Navigating the complexities of personal finance can often feel like steering a ship through a perpetual storm, especially when unexpected expenses arise or financial goals seem just out of reach. For many, the idea of managing money evokes feelings of dread or confusion, leading to a cycle of uncertainty about where their hard-earned dollars actually go. But what if there was a simple, yet powerful, tool to transform this financial chaos into clarity and control?

This is where a robust financial monthly budget template comes into play. It’s not merely a spreadsheet; it’s a dynamic roadmap, a personal financial GPS that guides you towards your aspirations, whether that’s building an emergency fund, paying down debt, saving for a down payment, or simply understanding your cash flow better. Far from being restrictive, adopting a well-structured spending plan empowers you to make intentional choices, ensuring your money works for you, not against you, paving the way for lasting financial peace.

The Unseen Power of a Solid Spending Plan

Many view budgeting as a chore, a necessary evil that restricts enjoyment. However, embracing a monthly budget is, in fact, an act of financial liberation. It transitions you from a reactive stance, where you merely respond to bills and expenses, to a proactive position, where you dictate your money’s purpose. This shift in mindset is foundational to achieving any meaningful financial objective.

The benefits extend far beyond just knowing your balances. A well-maintained personal budget significantly reduces financial stress by eliminating surprises and fostering a sense of control. It shines a spotlight on your spending habits, revealing areas where you might be unconsciously overspending and identifying opportunities to save. Furthermore, it acts as a tangible plan for debt reduction, accelerating your journey towards financial freedom by allocating specific funds to liabilities. Ultimately, having a clear spending plan allows you to make informed decisions, align your spending with your values, and consistently move closer to your long-term wealth accumulation and lifestyle goals.

