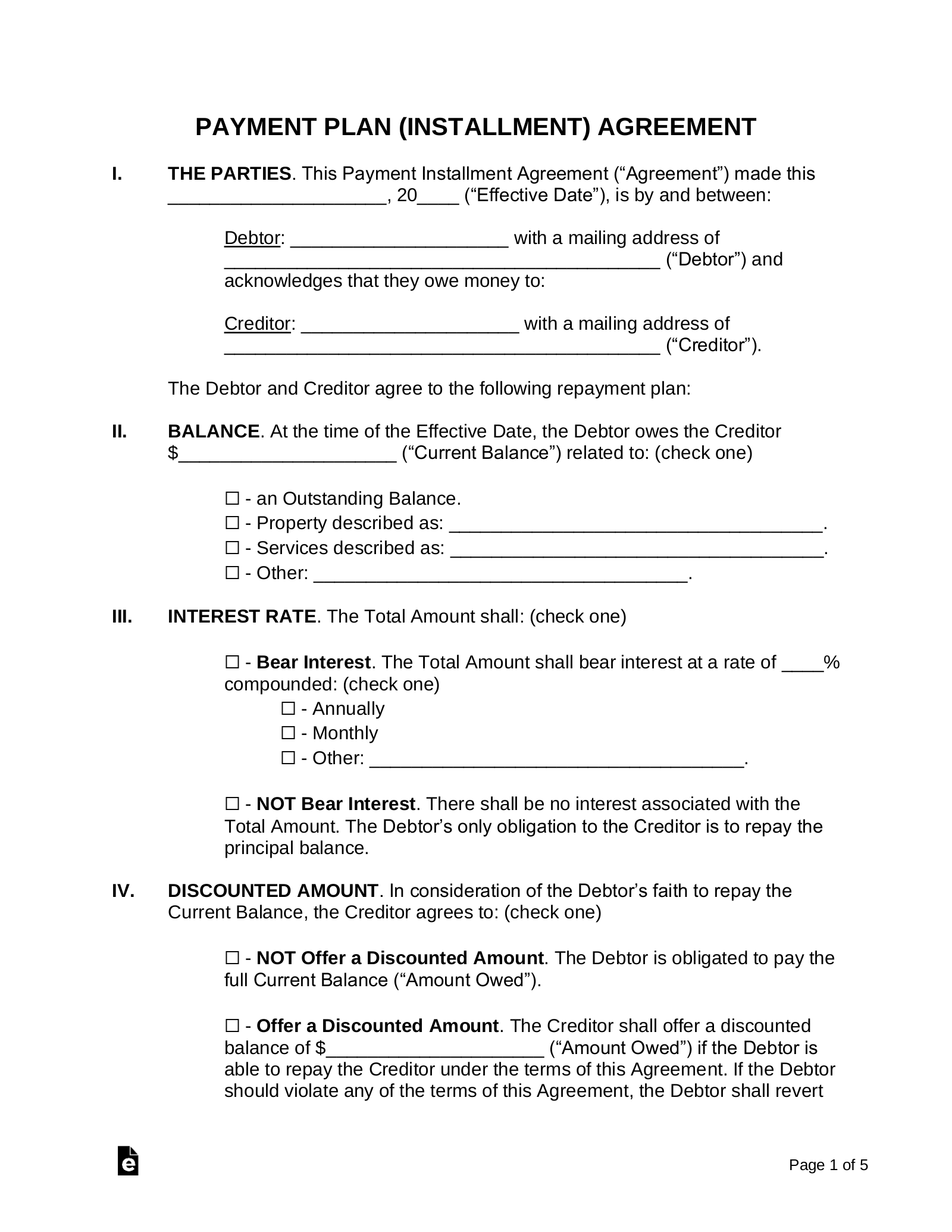

The following essential clauses or sections should always be included in any well-designed financial payment plan agreement template:

- Identification of Parties: Clearly state the full legal names and contact information of all parties involved (debtor, creditor, and any guarantors). This ensures no ambiguity regarding who is bound by the agreement.

- Purpose of the Agreement: Briefly describe the underlying debt or financial obligation being addressed. This provides context for the payment plan.

- Original Debt Amount: Specify the initial sum owed before any payments or interest are applied.

- Payment Schedule: Detail the exact amount of each payment, the frequency (e.g., weekly, monthly), and the precise due dates. This is the core of the payment plan.

- Interest Rates and Calculation (if applicable): Clearly state whether interest applies, the annual percentage rate (APR), and how interest will be calculated and applied to the principal.

- Total Amount Due: Calculate the grand total, including the original principal, any accrued interest, and applicable fees, that will be paid over the life of the agreement.

- Method of Payment: Specify acceptable payment methods (e.g., bank transfer, check, credit card, online portal) and instructions for submission.

- Late Payment Penalties: Outline any fees or additional interest that will be incurred if a payment is not made on time, including the grace period, if any.

- Default and Remedies: Define what constitutes a default (e.g., missed payments, failure to cure a breach) and the actions the creditor can take in such an event (e.g., accelerated payment, legal action, collection efforts).

- Early Repayment Options: State whether the debtor can repay the outstanding balance early without penalty, and if so, how.

- Governing Law: Specify the jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for legal disputes.

- Confidentiality Clause (if applicable): If sensitive financial information is exchanged, a clause protecting its confidentiality may be necessary.

- Entire Agreement Clause: States that the written agreement constitutes the entire understanding between the parties, superseding all prior oral or written communications.

- Amendment Clause: Outlines the process for making changes to the agreement, typically requiring written consent from all parties.

- Signatures: Spaces for all parties to sign and date the agreement, along with printed names. A witness signature line may also be included for added validity.

Formatting and Readability for Optimal Use

Even the most legally sound document can be rendered ineffective if it’s difficult to read or understand. Practical considerations for formatting and usability are crucial for ensuring that a payment plan agreement is both professional and user-friendly, whether it’s printed or accessed digitally. Prioritizing readability enhances clarity and minimizes the potential for misunderstanding.

Firstly, use clear, legible fonts (e.g., Arial, Times New Roman, Calibri) at an appropriate size (10-12 point for body text). Ample white space around paragraphs and sections improves visual flow and reduces cognitive load. Utilize headings and subheadings (like <h2> and <h3> tags in digital formats) to break up dense text and guide the reader through the document logically. Bullet points and numbered lists, as used above, are excellent for presenting detailed information such as payment schedules or terms in an easily digestible format. Ensure consistent formatting throughout, including margins, line spacing, and paragraph indents. For digital distribution, ensure the document is accessible across various devices and ideally provided in a non-editable format like PDF to maintain integrity. Consider including a table of contents for longer documents and clearly label all exhibits or attachments.

A Professional and Time-Saving Solution

In the complex ecosystem of financial transactions, precision and clarity are not just preferred; they are essential. The consistent application of a well-structured financial payment plan agreement template significantly reduces administrative burdens, mitigates legal risks, and builds stronger, more transparent relationships between all parties. It transforms potentially ambiguous financial arrangements into clearly defined, legally binding commitments that protect everyone involved.

By investing in and customizing such a template, businesses and individuals alike can streamline their processes, ensure compliance, and confidently navigate the intricacies of installment payments and debt resolution. This professional tool is more than just a form; it’s a foundation for trust, a safeguard against disputes, and a testament to meticulous financial planning, ultimately proving to be an invaluable asset that saves both time and potential future headaches.