Deconstructing Your Financial Monthly Budget Template: Key Components

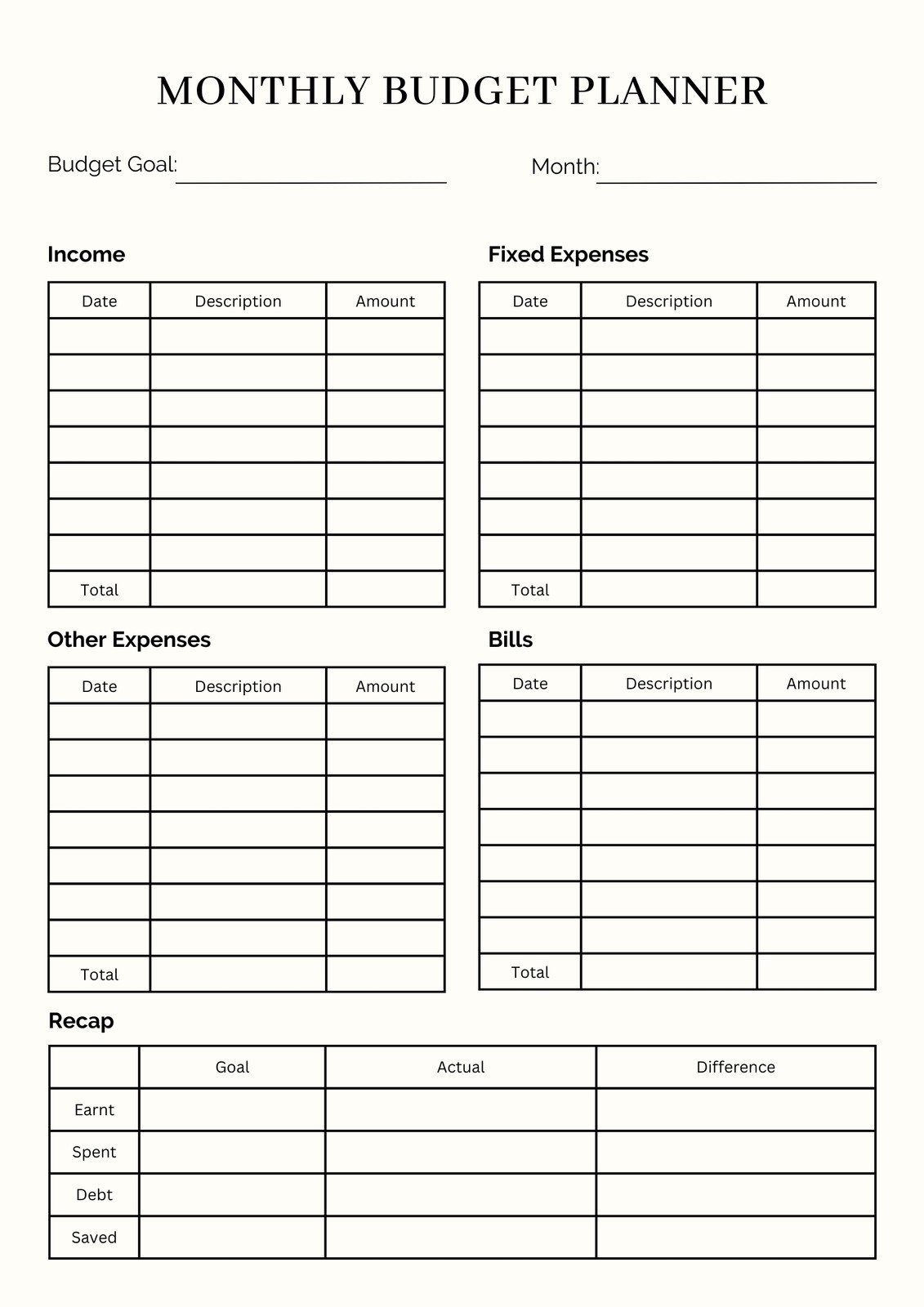

An effective financial monthly budget template is designed to give you a comprehensive overview of your financial landscape, breaking it down into manageable and understandable categories. It acts as your personal ledger, meticulously tracking every dollar that enters and exits your accounts. Understanding these core elements is crucial to building a budget that genuinely reflects your financial reality and supports your aspirations.

Here are the essential components you’ll find in any comprehensive budget worksheet:

- **Income Sources:** This section captures all money flowing into your household each month. This includes your net paychecks, income from side gigs, rental income, benefits, or any other regular source of funds. It’s vital to use your net income (after taxes and deductions) for the most accurate picture.

- **Fixed Expenses:** These are the predictable costs that remain relatively consistent each month. Think of your **rent or mortgage payment**, car loans, insurance premiums, loan repayments (student loans, personal loans), and subscription services. These are non-negotiable and form the base of your monthly outflows.

- **Variable Expenses:** Unlike fixed expenses, these costs fluctuate from month to month. Categories here typically include **groceries**, dining out, utilities (which can vary seasonally), transportation costs (gas, public transit), entertainment, clothing, and personal care. This is often where the most adjustments can be made.

- **Savings Goals:** This is a critical component that ensures you’re building financial resilience and moving towards future objectives. Allocate specific amounts for an **emergency fund**, retirement contributions, down payments for a home or car, vacation funds, or other long-term investment goals. Treat savings as a non-negotiable expense.

- **Debt Repayment:** Beyond regular loan payments, this category is for any additional payments you might make towards high-interest debt like **credit card balances**. Strategically targeting debt can save you significant money in interest over time.

- **Miscellaneous/Buffer:** Life is unpredictable, and a good personal budget acknowledges this. Including a small buffer or miscellaneous category for **unexpected costs** or small, infrequent purchases prevents your entire plan from derailing when minor surprises occur.

Building Your Personal Financial Blueprint: A Step-by-Step Guide

Creating your monthly budget doesn’t have to be an intimidating task. With a structured approach and a willingness to be honest about your spending, you can craft a financial blueprint that genuinely serves your needs. The goal is to build a practical spending plan that you can stick to, not a restrictive document that gathers dust.

Step 1: Gather Your Financial Data. Before you can allocate funds, you need to know what you’re working with. Collect all relevant financial documents: pay stubs, bank statements from the last 1-2 months, credit card statements, loan statements, and any recurring bills. This information will provide the baseline for your income and expenses.

Step 2: Track Your Spending Diligently. For at least one full month, meticulously track every dollar you spend. This can be done through a budgeting app, a simple notebook, or by reviewing your bank and credit card statements. The purpose here isn’t to judge, but to gain an accurate understanding of where your money is currently going. This "discovery phase" often reveals surprising insights into unconscious spending habits.

Step 3: Categorize and Allocate Your Income. With your data in hand, it’s time to populate your budget worksheet. List all your net income sources at the top. Then, systematically list all your fixed expenses, followed by your variable expenses. Assign a specific amount to each category. A common rule of thumb is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Adjust these percentages to fit your unique financial situation and priorities. Ensure that your total allocated expenses and savings do not exceed your total income.

Step 4: Review and Adjust Regularly. Your financial life is dynamic, and your budget should be too. At the end of each month, compare your actual spending against your allocated amounts. Did you overspend in one area? Underspend in another? Use these insights to make necessary adjustments to your categories for the following month. Flexibility is key; a budget that’s too rigid is destined to fail. This continuous refinement makes your budget an ever more accurate reflection of your life.

Step 5: Automate for Success. Once you have a working budget, leverage automation to make adherence easier. Set up automatic transfers from your checking account to your savings accounts (emergency fund, retirement, specific goals) on payday. Schedule automatic bill payments for fixed expenses. This "set it and forget it" approach ensures your financial priorities are met consistently, reducing the mental load of managing money.

Mastering Your Money: Practical Tips for Budgeting Success

Having a well-designed financial planning guide is only half the battle; the other half is consistently applying it and making it a sustainable part of your financial routine. These tips will help you not just start, but truly thrive with your budgeting efforts.

- Be **realistic** with your estimates. Don’t starve your grocery budget or eliminate all discretionary spending from the outset. A budget that’s too strict is hard to maintain and can lead to frustration and abandonment.

- Find a **method** that works for you. Whether it’s the envelope system, zero-based budgeting, the 50/30/20 rule, or simply tracking in a spreadsheet, the best method is the one you will actually use consistently.

- **Involve** your household. If you share finances with a partner or family, make budgeting a collaborative effort. Open communication about money goals and spending habits is crucial for shared financial success.

- Track **consistently**. The power of a monthly budget comes from ongoing engagement. Don’t just set it and forget it; regularly check in on your spending and make real-time adjustments.

- Celebrate **small wins**. Did you stick to your dining-out budget this month? Did you hit a savings goal? Acknowledge your progress to stay motivated and reinforce positive financial habits.

- Don’t be afraid to **adjust**. Life happens. An unexpected car repair or a sudden income change might necessitate a revision of your spending plan. View your budget as a living document, not a rigid decree.

- Utilize **technology**. Modern budgeting apps and software can automate tracking, categorize expenses, and provide visual reports, making money management much more intuitive and less time-consuming.

Frequently Asked Questions

Is a monthly budget really necessary if I earn a good income?

Absolutely. Income level doesn’t negate the need for financial awareness and planning. High earners can still fall into the trap of lifestyle inflation, where spending increases proportionally with income, leaving little room for savings or investments. A personal budget ensures that your money is working towards your specific financial goals, regardless of how much you earn.

How long does it take to create an effective spending plan?

The initial setup, gathering all your data and populating the first draft of your budget, can take a few hours. However, the process of making it truly effective is ongoing. It often takes 2-3 months of tracking and refining to create an accurate and sustainable money management system that truly reflects your spending habits and financial goals.

What if I consistently overspend in certain categories?

Consistently overspending in a category is a clear signal to re-evaluate. It could mean your initial allocation was unrealistic, or it might indicate a habit that needs addressing. You have two main options: either adjust your budget to allocate more to that category (if feasible and aligns with your goals) or consciously work on reducing spending in that area by finding alternatives or cutting back.

Should I use a digital tool or a physical spreadsheet?

Both digital tools (apps, software) and physical spreadsheets (or even pen and paper) have their merits. Digital options often offer automation, detailed analytics, and accessibility across devices, which can simplify tracking. Physical methods might appeal to those who prefer a more hands-on approach and can help with visual learning. The best choice is whichever method you find most intuitive and are most likely to use consistently.

How often should I review my budget?

Ideally, you should review your household budget weekly for quick check-ins on spending, and then conduct a more comprehensive review at the end of each month. This monthly review allows you to compare actual spending to your plan, make adjustments for the upcoming month, and reflect on your financial progress. Quarterly or annual comprehensive reviews can also be beneficial for assessing long-term goals and making larger strategic changes.

Embracing a robust financial monthly budget template is more than just a fiscal exercise; it’s a foundational step towards building a secure and prosperous future. It transforms abstract financial worries into concrete actions, giving you the clarity and confidence to pursue your dreams without the constant shadow of monetary uncertainty. This tool, far from being a burden, becomes a powerful ally in your quest for financial wellness, offering a clear path through the complexities of modern money management.

So, take the initiative. Download a budget template, gather your statements, and dedicate the time to understand your financial flow. The journey to financial empowerment begins with a single step, and an organized spending plan is undeniably the most effective starting point. By taking control of your finances today, you are actively investing in a future where you dictate your destiny, secure in the knowledge that your money is aligned with your deepest aspirations.